Investing in precious metals has always been a popular strategy for hedging against inflation and economic uncertainties, and that goes beyond Silver and Gold. I think the abrdn Physical Platinum Shares ETF (NYSEARCA:PPLT) is worth considering as it’s a unique instrument that offers exposure to the platinum market.

The investment case for platinum rests on its rarity and diverse applications. The demand for platinum is strong in the automotive industry, particularly for catalytic converters in diesel engines to reduce emissions. Platinum is also essential in various industrial applications, including in the chemical and petroleum refining industries. Its role in emerging hydrogen fuel cell technology presents future growth potential. Jewelry demand adds to its consumer appeal. The limited supply, with mining concentrated in South Africa and Russia, can lead to price volatility, potentially benefiting speculative investors. Lastly, platinum’s historical discount to gold offers a potential upside if the price ratio adjusts to historical norms.

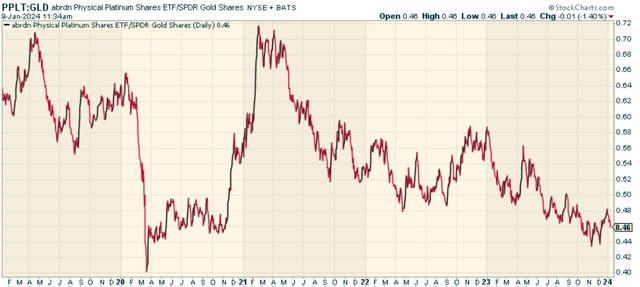

To that end, I suspect some mean reversion will soon kick in when it comes to the Platinum to Gold ratio, which is near its 2020 levels.

stockcharts.com

PPLT is a financial instrument designed to offer investors a cost-effective and convenient method to invest in physical platinum. Launched on the NYSE Arca in January 2010, PPLT aims to reflect the performance of the price of physical platinum, less the trust’s expenses.

The fund’s total assets are valued at approximately $997 million with a total expense ratio of 0.60%. This number represents the fund’s operating expenses as a percentage of the total assets, which investors must pay for the fund management.

PPLT ETF Holdings: Understanding the Investment

PPLT is a physically-backed ETF, which means it holds actual physical platinum bars in secure vaults located in London and Zurich. The vaults are inspected twice a year by Inspectorate International Limited, a leading auditor for commodity inspections. The Trust’s platinum holdings are valued based on the London PM Fix for Platinum, a benchmark price set by the London Bullion Market Association.

Peer Comparison

There are other ETFs that provide exposure to platinum, such as the GraniteShares Platinum Trust ETF (PLTM). While these funds also offer exposure to platinum, they operate differently. For instance, PLTM is physically backed like PPLT, but it has a lower expense ratio of 0.50% and significantly lower assets under management, or AUM, of $39 million. PPLT stands out due to its liquidity with higher AUM and daily trading volume, which can lead to tighter bid-ask spreads, reducing the cost of trading for investors.

Pros and Cons of Investing in Platinum

Advantages

-

Supply-Demand Dynamics: The global platinum market is expected to register a significant deficit in 2023 following two consecutive years of surplus. This could potentially boost the platinum price.

-

Industrial Demand: Platinum is used in various industrial applications such as catalytic converters, jewelry, and glassmaking. The rising demand in these sectors could support the price of platinum.

-

Inflation Hedge: Like other precious metals, platinum is often seen as a hedge against inflation.

Disadvantages

-

Volatility: The price of platinum can be highly volatile, influenced by various factors such as economic conditions, currency exchange rates, and changes in industrial demand.

-

Lack of Diversification: Investing in PPLT exposes investors to the performance of a single commodity, which could lead to higher risk compared to diversified investments.

-

Storage and Insurance Costs: While PPLT covers the cost of storing and insuring the physical platinum, these costs are reflected in the ETF’s expense ratio, which is higher than many other ETFs.

Conclusion: Should You Invest in PPLT?

Given the potential supply-demand imbalance in the global platinum market, investing in a platinum-focused ETF like abrdn Physical Platinum Shares ETF could be a strategic move for investors seeking exposure to precious metals. However, it’s important to consider the volatility of platinum prices and the lack of diversification associated with investing in a single-commodity ETF. I think it’s worth considering, especially if you’re looking for diversifiers to your portfolio.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here