It pays to invest in things that form the backbone of the economy, and what is a better example of that than the U.S. Postal Service, which since its inception has delivered for the American public come rain or shine.

While the USPS is an independent agency of the federal government that you cannot invest in, Postal Realty Trust (NYSE:PSTL) offers the next best thing by allowing investors to buy into real estate leased to the USPS.

I last covered PSTL here back in October of last year with a ‘Buy’ rating, noting this unique investment vehicle’s high tenant retention and attractive valuation. The stock has risen by 6.2% since my last piece and has given an 8.2% total return including dividends, as concerns around a higher-for-longer interest rate environment has eased.

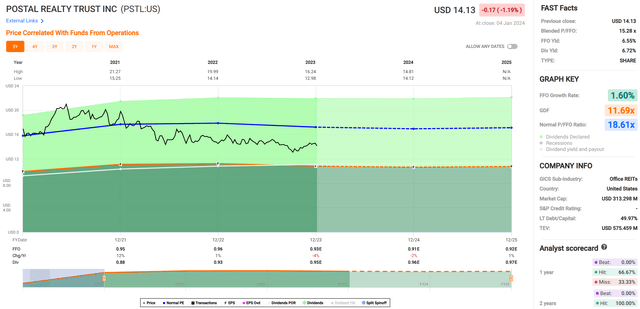

Some of the recent momentum around the stock has faded and PSTL is still down by 4% over the past year, as shown below. In this article, I highlight why now may not be a bad time to pick up this quality player for reliable rent checks for who knows where the economy in 2024 will land, so let’s get started!

PSTL Stock (Seeking Alpha)

Why PSTL?

Postal Realty Trust is the largest REIT to focus singularly on owning properties leased to the U.S. Postal Service. Its portfolio consists of 1,439 owned properties covering 5.7 million interior square feet across 49 states. PSTL benefits from owning a piece of USPS’s mission-critical infrastructure, as Amazon (AMZN), UPS (UPS), FedEx (FDX) and DHL all utilize USPS’s logistics network every day.

This network has high barriers to entry due to the time and costs it would require to replicate it, thereby giving it little to no competition. Plus, 31K+ USPS facilities represent essentially last mile delivery points, and the USPS Parcel Select service has seen an impressive annual revenue compound growth rate of 18% since 2013.

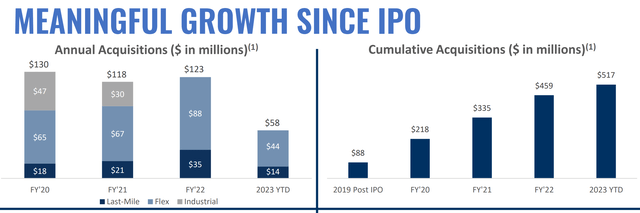

As the largest player in this niche category, PSTL benefits from management expertise in this space. This includes its CEO, who has 20+ years of experience focused on investing in and managing USPS properties. Since its IPO in 2019, PSTL has significantly grown its property portfolio with $517 million of cumulative acquisitions spanning across last-mile, flex, and industrial USPS properties, as shown below.

Investor Presentation

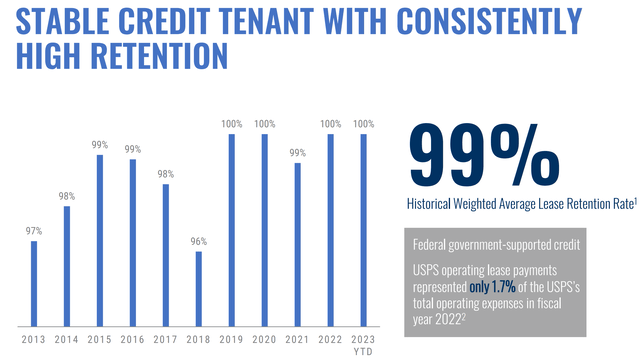

At the same time, PSTL has been able to maintain high occupancy through strong tenant retention. That’s because PSTL invests in mission-critical USPS infrastructure, given its leases a high likelihood of being renewed at expiration. This is reflected by a historical weighted average lease retention rate of 99%. As shown below, tenant retention has never fallen below 96% over the past 10 years, and has stayed at 99% to 100% since 2019.

Investor Presentation

Meanwhile, PSTL continues to maintain a high occupancy rate, with it landing at 99.7% during the third quarter. It’s also seeing accretive growth, as it acquired 70 properties during the last reported quarter at an 8% weighted average cap rate. In the first 10 months of 2023, PSTL added 153 properties in total at a weighted average 7.5% cap rate. The acquisition cap rate compares favorably to PSTL’s cost of debt which carries a weighted average interest rate of 4.04%, and also compares favorably to newly issued debt. This includes a $25 million term loan issued in July with maturity in 2027 at a 5.7% interest rate and another $10 million loan issued in September with maturity in 2028 at a 6.05% interest rate.

Looking ahead, I see PSTL as being well-positioned in various market conditions, considering that the USPS is rather immune to recessions and is likely to continue to renew their leases. This is considering the fact that USPS is supported by the federal government and that its operating lease payments represent just 1.7% of the USPS’s total operating expenses. Most of its recent lease renewals also include 3.5% annual rent escalations, helping to ease the burden of inflation in the near term.

Moreover, PSTL’s relatively short weighted average lease term of just 3 years actually works to its advantage in an inflationary environment, as it allows for continual mark-to-market adjustment of rents. As the largest player in this space, PSTL has an outsized opportunity to continue to consolidate USPS properties. This is considering that PSTL’s portfolio represent just 6% of the leased market, and the next top 20 largest portfolio owners hold only 11% of the market.

PSTL’s forward growth potential is supported by a prudently managed balance sheet with a net debt to EBITDA of 5.5x, sitting below the 6.0x level generally considered to be safe for REITs by rating agencies. Plus, PSTL has no debt maturities until 2027 and 100% of its debt is held at fixed rates. This means that PSTL is able to realize the benefits from mark-to-market rents on lease expirations and 3.5% annual rent escalators on recently signed leases, while maintaining the same interest expense profile on existing debt.

These factors lend support to PSTL’s 6.7% dividend yield, and the dividend is covered by an AFFO payout ratio of 88%. While dividend growth has slowed to just 1.1% growth this year, it’s worth noting that PSTL has grown its dividend by 70% since Q3 of 2019. While I would expect for dividend growth to be low in the near term due to an elevated payout ratio, interest rate uncertainty, and a low share price (making equity issuances a less attractive avenue to fund growth), there is potential for growth to pick up steam down the line from leases coming up for renewal and from the aforementioned 3.5% annual rent escalators without PSTL having to do much heavy lifting.

Risks to PSTL stem from the obvious concern that its fortunes are tied to the health of the postal service and their willingness to continue to lease its properties. I don’t see this as being a risk in the near term considering recent renewal and occupancy trends, but the binary risk is worth keeping in mind. In addition, while interest rates are expected to come down this year, there is no guarantee of that happening, as higher than expected inflation could put upward pressure on rates and raise PSTL’s cost of debt when maturities start coming due in 2027.

Considering all the above, I continue to see value in PSTL at its current price of $14.13 with a forward P/FFO of 15.4, sitting below its normal P/FFO of 18.6 over the past 5 years. While analysts expect a 2% decline in FFO/share this year, they have a consensus annual FFO/share compound growth rate in the 2-5% range in the 2025-2027 timeframe.

FAST Graphs

If PSTL were to hit the middle of the aforementioned growth range, it would mean a 3.5% annual FFO/share growth rate, which makes sense considering its 3.5% annual rent escalators. This, combined with the 6.7% dividend yield, could mean a total annual return potential of 10% in the medium term, and potential for a return to mean valuation and mark-to-market rents could result in a higher expected return.

Investor Takeaway

PSTL has proven to be a strong performer as the premier USPS landlord, with a well-diversified portfolio and high occupancy and lease retention rates. Despite potential risks from its concentration exposure to the postal service and inflation uncertainty, PSTL’s strategic investments and prudent balance sheet management make it an attractive investment opportunity with potential for steady growth and income. Lastly, given PSTL’s attractive dividend yield and reliable rent checks from mission-critical real estate, I maintain a ‘Buy’ rating on the stock at the current price, especially after the recent dip in price.

Read the full article here