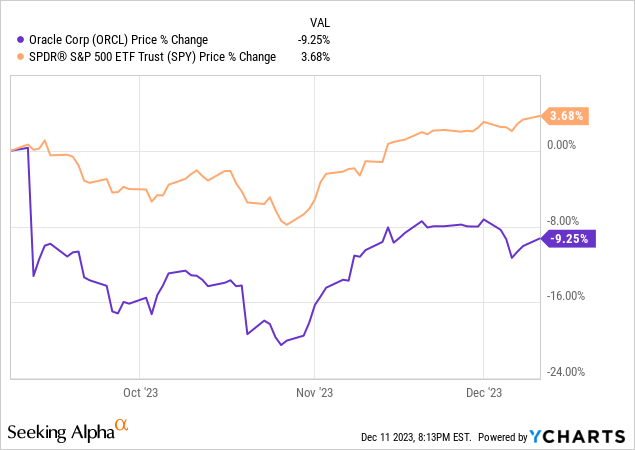

We’re maintaining our hold-rating on Oracle (NYSE:ORCL). Consistent with our expectations during our downgrade in mid-October, ORCL is struggling to boost top-line growth. 2Q24 top-line missed consensus estimates as its Cloud Services sales were not enough to offset its muted services and the deceleration in its Cloud and On-Premise licenses sales. We think our negative thesis is playing out. We expect macro weakness to continue weighing on ORCL’s near-term financial performance and recommend that investors stay on the sidelines. We think the stock will remain an inline performer through 2HFY24. The following outlines ORCL’s stock performance over the past three months against the S&P 500.

YCharts

ORCL reported 2Q24 results missing top-line consensus estimates, with revenue coming in at $12.94B versus consensus of $13.05B. Since our downgrade to a hold in mid-October, the stock has been performing in line with the S&P 500. Now, after the stock slid +8% in extended trading, we see a continued downside risk ahead. ORCL sales trailed expectations not only on top-line growth but also on segment factored results; the company’s Cloud Services and License Support segment, accounting for 77% of total sales, missed expectations this quarter. We think ORCL is at higher risk of underperforming due to the company’s exposure to the softer enterprise, service provider, and government spending. ORCL’s management continues to push the A.I. growth story with a new partnership with Microsoft (MSFT) Azure; Oracle Database@Azure gives customers direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure datacenters. We think the company is now better positioned to grow with its cloud infrastructure deal with MSFT, but we don’t see any near-term catalyst boosting profits.

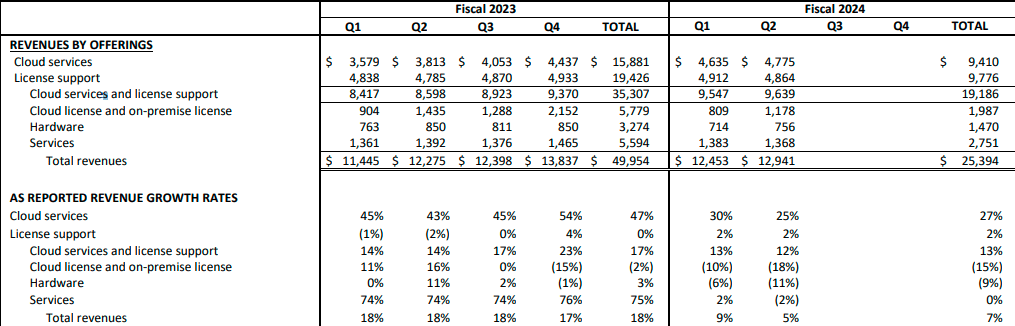

The company’s revenue growth rates are substantially slower in its Cloud services revenue in the 1HFY24, and growth in its Cloud Licenses and on-premise licensees, as well as hardware and services growth, has been moderating. Our neutral stance is based on our belief that ORCL will struggle to outperform amid macro uncertainty and increased competition in the cloud computing market as both weigh on top-line growth in 1H24; we see increased competition here from MSFT and Amazon (AMZN). We think the sticky inflation and higher interest rates have tightened budgets around firm expenditure, dragging down revenue for players like ORCL that depend on enterprise spending to boost profits.

The following outlines ORCL’s revenue by offering and revenue growth rates.

2Q24 earning results

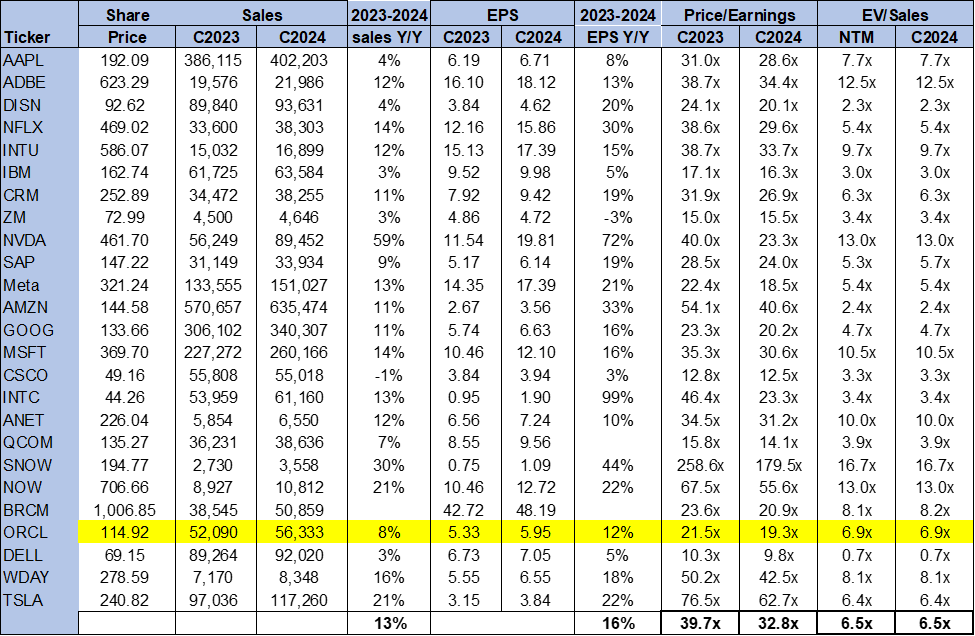

Valuation

In our opinion, the stock is fairly valued, but we don’t see attractive entry points at current levels. We think the near-term risk of ORCL underperforming is too high to explore entry points at current levels. On a P/E basis, the stock is trading at 19.3x C2024 EPS $5.95 compared to the peer group average of 32.8x. The stock is trading at 6.9x EV/C2024 Sales versus the peer group average of 6.5x. We recommend investors wait for evidence of a recovery in enterprise, service provider and/or government before stepping back into the stock in 2024.

The following chart outlines ORCL’s valuation against the peer group average.

TSP

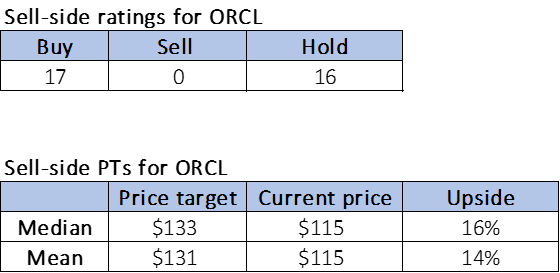

Word on Wall Street

Wall Street is almost evenly divided between bullish and neutral sentiments on the stock. Of the 33 analysts covering the stock, 17 are buy-rated, and the remaining are hold-rated. We think ORCL is a tricky stock because of its run-up on A.I. hype earlier this year without the fundamentals to support outperformance. We usually are more bullish on a stock once we think the negative is priced in, but with ORCL, even as the stock sells off, we see no need to upgrade as we don’t believe the company can outperform in the current macro backdrop.

The stock is currently priced at $115 per share. The median sell-side price-target is $133, while the mean is $131, with a potential 14-16% upside. The following charts outline ORCL’s sell-side ratings and price-targets.

TSP

What to do with the stock

We maintain our hold-rating on ORCL post-earnings. We don’t think ORCL will realize its A.I. infrastructure ambitions in the current market; we think larger players with the advantage of economies of scale and deep integration in A.I. ecosystems control the cloud computing market. We don’t see any near-term catalyst setting up ORCL’s Cloud services revenue for higher-digit growth. We think the stock will remain an inline performer in 1H24.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.

Read the full article here