Reasonable sales, profits, dividends, and low valuations… This is all about Qualcomm (NASDAQ:QCOM) stock. You might be wondering what is not to like here. But the semiconductor industry is experiencing a decline. Qualcomm’s 2Q 2023 results also disappointed many investors. In this article, I would like to explain why the stock is not a great buy right now.

Qualcomm 2Q 2023 earnings results

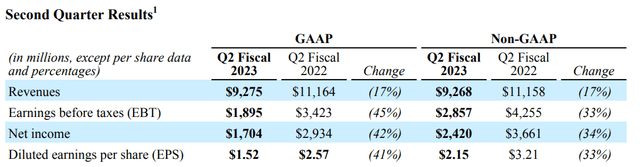

Many articles have already been written by Seeking Alpha authors about Qualcomm’s 2Q 2023 earnings results. So, I will just say a couple of words about these without going into too much detail. Qualcomm has reported rather disappointing earnings compared to the same period a year ago.

My fellow Seeking Alpha contributor Tradevestor wrote a very good article on Qualcomm’s recent results. Indeed, the revenue decreased by 17%, the earnings before taxes declined by 33%, whilst the earnings per share were down by 33%. The most worrying problem was the quarterly free cash flow that declined from $2.7 Billion to -$486 Million year-on-year.

Qualcomm

The segment results were not good. Neither the QCT (Qualcomm CDMA Technologies) nor the QTL (Qualcomm Technology Licensing) divisions performed well. As my fellow Seeking Alpha contributor mentioned, only the automotive segment of the QCT division grew by 20%.

Qualcomm

But even worse was Qualcomm’s management’s outlook. The company does not seem to have a very bright future due to the fact the mobile handset market is not going through its best days. The chipmaker lowered its third-quarter earnings and sales expectations below its own earlier estimates.

The management said it expected the company’s earnings to total between $1.70 and $1.90 a share, excluding one-off items, on sales between $8.1 billion and $8.9 billion for its third quarter.

One of the issues facing Qualcomm is its inability to continue its supplies to Apple (AAPL) as usual. QCOM is working to diversify its smartphone customer base. Right now, Apple makes up about $5 billion of Qualcomm’s annual sales. Analysts predict Apple will likely not need QCOM’s modems as early as 2024. Apple acquired Intel’s modem unit in 2019 and there had been speculation it would begin using its own in-house parts as early as 2023.

Qualcomm’s EPS and sales history

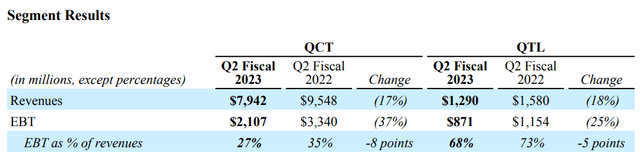

According to SIA, the semiconductor sales for the month of March 2023 increased by 0.3% compared to February 2023. However, the total semiconductor sales for the first quarter of 2023 decreased by 8.7%. From the graph below, you could see that the semiconductor sales are declining.

SIA

Some of Qualcomm’s competitors have also reported poorer results than the markets had expected. The industry’s downturn can continue for a while.

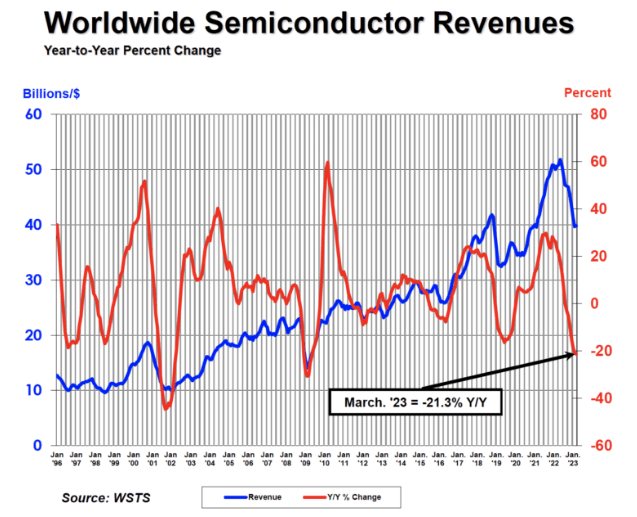

But let’s also have a look at Qualcomm’s earnings and revenue history.

Qualcomm’s annual net income and revenues history (In Millions of United States Dollars (USD) except per share items)

Seeking Alpha

Source: Seeking Alpha

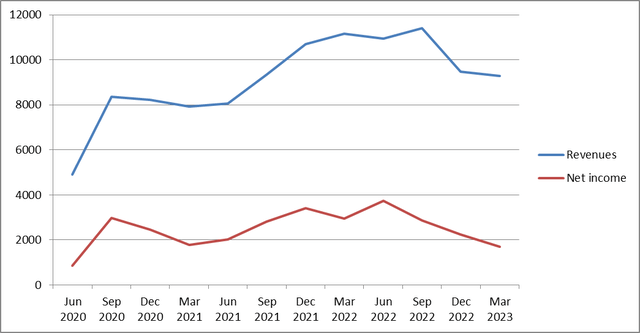

Qualcomm’s quarterly net income and revenues history (In Millions of United States Dollars (USD) except per share items)

Seeking Alpha

Although 4Q 2022 and 1Q 2023 were not brilliant, we can still safely say the 2019 – 2022 period was good. 2022 was even outstanding for Qualcomm. All seems good so far. But let’s see what general problems the company is experiencing, given its reliance on the smartphone industry.

International Data Corporation (IDC) estimates that smartphone shipments will not grow in 2023. Instead, IDC forecasts the shipments of smartphones will decline 1.1% in 2023 to 1.19 billion units, quite a decrease from the previous 2.8% growth estimate as the market continues to suffer from weak demand and ongoing macroeconomic problems. Most of Qualcomm’s sales come from the company’s QCT (Qualcomm CDMA Technology) division, and that segment is far too reliant on chips that go into smartphones. But the current smartphone slowdown is not over. So, it may likely mean further hardships for Qualcomm’s business.

The stock is also under pressure due to the general tech sector’s decline and the broader recession fears. But let us look at the other stock fundamentals too.

QCOM stock fundamentals

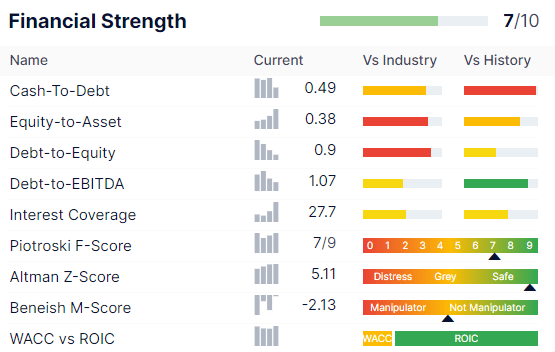

At first glance, Qualcomm has quite strong financial fundamentals.

Particularly good are the debt-to-equity, the debt-to-EBITDA, and the interest coverage ratios. A reasonable debt-to-equity (D/E) ratio can be up to 2. Qualcomm’s D/E is substantially below that. A good debt-to-EBITDA is below 10. An indicator of 3 or 4 is brilliant, whilst Qualcomm’s debt-to-EBITDA is even less than that. QCOM’s earnings also allow it to pay its interest many times, which is also important. All that means the company can easily service its debt.

GuruFocus

I would say Qualcomm’s cash-to-debt ratio is not brilliant but still quite reasonable, currently standing at about 0.50. In other words, Qualcomm does not have too much extra cash.

Seeking Alpha

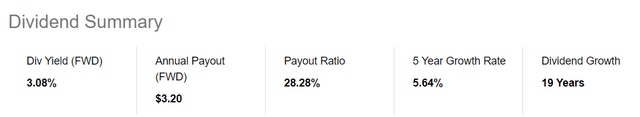

The company regularly pays dividends, which is a good sign. The chipmaker has been growing dividends for 19 years. QCOM’s dividend yield is standing at about 3%, whilst the payout ratio is more than 28%. All that means Qualcomm’s dividends are sustainable.

Risks

The risks are substantial. To start with, US-China relations are deteriorating fast. You might be thinking they used to be even worse during the trade war. I do not personally think so. First of all, right now, the tensions around Taiwan are rising. Since Nancy Pelosi’s visit to Taiwan, the situation got even more worrying. There are risks of a real war since the arms supplies are quite high and increasing.

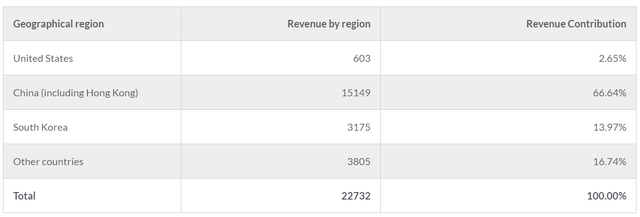

It is a serious threat to Qualcomm, since the company is American and about two-thirds of its revenues are due to China.

Businessquant.com

In my view, the threat is serious. Not to mention, the general recession risks are high right now. With any substantial decline in the manufacturing sector, the demand for semiconductors will be low. Just a quick reminder that they are essential in the production of smartphones, computers, and cars. So, Qualcomm is here to lose as well.

However, the semiconductor industry’s decline could be temporary. It is possible for the Fed to stop hiking the interest rates. In fact, the Fed and other central banks can even start easing their monetary policies if we face more serious economic problems. Lower interest rates will be a gift for the global economy, including semiconductors and Qualcomm. If that happens, I will get more bullish on the company. So, some investors might view Qualcomm’s stock price decline as a chance to buy QCOM shares. But I do not personally think the company’s stock is a real bargain right now.

Valuations

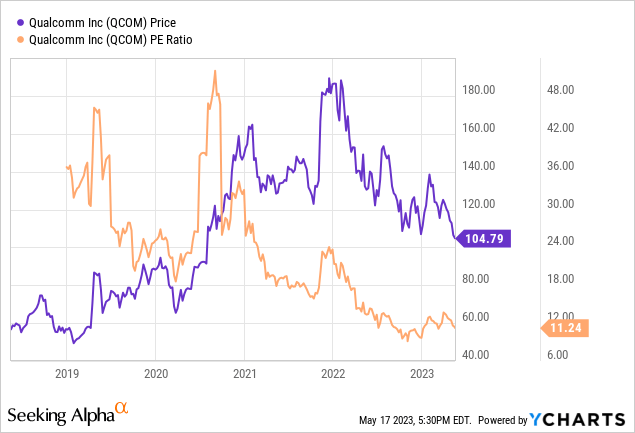

Qualcomm’s stock seems to be relatively cheap if we see its recent history.

Qualcomm’s price-to-earnings (P/E) ratio is currently just above 11, quite good value for money, it seems.

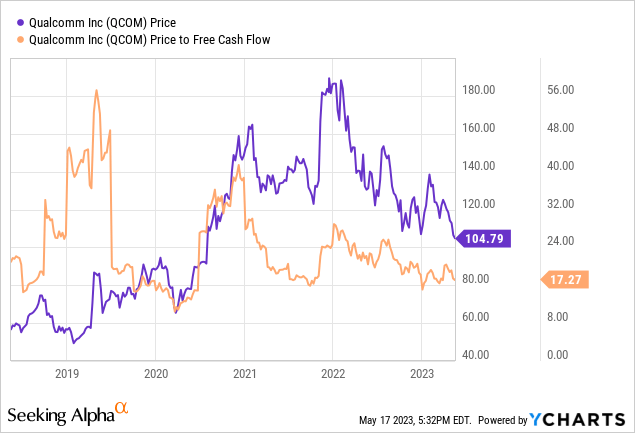

QCOM’s price-to-free cash flow (P/FCF) ratio is currently near multi-year lows. Yet, an indicator above 10 is not an excellent value for money. Qualcomm’s P/FCF is just above 17.

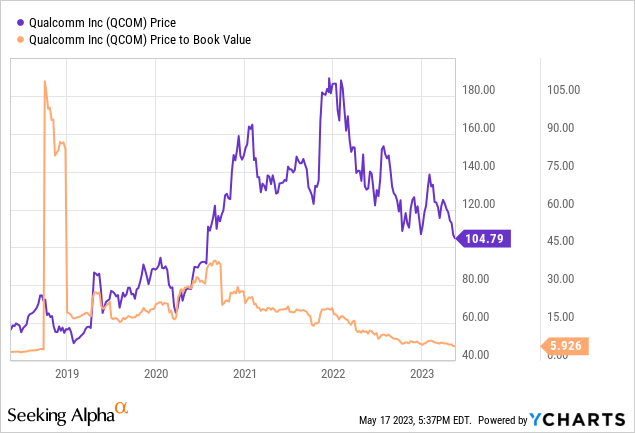

Qualcomm’s price-to-book (P/B) ratio of around 6 is quite high. It is substantially lower than these of many high-tech firms but still not low enough for QCOM to be a value stock.

So, QCOM stock is not overvalued but is not too cheap either.

Conclusion

Qualcomm’s stock seems to be reasonably valued and only experiencing a temporary slowdown. But the question is how long it would last. Given the decline and geopolitical threats, the stock is not very cheap. Although Qualcomm is a good company, I would personally take the wait-and-see position.

Read the full article here