Charlie Munger passed away at the end of November, just a month before what would have been his 100th birthday. The legend in the investing world, a billionaire through his own investments, worked with his partner Warren Buffett to build Berkshire Hathaway (BRK.A) (BRK.B) into one of the largest companies in the world.

Among their favorite investments for retail investors was the S&P 500 (SP500).

In my view, for most people, the best thing to do is to own the S&P 500 index fund. – Warren Buffett.

The S&P 500 is expected to be a long-term investment. However, it’s important to use its variance year-to-year to look for investment opportunities. With that said, here’s our view for the S&P 500 to close at on December 31, 2024.

Our view is that 2024 will be centered around the following 3 factors.

Magnificent Seven

The first thing that we think will come into play next year is how much the U.S.’ market performance has relied on a few select stocks.

Magnificent 7

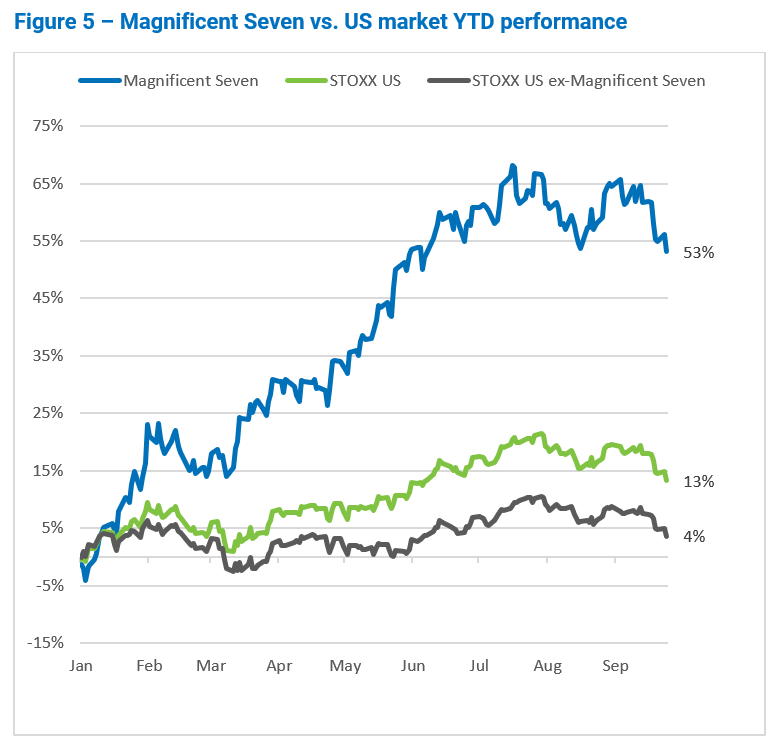

The top 7 largest stocks in the S&P 500 now make up almost 30% of the S&P 500. That’s one of the highest ratios in history. The S&P 500 has put on a stellar headline performance in 2023. However, when you look at the details, most of that is due to the performance of the magnificent 7, which have seen returns together of more than 50%.

That’s primarily due to headline factors such as the growth of artificial intelligence, along with a general multiple recovery for many companies. Outside of that, the S&P 500 has barely increased. The other 493 companies have seen returns in the single digits. That phenomenon means there’s not much strength in the markets once the 7 companies stop growing.

Global Economic Slowdown

The current global GDP is just over $100 trillion USD. That’s massive.

Statista

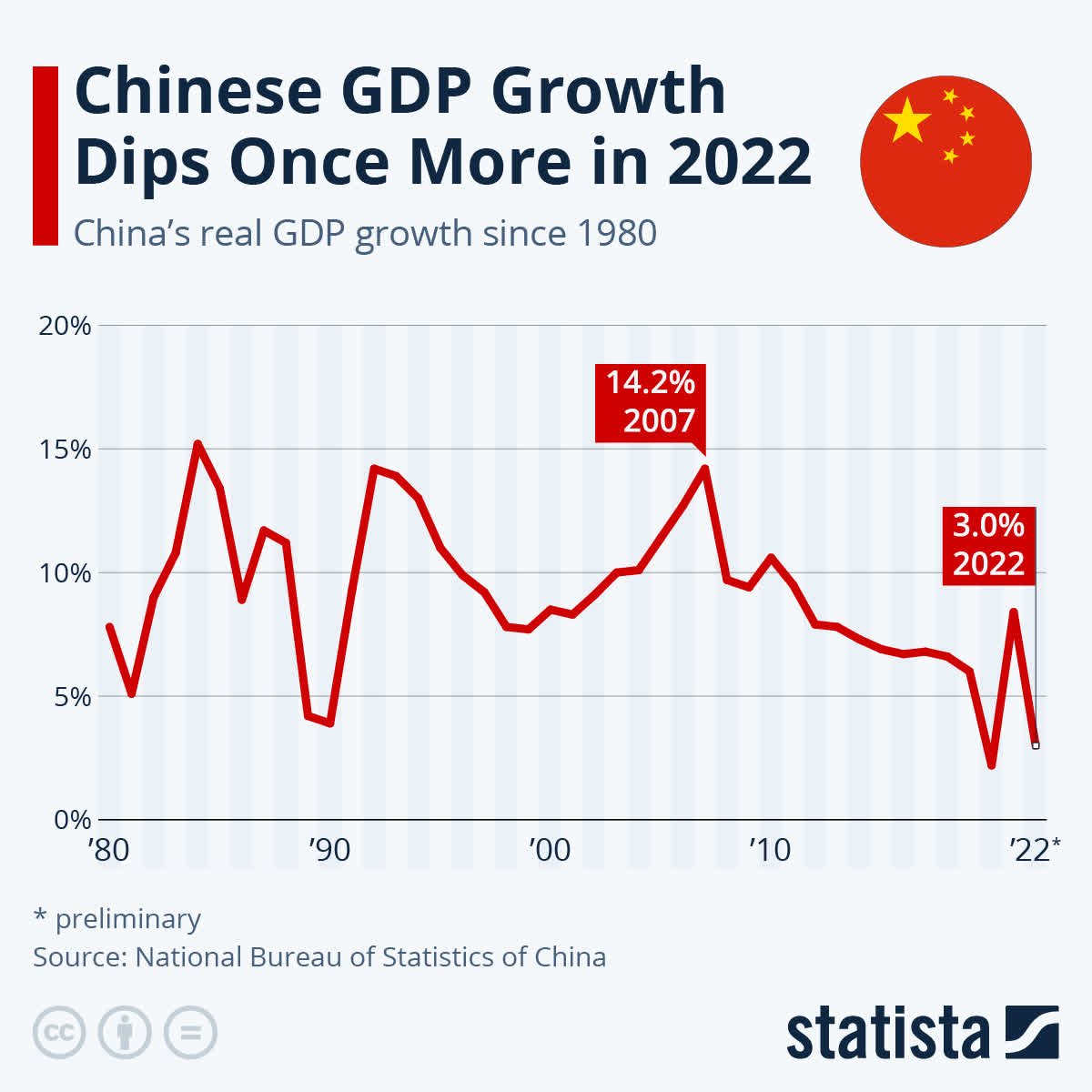

In 2000, the global GDP was just under $34 trillion. The U.S. GDP was $10.25 trillion, or roughly 30% of the global GDP, in the year 2000. China’s GDP was a mere $1.2 trillion. Since then, China has embarked on one of the fastest GDP growth rates in history, to its present GDP of almost $18 trillion. That means, out of the $66 trillion in global GDP growth, China was 25% of that.

China’s growth engine is slowing down. The country is hitting some of its fastest deflation. Its growth to date has involved a massive amount of debt, a lot of it hidden in shadow banking, and more. That’s started to unravel the economy, including some of the fastest-growth sectors in its economy, such as property. Many of the largest companies in those sectors are now bankrupt.

That’s a vital global growth engine disappearing, and we expect the world to take note of that next year.

Market Reevaluation

The last factor that we expect to be a major factor in the market is the driving of returns.

YChart

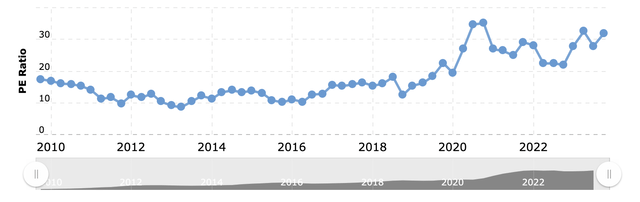

Much of the magnificent 7 returns haven’t been due to profit increases. In fact, many of the large technology companies have had layoffs. Nvidia (NVDA) stands out in its earnings growth, as companies around the world have looked for its GPUs. Still, across the group, much of the growth has been an expansion in earnings ratios.

Apple (AAPL), for example, seen with its P/E ratio above, has gone from just over 20 to above 30 with minimal earnings increase. Roughly 50% of its shareholder returns have been from this multiple increase. Investors who change their view on the potential of the company can cause a rapid decrease in the share price, even with no earnings change.

Key Risks

There are two key risks for the market that could cause the S&P 500 to end up below or above our expectations.

To end up below is all about the soft-landing that the FED is trying to achieve. The FED itself has said that interest rates have grown into what’s considered heavily restricted territory, there’s no denying that. Deciding when to decrease rates and stop that restriction is massively difficult. There’s been much discussion about the “elusive soft landing.”

If the market starts to slow down, or more weakness is revealed like with the banking bankruptcies earlier in 2023, earnings, the overall valuation of companies could drop substantially. That could result in the S&P 500 coming in substantially below our estimate.

Alternatively, the bull market could continue. There’s always capital that people have yet to deploy into the markets. The Magnificent 7 are some of the strongest companies in the world, with their earnings power. Many of them are well positioned to take advantage of efficiency gains related to artificial intelligence, and they all have enormous demand for their products and strong moats.

Continued outperformance into 2024 could result in the market rewarding that reliability with an even higher multiple than their current multiple. That could pull up the overall market.

Our View

We recently rated Nvidia as our top short pick for 2024, and that rates into our forecast for the market.

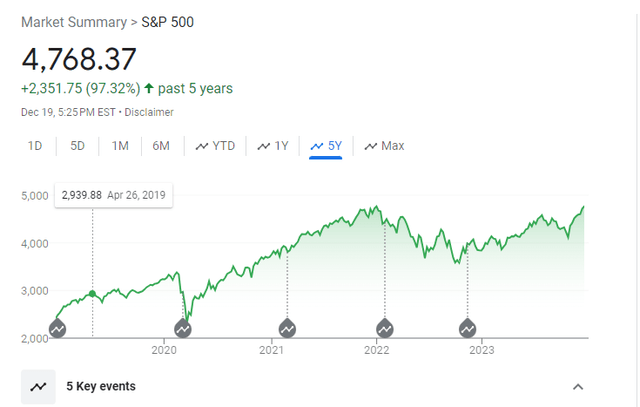

Google Finance

The S&P 500 is currently trading at almost 4800, near its all-time highs. While it’s difficult to time the market, and we don’t know when the market will reevaluate valuations, making predictions about the future involves some element of just that, a prediction. We expect the market will pay more attention to the factors discussed above in 2024.

That, we expect, will drive down the magnificent 7 and the overall market, substantially. In the end, our prediction is for the S&P 500 to close the year near its prior support levels of 3600.

The current S&P 500 multiple is at 26.34, with earnings of roughly $180 / share combined. We expect earnings to remain roughly constant, but we expect the multiple for the S&P 500 to go down to 20 as the market reevaluates a lack of future growth. That leads us to our expectation of ~3600. Let us know your thoughts in the comments below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s 2024 Market Prediction competition, which runs through December 20. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here