Pfizer Inc. (NYSE:PFE) has been one of the most frustrating companies in my coverage, as my previous bullish thesis on the leading biopharma leader hasn’t panned out. The company’s outlook on its COVID franchise has proved to be more challenging than anticipated, leading to over-optimistic Wall Street estimates. As a result, I believe the market has gotten on point, as it battered PFE to a 10-year low.

Accordingly, Pfizer de-rated its guidance again, which followed a downgrade after its third-quarter or FQ3 earnings release. As a result, Wall Street analysts were palpably concerned with the company’s modeling in its recent conference call discussing the review of its guidance. Notably, Pfizer highlighted that its previous 6% ex-COVID revenue CAGR from 2020-25 “seems challenging to achieve” if the company doesn’t include business development revenue. As a result, it called into question that Pfizer investors might need to deal with anemic topline growth rates as the COVID headwinds continue to rear their ugly head.

An analyst on the recent call didn’t disguise his disappointment, highlighting that “2025 will have a tough comp because of the acquisition, so another sluggish year.” As a result, analysts are becoming increasingly concerned about whether there could be further downgrades to Pfizer’s COVID-related revenue. At the same time, the company is attempting to scale up its Seagen acquisition, which closed recently.

Management indicated it wasn’t ready to call a “trough” in its COVID revenue outlook downgraded to $8B for 2024, with $5B attributed to Comirnaty and $3B to Paxlovid. However, it indicates a significant downgrade from Wall Street estimates of $13.8B, suggesting a significant forecasting error in projecting Pfizer’s COVID outlook. As a result, it seems possible that management has realized its mistakes in trying to project a more optimistic outlook on its COVID franchise previously. In the recent call, management accentuated its “intent to provide a realistic and conservative estimate for COVID revenue.” The company stressed the challenges in trying to “model with certainty,” suggesting the market has likely de-rated its COVID franchise to account for much higher execution risks than anticipated.

Notwithstanding the near-term caution, Pfizer attempted to assure investors that its long-term forecasts on Seagen remained on track and did not communicate a deviation. Management highlighted a $0.40 near-term dilution on its FY24 adjusted EPS to account for financing costs related to the acquisition. However, Pfizer maintained its expectation of achieving $10B in revenue from Seagen by 2030. Seagen is expected to accrue to Pfizer’s topline in 2024, contributing an estimated $3.1B. As a result, it should help to mitigate Pfizer’s COVID headwinds, although the market could remain concerned about further de-rating risks related to its $8B forecasts. Given how off-the-mark management’s outlook has been related to its COVID franchise, I expect the market to have sufficiently de-risked its 2024 outlook.

With the battering in PFE over the past year, the critical question is whether it has likely formed its long-term bottom? Seeking Alpha assigned an “A-” valuation grade, suggesting relative appeal compared to its sector peers. However, given the unpredictability of its COVID-related revenue estimates, its “F” growth grade should have been considered with more caution. As a result, I believe the market’s focus on its growth prospects is correct, notwithstanding its relatively attractive valuation grade.

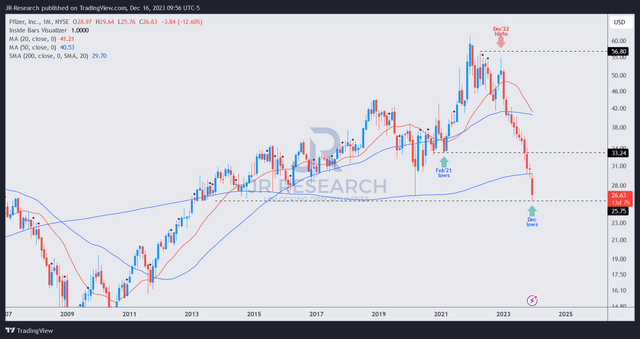

PFE price chart (monthly) (TradingView)

PFE’s long-term price chart remains bearish and seems to have broken below its 200-month moving average or MA (purple line). As a result, PFE could continue to struggle for momentum unless dip-buyers return over the next three to four months to help defend against a further slide.

I assessed that a bear trap could still occur at the $26 level, as investors over the past ten years likely capitulated. Given PFE’s steep plunge over the past year, it seems to have dropped into peak pessimistic levels, as the $26 level was a highly critical support zone that underpinned its long-term bottom.

As a result, I believe it’s not unreasonable for me to remain bullish at the current levels. However, more conservative investors should consider waiting for confirmation about a possible bullish reversal.

Takeaway

Pfizer’s steep collapse over the past year took out a ten-year low and wiped out all the gains since it bottomed out after its 2020 COVID lows. As a result, the market seems to have disregarded the benefits of its COVID franchise, which bolstered its balance sheet and allowed Pfizer to continue making its dividends and business development activities.

Management also highlighted that it remains committed to paying dividends, with its forward yield surging to 6.2%, well above its 10Y average of 3.7%. Coupled with a more dovish Fed, which looks primed to cut rates from 2024, income investors should be more assured about a well-battered PFE stock that still received a “B-” dividend safety grade from Seeking Alpha Quant. As a result, I believe it demonstrates the sustainability of Pfizer’s robust earnings quality, rated with a best-in-class “A+” grade.

Consequently, I believe it’s unreasonable for investors to ignore the benefits of Pfizer’s COVID franchise, as it last traded at a forward EBITDA multiple of 9.2x, markedly below its 10Y average of 10x. Therefore, I assessed that the pessimism on PFE has likely hit rock bottom, as it re-tested its $26 critical support level, bolstering a capitulation thesis for long-term buyers to add more exposure.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here