Thesis Summary

Bitcoin (BTC-USD) has rallied over 20% in the last month, creating a strong confirmation for many that, indeed, the bottom is in and the bull market approaches.

A lot of investors are now expecting Bitcoin to behave as it has done in many of the previous cycles, rallying into and after the halving. And most pundits also seem to believe Bitcoin will break above triple digits in this cycle.

While this is an argument I have made myself before, I can’t help but wonder: Could this time be different?

It’s unusual for markets to do exactly what everyone is expecting, and Bitcoin is no exception. What if we don’t rally after the halving? What if we don’t break above $100,000?

In this article, I expand on this scenario.

Keeping Up With Bitcoin

Back in October, as Bitcoin broke above $35,000, I covered a few of the recent catalysts that had pushed Bitcoin up and discussed possible price targets for the coming bull market.

Bitcoin has continued to confirm a bull market is underway, as it has soared past $45,000 in the last month.

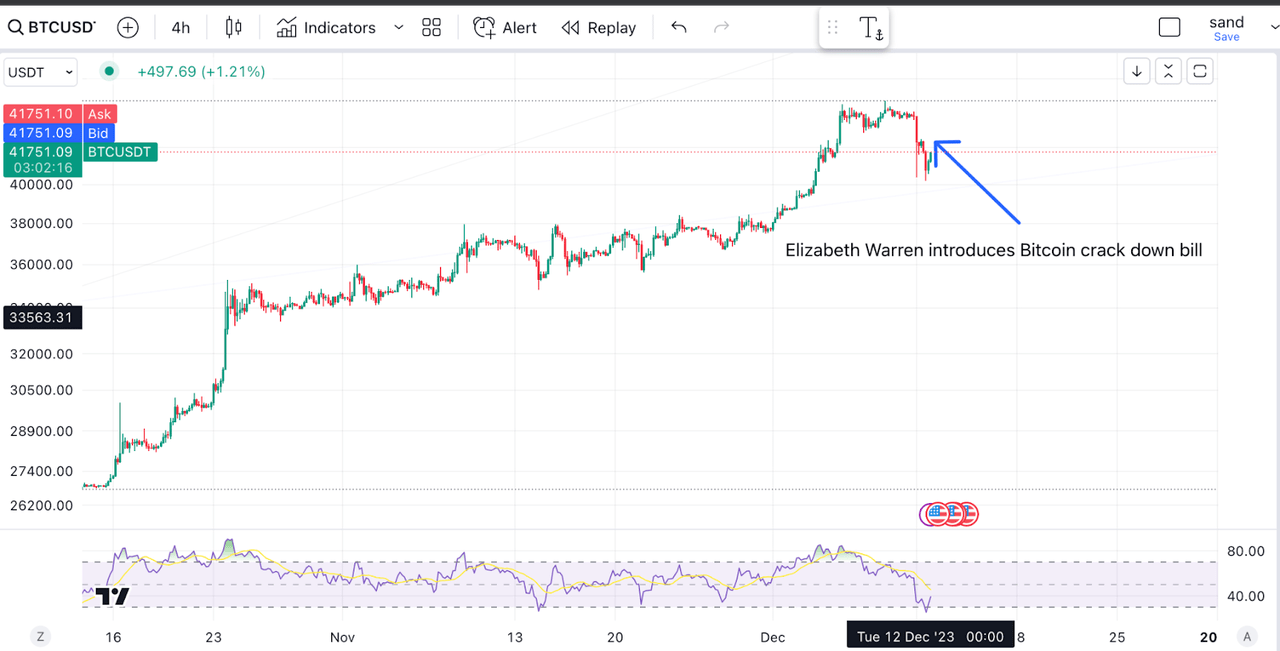

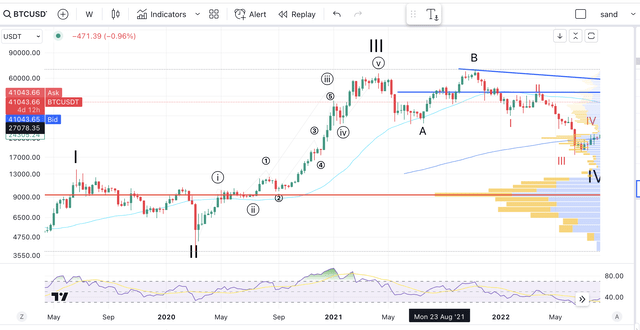

Bitcoin price chart (TradingView)

Over the last 24 hours, however, Bitcoin has fallen close to 5%, which could be partly attributed to Elizabeth Warren’s latest crypto bill, which seeks to crack down on Bitcoin and self-custody.

Nonetheless, a pull-back after this relentless rally seems like a necessary step before Bitcoin can continue higher.

Overall, Bitcoin has so far followed the path laid out in our previous article:

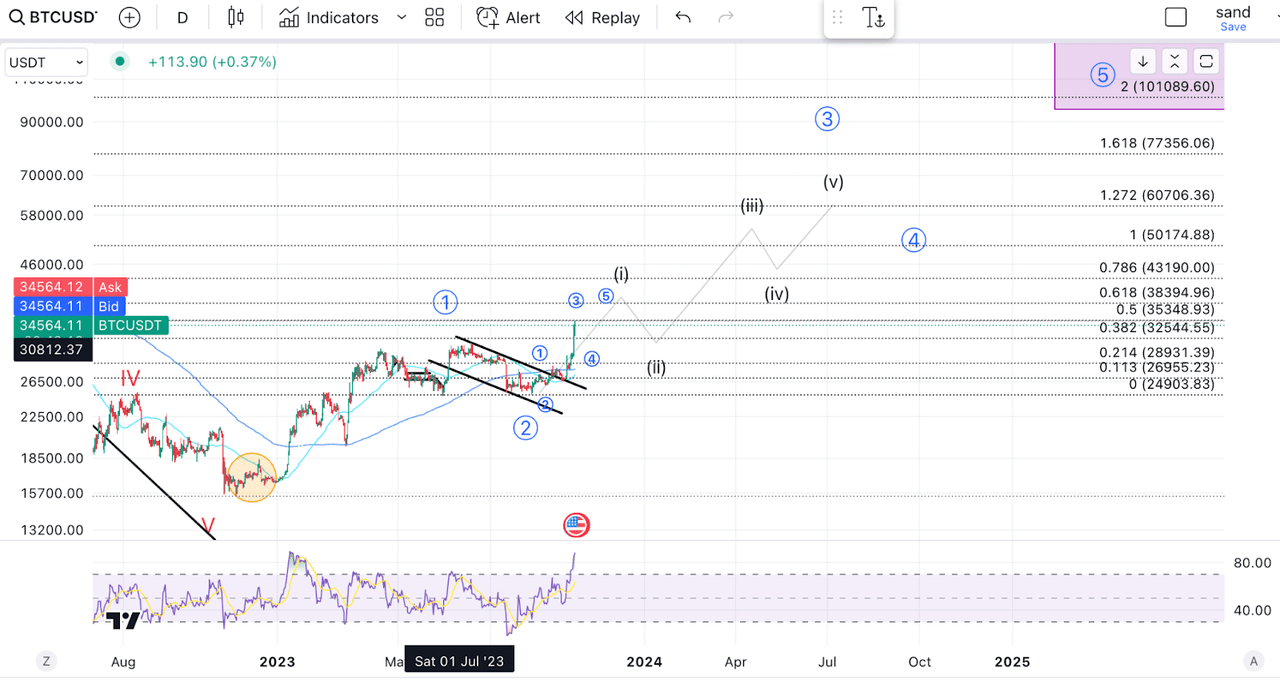

BTC TA (Author’s work)

Though we have not really seen a substantial sell-off until now, we have rallied into the $40,000-$50,000 region, which has always been a clear area of resistance.

So Far So Good

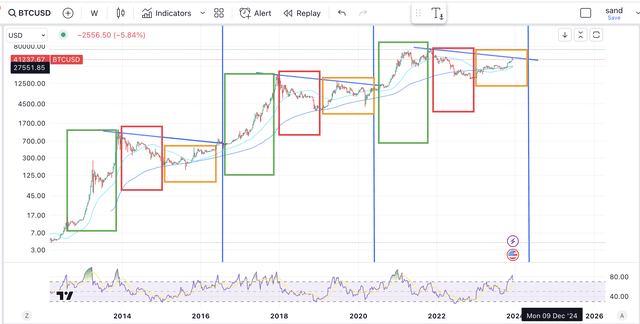

If we actually look at the long-term Bitcoin price history, this is playing out exactly as we would expect based on previous halving cycles.

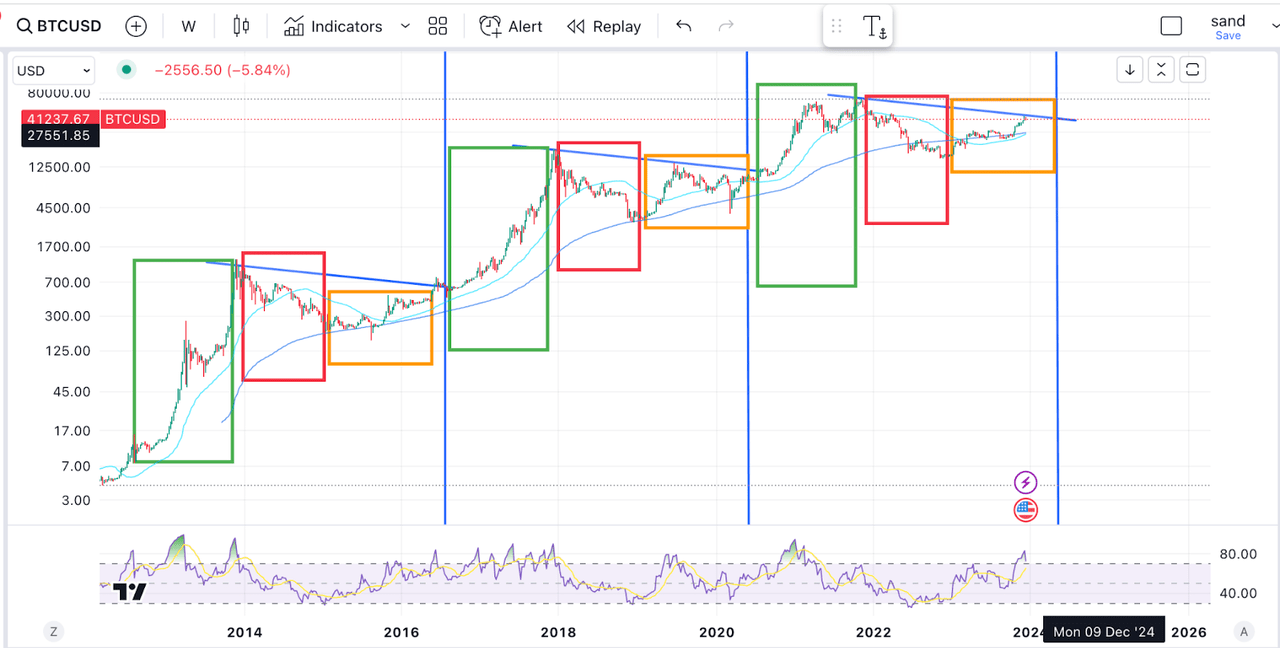

BTC cycle (Author’s work)

Bitcoin’s block reward gets halved every four years, with the next halving scheduled sometime around March/April 2024.

In previous cycles, we have observed a very similar price action around the halving. Bitcoin rallies very strongly following the halving. It then tops and enters a bear market, giving up a lot of the bull market gains and leaving a lot of later investors underwater.

Bitcoin then experiences a few months of consolidation ahead of the next halving. Bitcoin tends to bottom well in advance of the halving, but it doesn’t really take off until after the event. This is the period inside the orange box.

In the chart above, I have also drawn three identical trendlines, going from the top of the bull market, which in the two previous cycles have limited the upside before halving.

Quite interestingly, we reached this level in the last week, and we have now begun a reversal.

Based on previous halving cycles, we might expect Bitcoin to move sideways or even sell off from here without breaking the previous low.

Then, around March-April 2024, Bitcoin would rally after the halving, and most would expect it to reach new all-time highs, probably surpassing $100,000.

Expect The Unexpected

With that said, now that everyone is expecting a halving rally, it’s hard to imagine that this will play out exactly like everyone expects.

When has the market been that easy to read?

Once a narrative is expected and accepted, it is likely the opposite that happens, and one just needs to look at the past two years to understand this.

Back when Bitcoin was at $60,000, everyone was expecting it to break above $100,000 too. Back when the S&P 500 was bottoming at 3600, everyone was expecting it to go even lower.

When inflation was peaking at 9%, everyone was expecting this to continue, just as it reversed.

This time could indeed be different, and there are other factors at play here.

The Bitcoin ETF release has everyone excited, but much like the halving, this news is already getting priced in. Some believe a spot Bitcoin ETF could be approved as early as January.

It seems like the spot Bitcoin ETF could come in some time around the Bitcoin halving. But with these two catalysts gone, what will propel Bitcoin higher?

Indeed, I believe this could be a “sell the news” type of event. At the very least, even if the halving cycle does play out, it could happen a lot faster since everyone is expecting it, and the final Bitcoin price target could be a lot lower, leaving some unfortunate investors holding the proverbial bag.

Technical Analysis

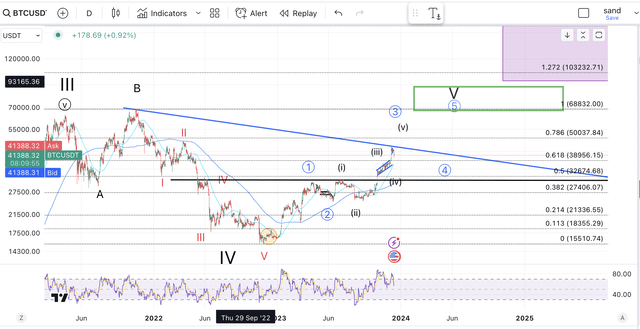

Ultimately, it is impossible to know with 100% certainty what will happen, especially in the short term. I have shared before various possible price targets for Bitcoin based on different Elliott Wave targets.

I share below the most conservative target.

Bitcoin TA (Author’s work)

The Guideline of Equality says that two of the motive sub-waves in a five wave sequence will tend toward equality, which is generally true of the non-extended waves.

This means that, when Wave 3 of an impulse wave is the extended wave, Wave 5 will approximately equal Wave 1 in price. This is useful for potentially projecting the end of Wave 5 in an impulse if you recognize Wave 3 as an extended wave.

Source: StockCharts

We could definitely make an argument that the previous Wave 3, the rally that took us north of $60,000 was “extended”. In other words, the Wave 3 was in a nine-wave structure.

Bitcoin TA (Author’s work)

This means that a reasonable target for our Wave 5, the next leg up in Bitcoin, could be somewhere around $68,000, which is where Wave 5 would be equal to Wave 1.

Now, this is just a guideline and is not an imperative. Wave 5 could, in fact, also be extended.

However, it would definitely take a lot of people by surprise if Bitcoin, in fact, topped just above the last cycle high. And in markets, surprises seem to be more likely.

How Do We Play This?

We have strong confirmation that a bull market is in play. The question is, how can investors best profit from it?

The actions each investor takes will very much depend on the investment style one wishes to apply.

Long-term investors would do well simply holding Bitcoin and accumulating it, not even bothering about the Bitcoin cycle.

However, those wanting to try to take profits at the top, should be looking at selling earlier.

But how do we know if this time, the Bitcoin cycle will be different? One indication will be the resistance line I have shown above.

BTC cycle (Author’s work)

If we break above this resistance level before the halving, it would be a strong indication that Bitcoin might be getting ready to rally before the halving rather than after.

On the other hand, investors must keep an eye on other important factors that move Bitcoin, which I discussed in my last article, such as the news and liquidity.

In any case, it looks like the $70,000 area would be a good spot for a reversal, even within a larger structure that does take us north of $100,000.

Risks

Most people are now discounting the regulatory risk, since a spot Bitcoin ETF looks like a done deal. However, the recent bill introduced by Warren shows that Bitcoin is still under attack by many governments.

On the other hand, since Bitcoin is so tied to liquidity, I don’t think it will be immune to a deflationary recession, something which is becoming more likely in the past few months and could hit in 2024.

Takeaway

We will have to wait and see how things play out next year. For now, the recent dip does indeed seem like a reasonable place to add. I do expect Bitcoin to go much higher, but perhaps sooner than most expect and less high than they anticipate.

Read the full article here