Investment Thesis

Before the release of the Q1 2024 results, which led to a 30% drop in the share price, I wrote a critical article about Planet Labs (NYSE:PL). It was mainly about my pessimism regarding the profitability to be achieved in about two years and the massive dilution for shareholders. At least the stock is now 30% cheaper, is it now fairly valued or even a buy?

Financial Progress & Trends

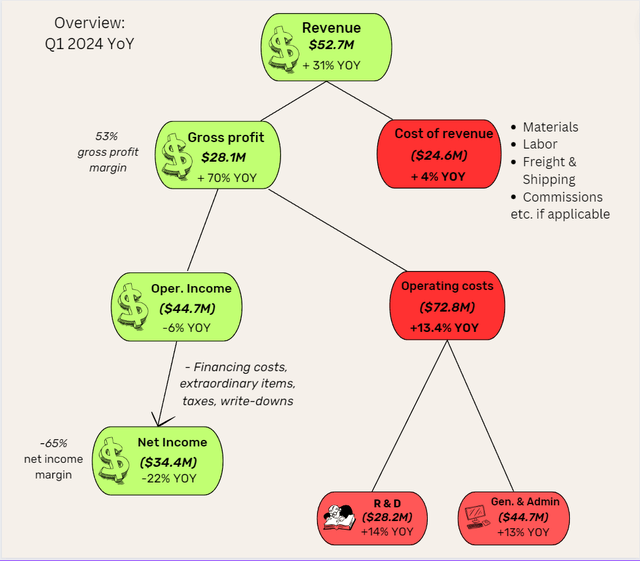

I have created this overview of the income statement of the last quarter compared to the previous year, showing where money is spent and how the revenue and cost development is in general. I view these results with mixed feelings. On the one hand, it is very positive that the gross profit is increasing so strongly, as the cost of revenues has remained almost constant year over year.

The most important key figure for the company is the operating income. This is because the operational costs for General & Admin and Research & Development make up a much larger part of the expenses than the cost of revenue. Operating income has improved slightly by 6% vs. ($47.7M) in Q1 2023.

author

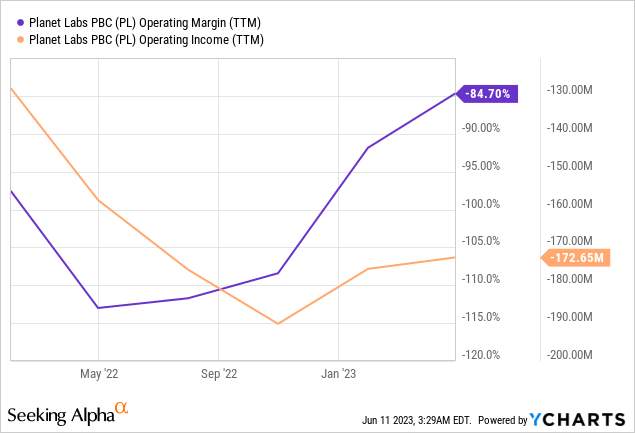

Net income has improved significantly by 22%. However, this is due to the company’s net cash position, which provides interest income due to the central bank monetary policy change. However, this interest income will likely decrease in the future as the company is still losing money overall, and thus the cash position will continue to decline. In this respect, the net income improvement looks better than it is. In addition, for the last quarter, 6M income is reported under “other non-operating income”, which improves net income even more.

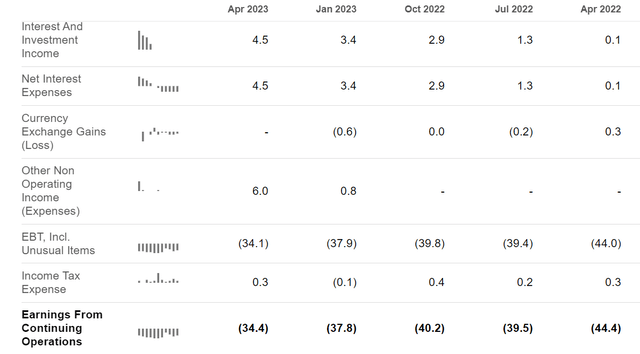

Seeking Alpha

However, if we look at the longer-term development of the operating margin, it is slowly but steadily improving, which overall signals that revenues are rising stronger than costs.

Valuation & Outlook

After the 30% drop in share price, the company is now valued at an enterprise value of $590M, the market cap is $940M, and the remaining cash is about $376M. In the trailing twelve months, the cash burn was $152M, so if we take into account that profitability is improving, cash should be sufficient for at about another three years.

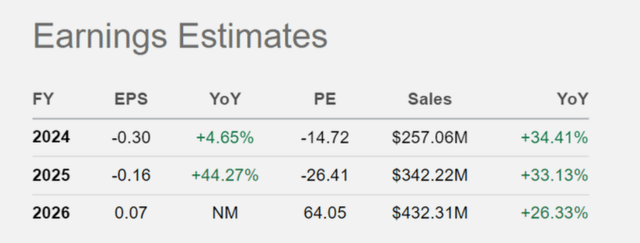

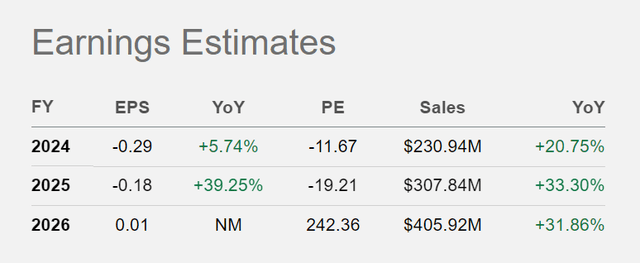

In my last article, I explained why I don’t think the company will reach profitability as fast as the analysts estimate. Just two weeks later, here is an example of why earnings estimates are only estimates and are constantly changing; usually, we just don’t notice it. These were the earnings estimates two weeks ago.

Planet Labs: Massive SBCs And Profitability Still Far Away

Now, the estimates have been revised downwards significantly. Note that YoY growth in 2025 and 2026 is expected to be well above 2024 (the company’s current fiscal year). Given recent margins and revenue growth, I remain skeptical that profitability will be achieved so quickly. An example calculation of why this is unrealistic can be found in my mentioned article.

Seeking Alpha

As many readers probably already know, the lowered guidance was the main reason for the sharp sell-off.

Looking ahead, Planet Labs guided for Q2 revenue of $53M to $55M vs. $60M consensus and see a gross margin rate of 48% to 49%. Planet Labs sees revenue of $225M to $235M for the full years. a prior view for $248M to $268M and the consensus mark of $257M.

Despite the pullback in guidance, CEO Will Marshall said Planet Labs continues to see strong demand for its proprietary data solutions, driven by global events and the growing awareness of the company’s capabilities. “It’s our conviction that satellite data is one of the most valuable assets in the world. Recent advances in AI are unlocking this value faster, especially for Planet’s unique data archive,” he noted.

Seeking Alpha news

As we all know, the market sometimes overreacts. Was the 30% crash justified? From my point of view, the company was overvalued before, and the earnings estimates were overestimated. So I would say yes, it was justified. Now the market cap has fallen below $1B. Given the also existing positive developments of the company (increasing sales, improving margins), I believe there is not much downside potential left. At least not enough to justify a short position. In other words, the overvaluation is now much lower, if it still exists at all.

However, it is not yet a long position for me either; a further downward correction of the estimates is too likely. If the analysts realize that positive EPS cannot yet be achieved in 2026, they will correct their estimates downward again, and the market will most likely react to this with a further sell-off. The last two paragraphs could sound like a contradiction, but I want to say that I currently see no clear trend up or down. Perhaps the share trades for the next twelve months more or less sideways. For me, the positive developments are not clear enough for a long position, and the overvaluation is not apparent enough for a short position.

Share dilution, insider trades & SBCs

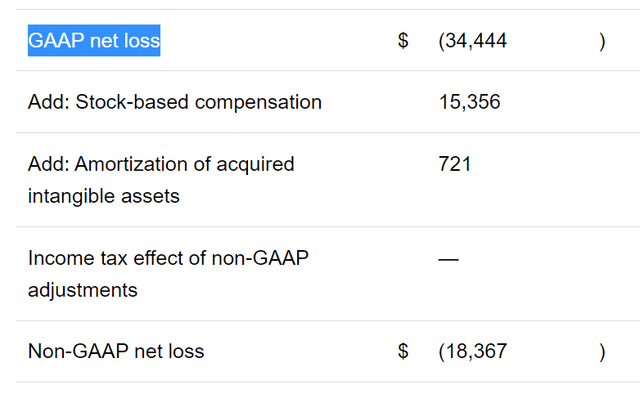

As mentioned in various articles, earnings estimates are non-GAAP numbers. So as long as the SBCs are as high as they are, you always have to look at the GAAP numbers as well.

PL report

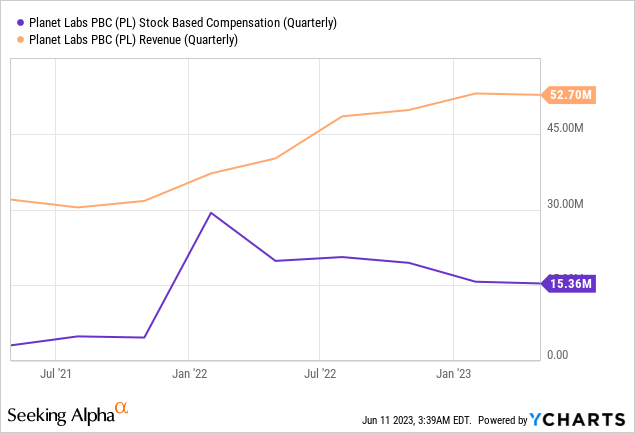

According to the company’s cash flow statement, SBCs were $15M in the last quarter (vs. $19M last year). This is almost a third of the revenue of $53M. The gap between revenue and SBCs is widening, as seen below, but it is still extremely high.

Conclusion

I am critical of the company, but I generally like its business model. It has the potential to become a scalable, highly profitable business. But at this stage, this is only theoretical; in reality, we are still years away from achieving this. So I prefer to put my money into other growing and profitable companies. Every portfolio can tolerate a certain amount of risk positions, but I think there are more attractive candidates than Planet Labs.

Given the 30% share price drop and the further improving margins, I change my rating from Sell to Hold. Overall, the stock is a very good example of the risk of companies where much of the growth is already priced in. We have seen this pattern quite a few times in 2022. When results meet or exceed expectations, the stock tends to stay flat or rise about 3% to 15%. When there are negative surprises, and the outlook is lowered, shares plummet 20% to 30%.

| Investor’s Checklist | Check | Description |

|---|---|---|

| Rising revenues? | Yes | Increasing over longer time periods |

| Improving margins? | Yes | Possible competitive edge |

| PEG ratio below one? | No profit, so no PEG | PEG ratio below one may suggest undervaluation |

| Sufficient cash reserves? | Yes | Vital for the survival & growth especially of unprofitable companies |

| Rewards shareholders? | No | Returning capital to shareholders |

| Shareholder negatives? | Yes | Actions that disadvantage shareholders |

| Stock in uptrend? | No | Trading above its 200-day moving average? |

Read the full article here