Summary

In my coverage on Planet Fitness (NYSE:PLNT), I recommended a hold rating due to my expectation that there was concern regarding the extended timeline for store openings. This post is to provide an update on my thoughts on the business and stock. I remain negative on the near-term outlook for PLNT, as the headwinds (permit delays and new franchisee agreements) should continue to delay the pace of store openings. Management comments during the earnings call were also not positive, in my opinion.

Investment thesis

PLNT reported total 3Q23 revenue of $277.55 million, in line with consensus estimate of $270 million, and EBITDA of $126.29 million, beating consensus estimates by ~4%. Despite the positive headline results in 3Q23, I am not convinced that the business outlook has significantly improved. I am still bearish on the near-term growth prospect as the key growth headwind—the pace of store openings—is still present. Store development is hindered by tougher vacancy rates and the presence of exclusionary clauses at certain sites that prohibit fitness centers. While these can be negotiated (I am sure there is a way to come to an agreement), the problem is that the market is unforgiving. PLNT is a business that has traditionally grown at very high rates, and this permit delay issue is significantly impacting the growth trajectory in the near term. To illustrate how bad the situation is, PLNT is now expected to grow by only 8% based on consensus FY24 estimates, the lowest annual if it comes true. Management guidance also proved my point as they are guiding for $1.07 billion revenue for FY23, which implies a growth rate of 13.7% vs FY22. This is a stark decline from the 44.4% and 59.6% growth in FY21 and FY22 respectively. Another issue is that these delays also result in the expiration of free rent periods, which puts a lid on margin expansion potential. In fact, I am surprised that these permit delays are an issue within the company’s deployment plans. Given the scale of PLNT (the largest player in the industry), with ~2.5k stores and close to 19 million members, I would’ve expected them to know how to avoid these from happening. In any case, this is definitely not positive.

Moreover, management comments during the call are not encouraging either. While management has mentioned continued real estate site availability, comments regarding unpredictable delays from permitting constraints sent a very negative message. Below is a portion of the call that blew my mind. From the comments, it seems like management is not executing as well as it should, given that PLNT is an experience player with strong track record of penetrating new markets across the nation. This is clearly not their first rodeo, so why are all these “issues” coming to the surface now? Also, “hope for the best” certainly isn’t something that I am happy to hear.

“It is, it is completely dependent upon where you’re trying to locate. Some towns are very cooperative and other towns are very slow, and it starts with just getting the permit to start and it goes all the way through the inspections. My last, second last club I just opened a month and a half or so ago, the guy decided, the building inspect decide to go to Italy for a month and didn’t tell anybody.

And so we couldn’t get it. We sat for a month waiting for him to come back from his trip that was unplanned. And so since COVID, some of the departments in some of the towns have taken a lot of new personalities as far as expediting permits and inspections and certificates of occupancy. So it’s you go in and you don’t even know what you’re going to deal with till it starts, that’s the other thing. Because in my case, if you’re going into a new town, you don’t know what to expect until you are in the process. And you hope for the best, but sometimes that doesn’t happen. Other towns are great.

But it’s You don’t know. So it’s difficult to project and and different portions of the permitting process and and the inspection process are run by different people, so that one section may be fine and another section may not be as fine, so it is, it is all over the place.” 3Q23 earnings results call

The lack of confidence and weak execution are big contributors to my negative outlook on the business. Furthermore, I also expect changes to the current franchise agreement to have a major near-term impact on near-term growth. The franchise duration agreement has now increased from 10 years to 12 years, with remodel requirements now in year 12 for the new stores. While 2 years might not seem like a big deal to an outsider, I’d imagine it increasing the psychological barrier for new franchisees as 12 years is a very long time (this is similar to the $10 vs. $9.99 issue; the latter is more well received). Another major change that I believe further increases the psychological barrier is the changes to the ADA (area development agreement). The change includes transitioning from the current grace periods to a 6-month cure period (from a 12-month grace period) if the franchisee is in default on a unit obligation. This is huge because the time provided for any franchisee to “turnaround” is 50% shorter. The big concern for franchisees is “what if it doesn’t work?” and with 12 months, there is significantly more time for franchisees to think of a strategy to turn it around. With six months, there is barely any time to brainstorm, execute, and turnaround strategies. In short, I think franchisees uptake rate is going to weak in the near-term as they need time to digest these new terms. The high cost of capital and business operation (wages) is also certainly not in favour of PLNT.

All in all, I feel a lot more uncertain about the near-term growth prospect. I remain negative on the near-term growth outlook and recommend a hold rating until management provides more clarity.

Valuation

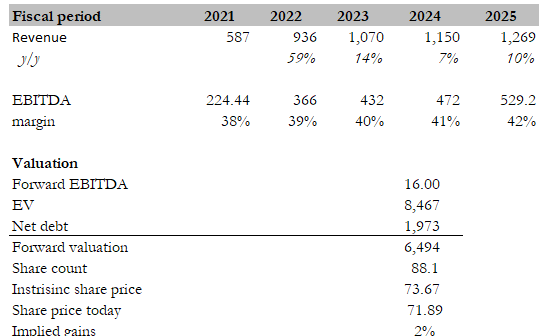

Own calculation

In my previous model, I laid out my worst-case scenario for the stock, but with the 3Q23 performance, I think it has proven that my worst-case assumptions are too aggressive. For this post, my model assumptions are based on market estimates: 7% growth in FY24 and 10% growth in FY25. I believe this set of growth assumptions is fair, as I am certain that FY24 is going to be a weak year given all the headwinds it is facing today. FY25 should see some form of recovery as management works through permit delay headwinds and franchisees digest the new agreement terms. Where I differ from consensus is that I expect FY24 EBITDA expansion to be slower as revenue growth is going to be weak (remember, permit delays also cause rent-free periods to expire). I also don’t see any near-term catalyst for the stock valuation to rerate higher, given all the headwinds I have mentioned above. PLNT should remain trading at this level until all the headwinds are addressed. From a relative valuation perspective, one could argue that PLNT is quite expensive given its expected growth rate. Take Xponential Fitness (XPOF) for instance, it is expected to grow at a similar rate vs PLNT but is only trading at 6.5x forward EBITDA. The counterargument that XPOF has a lower margin profile, hence the discount, has merits, but remember that XPOF is also expected to grow EBITDA at a much higher rate given its margin expansion potential. The reason for this is because XPOF revenue base is much slower than PLNT, which means the growth runway is longer than PLNT. If we compare XPOF current revenue and margin profile, it has similarities to PLNT in FY15 (PLNT has $330 million in revenue and 34% EBITDA margin). PLNT has shown that it is possible to improve EBITDA margin to 40+% as revenue grows to $1 billion. I believe this supports the case for XPOF ability to continue expanding EBITDA margin (note that PLNT and XPOF has similar gross margin structure). Either way, there is certainly room for PLNT valuation to re-rate lower if growth and margin perform weaker than expected.

Risk

The timeline for resolving all the headwinds is unclear and hard to ascertain. If PLNT manages to resolve all of it within a short period of time, the growth outlook for FY24 could be dramatically different as it reverts back to its historical growth rate, heavily outperforming consensus estimates.

Conclusion

I still think PLNT near-term growth is weak, despite the alright 3Q23 performance. Headwinds from ongoing permit delays and potential weakness in franchisees uptake rate should continue to weigh on growth. Management’s negative comments also reinforce my view. Altogether, these uncertainties led me to have a negative near-term outlook. As such, I am recommending a hold rating until management offers clearer insights.

Read the full article here