Intro

Qualcomm Inc (NASDAQ:QCOM) is a global semiconductor and telecommunications equipment company. The company designs and manufactures semiconductors, software, and related technologies used in wireless communication devices. Despite a chip shortage that affected the semiconductor industry, Qualcomm’s stock has seen growth, being up 14% year to date. Qualcomm is the dominant provider of processors to mobile devices, and with the artificial intelligence craze, their processors help them continue to be one of the big winners in the semiconductor industry.

Google Finance

Company and Industry Overview

Qualcomm Inc. is a global semiconductor and telecommunications equipment company. It designs and manufactures semiconductors, software, and related technologies for wireless communication devices. The company operates through three segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). Revenue is primarily generated through semiconductor sales and licensing agreements for its extensive patent portfolio.

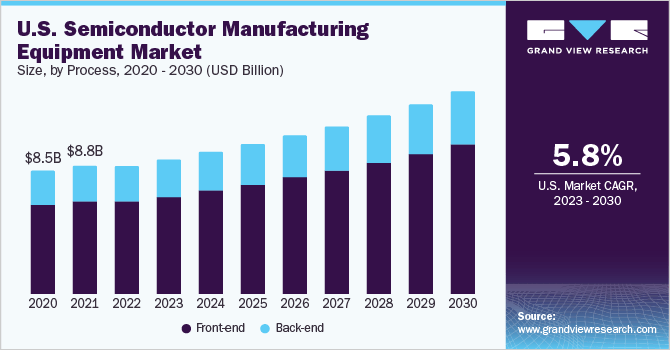

The global semiconductor market remains in a cyclical downturn, made worse by sluggish macroeconomic conditions. However, global semiconductor industry sales were $40.0 billion during the month of April 2023, an increase of 0.3% compared to the March 2023 total of $39.8 billion, foreshadowing a continued rebound in the months ahead. The industry is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030.

Competitive Analysis

Qualcomm differentiates itself from competitors through its strong focus on innovation and intellectual property. The company has a large portfolio of patents and technology licenses, which provide a significant revenue stream through licensing agreements with other companies in the wireless industry. Qualcomm’s expertise in wireless communication technologies, particularly in 5G, makes it a leader in the market. The company’s ability to develop advanced semiconductor solutions and provide comprehensive system-level solutions further enhances its competitive advantage. Intel Corporation and MediaTek Inc. are key competitors in the semiconductor market. However, Qualcomm’s expertise in wireless communication technologies, particularly in 5G, positions it as a market leader. Its ability to develop advanced semiconductor solutions and provide comprehensive system-level solutions gives Qualcomm a competitive edge over these competitors.

Grand View Research

Financials

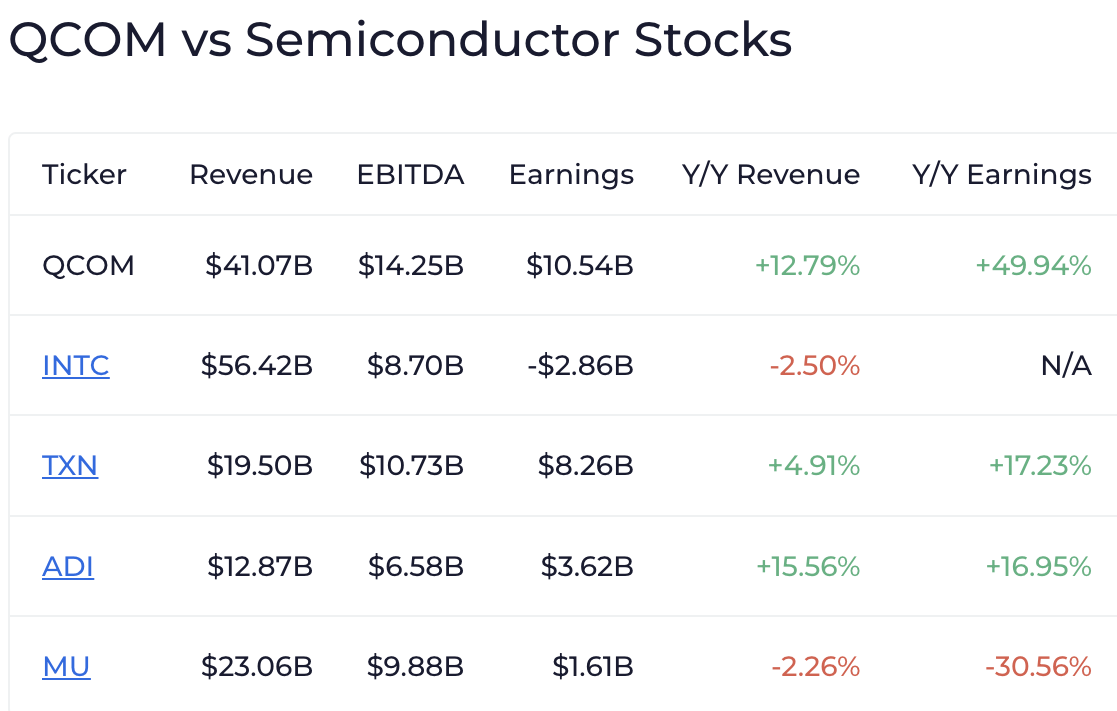

In Q2 2023, QCOM reported revenue of $9.28B. Although down 17% from $11.15 billion for the same quarter one year ago, the revenue figure beat estimates by $150M. EPS was reported at $2.15, which missed estimates by $0.01.

Qualcomm’s revenue of $9.28B beat estimates by an impressive $150M, however, it’s still a decline of 17% YoY. CEO Cristiano Amon blamed the weakness in part on a “challenging” smartphone market, challenging macroeconomic conditions, and COVID headwinds in China, driving industry-wide demand weakness Looking to the third-quarter, Qualcomm said it expects adjusted earnings to be between $1.70 and $1.90 a share, on revenue between $8.1B and $8.9B. Wall Street analysts had previously forecast Qualcomm to earn $2.13 a share on sales of $9.12B. Despite the weak outlook, Amon stated that the company was committed to its diversification strategy, and looking to broaden its customer base.

Wall Street Zen

Key Catalyst

One of the biggest revenue drivers is Qualcomm’s patents. Qualcomm controls an extensive portion of the essential patents needed to operate wireless networks. Historically, Qualcomm obtained a near-monopoly on technology patents in 3G wireless networks, and the firm was able to charge a royalty fee as a predetermined percentage of the price of each 3G device sold. In the 5G world, Qualcomm still owns a good portion of essential patents, and when combined with backward compatibility with 4G and 3G, the company is able to extract a great stream of royalty revenue from virtually all 5G phones. Officially, the company’s licensing program allows Qualcomm to earn royalties equal to 3.25% of the net selling price of smartphones that have backwards compatibility, and 2.275% of the net selling price of single-mode 5G smartphones. With such a minimal variable cost, Qualcomm generates operating margins in the 70% range

Valuation

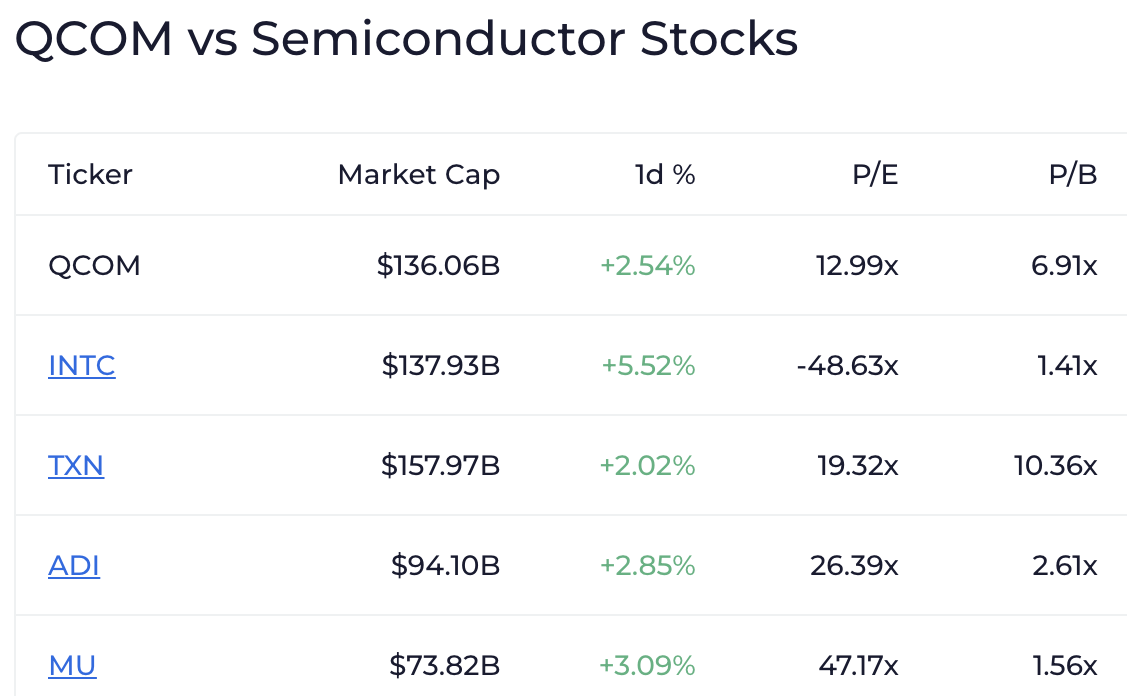

Although troubled by challenging macroeconomic conditions and a challenging smartphone market, Qualcomm seems to be in great shape with a bright future ahead of it. QCOM’s revenues are forecast to at a 13.47% CAGR, and earnings are forecast to grow at a 23.29% CAGR. Their return on equity forecast is 71.14%, which is considered strong. QCOM has a price to earnings ratio of 13.35, which compared to semiconductor industry competitors Intel, at -48.63, and Analog Devices, at 26.39, make it undervalued and a very promising buy. Qualcomm has positioned itself as a leader in the semiconductor industry, and with an average price target of $138.13 at a 13.09% upside, it is a Strong Buy.

Wall Street Zen

ESG

Qualcomm invents technologies that have the power to catalyze social change and the potential to have a positive impact on society for the better. Their focus on 5G technology is important as 5G enables industries to increase sustainability efforts, creates green jobs, and accelerates economic growth in the U.S., with 20% improvement in fuel efficiency, 370+ million metric tons of GHG emissions avoided, and 300k new green jobs by 2030. 5G networks have the potential to be more energy-efficient compared to previous generations of wireless technology.

Risks

While Qualcomm is a prominent player in the semiconductor and telecommunications industry, it faces certain risks that investors should consider, such as the highly competitive market for semiconductors and telecommunications equipment, the risk of Qualcomm failing to adapt to evolving industry trends, and intellectual property disputes, infringements, or challenges to its licensing practices. However, Qualcomm has several strengths and strategies in place to mitigate these risks. The company’s strong focus on research and development allows it to continually innovate and develop cutting-edge technologies, along with staying ahead of competitors. Additionally, Qualcomm’s extensive intellectual property portfolio, including a significant number of patents, provides a strong foundation for licensing agreements, and the company has a history of successfully defending its patents and resolving legal challenges.

Conclusion

In conclusion, Qualcomm differentiates itself through its strong focus on innovation and intellectual property. Despite the challenges in the highly competitive market for semiconductors and telecommunications equipment, Qualcomm’s technological leadership and robust intellectual property portfolio position it as a prominent player in the industry. The company’s ability to adapt to evolving industry trends, particularly in the 5G space, further enhances its competitive advantage, adding possible upside potential for investors.

Analyst Recommendation By: David Diaram

Read the full article here