Introduction

I have written about several hospitality REITs in the past couple of months, most recently on Ashford Hospitality Trust (NYSE: AHT) and Hersha Hospitality Trust (NYSE: HT). I also wrote about Service Properties Trust (NASDAQ: SVC) which isn’t a pure hospitality REIT, though the Seeking Alpha website classifies it as one.

I noticed that there hasn’t been much coverage on the focus of this article, Pebblebrook Hotel Trust (NYSE:PEB), in recent years – just 2 articles this year and 4 the whole of last year. Moreover, both of the articles this year are focused on the company’s preferred shares. With the company due to report its earnings in the coming week, I feel that now would be a good time for me to evaluate the company ahead of its earnings release to determine if I would like to add the company to my portfolio.

The Business

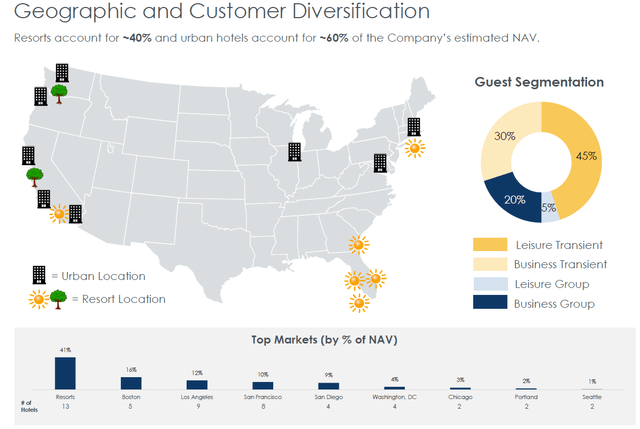

Pebblebrook Hotel Trust is a hospitality REIT with a focus on full-service upscale and luxury hotels and resorts. Such properties typically offer an array of amenities such as multiple dining options, lounges, meeting facilities and other premium services. The company’s focus is on major gateway markets, which are areas with high demand. Subsequent to the end of the first quarter, the company sold both of its hotels in Seattle. As of July 2023, the company’s portfolio comprises 47 hotels spread across 13 markets, encompassing approximately 12,200 rooms. The properties are located in the following locations – Boston, Massachusetts; Chicago, Illinois; Hollywood, Florida; Jekyll Island, Georgia; Key West, Florida; Los Angeles, California (Beverly Hills, Santa Monica, and West Hollywood); Naples, Florida; Newport, Rhode Island; Portland, Oregon; San Diego, California; San Francisco, California; Santa Cruz, California; Stevenson, Washington; and Washington, D.C. This diverse geographic presence enables the company to capture a wide range of markets and customer segments.

Of the company’s 47 properties, 13 of them are resorts with a leisure-focused target market. The company has either undertaken, or has plans to undertake, redevelopment and repositioning initiatives for all 13 of the resorts. Such initiatives are expected to improve the overall guest experience, which will in turn improve the company’s bottom line. In 2023 alone, the company expects its resorts to generate an additional $60 million to $65 million in EBITDA compared to 2019 (the last “normal” year).

As a result of the company’s repositioning in recent years, it has a fairly even split in its customer mix of business and leisure travelers which ensures a balanced revenue stream. This diversification helps the company mitigate any risks from relying too heavily on any one particular segment.

PEB Apr 2023 Investor Presentation

Q1’23 Performance & Q2’23 Outlook

The latest earnings for the company are for Q1 2023. The company will be releasing its Q2 2023 earnings on Thursday, 27 July 2023, after market close, with the earnings call set for the following day.

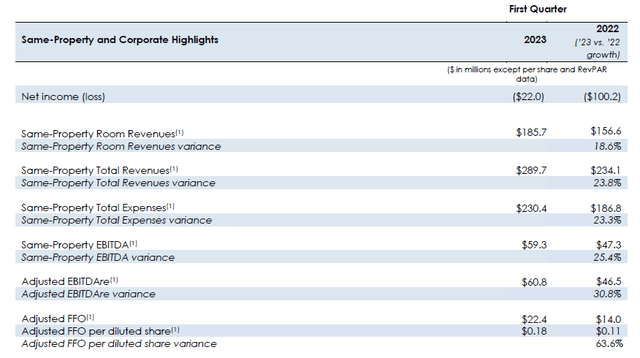

For the first quarter, the company reported a net loss of approximately $22 million, a significant improvement compared to the net loss of $100 million reported in the same period last year. The adjusted funds from operations (AFFO) came in at $22.4 million, or $0.18/share, a notable increase compared to the AFFO of $14 million or $0.11/share reported in Q1 2022. Looking at the more granular details, various metrics demonstrated double-digit improvements in percentage terms compared to Q1 2022, an indication that the company is on the right track as it continues to recover from the effects of the pandemic.

PEB Q1’23 Earnings Release

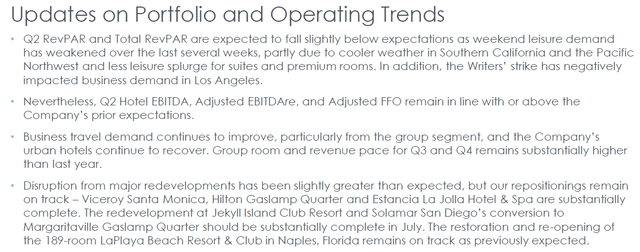

In terms of the Q2 2023 outlook, the company initially projected a net income of between $34 million and $38.9 million, an AFFO of between $0.52/share and $0.57/share and a revenue per available room (RevPAR) growth of between 1% and 4% compared to Q2 2022. However, in an update provided last month, the company said that it expects its RevPAR to come in below expectations due to a weakening of demand. However, the company reiterated that it still expects to meet its expectations for the other metrics.

PEB Jun’23 Update

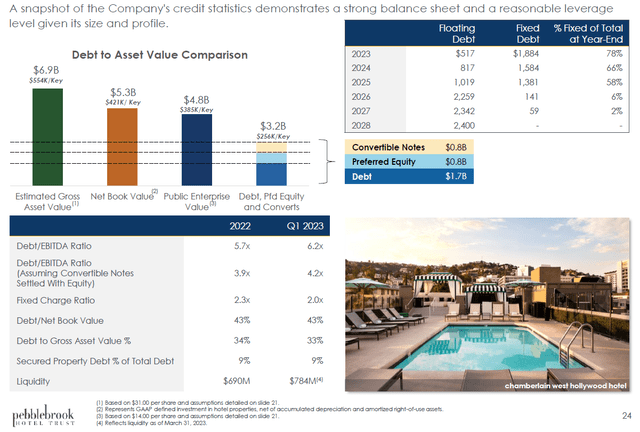

Balance Sheet

As of Q1 2023, Pebblebrook Hotel Trust has a robust total liquidity of $783.5 million. This includes$146.5 million in cash reserves, and an additional $636.9 million available on its credit facility. Additionally, as mentioned above, the company disposed of 2 properties subsequent to the quarter end for $97 million, which further boosts its liquidity. During the Q1 2023 earnings call, management said that the net proceeds from the property sales would be retained as cash to reduce the company’s net debt as well as potentially facilitate share repurchases. As a result, the current liquidity should be approximately $880 million after taking into account the additional cash from the disposal of its properties.

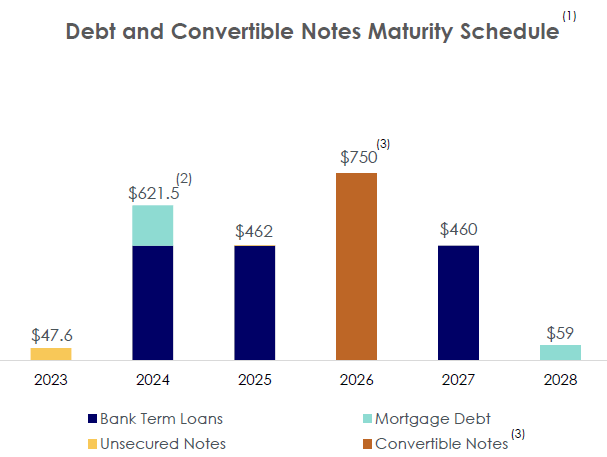

In comparison, the company has a total debt of approximately $2.4 billion, with a weighted average interest rate of 4.1%. A look at its debt maturity schedule shows a fairly manageable repayment schedule, with less than $50 million due in the current year and the bulk of the remainder spread across the subsequent 4 years. Its strong liquidity ensures that the company will be able to fulfill its near-term debt obligations, with the recent sales of its 2 properties in Seattle having further strengthened its liquidity position.

PEB Apr 2023 Investor Presentation

Additionally, the company has a significant portion of its debt structured as fixed debt. This ensures a level of predictability it its cash flows, allowing for better financial planning and stability. Additionally, it also has other favourable metrics, such as a low debt-to-net book value of 43%.

Put together, the company has a fairly healthy balance sheet with no questions over its sustainability in the near future.

PEB Apr 2023 Investor Presentation

Dividend

Prior to the pandemic, the company had a track record of consistently paying a quarterly dividend of $0.38/share and had been maintaining this level for several years since 2016. However, as with other hospitality REITs, the company had to make adjustments to its dividend policy as a result of the pandemic. The company lowered its dividends to a nominal $0.01/share, and has kept it as such for the past 3 years (or 14 consecutive quarters). Based on the company’s latest share price of approximately $14, this gives it a 0.29% dividend yield. Put another way, an investor would need 350 years to recover his/her initial investment through dividends alone.

Of course, this situation is far from ideal for investors seeking significant dividend returns. With the company’s healthy balance sheet, it is a matter of when, instead of whether, the company will increase its dividends again. However, it should be noted that management has shown itself to be conservative, and there is no indication when its dividends will increase.

Valuation

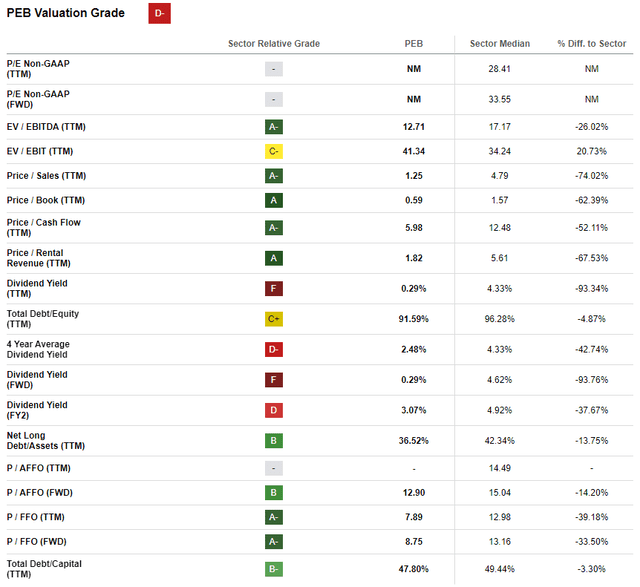

The Seeking Alpha quant rating gives the company an overall “D-” rating. At first glance, this may indicate that the company is overvalued. However, a closer inspection reveals that the company actually receives either “A” or “B” ratings for most financial metrics. For instance, the company has a “B” rating for its forward price-AFFO ratio (price/AFFO ratio) , an indication that it is undervalued based on its current financial performance.

The company also receives an “A” for its price-to-book ratio (P/B ratio), with its P/B ratio standing at an attractive 0.59, substantially lower than the sector median of 1.57, an indication that the market is valuing the company’s assets at a discount compared to its peers in the hospitality sector.

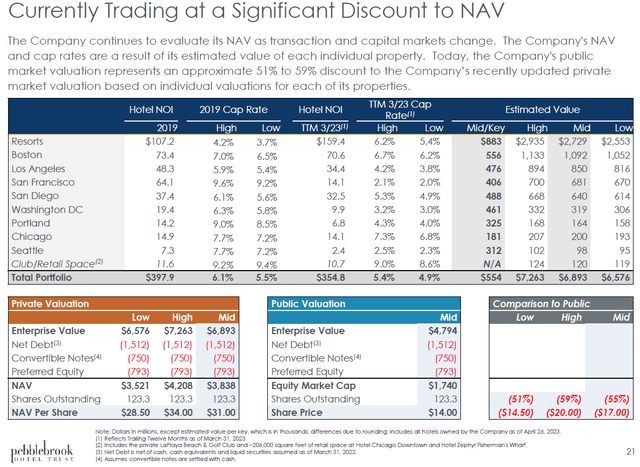

Seeking Alpha

The company’s internal valuations also support this thesis. Even at the lower end of its valuations, the company estimates its net asset value (NAV) to be $28.50/share, a more than 50% discount to its current share price of approximately $14. While the company’s own valuations should be taken as a pinch of salt as there is an inherent bias, it can still be used as a rough gauge. Furthermore, the company’s commitment to share repurchases is also proof that the company is confident in its valuations. Since Q4 2022, the company utilized $124.6 million to repurchase over 6% of its common shares outstanding at an average price of $14.64/share. Such buybacks are an indication that the management believes its stock is substantially undervalued.

PEB Apr 2023 Investor Presentation

The main reason the company receives an overall “D-” rating is because of its current dividend yield. With a dividend yield of virtually zero, it scores an “F” on these dividend-related metrics. However, as mentioned above, the company does have the capacity to increase its dividends – it is just a question of when.

Conclusion

There is much to like about the company. Its shares seem significantly undervalued, and it has a healthy balance sheet, meaning there are no immediate concerns over the company’s financials. However, it has a near-zero dividend yield, which is an issue for me. While capital growth is definitely welcome, dividends are ultimately the main reason I look to invest in REITs. With its healthy balance sheet, the company has shown that it is certainly able to increase its dividend if it wants to. However, until then, the company is a “Hold” for me. I will be watching the upcoming earnings closely to see if the company decides to increase its dividends. If so, I would have to re-evaluate my rating on the company.

Read the full article here