Exactly two years ago we wrote about Prologis, Inc. (NYSE:PLD). We highlighted the strengths of this industrial REIT. There was fast growth and exceptional quality that made the REIT a favorite amongst real estate investors. The valuation though, remained unappealing. PLD’s funds from operations (FFO) multiple had expanded for a long time and we felt it was time for the other side of the hill in the next few years. Specifically we said,

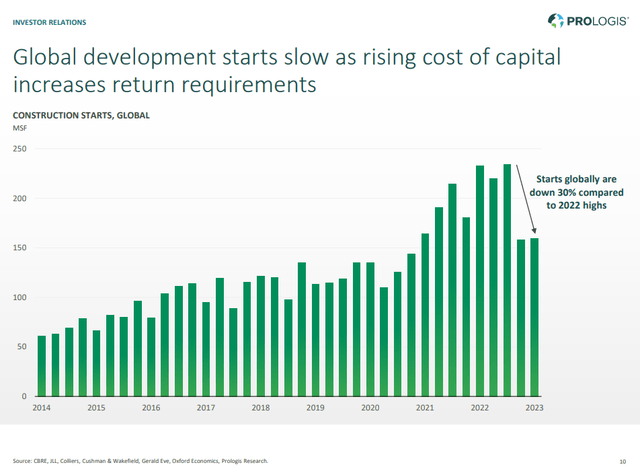

So if we keep building at this pace, it’s a matter of time before we run into oversupply. Pricing power can fall quite rapidly when that happens and this REIT’s valuation will likely make the trip down even more unpleasant.

Based on all information we have, we are still maintaining a “Neutral” and not a “Sell” on Prologis. The REIT is doing exceptionally well but investors must keep in mind the valuation discounts roses and butterflies as far as the eye can see. If that changes, look out below.

Source: What Could Derail The Exceptional Returns

That call has not been bad, as the REIT has delivered 7% total since then.

Seeking Alpha

We look at the recent results and update our outlook.

Q1-2023

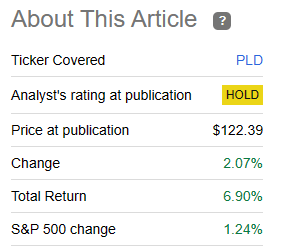

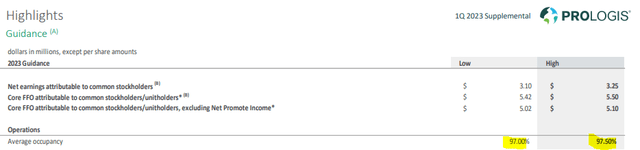

PLD delivered a solid quarter with core FFO coming right on expectations of a $1.22 per share. While the number was fine, one can see the first signs of a slowdown as the core FFO contracted quarter over quarter.

PLD Presentation

PLD also had trailed estimates in their guidance for 2023 after their Q4-2022 results. While one should not quibble over a 10 cent differential ($5.45 guided vs $5.56 expectations at the time), this is a notably different REIT than what we saw before.

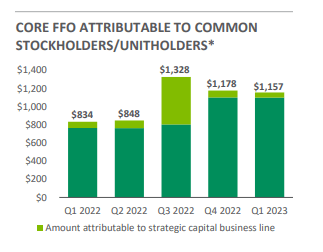

What we saw before was strong double digit increases in revenues, EBITDA, FFO (and AFFO), and dividends.

PLD Presentation

Assuming PLD does hit these numbers, we are looking at a remarkable slowdown that will trail average inflation rates.

Seeking Alpha

Keep in mind that PLD bought out Duke Realty at the end of 2022 and by end of 2024 we should have seen all these benefits flow to the bottom line.

The transaction is anticipated to create immediate accretion of approximately $310-370 million from corporate general and administrative cost savings and operating leverage as well as mark-to-market adjustments on leases and debt. In year one, the transaction is expected to increase annual core funds from operations* (Core FFO), excluding promotes per share by $0.20-0.25. On a Core AFFO basis, excluding promotes, the deal is expected to be earnings neutral in year one.

Further, future synergies have the potential to generate approximately $375-400 million in annual earnings and value creation, including $70-90 million from incremental property cash flow and Essentials income, $5-10 million in cost of capital savings and $300 million in incremental development value creation.

Source: PLD Website

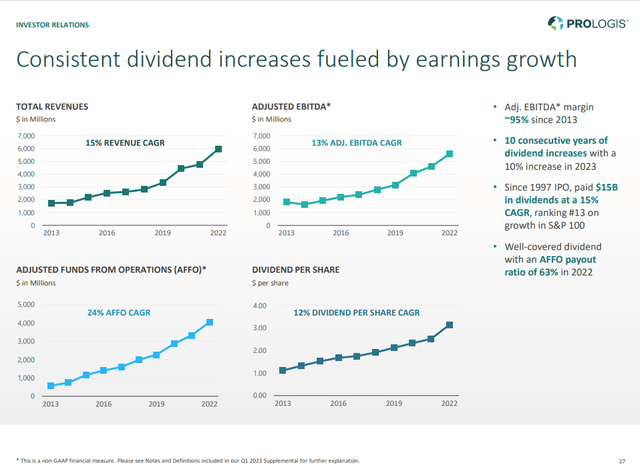

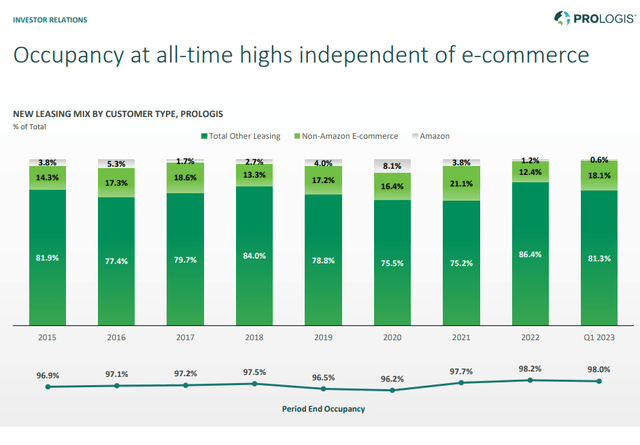

What is happening here is the impact of peak occupancy and peak pricing power reversing slowly. PLD’s occupancy declined slightly from Q4-2022 to Q1-2023.

PLD Presentation

This will drop another percentage point during 2023.

PLD Presentation

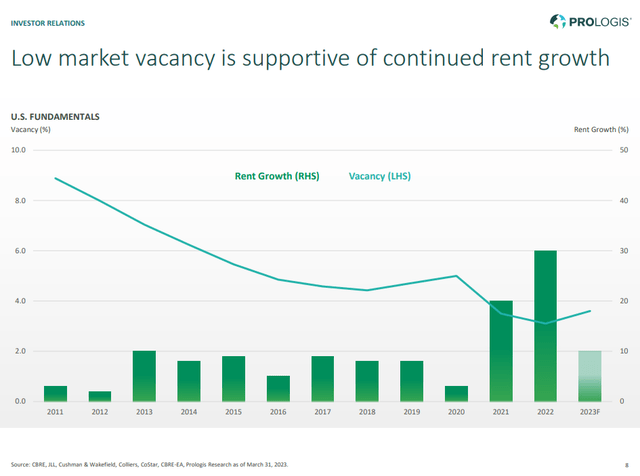

The company cites this as average occupancy, so period end occupancy is likely to breach under 97%. That is still a high overall occupancy and we don’t want to equate this with the end of the world. Certainly overall US fundamentals remain supportive at this stage.

PLD Presentation

But it is still very early days to assess the full impact of the developmental pipeline. Investors should remember that we went absolutely berserk creating industrial property supply in 2021 and 2022 and that pipeline is still coming.

PLD Presentation

Some softness has been seen in a few markets and we think full impact is a 2-5 quarters away.

Despite elevated manufacturing and consumer goods production through 2022, the industrial sector is reflecting the start of a softening period, according to Ermengarde Jabir, senior economist at Moody’s Analytics, in a report published on the Scotsman. Jabir said this is occurring across distribution and warehouse properties, as well as flex spaces for research and development purposes. “Many U.S. metros are seeing lower or even negative absorption rates, although last year also featured more completions as developers and investors sought to capitalize on the booming sector,” she said.

Source: Globe Street

One also has to combine this data with what we are seeing in the US manufacturing and retail arenas. We saw Chicago PMI for example, come in near 40 (vs 48 expected). This is the kind of severe contraction which will put off a lot of expansion plans. On the US retail side, most retailers are reporting exceptionally poor results and downgrading outlooks for 2023. Even those poor numbers are being bolstered by price increases rather than volume increases. In almost all cases, volumes are declining. So this creates a very challenging dynamic for PLD and we would not be surprised to see trough occupancy levels near 95%.

Verdict

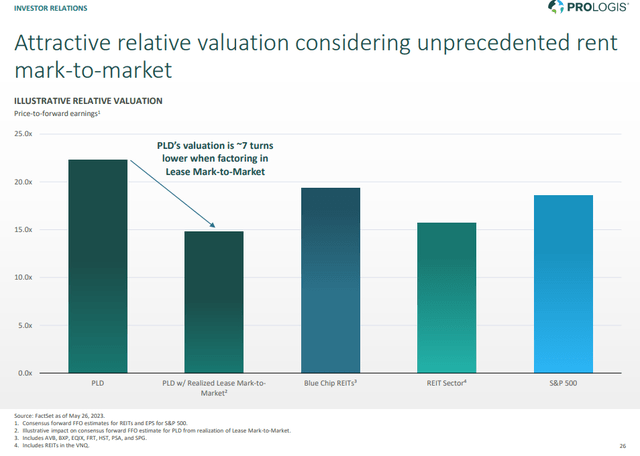

The REIT is trading cheaper than the peak in 2021 and there is some mark to market opportunity in its portfolio over the next few years as rents reset.

PLD Presentation

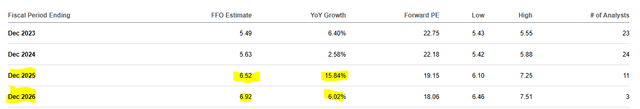

You will find some variant of this data in all industrial REITs and that does not materially change the outlook. The stock still remains incredibly expensive for a non ZIRP (zero interest rate policy) environment. PLD has had some historically important troughs yielding 2% more than the 10 year Treasury rate. Currently it yields, 1% less than the 10 Year Treasury. If we are right and FFO actually contracts in 2024, look out below. Analysts are still pricing very rosy outlooks beyond 2024, and we strongly disagree that PLD will reach almost $7.00 in FFO by 2026.

Seeking Alpha

A trough multiple of 15X FFO seems highly likely as growth completely falters and we would look for that in the next 24 months.

Prologis, Inc. 8.54% PFD SR Q (OTCQB:PLDGP)

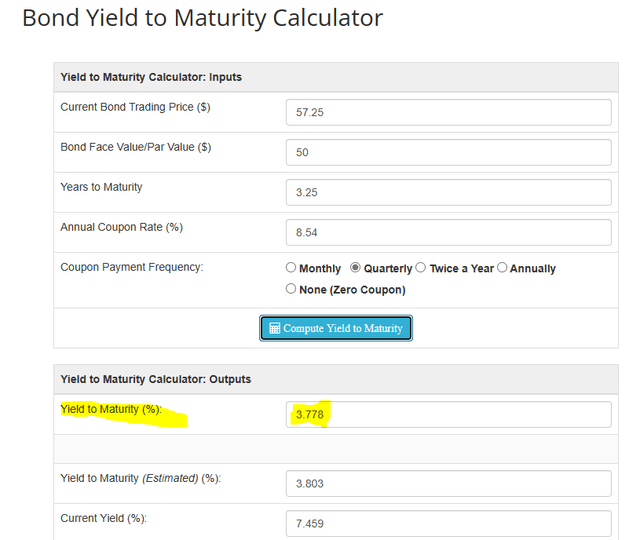

We often find value elsewhere in the capital stack when the common equity rings in expensive. One related example is Rexford Industrial Realty, Inc. (REXR) where the preferred shares Rexford Industrial Realty, Inc. 5.875% PFD SER B (REXR.PB) and Rexford Industrial Realty, Inc. 5.625 CUM PFD C (REXR.PC) have often got a vote of confidence from us despite sell ratings on the common shares. PLD does have PLDGP publicly traded. Unfortunately there is little value to salvage here. The preferred shares can be called in October 2026 and that is about as close to a certain outcome as one can find in the markets.

While the current yield is high, the yield to maturity is abysmally bad. That is thanks to the shares trading well over par.

DQYDJ

These should be ditched at the earliest opportunity.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here