The past few days have been very busy for Pembina Pipeline Corporation (NYSE:PBA). On December 11th, the management team of the firm came out with initial guidance for the 2024 fiscal year. And two days later, on December 13th, news broke that the company had agreed to acquire the ownership interests that Enbridge Inc. (ENB) currently owns in joint ventures that both companies are part of. The updated guidance gives us a reason to step in and value the company to see what kind of upside potential, if any, shares might warrant. And given the size of the acquisition that the firm has made, it’s not a bad idea to gauge just how appealing that particular purchase is and whether management made an error by going this route or not. Based on my own assessments, the deal has positive and negative aspects to it. On the whole, I would view it that’s fine. But even with guidance looking up for 2024, I wouldn’t exactly call this a great prospect for shareholders. Right now, it’s one of the more expensive companies in its space and, in my view, it deserves only a very soft ‘buy’ rating at this time.

A necessary note

Before I get into the details, it’s important to note that Pembina Pipeline is a Canadian company. It reports all of its financial results in Canadian dollars. Shares are also listed, not only on the Toronto Stock Exchange but on the New York Stock Exchange as well. Given that my primary audience uses U.S. dollars as opposed to Canadian dollars, I have converted all of its financial results into U.S. dollars. If I reference Canadian dollars, you will notice a ‘CDN’ listed before the dollar sign.

Current guidance is bullish

For those not aware of Pembina Pipeline, the company describes itself as an energy transportation and midstream service provider that operates throughout parts of North America. The company’s network consists of hydrocarbon liquids and natural gas pipelines, as well as gas gathering and processing facilities, oil and NGL infrastructure and logistics assets, and export terminals. At the end of the day, its entire business is really dedicated to helping oil and gas get where it needs to go.

This market is actually highly attractive in many respects. In addition to generating strong cash flow margins, cash flows tend to be stable even when revenue can be volatile. It helps that many companies in the space have come to focus heavily on serving customers that will provide minimum volume commitments with guaranteed payments and payments that are often disconnected from the price of the commodities they transport.

Since its founding 65 years ago, Pembina Pipeline has grown into a rather large company with a market capitalization of $18.8 billion. Its Pipelines Division handles pipeline transportation capacity equivalent to 2.8 million boe (barrels of oil equivalent) per day, as well as above ground storage capacity of 11 million barrels and rail terminalling capacity of approximately 105,000 boe per day. The firm has other divisions as well, such as a Facilities Division that involves its natural gas gathering and processing facilities and other related assets. Amongst other things, these facilities have a total capacity for what they do of 5.4 Bcf per day. This part of the business has around 354,000 barrels per day of NGL fractionation capacity and 21 million barrels of cavern storage capacity. And finally, there is the Marketing & New Ventures Division, which focuses on selling off the hydrocarbons that it deals with. Some of these operations also include cutting edge developments to focus on greenhouse gas emissions reduction.

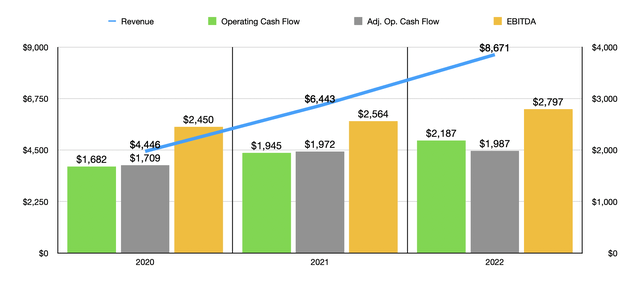

Author – SEC EDGAR Data

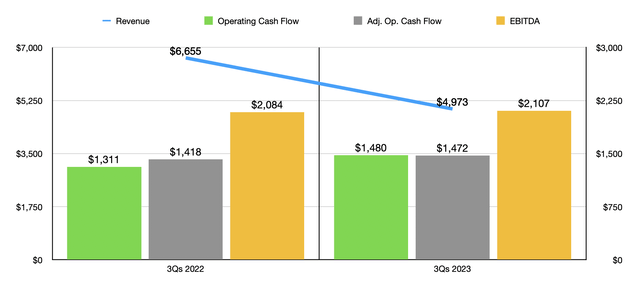

Over the years, management has done a solid job growing the company’s top and bottom lines. High energy prices have been one factor in driving revenue up from $4.45 billion in 2020 to $8.67 billion in 2022. Operating cash flow has managed to grow from $1.68 billion to $2.19 billion. If we adjust for changes in working capital, we get a rise from $1.71 billion to $1.99 billion. And lastly, EBITDA has grown from $2.45 billion to $2.80 billion. This year has so far been a bit mixed in some respects, but also illustrative. In the chart below, you can see financial data covering the first nine months of 2023 relative to the same time last year. As you can see, revenue plummeted, with that drop driven by a combination of a reduction in volumes transported and lower energy prices. At the same time, however, the company’s profitability metrics have only improved. In this space, revenue is not all that significant because much of what the company does involves guaranteed fees and margins between the price at commodities are sold and the price at which they are bought.

Author – SEC EDGAR Data

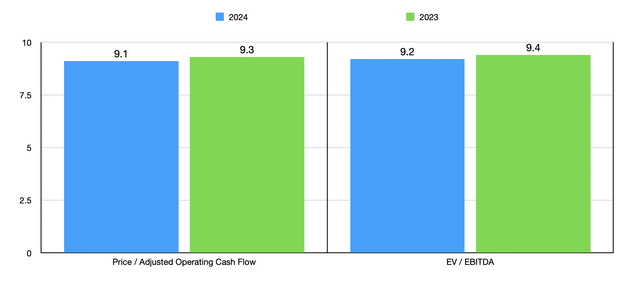

In its third quarter earnings release, management said that EBITDA for 2023 should now be between CDN$3.75 billion and CDN$3.85 billion. That’s up from the prior expected range of between CDN$3.55 billion and CDN$3.75 billion. At the midpoint and using U.S. dollars, we are looking at $2.84 billion, which would be approximately 1.5% above what the company reported for 2022. This should translate to an adjusted operating cash flow of approximately $2.02 billion. But on December 11th, management came out with guidance for 2024. Their current expectation is for EBITDA to come in somewhere between CDN$3.725 billion and CDN$4.025 billion. At the midpoint, we are looking at around $2.89 billion. And that should be about $2.06 billion for adjusted operating cash flow.

Author – SEC EDGAR Data

Using these figures, I was able to value the company as shown in the table above. You can see valuation data for not only 2023 but also for 2024. The stock does look a tiny bit cheaper on a forward basis. But I wouldn’t say the disparity is material. Relative to similar firms, shares are, unfortunately, a bit pricey. In the table below, I compared Pembina Pipeline to five similar enterprises. It was the most expensive of the group when it came to the price to operating cash flow multiple. And four of the five companies were less expensive than when using the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Pembina Pipeline Corporation | 9.3 | 9.4 |

| Targa Resources (TRGP) | 7.0 | 8.6 |

| Cheniere Energy Partners (CQP) | 6.6 | 5.6 |

| Western Midstream Partners (WES) | 6.6 | 8.7 |

| Plains All American Pipeline (PAA) | 5.1 | 7.3 |

| Enbridge Inc. | 6.9 | 14.0 |

An interesting transaction

Pembina Pipeline Corporation

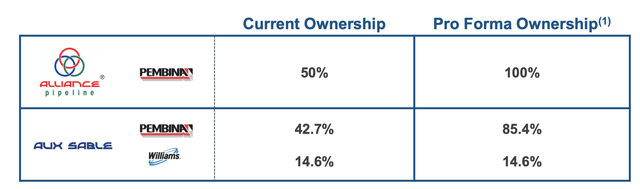

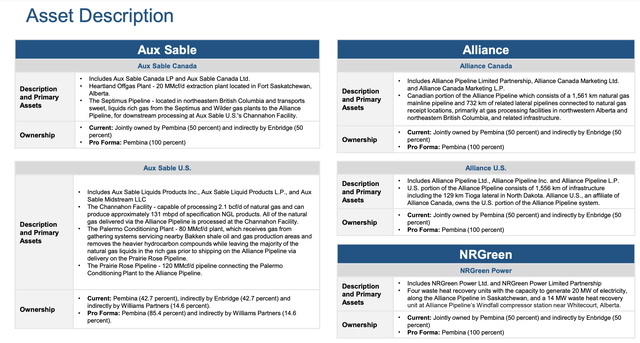

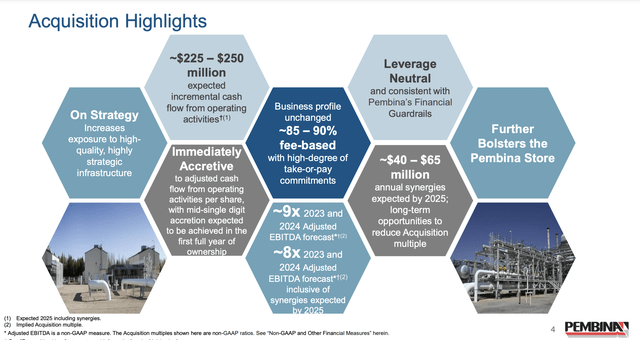

As I mentioned earlier in this article, another development occurred on December 13th. On that day, management announced that it was buying up some assets from a joint venture between it and Enbridge. In exchange for CDN$3.1 billion, or $2.32 billion, Pembina Pipeline is going to be acquiring the 50% ownership interest that Enbridge currently has in the Alliance and NRGreen joint ventures, plus a 50% ownership interest in the Canadian operations of the Aux Sables entity. It also will receive 42.7% of the interest in the US operations of Aux Sable as well. This will make the company the whole owner of all of these assets, with the exception of the US business of Aux Sable which it will have only an 85.4% stake in. The Williams Companies (WMB) currently has the other 14.6% of that.

Pembina Pipeline Corporation

It’s worth noting that in order to make this transaction happen, Pembina Pipeline is offering up subscription receipts for sale totaling CDN$1.1 billion. In short, what will happen is that 26 million subscription receipts will be issued to the public markets, giving holders of them the right to receive shares of Pembina Pipeline at a price of CDN$42.85 immediately upon closing of the transaction in the first half of 2024. The subscription receipts also carry with them dividend equivalent payment rates where basically any dividends paid out to common shareholders from the offering date until the date the transaction ends up being closed will also be paid to the holders of these subscription receipts as though they were common shareholders at that time. In the event that the deal is terminated or cancelled for any reason, holders of these subscription receipts will get their money back and will be entitled to the dividends as if they had owned the stock during that time. Underwriters also have a 30-day option available for an extra 3.9 million shares under the same terms. I should also mention that the purchase price of the assets in question includes CDN$327 million in debt that the company is assuming from Enbridge as well.

Pembina Pipeline Corporation

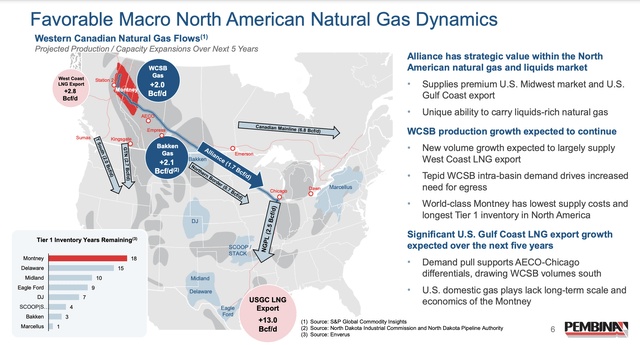

The assets being acquired will further commit the company to the North American gas industry, including the NGL space. The Alliance pipeline is itself capable of transporting 1.7 Bcf per day of liquids-rich natural gas. It alone is nearly 2,400 miles in length and stretches from places like northern Canada and North Dakota to Chicago. In truth, an entire article could be written just discussing the intricacies and aspects of these particular assets. But management has a really good description of each asset as shown in the image above.

Pembina Pipeline Corporation

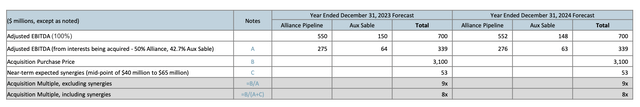

Initially, the purchase price implies an EV to EBITDA multiple on the assets of approximately 9. But management has some cost cutting initiatives in mind. You see, these assets integrate very well with the firm’s existing network of assets and, in 2023 and 2024, the business will be pushing for between CDN$40 million and CDN$65 million in annual synergies, with over CDN$100 million in annual synergies possible in the long run. The expectation is that, by 2025, the assets should generate between CDN$225 million and CDN$250 million in operating cash flow per annum. At the midpoint and in U.S. dollars, which translates to approximately $177.4 million. The data also implies that the assets, with a midpoint of synergies captured, should be responsible for around $292.4 million in EBITDA per annum. At the end of the day, what we get from all of this is an EV to EBITDA multiple of 7.9, which is comfortably lower than what Pembina Pipeline is trading for at this time.

Pembina Pipeline Corporation

Takeaway

From all that I can see, it looks as though Pembina Pipeline is doing a fine job and that it is making a wise decision with this purchase. The company is also a fine enterprise, and shares are cheap on an absolute basis. However, relative to similar companies, the stock does trade at a premium. That could certainly serve as a deterrent for many investors. But in the long run, I think the stock is still cheap enough to warrant a soft ‘buy’ rating at this time.

Read the full article here