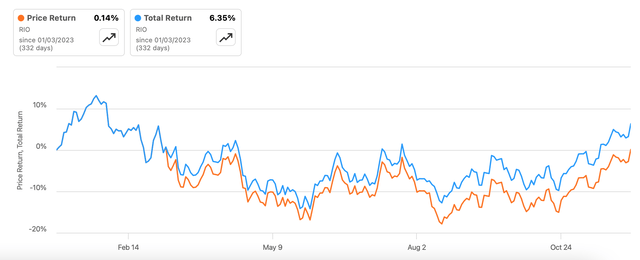

Since I last wrote about the multi-commodity miner Rio Tinto (OTCPK:RTNTF) (NYSE:RIO) in July, its price is up by 7.4%. With a healthy trailing twelve months [TTM] dividend yield of 5.65%, the total returns are even higher at 10.5%. This is a pretty decent return, especially considering that the S&P 500 (SP500) has barely moved since and that the company is seeing a cyclical downturn of its own.

RIO, Price and Total Return, YTD (Source: Seeking Alpha)

Even then, it was clear even in July that Rio Tinto was due an uptick going by its low market valuations and healthy dividends, even considering its weakening earnings. But with some price uptick, the question now is whether it still looks like an attractive investment.

Dividends decline on weaker earnings

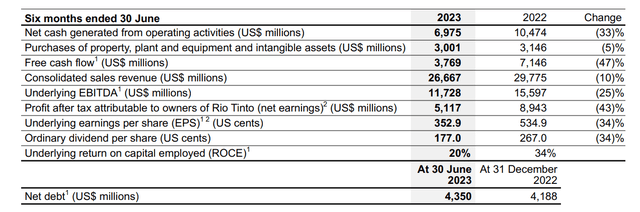

As far as the foreseeable future goes, the first point to note is the recent dividend cut. When Rio Tinto released its interim results (H1 2023) in late July, it also reduced its dividend payout by 34%. This wasn’t unexpected, of course. Even when I last wrote, the company’s dividend payout ratio was at 85.6%, which is higher than the average of 61.5% for the past five years.

Softening earnings further indicated the likelihood of lower dividends. The company’s attributable net profit had declined by 41% year-on-year (YoY) in 2022, and shrinking earnings continued in H1 2023 as well, as profits declined by 43% on a softening in commodity prices. Specifically, the Platts index for iron ore fines showed an average monthly decline of 14%. This is important for Rio Tinto considering that iron ore accounted for 84% of the company’s underlying earnings in 2022.

Key Financials, H1 2023 (Source: Rio Tinto)

Improved outlook

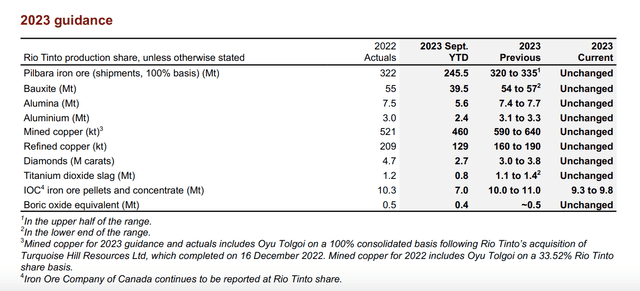

The outlook for the remainder of 2023 and next year has improved in the past months. For one, its third quarter (Q3 2023) production figures show that it’s on track to meet its production guidance (see table below).

Source: Rio Tinto

Improved China economy

Significantly, iron ore prices have picked up since late October as well. The commodity is up by 20% YTD now, supported by positive news flow from China, which is the biggest importer of iron ore in the world. The economy’s growth surprised on the upside in Q3 2023, coming in at 4.9% compared to analysts’ expectations of 4.4%. Subsequently, the IMF raised the economy’s growth to 5.4% from 5% this year and has also raised the 2024 forecast to 4.6% from 4.2% earlier.

China’s government is also supporting the economy more, with an increase in its target fiscal deficit ratio to 3.8% now from 3% in March. I had pointed to the likely fiscal stimulus as a reason for optimism on Rio Tinto in H2 2023, and so far it appears to be playing out.

Price, Iron ore (Source: Trading Economics)

BHP faces industrial action

Iron ore prices have also risen speculatively on industrial action at BHP (BHP), which is among the biggest iron ore producers in the world along with Rio Tinto. The segment, which accounted for 64% of the company’s underlying earnings in 2022, is now seeing train drivers responsible for transporting iron ore from the Pilbara mines in Australia demand better terms. The company’s initial offer hasn’t been accepted.

Improved estimates

Likely as a result of both increased potential demand from China and an impact on iron ore supplies from BHP, analysts’ estimates for Rio Tinto have also improved significantly since July. They now expect earnings to grow again in 2024 itself, while earlier they had expected an earnings pick up in 2025. Also, revenue expansion is now seen in 2026, whereas a decline was expected until 2027, the last I checked.

The downside

Despite the positive outlook, I do think there are risks to consider. China’s economy is facing challenges, for sure. Like a 50% increase in loan defaults to 8.54 million people since early 2020, and it’s also seeing deflation, which isn’t a good sign. Further, the very fact that the government has to step in to stimulate the economy is a sign that all isn’t well.

I’m also uncomfortable with pinning a company’s prospects on China’s stimulus. The country’s government has already said it will intervene in the iron ore price rally if required. In other words, we can expect a ceiling to iron ore prices.

Rising market valuations

Further, the stock’s valuations have risen since the last I checked. From 9x in July, its TTM price-to-earnings (P/E) ratio has risen 13.5x. To put the increase in context, the long-term average TTM P/E for RIO is 11.1x, which is lower than the current ratio. RIO’s P/E is still lower than that for the materials sector, though, which has now risen to 17.2x from 13.9x in July.

The forward GAAP P/E ratio at 9.2x has also risen from 8.5x in July, but it too is also lower than the 16.9x for the materials sector. But it is higher than the stock’s five-year average of 7.9x.

The key takeaway here is that RIO’s valuations are still competitive compared with the sector but are now elevated compared to its averages over time. I’m more inclined to go by the past averages, though, which indicate around a 15% correction in Rio Tinto in the near term.

What next?

If the company were at the start of a cyclical upturn, I’d be willing to overlook the market multiples right now. But considering that it’s dependent on stimulus in China and short-term disruptions for BHP right now, I’m not entirely convinced.

Sure, there are signs of improved performance going forward. But even the forward P/E for 2024 at 8.8x reflects that Rio Tinto is richly valued now. I do think that its dividends are attractive, even considering that they have been reduced, and the price has risen. But I’m no longer certain that, for now, they can make up for a share price softening.

For medium to long-term investors who are looking more at a passive income from Rio Tinto, now may be as good a time to buy as any, going by its 171% total return over the last 10 years. But I think that for investors looking to buy the stock, there could be a better opportunity in the coming months. With this in mind, I’m downgrading RIO to Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here