Thesis

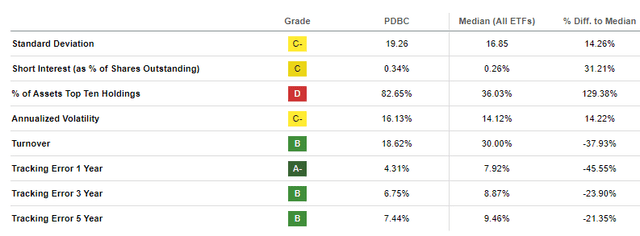

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC) is an actively managed exchange-traded fund. The vehicle invests in commodity-linked futures that provide economic exposure to a diverse group of the world’s most heavily traded commodities, including oil, gasoline and gold. As per its literature, the fund:

seeks to provide long-term capital appreciation using an investment strategy designed to exceed the performance of DBIQ Optimum Yield Diversified Commodity Index Excess Return™ (DBIQ Opt Yield Diversified Comm Index ER) (Benchmark), an index composed of futures contracts on 14 heavily traded commodities across the energy, precious metals, industrial metals and agriculture sectors.

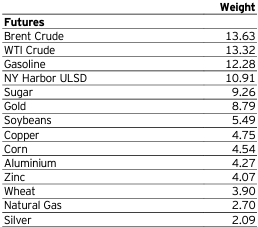

PDBC represents a pure play on commodities prices, and takes a diversified approach to its portfolio by utilizing futures contracts on 14 different commodity classes, thus reducing overall volatility and the fund’s standard deviation:

Futures (Fund Fact Sheet)

Brent and WTI oil make up over 26% of the fund, while oil linked products such as gasoline and heating oil (‘NY Harbor ULSD’) cumulatively account for roughly 50% of the ETF.

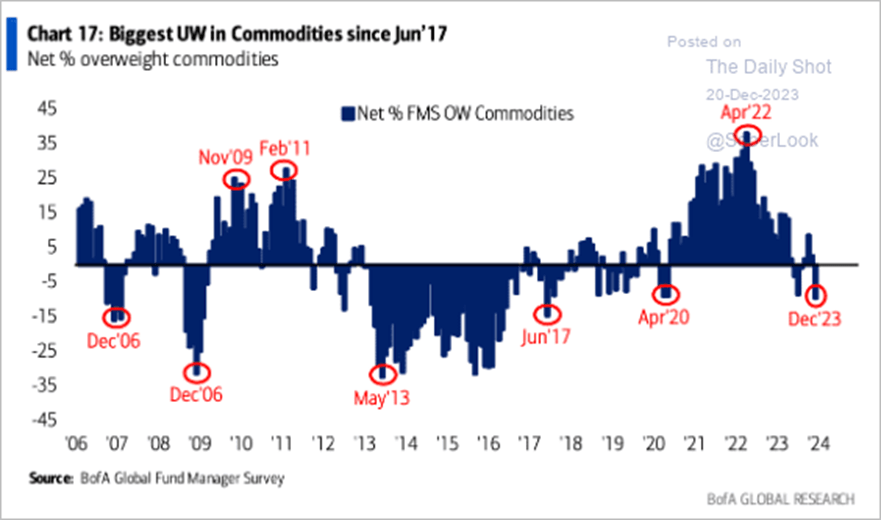

PDBC represents a diversified take on commodities, and it is ideally set-up to take advantage of one of the most underweight positionings in the sector since 2017:

Sentiment Indicator (BofA)

The above chart, provided by Bank of America and the Daily Shot, represents the results of the BofA Global Fund Manager Survey, and highlights how institutional investors are again severely underweight the asset class. Investment returns work in cycles, and similarly to equities when the largest returns are made when peak pessimism is in place, one should follow the same rule for commodities. Buy them when they are out of fashion and sell them when everybody is chasing the trend. Buying PDBC in April 2020 would have landed you a substantial gain until the sentiment peaked in April 2022:

Buying when sentiment was at peak-pessimism and selling when sentiment was at peak-optimism would have generated a price return in excess of +70%. This time will be no different versus historic occurrences.

Futures investing vs commodity equities

Investing in commodities via futures or futures-based ETFs represents a direct take on commodity prices, with the implied direct volatility. Commodity equities and commodity equities ETFs contain a number of risk factors, one of them being commodity prices. While commodity equities can represent a less volatile take on the asset class, they exhibit outside risks such as balance sheet management and strategic orientation for the underlying company. Furthermore a corporate can go bankrupt, thus completely wiping out the value of said equity, while this is not the case via futures investing for most commodities.

In our opinion it is best to utilize a fund like PDBC when investing in a diversified basket of commodities, while equities are preferrable when targeting a specific sub-sector of the commodities market. To that end we are bullish on the natural gas sub-sector and have penned an article regarding the expression of our stance via an equities ETF – ‘FCG: Buy The Bottom In Natural Gas Prices’. Natural gas on its own (or via futures) is an extremely volatile asset class, and investing views are more aptly expressed via natural gas equities.

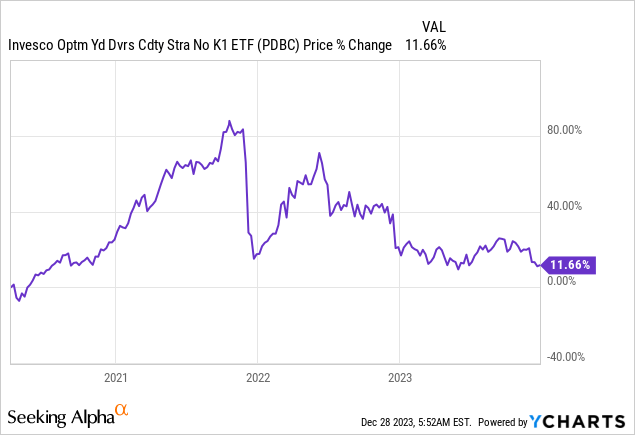

Via its diversification PDBC achieves a normalized portfolio risk profile:

Risk (Seeking Alpha)

The above table can be found under the ‘Risk’ tab on the Seeking Alpha platform, and it highlights the ETF’s standard deviation and annualized volatility. PDBC has a standard deviation comparable with the one exhibited by the S&P 500, and we can see the benefits of portfolio diversification via its rather low 16.13% annualized volatility. As a comparison point, the United States Natural Gas Fund, LP ETF (UNG) which represents a take on natural gas futures, has an annualized volatility of 59%!

The outlook is strong for oil coming into the new year

WTI oil looks like it is bottoming out, bouncing off its long term support level in the mid 60s:

WTI Oil (Tradingview)

Technicals play an important role in commodities investing and trading, and while fundamentals take time to develop and adjust, technicals usually drive shorter term moves. In the case of oil, large investment banks also see this asset class as an opportunity going into 2024:

Expect Brent crude to average $90, commodities to restock: OPEC+ has been cutting supply since 2022 and will likely keep at it in 2024. Francisco Blanch, head of Commodities and Derivatives Research, sees oil demand growing by 1.1 million barrels per day in 2024 as emerging markets benefit from the end of the Fed’s monetary tightening cycle. Yet Brent and WTI prices should average $90/barrel and $86/barrel, respectively. Recession, faster-than-expected US shale growth, and lack of OPEC+ cohesion are downside risks to oil prices. Lower rates should boost gold and lead to restocking in industrial metal.

Source: Bank of America

Looking at our technical chart above, the BofA call on WTI pricing puts it squarely into our modeled range, with a bottom in the mid 60s and a top at $90/per barrel. With roughly 50% of PDBC invested in oil-linked futures, the strong outlook for oil and related derivatives should translate into a strong performance for PDBC.

Gold could break on the upside in 2024

Gold as a commodity has a 8.7% weighting in the fund, and from a technical standpoint it is set to break out on the upside into the new year:

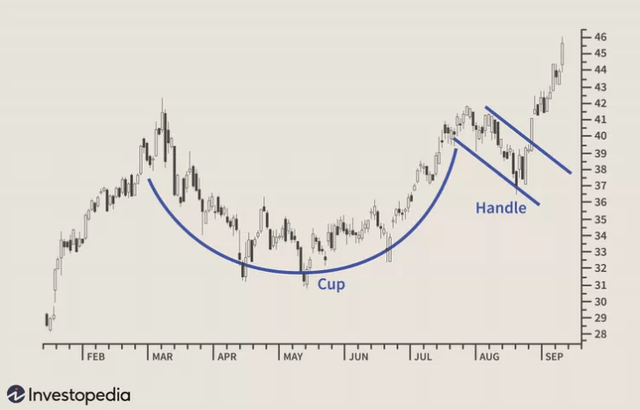

Technical Pattern (Trendspider)

The above is a clear long term ‘Cup-and-handle’ pattern, which is a very bullish technical indicator. As per Investopedia:

A cup and handle price pattern on a security’s price chart is a technical indicator that resembles a cup with a handle, where the cup is in the shape of a “u” and the handle has a slight downward drift. The cup and handle is considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. A profit target is determined by measuring the distance between the bottom of the cup and the pattern’s breakout level and extending that distance upward from the breakout.

Pattern (Investopedia)

A ‘cup and handle’ technical set-up is followed by a significant rally, which can now develop into 2024.

Conclusion

PDBC is an exchange traded fund. The vehicle invests in a diversified basket of commodities via futures contracts, and represents a balanced way to express a view on the sector. The fund has a rough 50% weighting to oil-related commodities such as Brent contract, WTI contracts, gasoline and heating oil futures, with the rest allocated to precious metals and agricultural commodities. The fund had a fairly flat performance in 2023, but 2024 looks much more appealing given the overall underweight positioning of the investment community in the asset class, which is running the most underweight since 2017.

Peak negative sentiment levels like today’s have been followed by strong returns, and we feel this time will be no different. With both oil and gold having extremely favorable set-ups going into 2024, we feel a retail investor is well served by buying into the commodities asset class via PDBC.

Read the full article here