Pacific Gas and Electric Co. (NYSE:PCG) has demonstrated a strong recovery from its 2019 bankruptcy. I believe the company is a buy due to its strong earnings and guidance into macroeconomic headwinds, integration of renewables, and undervaluation assuming my DCF figures.

Business Overview

PG&E Corporation, operating through its subsidiary Pacific Gas and Electric Company, is involved in the provision and distribution of electricity and natural gas to customers in northern and central California, United States. The company utilizes a diverse range of energy sources including nuclear, hydroelectric, fossil fuels, fuel cells, and photovoltaic systems to generate electricity.

PG&E owns and manages an extensive network of interconnected transmission lines, substations for both electric transmission and distribution, as well as natural gas transmission, storage, and distribution infrastructure. Its customer base encompasses residential, commercial, industrial, and agricultural sectors, and includes natural gas-fired electric generation facilities.

Electrifying and Sustainable Future

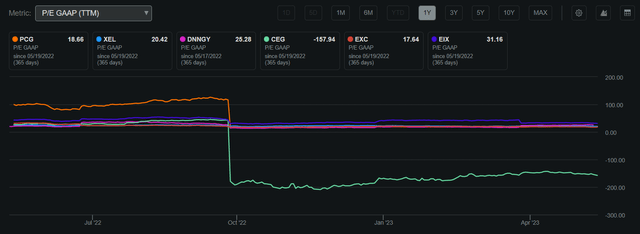

With a market capitalization of $33.15 billion, PG&E Corporation has reached a 52-week high of $17.68 and a low of $9.64. The current trading price of $16.61 positions the stock near its yearly highs. PG&E’s price-to-earnings ratio stands at 18.66, indicating a comparatively lower valuation than many other companies in the same industry.

P/E GAAP Comparison to Peers (Seeking Alpha)

Despite not currently paying a dividend, PG&E has demonstrated effective utilization of its free cash flow to regain its position as a prominent brand in the industry following its bankruptcy emergence in 2019. I hold the belief that as the company stabilizes its cash flows and establishes a solid balance sheet, the potential for introducing a dividend becomes a viable option to provide consistent rewards to investors, aligning with the practices observed in numerous other utility companies.

Seeking Alpha

In the first quarter of 2023, PG&E delivered a strong performance, with earnings per share meeting expectations at $0.29, while revenues exceeded projections by $20 million, reaching $6.21 billion, a notable increase of 7.3% compared to the previous year. These results highlight PG&E’s effective utilization of free cash flow to drive growth in its core operations, signifying the company’s ongoing recovery from its challenging period in 2019.

Additionally, PG&E has reiterated its earnings per share guidance range of $1.19 to $1.23 per diluted share for the year 2023. This reaffirmed guidance indicates that PG&E is effectively expanding its operations and safeguarding against potential macroeconomic challenges, underscoring the company’s strategic use of cash for growth.

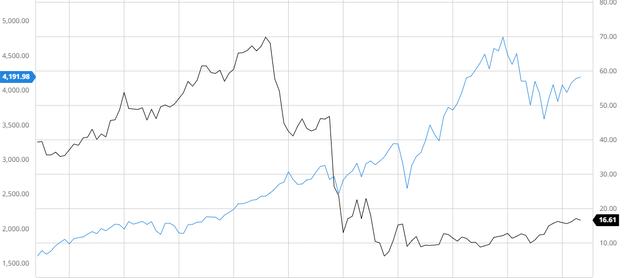

Performance in Comparison to the Broader Market

PG&E has underperformed the broader market in the last 10 years when adjusting for dividends. This is due to its bankruptcy filing in 2019 which forced the company to reduce expansion and utilize financial resources to survive instead of grow.

10Y Comparison of PG&E and S&P 500 (Created by author using Bar Charts)

Integration of Renewable Energy to Upgrade Grid Systems and Spark Growth

PG&E has been diversifying its energy sources to build a reliable portfolio that benefits from growth and efficiency. This diversification, which recently shifted towards renewable energy sources, will promote the expansion of the business’s primary business model.

For instance, A grid-scale battery and green hydrogen long-duration energy storage system (BH-ESS) are examples of the collaborative efforts that PG&E has proposed.

The purpose of this project is to continuously provide electricity to Calistoga’s downtown and the area around it. Calistoga is a city in Northern California. In the event of planned power outages or shut-offs brought on by increased wildfire dangers, the BH-ESS is intended to guarantee an uninterrupted power supply for at least 48 hours. This energy dispatchable storage system will have a minimum 293 MWh capacity. Its capacity might also be increased to 700 MWh, allowing for continuous operation without the need for refueling or recharging.

I believe these partnerships will enable PG&E to diversify its energy supply, which will result in a more stable pricing strategy for the business and less cyclicality from single sources. Once the initial investment is made, renewable energy sources like solar, wind and hydrogen also have reduced ongoing costs. In order to reduce its exposure to fluctuating fossil fuel prices, PG&E can stabilize its energy costs over the course of the contracts by negotiating long-term PPAs with fixed or indexed pricing.

Lastly, PG&E may be able to secure long-term PPAs and a reliable source of income by investing in renewable energy projects. The business can gain from cost reductions and even increase revenue through the sale of extra renewable energy to the grid as technology develops and renewable energy costs continue to fall. With the ability to expand into many markets and generate long-term cash flows, this will give PG&E the more solid investment it needs as it emerges from bankruptcy.

IEEE SA

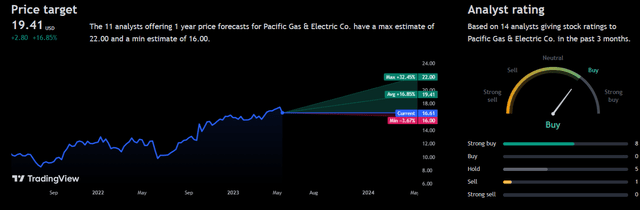

Analyst Consensus

Analysts rate PG&E a “buy” with an average price target of $19.41, which presents a 1Y 16.85% potential upside.

TradingView

Valuation

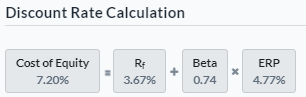

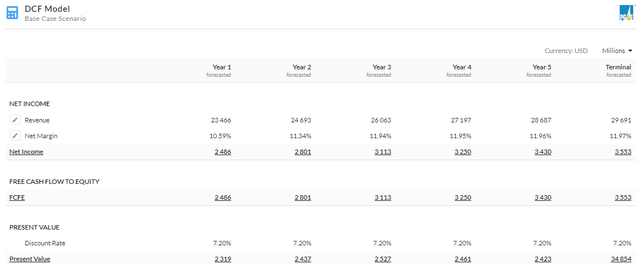

Before formulating my assumptions, I calculated a suitable discount rate for PG&E using the Capital Asset Pricing Model approach. By incorporating a risk-free rate of 3.67%, I arrived at a Cost of Equity of 7.2%.

Created by author using Alpha Spread

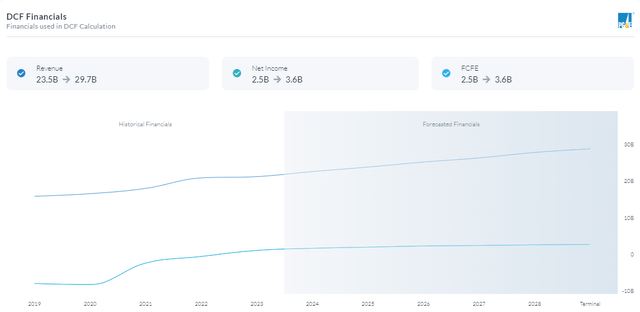

Based on my Equity Model DCF analysis using net income, I have found that PG&E is currently undervalued by 13%, indicating a fair value of approximately $19.01. This valuation was determined by applying a discount rate of 7.2% over a 5-year period. Additionally, I considered the company’s projected low to mid-single-digit revenue growth rate beyond 2023, aligning with their own forecasts. Furthermore, I factored in the anticipated improvement in margins resulting from grid improvements.

5Y Equity Model DCF Using Net Income (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Risks

Regulatory and Legal Risks: As part of a highly regulated industry, PG&E’s operations and financial results are susceptible to changes in laws or legal challenges. This includes deciding on rates, safety requirements, and environmental regulations. Financial risks can also be associated with legal responsibilities resulting from prior events, such as wildfires.

Natural Disaster Risks: The region where PG&E works is vulnerable to natural calamities, especially wildfires. The business is at risk of wildfires harming its infrastructure, which could result in halted services, expensive repairs, and significant legal repercussions. The operations and financial performance of PG&E may be impacted by the frequency and intensity of wildfires in California, which are influenced by elements including climate change and vegetation management.

Financial Risks: PG&E has a significant amount of debt as shown below, and changes in interest rates, credit scores, and access to capital markets may have an impact on its financial situation. The company’s financial resources may also be strained by economic downturns, variations in energy consumption, or unforeseen costs.

PG&E balance Sheet (TradingView)

Conclusion

To summarize, I believe PG&E is a buy because of its strong earnings and guidance exemplifying resilience, integration of renewable energy to spark growth, and due to the company’s undervaluation when assuming my DCF figures.

Read the full article here