Investment Thesis

Quanta Services, Inc. (NYSE:PWR) is a global provider of infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries. With the growing energy transition, the company has positioned itself in the industry. It has capitalized on this trend, which has fueled its strong growth as exhibited by growing financials, strong price, and total returns. The company has generated a respectable total return of approximately 524% over the past five years and around 51% over the past year. This, in my view, positions the company as a good wager due to its appealing rewards to shareholders.

Seeking Alpha

Although historical success is certainly a factor to take into account, investors should give greater weight to the company’s potential going forward. Given the company’s strategic stance during the energy transition phase, I believe the company can achieve the highly attractive financials expected for the coming FYs. As a result, I am bullish on this stock in the long run.

Growth And Profitability: Nothing But Attractive

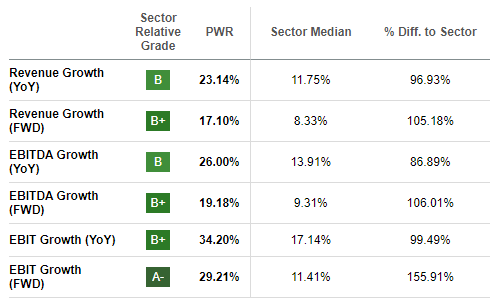

PWR’s growth data show that the company has been expanding. This is because its energy portfolio continues to see high demand thanks to the expanding energy transition. To begin, PWR’s revenue, EBITDA, EBIT, and operating cash flows are all expanding at double-digit rates year over year (23.14%, 26%, 29.21%, and 99.98%), which is significantly higher than the industry median of 11.75%, 13.91%, 11.41%, and 17.66%.

Seeking Alpha

Based on these growth figures, it is apparent that this company is way above the industry in terms of growth, something I attribute to its aggressive expansion plans through acquisitions, as will be discussed later in this article.

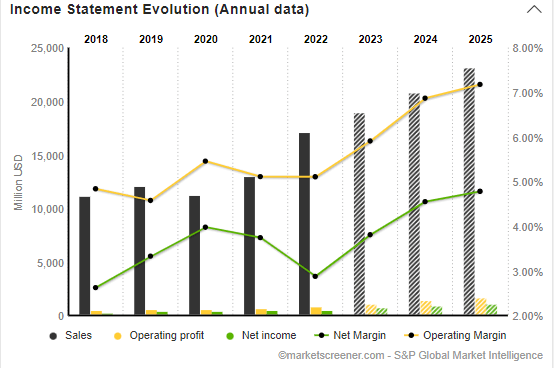

To delve even further into growth, the company’s revenues, operating profits, and net income have all increased steadily over the last three fiscal years, from $11203M, $611M, and $446M in 2020 to $17074M, $872M, and $491M in 2022. Over the course of three years, this expansion led to a 52.4% increase in sales, a 42.7% increase in operating profits, and a 10% increase in net income. These are, in my opinion, highly promising results.

Market Screener

This growth is also reflected in the MRQ, which indicates that the firm’s financial position continues to improve. With future prospects being very important in decision-making, it is very appealing to see that future financial projections are very strong, as represented in both charts attached above. In my view, the future looks even more appealing than the past, which gives me a reason why investing here is worthwhile based on these criteria.

MY Q2’23 Expectations

With this company expected to release its Q2 results on August 3rd, here are my expectations for the quarter. In terms of revenues, considering the investment plans the company has laid down, I expect the company to grow its quarterly revenues. Considering the $10 million revenue growth reported between Q4’22 and Q1’23, I expect the company to register a more robust growth than this, given then it has continued with its growth initiatives. At the minimum, I expect revenue of about $4.45B.

For EPS, the company has beaten its EPS estimates by an average of 0.05 over the last two quarters. Considering these eps surprises and the company’s current solid performance, I expect the company to exceed its EPS estimates of 1.64 and register an actual EPS of about 1.69. In terms of profitability, I don’t expect the company to grow its profits significantly, given the financial implication of its acquisition of RP Construction Services, LL, in April. In general, I expect strong Q2 results.

Growing Energy Transition: PWR Growth Catalyst

The term “energy transition” describes the ongoing transformation of the world’s energy infrastructure away from traditional fossil fuels like oil, natural gas, and coal and toward renewable energy sources like wind, solar, and lithium-ion batteries. Key drivers of the energy transition include the increasing share of renewable energy in the overall energy supply mix, the advent of electrification, and advancements in energy storage. Despite varied regulations and commitment to decarbonization, the energy transition will gain prominence as ESG elements become increasingly valued by investors.

Between 2019 and 2024, the total electricity capacity of the world based on renewable sources is expected to grow by 50%, according to the International Energy Agency. Utilities are rapidly shifting away from coal as a result of this change.

PWR’s management has noted that there is a considerable demand for their products in the market for green energy, which is very pleasing given the growth mentioned above. The company has also recognized the importance of the expanding EV industry to its future expansion, which I expect to be significant. UBS estimates that between 2025 and 2030, the percentage of electric vehicles in the US will increase from its current level of about 4% to over 19%; I believe this is a tremendous opportunity as it fits the company’s product portfolio.

PWR Excellent Position In The Market: Seizing The Opportunities

PWR is one firm that has benefited from the worldwide shift to renewable energy sources. In the United States, Quanta is already a dominant force in the field of energy transition. Quanta Services benefits from a favorable macroeconomic environment and is led by a savvy team that has made some brilliant acquisitions. I believe that the company is now in a prime position to take advantage of market opportunities due to these acquisitions.

For instance, PWRs acquired the 2018 Northwest Lineman College, a utility and energy industry training program provider. With an aging workforce, the need for trained people is growing, and Quanta’s investment in a college is one approach to fill that need for its many infrastructure service offerings.

Quanta’s acquisition of Blattner Holding Company in October 2021 was a smart strategic move that increased the company’s exposure to the renewable energy market. With a 30% share of the wind market and a 10%-15% share of the solar market, this corporation dominates the renewable engineering, procurement, and construction [EPC] sector. Blattner conducted projects in 2021 that built 6,857 MW of wind and solar generating capacity and battery storage projects, saving an estimated 11.9 million tons of CO2.

The company purchased RP Construction Services, LLC in April of this year. The acquisition of RPCS expands Quanta’s current infrastructure solutions platform, facilitating the transition to a lower-carbon economy. RPCS provides solar EPCs and developers with simple, high-performance solar tracking solutions by offering the best solar tracker technologies in the industry. These technologies are backed by project enablement services, such as design engineering, warehousing, shipping, pre-assembly, and mechanical installation. Since 2014, RPCS has sent fully designed single-axis solar tracking systems to customer sites in over 41 US states and Canada, totaling more than 4GW.

With these acquisitions and the over 90% completed large renewable transmission project in Canada, I am convinced the management is positioning this company appropriately in this growing market. In conclusion, PWR is set up to take capitalize on shifting energy trends, and it’s obvious that the push to decarbonize the global economy will boost demand for Quanta’s offerings.

Valuation

With nearly all relative valuation metrics above the industry median, it appears that PWR is trading at a premium. While this could be the case, I don’t believe this is a case of overvaluation. Still, I believe this valuation could be driven by investors willing to pay the premium price for this attractive company. Looking at past performance and future projections, PWR seems to be way above the industry average, which justifies the higher multiples.

Further, accessing the company’s investment in the energy transitions and its future projected financials, I am bullish on this stock and place a price target of about $230 per share, representing approximately a 15% upside. This figure was arrived at by running an EPS-based model, assuming a forward PE of 7.08, a discount rate of 10%, and a growth rate of 15% given the company’s growth potential. Considering this company’s strong growth, I don’t anticipate the share price to reverse and dip anytime soon, but instead, I expect them to rise even further. As a result, I wouldn’t waste time jumping into this growth opportunity.

Risks

Investing in Quanta Services, Inc. carries some risks, as do investments in general. Below are some of the potential risks:

Project Execution: PWR primarily operates on a project basis, contracting to complete large-scale projects for its clients. Delays, cost overruns, or failures to successfully complete projects can impact the company’s financial performance and reputation.

Labor and Workforce: Quanta heavily rely on skilled labor and workforce availability. Competition for qualified workers, labor disputes, wage inflation, or a shortage of skilled workers can impact the company’s ability to complete projects and affect profitability.

Geographical Concentration Risk: The company generates a substantial portion of its revenue from operations in North America, particularly the United States. This concentration makes it vulnerable to regional economic factors, weather conditions, political instability, and natural disasters.

Conclusion

I think PWR is a fantastic investment on the strength of its amazing overall returns over the past five years, its strong financial performance, and its solid future prospects supported by substantial investments in a premier market.

Read the full article here