Clean energy stocks have endured intense selling pressure throughout 2023. Higher interest rates, volatile commodity costs, and weakness in the EV niche of the auto market with falling retail sticker prices, among other macro factors, have hurt the group. Are there green shoots in clean energy though? I assert that valuations have come in enough to warrant an upgrade of this ETF. What’s more, sharply lower global interest rates should help executives and investors rethink their capital deployment plans in 2024, potentially offering a boost to this beaten-down group.

I am upgrading the First Trust NASDAQ Clean Edge Green Energy Index Fund ETF (NASDAQ:QCLN) from a sell to a hold. If we see continued positive fundamental and technical development into next year, it may even be a buy.

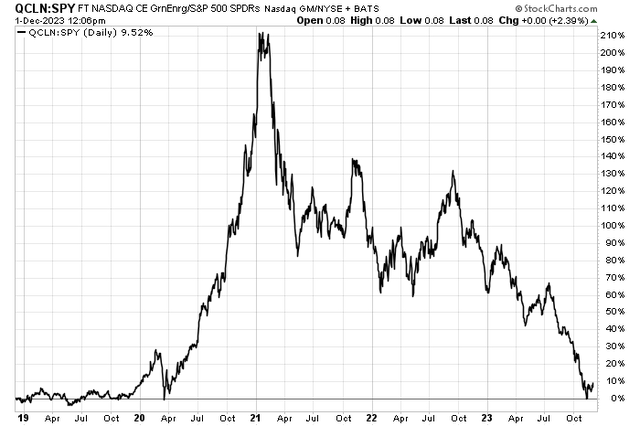

QCLN vs SPY: A Full Relative Round Trip

StockCharts.com

According to the issuer, QCLN invests in stocks of companies operating across sectors and holds growth and value stocks of companies across diversified market cap sizes. It invests in shares of companies that directly promote environmental responsibility. The index it tracks is rebalanced quarterly and reconstituted semi-annually.

QCLN is a moderate-sized fund with just shy of $1 billion in assets under management and it pays a small 0.88% trailing 12-month dividend yield as of November 30, 2023. The annual expense ratio is not too costly at 0.58%. Down 35% in the last year, share-price momentum, not surprisingly, is given an F rating by Seeking Alpha ETF Grades. The ETF is also highly risky when analyzing standard deviation trends, among other factors, but liquidity is usually robust with QCLN. Its average daily trading volume is not all that high at 196k while its 30-day median bid/ask spread is somewhat tight, averaging just 8 basis points.

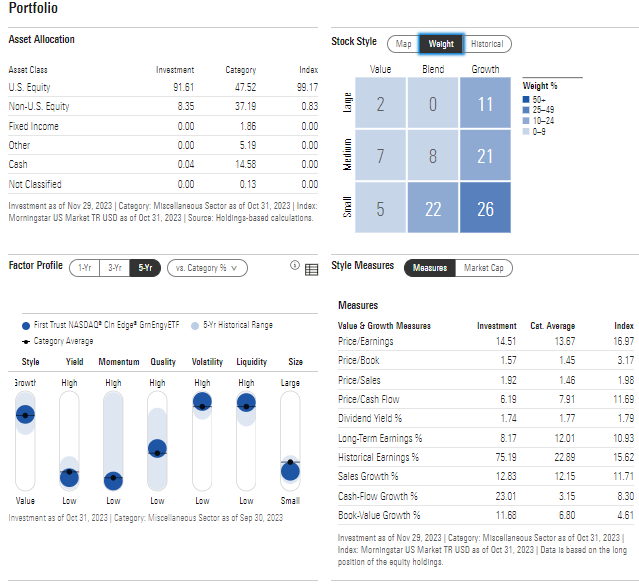

Digging into the portfolio, there’s diversification across the style box. Illustrated below, more than half the allocation is considered small cap, though some of its largest holdings are familiar large-cap names. QCLN is also bent to the growth style with just 14% of the fund’s considered value. But take a look at the current price-to-earnings ratio listed by Morningstar – it’s just 14.5 while its price-to-sales ratio is low at 1.9 for such a growth-heavy mix of stocks. The P/E was north of 22 when I last reviewed the fund during the middle of the year. Thus, it is a much better value today.

QCLN: Portfolio & Factor Profiles

Morningstar

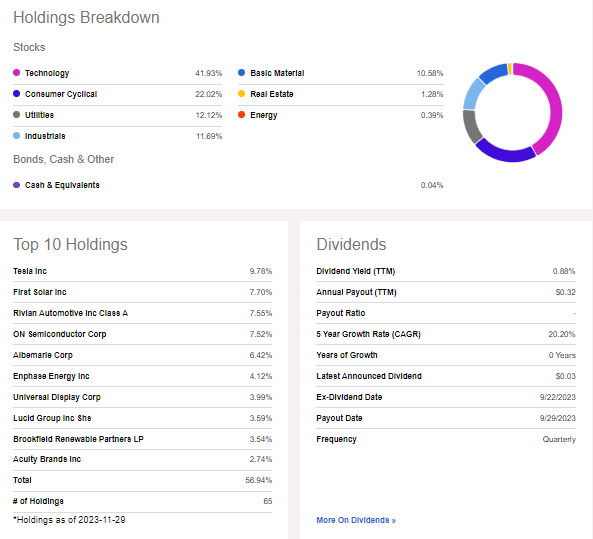

QCLN is, however, quite a sector wager. Consider that more than 40% of the ETF is allocated to the Information Technology sector with significant overweights compared to the S&P 500 in the Consumer Discretionary, Utilities, and Materials sectors. Moreover, a high 57% of total assets are in the top 10 holdings, so monitoring firm-specific issues with the largest handful of companies in QCLN is important.

QCLN: Holdings & Dividend Breakdown

Seeking Alpha

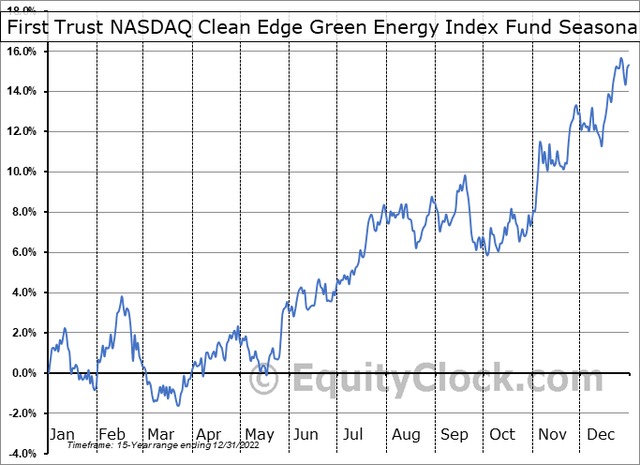

Seasonally, QCLN tends to perform well now through mid-January before volatility strikes, on average, over the back half of the first quarters, according to data from Equity Clock. The March through July stretch is also strong, though typical seasonal trends did not play out over the first three quarters of 2023. Bullish trends did pick up on cue in late October.

QCLN: Bullish Seasonality Through Mid-January

Equity Clock

The Technical Take

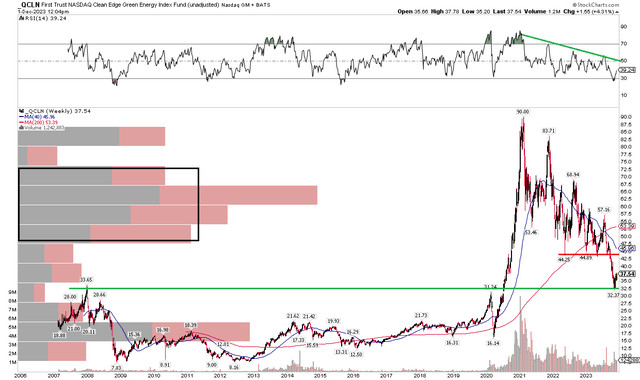

I zoomed out to view QCLN’s full price history. Notice in the chart below that the bulls stepped up right where you might imagine they would. The peaks from late 2007 and early 2020 proved to be support during the catastrophic plunge in shares from early 2021 through last month. I can see the fund easily climbing to the $44 mark – an area that offered support on a few tests in 2022 and earlier this year.

Given that air pocket of volume, playing it here for a continued bounce may work. Still, the weekly RSI indicator at the top of the graph shows that momentum still wanes – I would like to see a breakout in the RSI view. Moreover, the long-term 40-week moving average (comparable to the 200-day moving average) remains very negatively sloped, suggesting that the bears are in control. Finally, there is a high amount of volume by price starting in the mid-$40s, so that will make tough sledding for the bulls should a sustained rally take place.

Overall, long with a stop under $31 looks like a favorable risk/reward play, but there is a significant amount of overhead supply in the mid-$40s that makes me cautious longer-term.

QCLN: Holds Long-Term Support, Mid-$40s Resistance, Downtrending RSI

StockCharts.com

The Bottom Line

I am upgrading QCLN from a sell to a hold following a dramatic second-half plunge. The fund looks like a decent value today, though significant risks remain. Additionally, there’s room for some technical upside, but keeping an eye on resistance is critical.

Read the full article here