Procter & Gamble (NYSE:PG) has experienced robust price and mix growth, coupled with weak volume growth, amidst a high inflationary market environment. I believe that their contributions to both price and volume growth may soon revert to their historical trend. Therefore, I am initiating coverage with a ‘Buy’ rating and a fair value estimate of $160 per share.

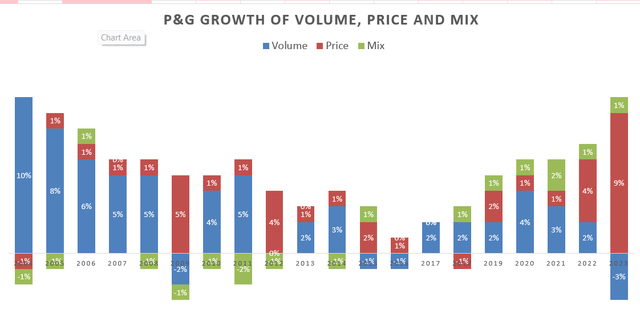

Volume, Price and Mix Growth

As depicted in the chart below, Procter & Gamble’s growth has primarily been propelled by price increases since the onset of high inflation. In the fiscal year 2023, they encountered a 3% decline in volume, as consumers had to curtail purchases due to excessively elevated prices.

P&G 10Ks

Starting from Q4 FY23, the decline in volume began to moderate to 1%, while price growth continued to show strength at 9%. I anticipate a reversal in their volume and price growth mix in the upcoming quarters, with investors likely to observe a gradual increase in volume growth and a deceleration in price growth. The primary factor behind this shift is the decline in core commodity prices. Procter & Gamble had increased product prices to offset heightened input costs during the pandemic, a period marked by disrupted supply chains and geopolitical events such as the war in Russia and Ukraine.

Currently, global commodity prices have reverted to pre-COVID levels, and notably, global inflation is beginning to moderate. A more balanced mix between price and volume growth would likely prove advantageous for Procter & Gamble compared to a growth strategy reliant solely on price increases. In a recent conference, their management indicated an anticipated recovery in volume contribution to a range of 2%-3% in the future, with price growth hovering around another 2%-3%. If this scenario unfolds, their normalized revenue growth rate is projected to be approximately 4-6%.

Commodity Price and Labor Cost Impact

In Q1 FY24, Procter & Gamble emphasized the tailwinds of approximately $800 million after tax, attributed to favorable commodity costs for fiscal year 2024. They specifically noted incremental relief on certain commodities, such as pulp. However, they cautioned that the contribution from commodity benefits is expected to diminish as they progress through the current fiscal year.

Simultaneously, Procter & Gamble is contending with labor inflation across its supply chain. The persistence of labor inflation is logical; despite a cooling job market in recent months, wage inflation is trailing behind inflation in other sectors. Even as the economy begins to slow down, there’s a possibility that labor inflation could endure for an extended period.

Of the total $800 million after-tax benefit, approximately one-third has already materialized in Q1. In essence, their margin expansion in the upcoming quarters is not expected to mirror the magnitude observed in Q1. To provide context, their currency-neutral operating margin expanded by 340 basis points in Q1 FY24.

Financial Result and Outlook

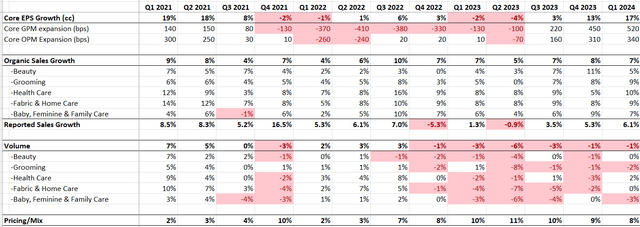

During Q1 FY24, Procter & Gamble achieved a 7% organic revenue growth, driven by an 8% increase in price and a -1% change in volume. The core EPS exhibited a robust year-over-year growth of 17%. The company has maintained its FY24 guidance for organic sales and EPS growth. Overall, the quarter appears to be relatively standard without significant surprises.

P&G Quarterly Earnings

Regarding the full-year guidance, Procter & Gamble anticipates reported revenue growth of 2-4%, inclusive of 1-2% headwinds from foreign exchange, and organic revenue growth of 4-5%. Diluted EPS is expected to show a year-over-year growth of 6%-9% for the full year. This guidance suggests a more balanced and mixed organic revenue growth in FY24, with an anticipated deceleration in price growth and a shift towards positive volume growth.

In terms of capital allocation, the company guides capital expenditure to be 4.5% of total revenue, with a free cash margin of around 90%. Additionally, they plan to pay out $9 billion in dividends and repurchase $5-$6 billion of their own shares in FY24, reflecting a notably generous capital return to shareholders.

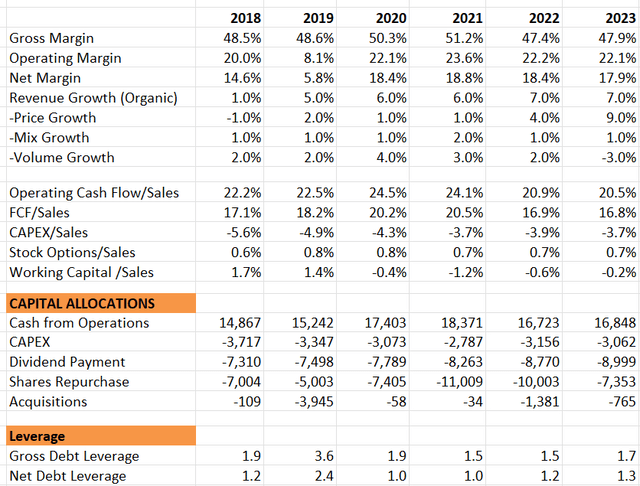

The table below provides an overview of their financial results over the past six fiscal years. In summary, Procter & Gamble boasts a robust balance sheet, substantial dividend payouts and share repurchases, a decent operating margin, a high free cash margin, and a solid growth rate in topline figures. As a long-term investor, I find comfort in their consistent and strong financial performance.

P&G 10Ks

Valuations

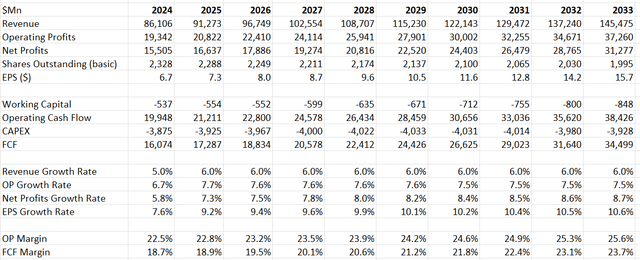

The assumptions for FY24 are slightly more optimistic than the company’s guidance, anticipating a 5% reported revenue growth. I believe they have the potential to achieve at least a 6% organic revenue growth. It’s expected that the price and mix contribution will moderate over time, with the price/mix continuing to drive significant growth in FY24.

For the normalized revenue growth, I am relying on their long-term track record, projecting a 5% organic revenue growth and a 1% contribution from acquisitions.

P&G DCF – Author’s Calculation

Regarding margins, I anticipate that their main source of expansion will be from operating leverage. Assuming a 5% organic revenue growth and a 3% growth in operating expenses, the company should achieve an annual margin expansion in the range of 30-50 basis points.

The valuation model incorporates a 10% discount rate, a 4% terminal growth rate, and a 21% tax rate. Based on my calculations, the fair value is estimated to be $160 per share.

Key Risks

China Weak Consumer Consumption: Greater China accounts for 9% of Procter & Gamble’s total revenue. The existing challenges in Chinese consumer consumption pose a near-term risk for P&G. The local team is actively engaged in portfolio optimization efforts to enhance their positioning for future growth. Nevertheless, given the significance of P&G’s exposure to China, any notable slowdown in consumption there could have a noteworthy impact on the company.

Restructuring in Nigeria and Argentina: Procter & Gamble is undergoing restructuring in their Nigeria and Argentina businesses. According to their conference disclosure, the business in Nigeria accounts for $50 million in net sales, while Argentina contributes $400 million in net sales. Specifically, they are divesting the Fabric and Home Care segment in Argentina. These restructuring activities are expected to create some near-term headwinds for growth.

Conclusion

Should Procter & Gamble’s price and volume growth return to normal, I anticipate the company achieving a 5-6% type of organic revenue growth in the near future. Given its well-managed and high-quality status, I am initiating coverage with a ‘Buy’ rating and a fair value estimate of $160 per share.

Read the full article here