Thesis

Although the share price has mostly gone down over the past two and a half years, ResMed Inc. (NYSE:RMD) still has the capacity to reward shareholders who are patient.

About ResMed

Founded in 1989, ResMed first offered a commercialized treatment for obstructive sleep apnea. That treatment was called continuous positive airway pressure, or CPAP, and according to the 10-K for 2023, it was“ the first successful noninvasive treatment for OSA. CPAP systems deliver pressurized air, typically through a mask, to prevent collapse of the upper airway during sleep.”

Since then, it has developed or acquired a number of other technologies that help with respiratory disorders. It operates through two segments, Sleep and Respiratory Care and Software as a Service, or SaaS. The latter is a cloud-connected, out-of-hospital software platform that supports professionals and caregivers with patients in the home.

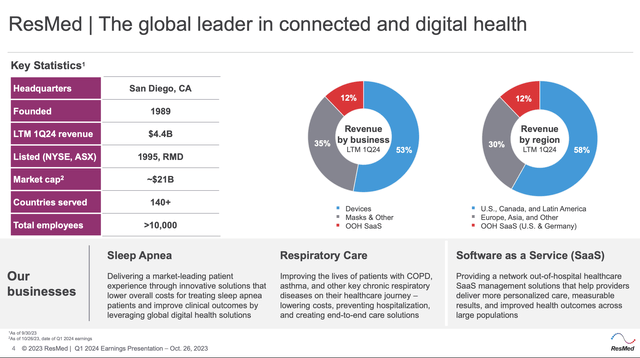

This slide, from the first-quarter 2024 investor presentation, provides an overview of the company from an investor’s perspective:

RMD Overview (RMD Investor Presentation)

The company’s fiscal year begins each July 1st and ends each June 30th.

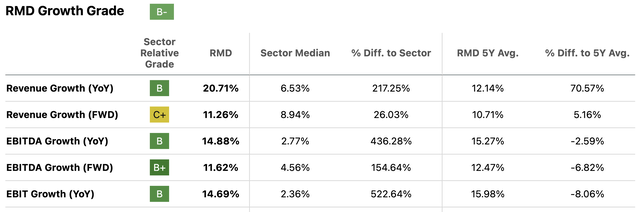

Consider ResMed a growth company, given its projected revenue and EBITDA growth rates [FWD]:

RMD growth table (Seeking Alpha)

The company also pays a dividend, which gets a good growth rating: B+, representing 7.80% for ResMed versus 4.62% for the Healthcare industry and, on a five-year basis, 7.16%, which is 8.86% higher than the sector’s midpoint.

Competition

ResMed reported in its 10-K that competition is intense for both segments. An Emergen Research overview shows that three companies dominate the sleep apnea market: Phillips Respironics, a subsidiary of Koninklijke Philips N.V. (PHG) (Revenue: $4.34 billion); ResMed ($3.6 billion), and Curative Medical, Inc., a subsidiary of ResMed ($3.6 billion).

It also holds approximately 9,700 pending, allowed, or granted patents and designs. Morningstar refers to switching costs and intangible brand assets in the headline to its moat evaluation. It added,

“ResMed is taking a “smart devices” and Big Data approach to further entrench itself as one of the two leading players in the global obstructive sleep apnea, or OSA, market. With cloud-connected devices, physicians can monitor patient compliance and encourage continued use. Higher adherence supports both reimbursement rates from payers and the resupply of masks and accessories. ResMed also plays a key role in producing clinical data that demonstrates treatment can minimize related risks such as hypertension, stroke, heart attack, and Alzheimer’s disease.”

Growth

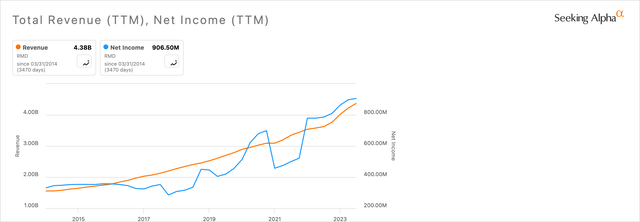

The following chart shows how revenue and net income have nearly tripled over the past decade:

RMD revenue & net income chart (Seeking Alpha)

Revenue has grown from $1.555 billion to $4.375 billion, while net income has increased from $345.3 million to $906.5 million.

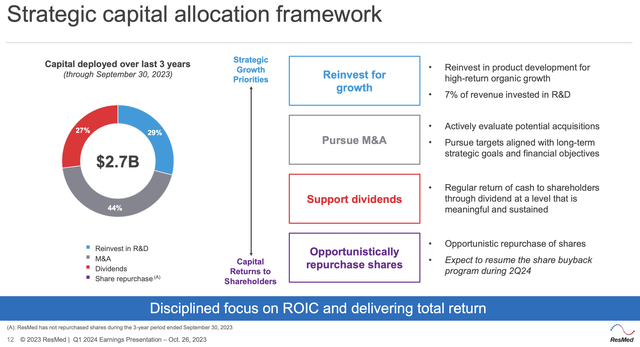

Behind that growth is an articulated capital allocation framework, as shown in this Q1-2024 presentation slide:

RMD allocation chart and info (RMD investor presentation)

Like many other companies in the medical field, it enjoys demographic-driven increases in healthcare spending. That’s also true for sleep apnea products, which are expected to grow from $4.5 billion in 2023 to $6.9 billion in 2030. Alternatively, it represents a CAGR growth rate of 6.2%, according to Grand View Research.

Margins

At the end of September 2023, its first quarter of fiscal 2024, ResMed had a gross margin of 54.44%, an operating margin of 22.15%, and a net margin of 20.72%. Such numbers back up the idea that the firm has a wide moat.

Hefty profit margins such as these feed strong cash flows, making funds available for organic investments, acquisitions, dividends, and share buybacks.

In Q4-2023, it increased its quarterly dividend, from $0.44 to $0.48; it announced in its Q1-2024 news that it planned to resume share repurchases in Q2 of this year; and that it will continue making capital expenditures that grow its business.

Management and Strategy

Michael Farrell has been with ResMed since 2000 and served in several senior positions before becoming CEO and chair of the board of directors. He has two university degrees, including an MBA, and at previous employers had management consulting, biotechnology, chemicals, and metals manufacturing roles.

Brett Sandercock has been chief financial officer since 2006 and has been with ResMed since 1998. He earned a bachelor’s degree in economics and is a certified chartered accountant.

Strategy: In its 10-K, the company said it planned to continue focusing on sleep and related care as it considers both to be “globally underpenetrated.” It also aims to maintain its interest in SaaS networking, “our software solutions are focused on out-of-hospital care, which we believe is fragmented and underserved, and where we see significant opportunity to transform and significantly improve out-of-hospital healthcare.”

Valuation

ResMed is a highly profitable, well-established, and steady performer, which is quite likely to keep delivering capital gains and a growing dividend over the medium to long term.

As such, it is unlikely to be a bargain. That’s confirmed with a look at some of its key profitability metrics, including:

- P/E Non-GAAP FWD: 26.26, compared to the healthcare median of 18.97.

- PEG Non-GAAP FWD: 2.74, compared with the industry median of 2.22.

- EV/EBITDA FWD: 17.93, versus the industry median of 13.53.

- Price/Sales FWD: 5.49, compared with the industry median of 4.14.

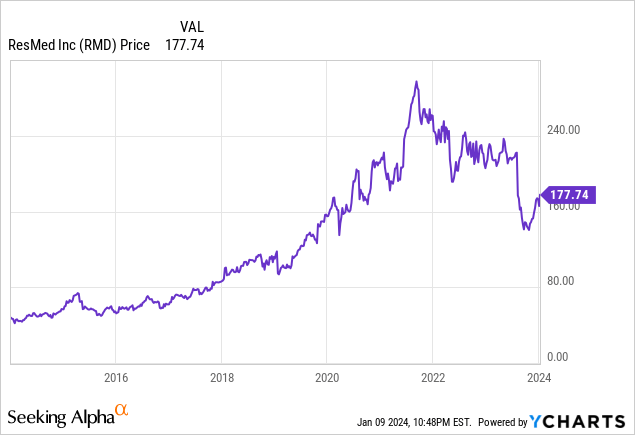

So, the company is overvalued—or at least seems to be. Consider this price chart, though, which shows the company was valued much higher in the past:

Over the nearly two years between September 2021 and October 2023, the stock took quite a tumble. It’s been on the rebound over the past two months, and the question arises, “Will it continue to push higher or drop back again?”

Based on its history, I expect the rebound to continue, although not necessarily smoothly. Among the 12 analysts who have provided EPS estimates for the current year, which ends on June 30th, the average estimate is $7.19 per share. Among the 11 who posted estimates for June 2025, the average is $7.93.

Those are significantly higher than the $6.09 per diluted share for the fiscal year that ended June 30th, 2023. Specifically, that’s 17.89% higher for this year and 30.21% higher than fiscal 2025’s estimate.

Based on the principle that share prices more or less track earnings, I would expect the share price to gain 15% to 20% by the end of June 2024. That would push up the price from $177.33 (at the close on January 9) to between $204.50 and $213.40 in the next six months.

Based on a longer-term perspective and anticipated growth in EPS, I believe ResMed is reasonably priced, and a Buy.

Other opinions

Quants overall are cautious about ResMed and have been giving it Hold ratings since late September.

The most recent Seeking Alpha opinion is Strong Buy, while four previous analysts gave it three Buys and one Hold.

Among the 13 analysts who have weighed in the past 90 days, there have been 5 Strong Buys, 4 Buys, and 4 Holds. Collectively, they think the current price should be $188.55, which is 6.03% above the current price.

Risks

ResMed participates in the Healthcare sector, meaning it competes in a fluid business that has seen quite a bit of disruptive technology. For example, the National Council on Aging reports that Inspire Medical Systems, Inc.’s approach to sleep apnea does away with the need for external machines and masks. However, it is much more expensive (for those without insurance, at least) and requires minor outpatient surgery.

As reported, the business is highly competitive and failure to meet consumer preferences could hurt revenues and earnings.

It is subject to global macroeconomic conditions, meaning it could be affected by everything from supply-chain problems to unfavorable currency exchange rates.

Intellectual property could be stolen or left unprotected, leaving it exposed to competitive threats.

Future healthcare reforms and regulations could have an adverse effect on product sales and margins.

Conclusion

ResMed is a solid growth company, with steady improvement on its top and bottom lines. That’s led to attractive margins, and in turn, cash flow for reinvestment and distributions to shareholders. It has a capable management team and a proven strategy, as well as a reasonable valuation.

It offers a history that reflects well on its management, business model, and execution. I expect its profitable growth, along with a very modest dividend, will continue to reward shareholders over the next five to ten years. Therefore, I consider it a Buy.

Read the full article here