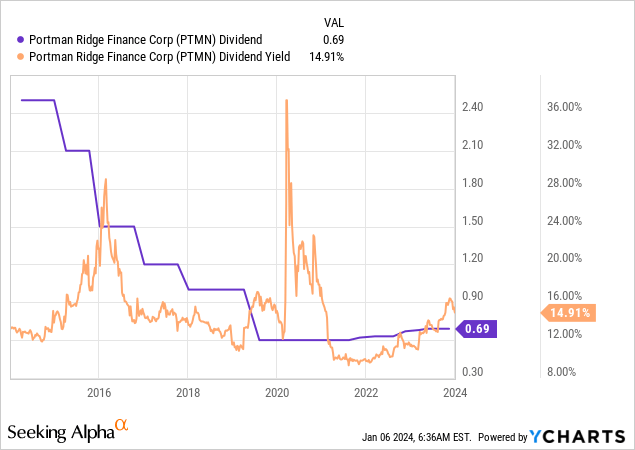

Portman Ridge Finance (NASDAQ:PTMN) is a small externally managed business development company investing in middle market businesses using a range of financing structures from first lien loans to subordinated debt and equity co-investment. The BDC is broadly sector-neutral with investments in tech firms, food and beverage businesses, and pharmaceuticals. A fully covered dividend distribution, stable net asset value growth, and strong underwriting quality are my core parameters for investing in BDCs and PTMN offers a mixed picture. The BDC last declared a quarterly cash dividend of $0.69 per share, left unchanged sequentially for a 15% annualized forward dividend yield.

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

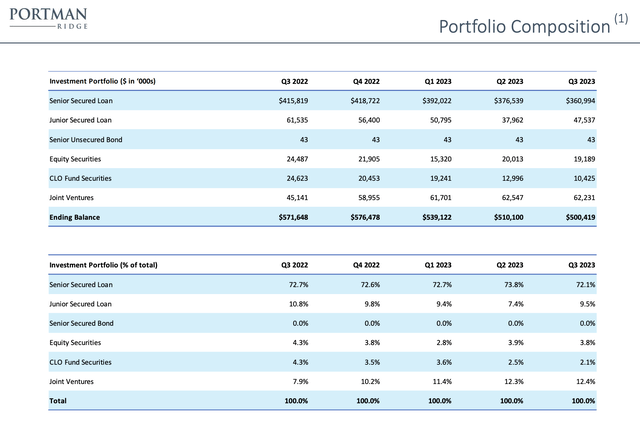

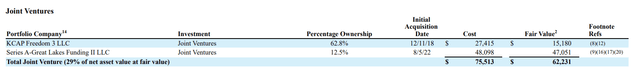

PTMN’s portfolio at fair value was $500.42 million at the end of its recent fiscal 2023 third quarter, down by $10 million sequentially and by 12.46% from $571.65 million in the year-ago quarter. Senior secured loans constituted 72.1% of the portfolio with two joint ventures forming the second largest components at 12.4% and with PTMN having a 3.8% allocation to equity securities.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

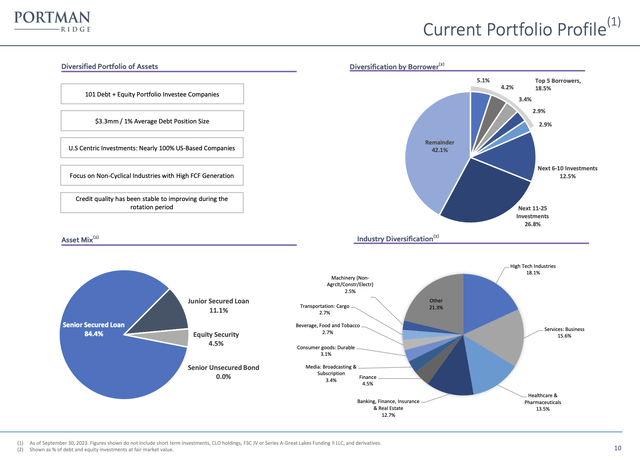

The KCAP Freedom 3 JV invests primarily in middle-market loans while the Series A – Great Lakes Funding II JV underwrites and holds senior, secured unitranche loans made to middle market companies. Critically, PTMN has underwritten 90.5% of debt securities it holds to be at floating rates with a spread pegged to SOFR. The BDC’s top 5 borrowers also form 18.5% of its portfolio adjusted for just debt and equity with 101 debt and equity portfolio investee companies. PTMN’s external manager is backed by BC Partners, a global multi-asset investment manager with over $30 billion in AUM.

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

Net Asset Value And Investment Income

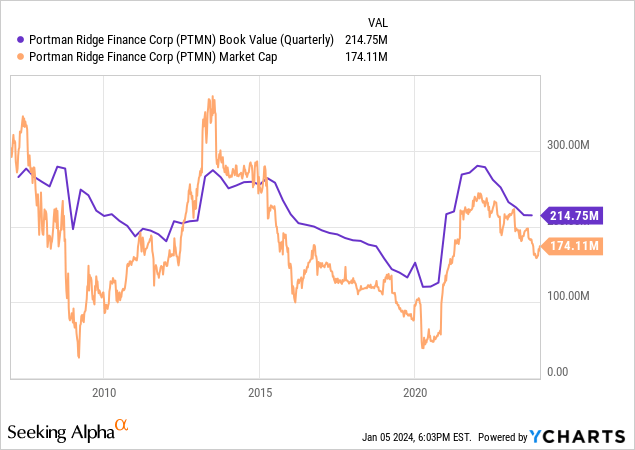

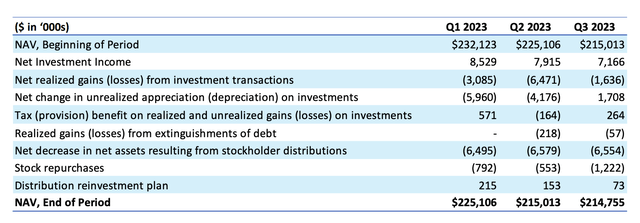

Third quarter book value was $214.8 million, around $22.65 per share. The BDC’s common shares are currently swapping hands for $18.45 per share, an 18.5% discount to NAV. This discount opened up in 2015 had has remained a perpetual feature of PTMN since then. Whilst buying a BDC at a discount to book value would normally be attractive, PTMN’s discount has become an inherent part of its common shares.

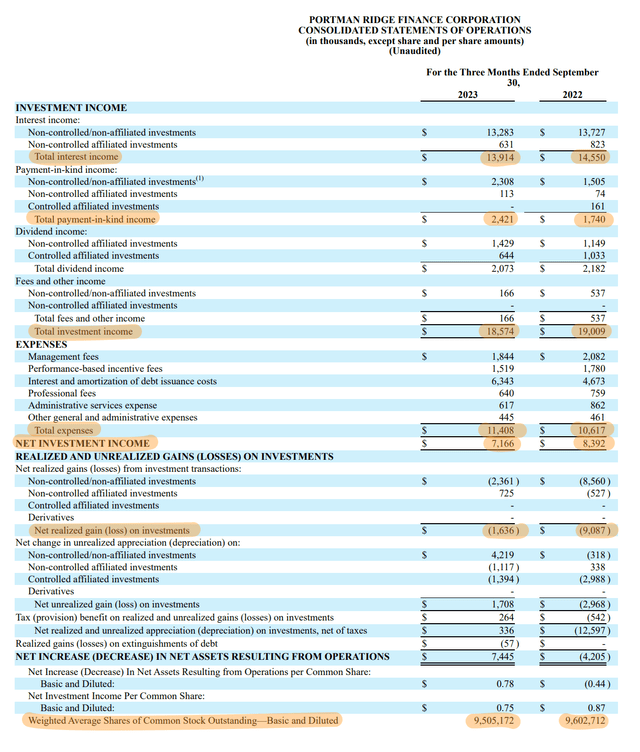

The direction of NAV has also been quite volatile over the years. NAV per share for the recent third quarter was up 11 cents sequentially but was down by a material 13.48%, around $3.53 per share, over its year-ago comp. PTMN recorded a total investment income of $18.6 million during the third quarter, down 2.3% versus its year-ago comp with net investment income of $0.75 per share dipping by 12 cents year-over-year.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

The investment income dip was driven by a fall in total interest income on the back of the year-over-year dip in the BDC’s investment portfolio. Further, payment-in-kind income at $2.42 million was up 39% year-over-year to form 17.40% of total investment income. PIK income formed 11.96% of total investment income in the year-ago period, 544 basis points lower than the recent third quarter.

Underwriting Quality, Dividend Coverage, And Closing The NAV Discount

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

The dip in NAV per share over the year-ago quarter came against PTMN buying back 60,559 shares during the quarter. PTMN diluted weighted average shares of common stock outstanding ended the quarter at 9,505,172, down 1.02% versus its year-ago comp. The buybacks drove the sequential increase in NAV on a per share basis against NAV which fell by $258,000 on a nominal basis.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

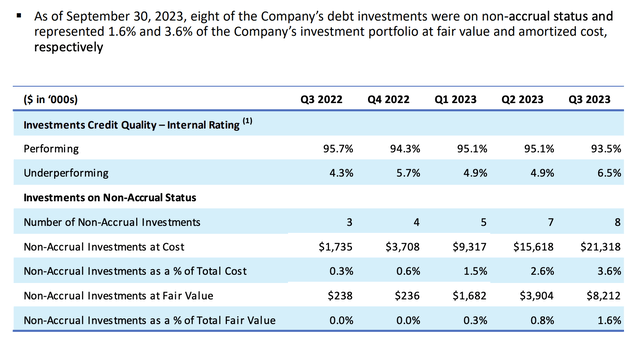

There were eight debt investments on non-accrual status at the end of the third quarter which formed 1.6% of PTMN’s investment portfolio at fair value and 3.6% at amortized cost. Further, the BDC has seen a broad deterioration in the performance of its debt investments with underperforming loans rising to 6.5% in the third quarter from 4.3% in the year-ago period.

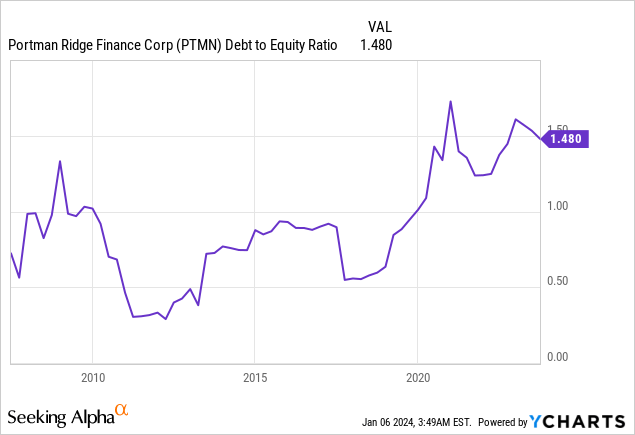

This has come as its debt-to-equity ratio at 1.48x sits close to its highest level since before the pandemic. The gradual increase in non-performing loans as PIK income rises and NAV continues to experience moderate weakness points to more near-term headwinds. The risk here is that investment income will continue to fall as non-performing loans rise to possibly pressure the dividend.

The BDC had a $1 per share quarterly distribution before the pandemic that had to be cut back and while rising is yet to fully recover. The longer-term timeline of the dividends has been negative with the current Goldilocks economy for BDCs driving the recovery. The BDC currently covers its quarterly distribution by 109%, down from the year-ago period but still a more than adequate level of coverage. How will this look in a year the Fed is expected to cut rates by 75 basis points? Pressure is already being experienced so probably not great. I don’t plan on buying.

Read the full article here