Overview

My recommendation for PVH Corp. (NYSE:PVH) is a buy rating, as I like how the business momentum has been so far, especially with PVH meeting internal targets without using too much promotion. This bodes well for 4Q23 performance and FY24 growth. Note that I previously gave a buy rating for PVH, as I believe the business was able to recover to its historical growth rate of mid-single-digit growth. I expected the growth recovery to be driven by its success in the direct-to-consumer [DTC] strategy and marketing campaigns.

Recent results & updates

I think the share price speaks very well to how the market is reacting to PVH’s performance in 3Q23. Since my initiation on PVH (the price back then was $77), the stock has almost doubled, reaching a peak price of $123. For readers that are new, PVH reported 3Q23 revenue growth of 3.6%, tracking well against my FY23 revenue growth of 3% and progress towards mid-single-digit growth. The growth was driven by continuous success in the DTC. As DTC continues to become a larger part of the business, gross margin expanded accordingly by 80bps to 56.7%. This also led to better EBIT margin performance in 3Q23, expanding by 88bps vs 3Q22 to 10.5%.

I expect strong performance to continue as PVH continues to execute very well in North America, where the region saw 2% y/y overall growth. I think PVH is starting to reap the rewards of its DTC strategy, which allows it to better understand and anticipate customer tastes; for example, the company’s recent shift in product emphasis has been highly successful, with Tommy Hilfiger premium essentials seeing a 50% year-over-year growth and Calvin Klein fall essentials seeing improved sell-through. This is a major win for PVH as a business because it means they can now better meet consumer demand. Taking a step further, knowing what consumers want also meant that PVH could plan for better SKU assortments at the wholesaler level as well. The fact that PVH’s key wholesale partner, Macy’s, experienced AUR growth in the double digits and Calvin Klein men’s essentials growth of 50% year over year is evidence of this. On the point of Calvin Klein, I think the strong performance was also in part due to PVH’s strategic marketing strategy of collaborating with Jennie and Jung Kook, who are key fashion icons in the Gen Z world. I expect the Calvin Klein brand to sustain its current growth momentum as the change in the brand image is structural, in my view.

On current business trends, management comments were also very encouraging, as they noted the business saw a very strong start to the holiday (i.e., 4Q23). In terms of internal KPI disclosures, management noted they have outperformed their target for Thanksgiving and Black Friday week in both North America and Europe. I think what was especially notable was that management mentioned the keywords “less discounting,” which means the growth performance was organic (which also means no margin deterioration).

We just came out of the important Thanksgiving and Black Friday week. One of the key consumer moments during the holiday period. And I’m pleased to share that in both North America and Europe, we beat our growth plans versus last year and delivered a strong start of the holiday season

First, against the current macro backdrop in the wholesale channel, we feel that it’s critically important to avoid having too much inventory in the market, even if that means less selling in, to secure strong sell-out with high margin and less discounting. from: 3Q2023 earnings call

Looking ahead into FY24, I expect profitability to see a further step up as PVH benefits from favorable product and freight costs (renegotiated freight rates were lower last year) as the supply chain gradually eases. This relates more to gross margin, and I note that PVH managed to achieve a gross margin of 58.2% in January 2021, and I believe this is a good yardstick for how much more gross margin can improve from here. At the EBIT margin level, PVH cost savings from the previously announced 10% reduction in global office headcount should drive further improvements. Overall, improved gross and reduced fixed costs should drive high growth in net margins. As for free cash flow margins, aside from the expected improvement in net margins, PVH has also done a very good job improving its inventory position, which has provided relief on working capital requirements, leading to higher free cash flow conversion. As of 3Q23, inventory levels have improved significantly, reducing by 18.9% vs. last year vs. a 6.2% increase in 2Q23.

Valuation and risk

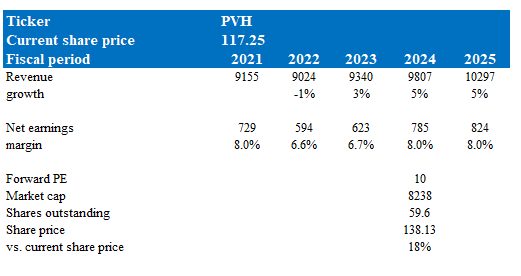

Author’s valuation model

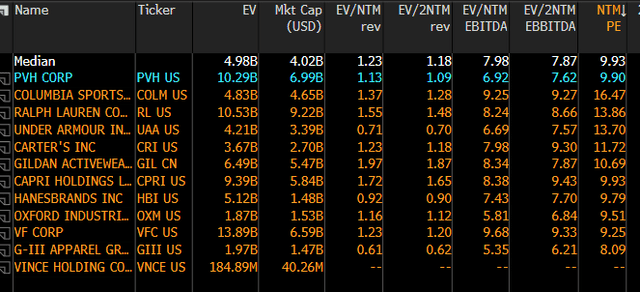

According to my model, I have a target price of $138 in FY24. I believe PVH is on track to grow back to its historical mid-single-digit profile. I note that my FY23 growth estimate is higher than management’s FY23 guidance, and the reason is that I believe 4Q23 might not be as weak as management is implicitly guiding for. With all the positive comments and momentum going into the holiday season, I find it hard to believe that it will see a negative growth of 3.3% (implied 4Q23 growth). Also, growth momentum over the past 2 quarters has been >3%. I expect net margin to improve from the current 6+% level to 8% (following the 3Q23 net margin performance), supported by better product/freight cost, inventory position, and a reduced workforce. As such, unlike my previous view that PVH should trade at 7x forward PE, I am assuming the stock now trades at 10x forward PE, in line with its peers. Previously, when the PVH growth outlook was weak, the valuation discount widened. Now that it seems to be on track to recover to historical growth, the discount should close.

Bloomberg

The one negative part (the risk) of the business update was that Europe continues to be in a rough patch. Management called out a more challenging macro backdrop in Europe, which is weighing on consumer confidence and wholesale channel growth going forward. As PVH has heavy exposure to Europe, this could drag down its overall growth trajectory.

Summary

I recommend a buy rating for PVH due to its strong business momentum and my expectation that it will return to mid-single-digit growth. The company’s performance in 3Q23 surpassed my expectations, showcasing revenue growth of 3.6% and marked progress towards mid-single-digit growth, supported by a successful DTC strategy. PVH’s ability to understand customer preferences led to successful shifts in product emphasis, notably boosting Tommy Hilfiger and Calvin Klein sales. Looking ahead to FY24, I anticipate further margin improvements driven by favorable cost dynamics, particularly in freight and product costs, as well as operational leverage (reduced workforce).

Read the full article here