Palantir Technologies Inc. (NYSE:PLTR) is a big data analytics company. Especially with the rise of artificial intelligence, or AI, the company has performed well recently. We think the company is in a great position. Amazon’s (AMZN) Amazon Web Services, or AWS, revolutionized the compute industry, despite its higher cost per unit-compute, because of how it freed up resources for major companies.

With the growth of artificial intelligence, we expect Palantir to do the same for artificial intelligence and big data.

Palantir Quarterly Results

The company had strong results in the most recent quarter.

Palantir Investor Presentation

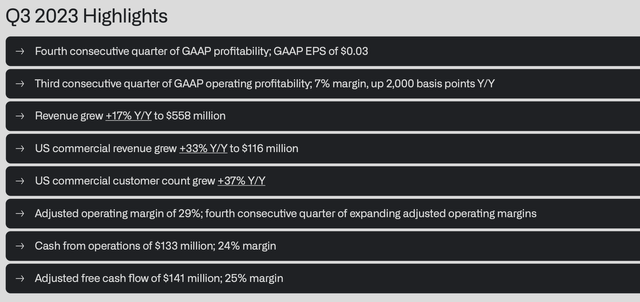

The company had its 4th consecutive quarter of GAAP profitability in Q3. Profitability remains low, but for a growing company, it’s still impressive. The company’s margin of 7% is up substantially YoY. Continued improvement in margins will enable profits to grow faster than revenues that are already growing quickly. That growth in profits will justify investing today.

The company’s revenue managed to grow a very respectable 17% YoY and is now annualized at well over $2 billion. That was supported by incredibly strong growth in the company’s commercial business as the company continues to take advantage of the artificial intelligence wave. Growing revenue and growing margins are essential for long-term returns.

At the end of the day the company earned $141 million in adjusted free cash flow (“FCF”), or annualized FCF of more than $550 million. The company has a market cap more almost $44 billion, meaning a FCF yield of more than 1%. That shows the company’s financial and cash flow strength.

Palantir Opportunity

The opportunity for Palantir is based on organizations continuing to see the benefits to their operations.

Palantir Investor Presentation

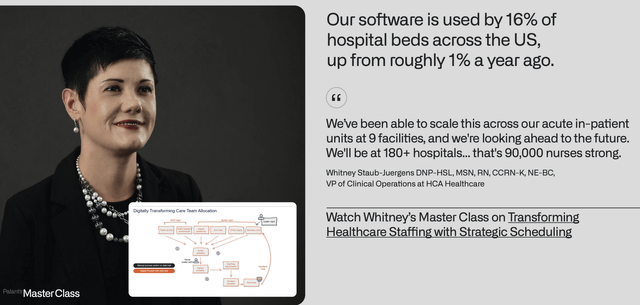

The company’s opportunity is evident in its growth from being used by 1% of hospital beds across the U.S. a year ago. Now it is being utilized at 16% of hospital beds across the U.S.. That growth is substantial. The same kind of growth is being seen at the company’s commercial partners. The company has an effective multi-stage process.

First, the company incentivizes and grabs a new customer. From that point, the company rapidly grows its scale with the customers. It shows them the opportunity it offers and gains larger and larger contracts. That double-whammy of new customers and rapid revenue growth per customer results in much faster overall medical growth.

The company grew its revenue 17% YoY, showing the continued desire for its products, and its profit growing even faster, shows that same desire.

Palantir Financials

Another exciting thing is the company’s commercial financial growth.

Palantir Investor Presentation

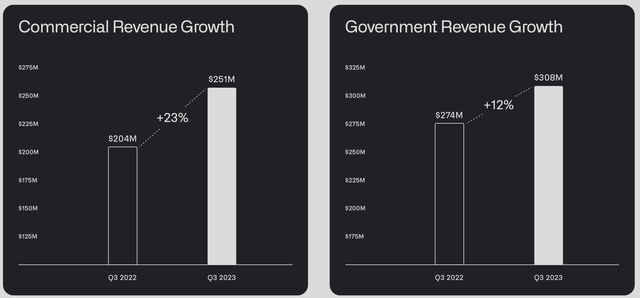

For a long time, the company was the preferred partner of governments, and to be fair it remains so. It continued to offer strong solutions to governments, and continued to win massive contracts to help them modernize and improve. While that was exciting to see, that growth for the company was relatively much slower.

A trend has come in the past year. Commercial companies are increasingly recognizing the company’s potential, supported by the overall movement for artificial intelligence.

Palantir Opportunity

The opportunity in Palantir is in the company’s impressive software and the continued desire for that software from major corporations. It enables those corporations to improve their workflows and operations at a much lower cost than what it would traditionally cost them to build software operations and build out those divisions.

At the same time, as revenue grows, Palantir’s margins will increase. That’s because the fixed costs will be increasingly spread outwards. That enables profits to increase even faster, which eventually justifies the company’s valuation. That opportunity, versus Palantir’s current valuation, is immense. In the meantime, the company has a strong cash position to support operations.

Thesis Risk

The largest risk to our thesis is the converse. That the trend changes and companies simply don’t see sufficient opportunity in the company’s software offerings. Given the company’s lofty valuation that its current profits don’t justify, that could lead to rapid poor returns in its share price, making the company a poor investment.

Conclusion

Palantir Technologies Inc. is a log rolling down a hill. The pace is picking up. The company continues to see strong growth in its government business, but now, thanks to artificial intelligence, the company’s commercial segment is picking up even quicker. In our view, the company offers to customers what AWS did for computing.

The company’s revenue is growing and its profits are growing even faster. That helps to make the company a valuable investment, as its profits continue to grow, justifying its valuation. Let us know your thoughts in the comments below.

Read the full article here