I last presented my thesis on Opera Limited (NASDAQ:OPRA) toward the end of June, as I cautioned investors to avoid chasing its momentum surge, which seems unsustainable. However, I also noted that a sell signal in OPRA had not been validated, suggesting holders who added at its lows in late 2022 could consider hanging on further.

However, over less than a month, a pivotal development has occurred. Opera filed a Form F-3 as it announced a $300M mixed shelf offering.

Accordingly, the offering allows its selling shareholders to sell up to “141.77M ordinary shares or equivalent ADSs in one or more offerings.” As a reminder, each ADS represents two ordinary shares.

| Name of Selling Securityholder | Ordinary Shares Beneficially Owned prior to this Offering | Percentage | Ordinary Shares Being Registered | Percentage |

|---|---|---|---|---|

| Kunlun Tech Limited | 128,020,286 | 71.2% | 128,020,286 | 71.2% |

| Keeneyes Future Holding Inc. | 13,753,012 | 7.6% | 13,753,012 | 7.6% |

Selling shareholders. Data source: Opera Limited Form F-3 (dated 14 July 2023)

Notably, the selling shareholders are considered affiliates of Opera Limited. Shenzhen-listed Kunlun Tech Limited and Keeneyes Future Holding Inc. own 78.8% of its shareholdings (equivalent to 141.77M shares or 70.89M ADSs).

In addition, the selling shareholders are linked to Opera Chairman and CEO Yahui Zhou. However, the aggregate initial offering price is limited to $300M. Therefore, based on OPRA’s closing price of $19.76 per ADS on July 14 (the day the F-3 was filed), the selling shareholders could offload about 15.18M ADSs or about 21% of the selling shareholders’ total holdings.

With that in mind, OPRA holders shouldn’t be surprised that it fell nearly 30% yesterday as the market attempted to price in the mixed-shelf offering. Therefore, some OPRA bulls could argue that the extent of yesterday’s selloff could have reflected the offering by the selling shareholders as they attempted to cash in on its gains.

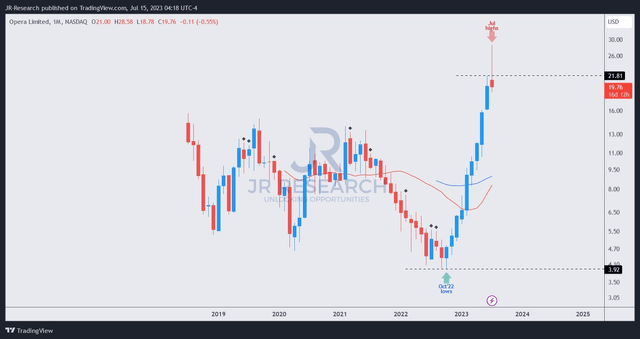

I think the move by the selling shareholders makes sense, as OPRA surged more than 600% from its October lows through this week’s highs. Therefore, it is reasonable that the selling shareholders take the opportunity to cash in on their massive upside.

In addition, it’s also a reminder for OPRA holders to avoid chasing momentum, as a reversal could arrive suddenly, without ample warning, as we saw for ourselves. In addition, OPRA is under the control of Kunlun Tech, which “holds more than 50% of the shareholder voting power of [Opera’s] outstanding share capital.”

As such, OPRA ADS holders might not have factored this sufficiently into their risks assessment, as Opera reminds them that “as an ADS holder, you are not considered a shareholder of Opera Limited and do not possess shareholder rights.”

Hence, I gleaned that the headwinds facing OPRA buyers who added late into this week’s surge could likely intensify moving ahead. Moreover, the price action that resulted in a massive bearish reversal looks likely to be validated (you can wait till the end of July for confirmation).

In addition, OPRA’s long-term price chart has a remarkable resemblance to Kunlun Tech stock (listed on the Shenzhen stock exchange with the ticker symbol 300418), suggesting that substantial profit-taking is in progress.

OPRA price chart (monthly) (TradingView)

As seen above, OPRA could form the bearish reversal pending validation by the end of July. Also, if it closes below its June highs, it could compel more OPRA dip buyers to flee, locking in their massive gains and dealing a significant blow to late momentum investors who chased OPRA to its recent highs.

300418 price chart (monthly) (TradingView)

Kunlun Tech stock’s (300418) long-term chart was more bearish in May, as it formed a validated bull trap. It has since declined steeply through this month’s low, with the previous surge resembling OPRA’s.

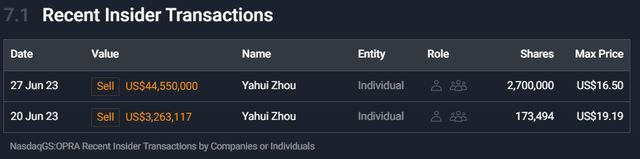

OPRA insider selling (Simply Wall St)

Moreover, Zhou had already cashed out nearly $48M in June, suggesting that he likely saw July’s surge as a fantastic opportunity to take more profit. I believe it’s opportune for OPRA holders who bought the lows late last year to consider capitalizing on the potential bearish reversal to cut their exposure and rotate out.

Late buyers who bought into this week’s surge have been provided another useful lesson about violent momentum swings. Also, while upward momentum seems “hard to die,” when it turns, the fall could be painful as it swings against you.

Rating: Sell (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here