If you’re not yet familiar with the business development company industry, you’d do well to check it out, especially if you’re an income investor.

Known as BDCs, these firms lend money to privately held companies, which also have co-sponsors, such as VC groups and hedge funds. We’ve covered several BDC’s in our weekend articles, and this week we’re covering PennantPark Floating Rate Capital (NYSE:PFLT), a BDC under the Pennant Park Investment Advisors Group platform.

Company Profile:

PFLT makes secondary direct, debt, equity, and loan investments. It focuses on companies that are owned by established middle market private equity sponsors with a track record of supporting their portfolio companies.

The fund seeks to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies. It primarily invests in the US, and to a limited extent non-U.S. companies. The fund typically invests between $2M to $20M.

PFLT is managed by PennantPark Investment Advisers, LLC, which has a middle market credit platform with $6.8B in assets under management.

PFLT also has a JV – PSSL, a Senior Secured Loan Fund, which was formed in 2017 with Kemper, which owns 12.5% of the JV, while PFLT owns 87.5%, and manages it. As of 9/30/23, 99% of PSSL’s investments were 1st lien Secured debt.

Performance:

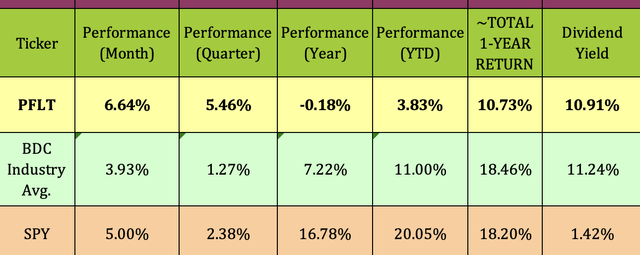

While PFLT has lagged the BDC industry over the past year and so far in 2023, it has outperformed them more recently, in the past month and quarter.

Hidden Dividend Stocks Plus

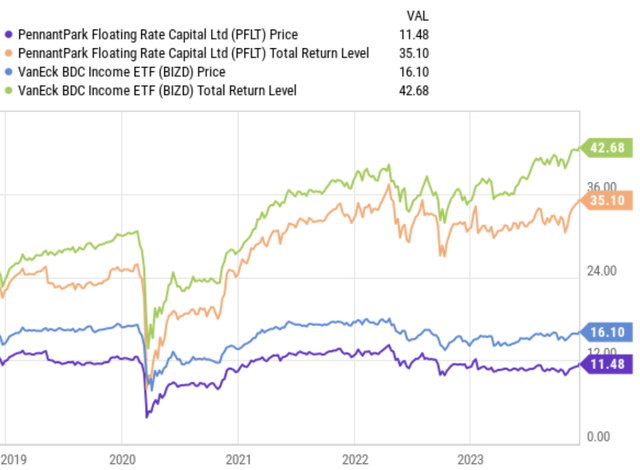

A longer lookback shows PFLT trailing the BDC industry on a price and total return level over the past 5 years:

YCharts

Holdings:

As of September 30, 2023, PFLT’s portfolio totaled $1,067.2M and consisted of: $906.2M of 1st lien secured debt (including $210.1M in its PSSL JV); $0.1M of 2nd lien secured debt; and $160.9M of preferred and common equity (including $50.9 million in PSSL). It held ~100% variable-rate investments.

The portfolio consisted of 131 companies with an average investment size of $8.1M and a weighted average yield on debt investments of 12.6%.

As of 9/30/23, the PSSL JV portfolio totaled $785.9M, consisting of 105 companies, with an average investment size of $7.5M and a weighted average yield on debt investments of 12.1%.

As of September 30, 2023, PFLT had 3 portfolio companies on non-accrual, representing 0.9% and 0.2% of its overall portfolio on a cost and fair value.

Earnings:

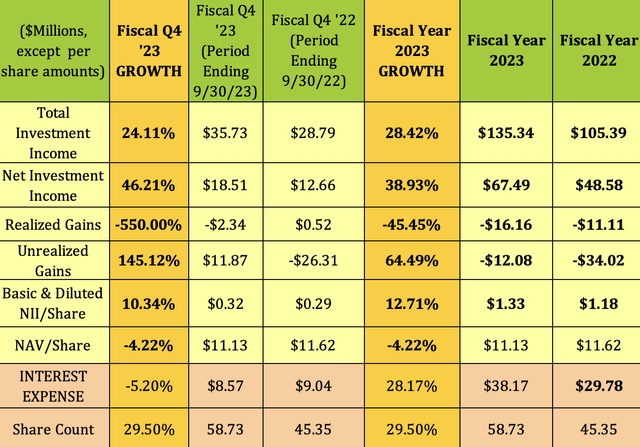

Fiscal Q4, the period ending 9/30/23, had robust top line growth of 24% and NII growth of 46%. Realized losses were $2.34M, while Unrealized Gains reversed and were up 145%, at $11.87M. Interest expense actually fell ~5%, an uncommon event these days.

Fiscal Year 2023 also had strong growth, as rising interest rates, and banks pulling back from commercial lending created a very beneficial earnings scenario for BDC. NII rose 39%, and total Investment Income rose over 28%.

Interest expense rose 28%. The share count rose over 29% in fiscal 2023, as PFLT issued 9,089,064 shares under its ATM Program, at an average price of $11.03.

Hidden Dividend Stocks Plus

New Business:

For the period ended September 30, 2023, PFLT invested $93.5M in 3 new and 31 existing portfolio companies with a weighted average yield on debt investments of 12.1%. Sales and repayments of investments for the same period totaled $141M.

The three months ended September 30, 2022, had a much lower yield, at 8.9%, and less activity – $54.7M invested in 5 new and 25 existing portfolio companies. Sales and repayments of investments for the same period totaled $98.0M.

For the fiscal year ended 9/30/23, PFLT invested $324.5M in 16 new and 71 existing portfolio companies, with a weighted average yield on debt investments of 12.1%. Sales and repayments of investments for the same period totaled $399.1M.

Dividends:

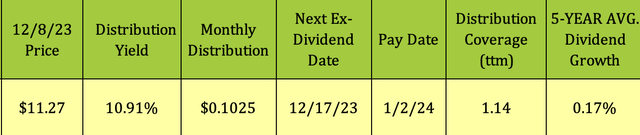

Management declared another $.1025 monthly dividend for December. After maintaining the monthly payout at $.095 since 2018, they increased it to $.10 in March ’23 and further increased it from $.10 to $.1025 in June ’23.

NII/Distribution coverage was 1.14X for fiscal 2023.

Hidden Dividend Stocks Plus

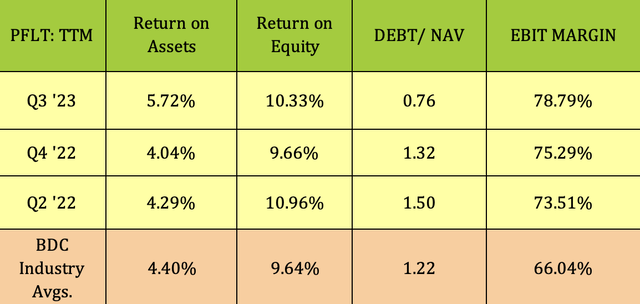

Profitability & Leverage:

Management has greatly de-levered PFLT in 2023, bringing its Debt/NAV down from 1.32X as of 12/31/22, to .76X, as of 9/30/23. ROA, ROE, and EBIT Margin also improved, and are all above industry averages.

Hidden Dividend Stocks Plus

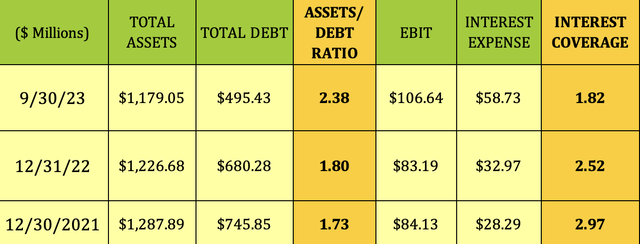

Debt & Liquidity:

“The Credit facility has an interest rate spread above SOFR (or an alternative risk-free floating interest rate index) of 236 basis points, a maturity date of August 2026, and a revolving period that ends in August 2024.” (Fiscal 2023 10K.)

Hidden Dividend Stocks Plus

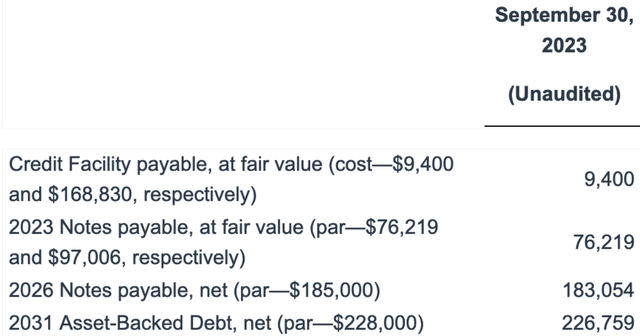

PFLT had cash equivalents of $100.6M, and credit availability of $376.6M, as of 9/30/23. PFLT also has $76.2M in 2023 Senior Notes, $185M in 2026 Senior Notes, and $226.76M in 2031 Asset Backed Debt:

PFLT site

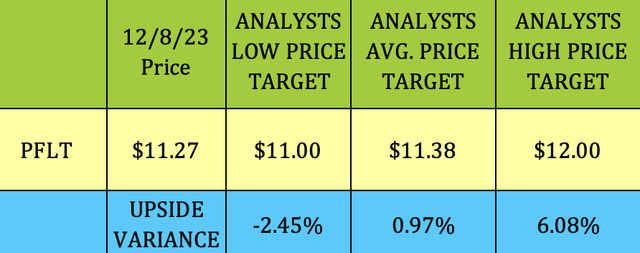

Analysts’ Price Targets:

At its 12/8/23 $11.27 price, PFLT was just 1% below the street’s average price target of $11.38, and 6% below their $12.00 highest target.

It is ~7% below its 52-week high of $12.33, and ~18% above its 52-week low of $9.69.

Hidden Dividend Stocks Plus

Valuations:

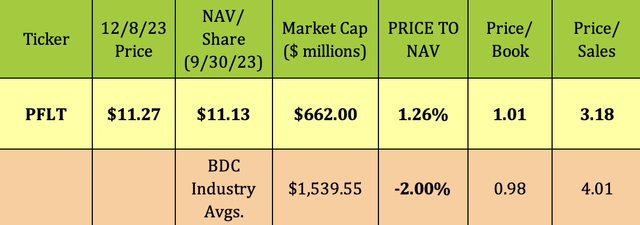

PFLT is in the smaller-sized group of BDCs with a $662M market cap, vs. the $1.5B industry average. At $11.27, it was priced at a slight 1.27% premium to its 9/30/23 NAV/Share of $11.13, vs. the BDC industry’s overall 2% discount to NAV. Its P/Sales of 3.18X is considerably lower than average.

Hidden Dividend Stocks Plus

PFLT’s trailing NII/Share multiple of 8.47X is slightly lower than the 8.56X industry average; whereas its 2024 Forward P/E of 9.02X is above the 7.79X average. Its dividend yield is roughly in line with the industry average, while its EV/EBIT is quite a bit lower.

Hidden Dividend Stocks Plus

Parting Thoughts:

We rate PennantPark Floating Rate Capital stock as a Hold – earnings are good, as with other BDCs, but we don’t see any undervaluation at this point, which is compelling enough to buy shares.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here