I’ve been noting that real estate investment trusts, or REITs, look interesting at this point in the cycle given their yield and the likely cycle shift we may be in with the Fed expecting to reverse course next year. The iShares Residential and Multisector Real Estate ETF (NYSEARCA:REZ) is an interesting fund to focus on. REZ is a unique exchange-traded fund, or ETF, that offers investors an opportunity to gain exposure to the residential and multisector real estate markets. It incorporates diverse investment holdings, and its primary focus is on residential and storage REITs. The “multisector” aspect of the fund refers to healthcare and self-storage real estate investments.

The fund includes 38 different investments, with residential REITs forming a significant portion of the fund’s top holdings. The ETF’s unique composition offers investors diversified exposure to various subsectors of the real estate market, thus minimizing the risk associated with investing in a single property type or geographic location.

An Overview of the ETF’s Holdings

REZ is a concentrated fund with its top ten holdings accounting for approximately 67% of its total value. A closer look at these holdings offers insight into the fund’s investment strategy and market exposure.

- Welltower Inc. (WELL): A healthcare-focused REIT that primarily invests in senior housing, assisted living, and memory care communities, post-acute care facilities, and medical office buildings.

- Public Storage (PSA): A prominent player in the self-storage sector, operating numerous storage locations across the United States and Europe.

- Extra Space Storage Inc. (EXR): Another significant player in the self-storage sector, EXR operates thousands of properties across the United States.

- AvalonBay Communities (AVB): This residential REIT owns and operates nearly 300 apartment communities across the United States.

- Equity Residential (EQR): A leading REIT in the residential sector, EQR owns and manages a large portfolio of apartments and condos.

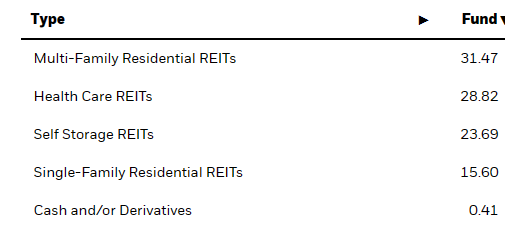

Sector Composition and Weightings

The sector composition of the iShares Residential and Multisector Real Estate ETF is primarily dominated by residential and health care REITs. However, the fund also holds a significant portion of self storage REITs. This sector diversification enhances the fund’s ability to generate income and capital appreciation from different market segments, thereby reducing the investment risk.

ishares.com

The residential sector forms the largest single component of the fund, providing investors with broad exposure to both single-family and multifamily housing markets across various geographic locations. The healthcare and self-storage sectors offer additional layers of diversification, contributing to the fund’s stability and growth prospects.

Pros and Cons of Investing in REZ

Like any investment, investing in the iShares Residential and Multisector Real Estate ETF has its advantages and potential downsides. Here are a few points to consider:

Pros:

-

Diversification: The fund offers broad exposure to various subsectors of the real estate market, including residential, healthcare, and self-storage.

-

Income Potential: REZ passes through the dividends paid by its underlying investments, making it a solid income play.

-

Market Exposure: The fund gives investors access to some of the best-run housing REITs in the market, along with robust REITs in self-storage and healthcare.

Cons:

-

Expense Ratio: The fund’s expense ratio of 0.48% is higher than many other index funds.

-

Market Risks: Like all investments, REZ comes with market risks. Changes in the overall real estate market or economic conditions can impact the fund’s performance.

Conclusion: Is REZ a Good Investment?

The decision to invest in the iShares Residential and Multisector Real Estate ETF should be based on your individual investment goals, risk tolerance, and investment horizon. The fund offers a unique investment proposition, providing diversified exposure to the residential and multisector real estate markets.

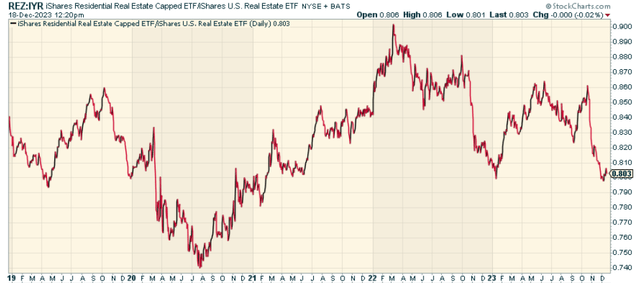

Relative to the broad-based iShares U.S. Real Estate ETF (IYR), it’s had a hard time this year, but the ratio may have bottomed, suggesting outperformance could be coming in 2024.

stockcharts.com

iShares Residential and Multisector Real Estate ETF is a good fund for what it does, and I think as part of a broader REIT allocation, deserves a close look.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here