At A Glance

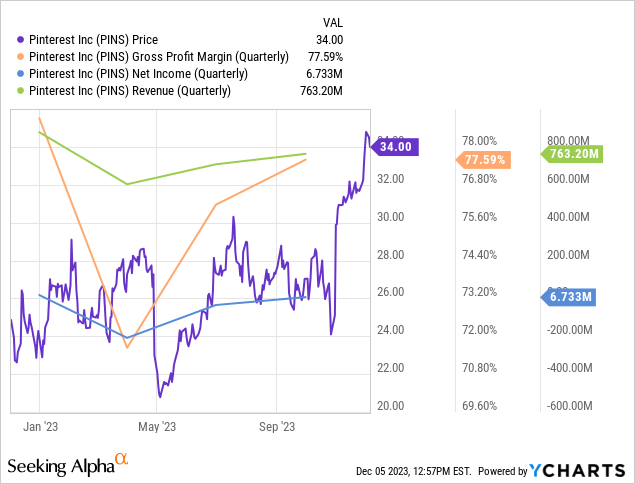

Pinterest (NYSE:PINS) stands out in the digital world, not just as another social network, but as a unique blend of visual exploration and online shopping. It’s their smart use of AI to tailor content and suggestions that’s really catching the eye of younger users. Looking at their finances, Pinterest is on a roll. Their third-quarter report for 2023 was pretty impressive, with revenues hitting $763 million and an adjusted EBITDA of $185 million. This shows they’re not just attracting users but also making money from them. The big news is that Pinterest has finally started making a profit, with a net income of about $6 million. That’s a big deal, considering they started the year with a net loss of $209 million (GAAP). They’ve got a strong financial foundation too, thanks to solid cash reserves and minimal debt. But it’s not all smooth sailing. The online world is fiercely competitive, and Pinterest has had its share of ups and downs in making money. They’ve got potential, but there’s still work to be done to boost profits and really secure their place in the market.

Economic Moat: The Power of Visual Discovery

Pinterest’s economic moat is deeply entrenched in its unique focus as a visual discovery engine seamlessly integrated with e-commerce capabilities. This distinctive approach sets it apart from typical social networking platforms, pivoting towards a model that values individual exploration over social interactions. This unique position in the digital landscape allows Pinterest to capture a niche market, which is integral to building its economic moat.

Strategic Acumen: AI and Enhanced User Engagement

Pinterest has heavily invested in AI technologies, revolutionizing content recommendation and personalization. This strategic use of AI serves as the backbone of Pinterest’s user engagement model, particularly effective in retaining and engaging the Gen Z demographic. Furthermore, the introduction of innovative shopping experiences like ‘Shop the Look’ and guided browsing has blended shopping seamlessly into the user experience, enhancing user interaction and streamlining the journey from inspiration to purchase. This unique blend of technology and user-focused design is a key differentiator in Pinterest’s strategy.

Comprehensive Advertising Solutions

Pinterest’s advertising strategy encompasses a comprehensive range, adeptly catering to various advertiser objectives from enhancing brand visibility to facilitating direct consumer actions. This multifaceted approach is exemplified by the introduction of innovative features like Mobile Deep Links and Direct Links. Mobile Deep Links, for instance, allow advertisers to seamlessly link users directly from a Pinterest ad to a specific page within their mobile application, significantly improving the user experience and potential for conversions. Direct Links further this capability by enabling a direct and streamlined journey from a Pinterest advertisement to a specific product page on the advertiser’s website. These features represent a pivotal enhancement in Pinterest’s advertising toolkit, showcasing its dedication to meeting the evolving and diverse needs of advertisers in a dynamic digital landscape. Through such innovations, Pinterest not only enhances the value proposition for advertisers but also enriches the user experience, aligning consumer interests with relevant commercial opportunities.

Q3 Financial Performance: Growth Coupled with Efficiency

Pinterest’s Q3 2023 financials not only underscore its growth but also its operational efficiency and astute financial management. The company reported a significant revenue jump to $763 million, reflecting an 11% year-over-year increase. This revenue growth, coupled with an expansion to 482 million monthly active users, illustrates Pinterest’s effectiveness in user acquisition and monetization.

The adjusted EBITDA for Pinterest stood at an impressive $185 million, signifying a 24% margin. This marks a substantial 1,300 basis point improvement compared to the previous year, highlighting the company’s profitability and efficient cost management. Such a considerable margin improvement underscores Pinterest’s ability to not only grow revenue but also manage its expenses judiciously, which is vital in the highly competitive and capricious digital landscape.

A critical aspect of Pinterest’s financial health is its balance sheet, which reflects the company’s overall economic stability and capacity for future investments. The amendment of its credit facility, increasing the borrowing capacity to $500 million (page 21), is a strategic move indicating financial preparedness. This increased liquidity could be strategically allocated for growth investments, technological advancements, or potential acquisitions, allowing Pinterest to remain agile and competitive in the rapidly evolving digital marketplace.

As of the end of Q3 2023, Pinterest’s balance sheet is robust, underlined by a healthy cash and cash equivalents position. The company reported approximately $2.3 billion in cash, cash equivalents, and marketable securities. This strong cash position provides Pinterest with a solid foundation to weather potential market uncertainties and invest in growth opportunities. The company’s low total liabilities ($498 million), in contrast to its cash reserves, further strengthen its financial stability and long-term health.

Competition in the Digital Landscape

Pinterest operates in a highly competitive digital landscape, contending with giants like Meta (META), Instagram, and Google (GOOGL), all vying for a share of the lucrative online advertising market. These platforms, with their vast user bases and advanced targeting capabilities, pose significant competition. However, Pinterest’s unique value proposition as a visual discovery tool sets it apart, focusing on individual creativity and inspiration rather than social networking. This niche focus has allowed Pinterest to carve out a distinct space in the market, appealing to users and advertisers seeking a different kind of engagement from the social media norm.

Peer Comparison

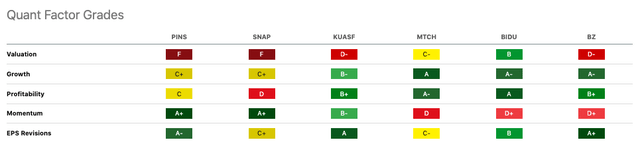

Pinterest displays a distinct financial profile compared to its peers, characterized by moderate valuation metrics and robust growth indicators.

Per Seeking Alpha, its Price/Sales [TTM] at 7.89 and EV/Sales [TTM] at 7.15 are relatively higher, suggesting a premium valuation in the market.

In terms of growth, PINS shows a strong historical revenue growth trend, with a 3-Year CAGR of 28.62% and 5-Year CAGR of 35.08%. This growth is robust, albeit slightly below that of high-growth China peers like Kanzhun (BZ) and Kuaishou (KUASF). Its forward revenue growth projection of 11.33% is healthy, indicating continued business expansion.

PINS’s profitability metrics in the trailing twelve months, however, paint a mixed picture. While its gross profit margin of 76.53% trumps peers, including Snap (SNAP) by ~20%, its negative EBIT and EBITDA margins indicate operational challenges, and a negative net income margin at -7.43% reflects struggles in achieving long-term profitability. This contrasts sharply with companies like Baidu (BIDU) and Match (MTCH), which show more robust EBITDA margins and net income margins.

Seeking Alpha

Overall, PINS shows strong growth potential but faces ongoing challenges in profitability and operational efficiency, positioning it uniquely among its peers. Its valuation suggests investor confidence in its growth prospects, despite challenges in profitability.

My Analysis & Recommendation

In conclusion, Pinterest exhibits a combination of promising advancements and lingering challenges that warrant a “Hold” recommendation. The company’s innovative integration of visual discovery and e-commerce, driven by its strategic deployment of AI, has effectively captured the Gen Z demographic, contributing to a notable revenue increase and a positive step towards profitability in Q3 2023. Pinterest’s robust balance sheet, with significant cash reserves and low debt, is commendable, reflecting financial prudence and stability.

However, Pinterest still has ground to cover before it can be considered a compelling buy. Its journey toward sustained profitability remains in its early stages, as evidenced by its recent transition from consistent losses to a modest net income. Additionally, the digital landscape’s competitive intensity, with formidable players like Meta and Google, poses ongoing challenges to Pinterest’s market positioning and growth trajectory.

For investors, mitigating risk in this scenario involves a diversified approach. Given Pinterest’s unique value proposition and growth potential, it can be a valuable part of a balanced portfolio. However, investors should balance this with investments in more established and consistently profitable companies within the tech and digital advertising sectors. This approach allows for exposure to Pinterest’s potential upside while buffering against the inherent risks associated with a company still in the process of proving long-term profitability.

Ultimately, while Pinterest’s recent advancements are promising, the company’s path to becoming a solid buy recommendation necessitates further evidence of sustained profitability and strategic differentiation in the competitive digital market. Investors should monitor Pinterest’s performance closely, looking for continued improvements in financial metrics and effective navigation of the competitive landscape.

Read the full article here