Investment Thesis

In recent years, Plug Power (NASDAQ:PLUG) gained public attention, as the demand for clean energy grew, driven by policy commitments to reduce carbon emissions. Despite the company’s achievements in specific market segments, several factors warrant a more cautious investment approach.

The 2021 meme-stock frenzy enabled PLUG to raise substantial capital through equity offerings, which led to a distortion of the company’s value relative to its manufacturing capabilities, degree of tech progress, and management organization. Empowered by the new cash infusion, the company has pursued aggressive expansion in various high-risk vertical markets, necessitating considerable capital investment over extended periods. Such expenses include the development of green hydrogen factories (electrolyzers), EV charging stations, and passenger-vehicle fuel cells in partnership with Renault (OTCPK:RNSDF).

At this point, all operations are loss-making, many of which on a gross-margin level, due to technological limitations that hinder hydrogen’s ability to compete with other sources (and storage) of power. Management has been betting on its ability to lower costs to achieve profitability, a promise that has yet to materialize.

Inherent Disadvantage

There are significant concerns over PLUG’s core offerings. At the center of these concerns is the company’s flagship product, the GenDrive fuel cell, which is primarily installed in material-handling vehicles such as forklifts. Out of the 55,000 fuel cells installed, 25,000 are sold under Power Purchase Agreements “PPA”, meaning customers only pay for the power generated, underscoring the unreliability and costs associated with owning PLUG’s products.

In nearly all of PLUG’s sales contracts, customers require long-term maintenance and hydrogen supply commitments, essentially shifting the risk of owning and operating the fuel cells to PLUG. These arrangements are facilitated through the company’s GenCare and GenFuel services, which provide maintenance and hydrogen supply respectively.

The remaining fuel cells are mostly sold under generous covenants, which include share options and strategic discounts to high-profile customers like Amazon (AMZN) and Walmart (WMT) in order to secure their business and leverage their brand names for marketing purposes. By associating with industry giants, PLUG aims to build credibility and mirror market viability to its shareholders.

Plug Power

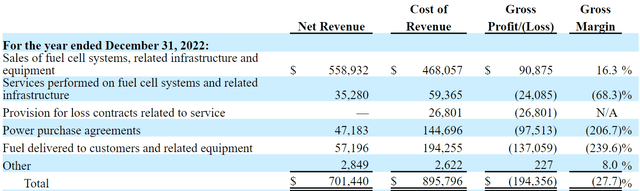

While these strategies have been effective in generating short-term revenue growth, they expose the inherent risk and costs associated with GenDrive fuel cells. The fact that customers seek protection from high maintenance costs through long-term agreements implies that PLUG’s products may not be as reliable or of the quality as advertised to shareholders. Additionally, GenCare and GenFuel have put significant strain on the company’s finances, as the costs of delivering these services outweigh the revenues generated from the PPAs and other sales contracts. As shown below, nearly all of the company’s revenue segments are loss-generating on a gross margin level.

Plug Power Annual Report

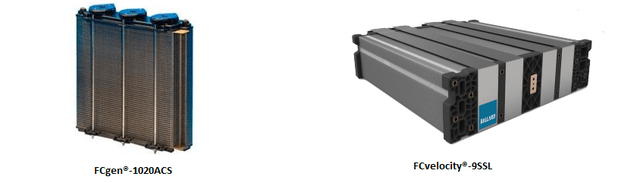

It is worth noting that Ballard Power (BLDP), a competitor, is a primary supplier of fuel cells for PLUG’s material handling business, and according to Ballard’s website, 12,000 out of the 55,000 installed base is composed entirely of Ballard’s fuel cells (the number could be higher, since Ballard seems to be using outdated figures, citing ~30,000 instead of the current base of ~55,000 fuel cells installed by PLUG). The reliance on a limited number of large customers and the dependence on a competitor for a significant portion of its product offerings raise concerns over its market position.

Ballard

Vertical Expansion: A Smart Move or A Gamble?

In recent years, PLUG has expanded its portfolio by entering the electrolysis business, a move that has been met with both optimism and skepticism. On the one hand, the electrolyzer market offers promising potential for renewable energy storage. However, the technology faces the same drawbacks as fuel cells, which is the significant heat that leads to erosion, and thus, high maintenance, costs. The unit economics are not clear yet, especially in light of the newly-introduced Inflation Reduction Act, which expanded subsidies to green hydrogen producers to $3 per kilogram. From my experience, the US government subsidies rarely completely offset an economic disadvantage of a certain tech, instead, they are designed to leave some incentive for the private sector to continue its efforts to lower costs. Thus, I believe that hydrogen as a storage chemical will still have a disadvantage over the battery, but perhaps with the subsidy, PLUG’s losses as a percentage of revenue will be narrower. On an absolute basis, given the expected increase in revenue, cash burn will be higher, as discussed in the following section.

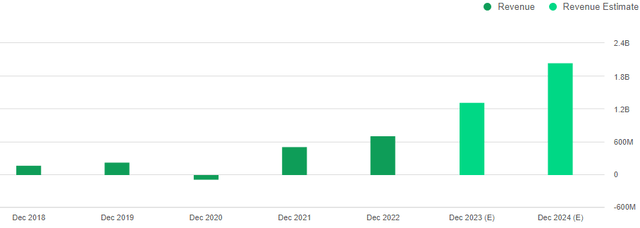

Sales Forecast (Seeking Alpha)

Adding to these concerns is the stiff competition in the hydrogen production market, from both established companies and emerging players. Although electrolysis is centuries-old technology, and neither PLUG nor any other company has material patents on hydrogen production, differentiation stems from manufacturing design and capabilities. A prime example is the different strategies adopted by PLUG and Electric Hydrogen “EH2 – a privately-held start-up” to lower system costs. PLUG builds its electrolyzers by stacking up smaller modules to create a high-capacity system. Electric Hydrogen on the other hand starts big from the start, designing and manufacturing large-scale electrolysers that aim to lower system costs through economics of scale.

In summary, manufacturing design and prowess is the new competitive frontier in the hydrogen economy market, where PLUG’s recent setbacks in Q4 have highlighted concerns over its manufacturing capabilities and management organization as investors have been left disappointed by the company’s inability to consistently achieve its goals.

Depleting Reserves

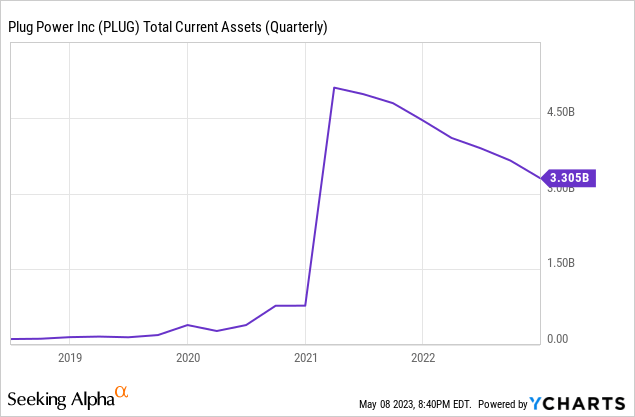

Recent financial reports show that PLUG’s liquidity position has weakened, setting the trajectory for the coming quarters. In 2022, total current assets saw a significant drop, as net cash used in operating activities more than doubled to $828 million, up from $359 million in 2021, as loss-making sales contracts increased with a renewed marketing push after the 2021 meme-trade bonanza, which allowed the company to raise $3.5 billion in a new equity offering.

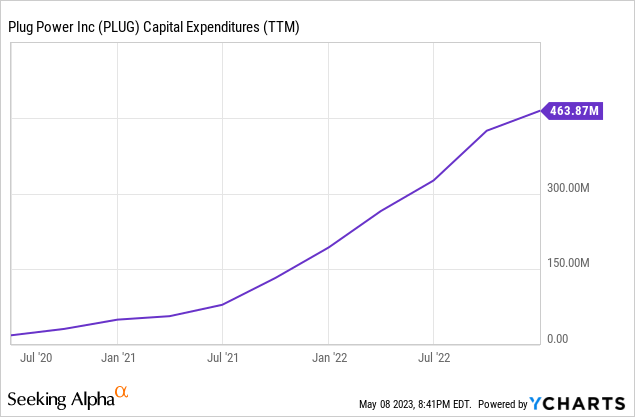

PLUG didn’t raise equity in 2022, and I don’t see an immediate need to raise capital this year, but perhaps the next. Cash outflow from investing activities highlights the significant demand for capital funding as the company pushes to ramp up its manufacturing capabilities and capacity. Cash used on Property, Plants, and Equipment “PPE” increased from $23 million in 2020 to $172 million in 2021, before skyrocketing to $436 million last year. Based on these figures, I believe that PLUG has a cash runway of two years.

Where My Analysis Could Fall Short

As countries around the world strive to reduce their carbon emissions and transition to more sustainable energy, hydrogen fuel cells are gaining popularity as an alternative to traditional fossil fuels, especially in areas where lithium-ion batteries fall short, including shipping, long-haul trucking, and aviation. PLUG continues to enjoy rapid revenue growth, and MY sell hypothesis rests on the presumption that it may not achieve profitability due to the technological limitations of fuel cells. The rating is also predicated on the assumption that PLUG will run out of cash before achieving any significant advancements in its hydrogen technology that could reduce costs.

Finally, this article puts little weight on management’s profitability forecasts, given its track record of overpromising and underdelivering. Still, no one knows PLUG’s business more than its insiders, and my profitability estimates could be wrong. Management expects a positive gross margin by 2024, and from my understanding, bottom-line profitability by 2025. I don’t see this happening for the reasons mentioned above, but again, I might be wrong.

Summary

PLUG’s strategy to expand its offerings and enhance production capabilities is a double-edged sword. While it may lead to increased market share and revenues in the long run, it also requires a substantial upfront investment, exacerbating the company’s cash burn.

The hydrogen economy, while promising, is still in its infancy, and it’s unclear whether PLUG’s investments will pay off as anticipated. The company’s success hinges on its ability to lower maintenance costs and improve unit economics rather than a never-ending pursuit of unprofitable scale.

Read the full article here