Rivian Automotive (NASDAQ:RIVN) announced results for its first-quarter recently and the EV company beat EPS estimates while falling short of revenue predictions. While the earnings card was mixed, Rivian said it was still on track to achieve its 50 thousand electric vehicle production goal for FY 2023, which sets Rivian apart from other EV manufacturers that have recently cut their forecasts. Lucid Group (LCID), as an example, appeared to have downgraded its production target of 10-14 thousand units to the lower end of this range. Rivian still has a strong balance sheet, but I believe it will take time for the EV company to grow into its current valuation!

Rivian beats EPS estimates, but the market still has reservations about Rivian’s production growth

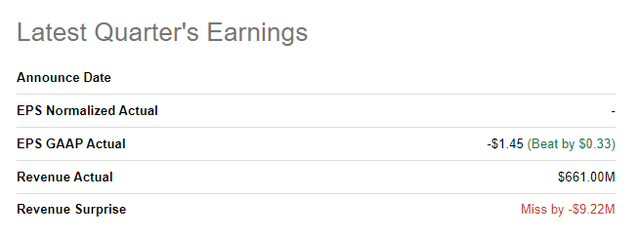

Rivian beat Q1’23 EPS expectations and reported a narrower than expected loss as the electric vehicle company slowly moves towards mass production of its R1T and R1S consumer-focused EV products. Revenues fell slightly short of expectations, but nonetheless saw solid growth year over year.

Source: Seeking Alpha

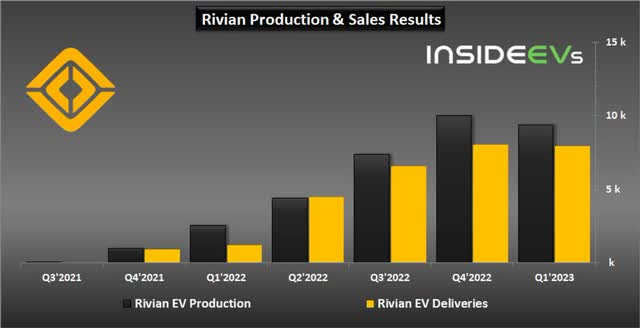

As Rivian previously announced, the electric vehicle company produced 9,395 (+268% Y/Y) electric vehicles in Q1 and delivered 7,946 EVs (+548% Y/Y) during the same quarter. Rivian really started to ramp up R1T and R1S production in the second half of FY 2022. However, Rivian’s momentum slowed in Q1’23 compared to the fourth-quarter as both production and delivery volumes fell quarter over quarter. Although the EV company reaffirmed its production outlook, investors clearly are more skeptical about Rivian’s growth prospects than a year ago.

Source: InsideEVs

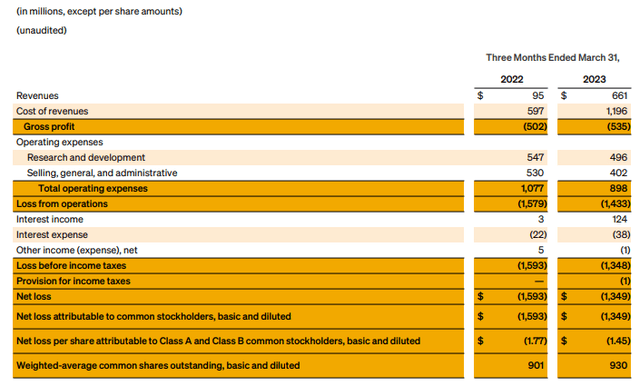

Rivian reported revenues of $661M, showing a year over year increase of 596% as the company’s steadily ramped production of its electric vehicles. Rivian also reported a narrower than expected net loss, but that doesn’t mean that the electric vehicle manufacturer is close to profitability: the EV maker reported a net loss of $1.35B for Q1’23 compared to a net loss of $1.59B in the year-earlier period. According to consensus EPS estimates, Rivian is now expected to see profitability only in FY 2028.

Source: Rivian

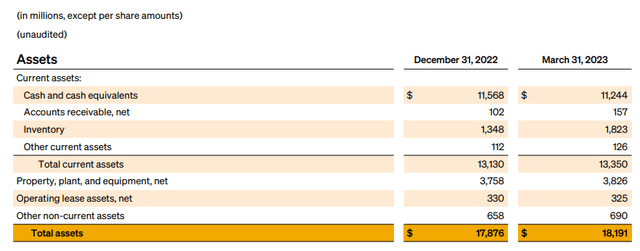

Strong balance sheet is a key asset for Rivian, especially during a recession

I am not concerned about Rivian’s balance sheet or the company’s ability to fund a multi-year ramp of its R1T and R1S products. Rivian had $11.2B in cash sitting on its balance sheet at the end of the first-quarter and with about $1.4-1.5B in quarterly costs (COGS, R&D and SG&A), I believe Rivian has enough cash to finance its production growth for at least 7-8 quarters before facing a potential liquidity issue. The comfortable cash position is also a key asset for Rivian should the U.S. economy have to deal with a recession as the EV company would not be forced to raise capital in the event of an economic slowdown this year.

Source: Rivian

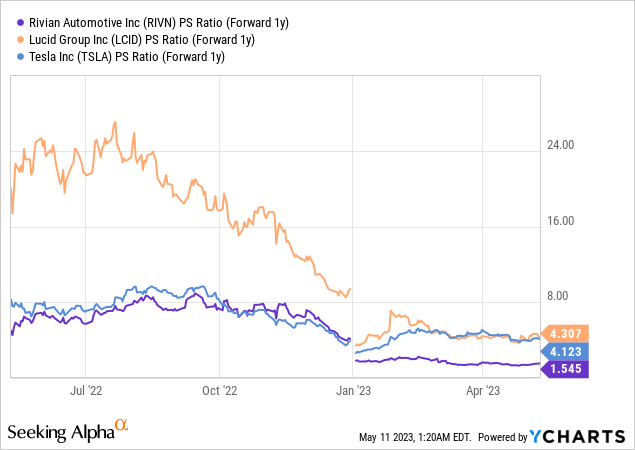

Rivian’s valuation and risk profile remain unattractive

Rivian is still one of the more expensive electric vehicle stocks in the U.S. stock market right now, even after a 65% price drop since reaching a 1-year high. Rivian is currently trading at a price-to-revenue ratio of 1.55X which is less than Lucid’s 4.3X P/S ratio and less than Tesla’s (TSLA) 4.1X P/S ratio. However, Rivian is still highly valued as investors still price in enormous production and top line growth for the electric vehicle company over the next few years. Rivian’s risk profile remains skewed to the downside here, in my opinion, and a few months ago I warned that Rivian was set to reach new lows due to ongoing production challenges. I am reaffirming this view now.

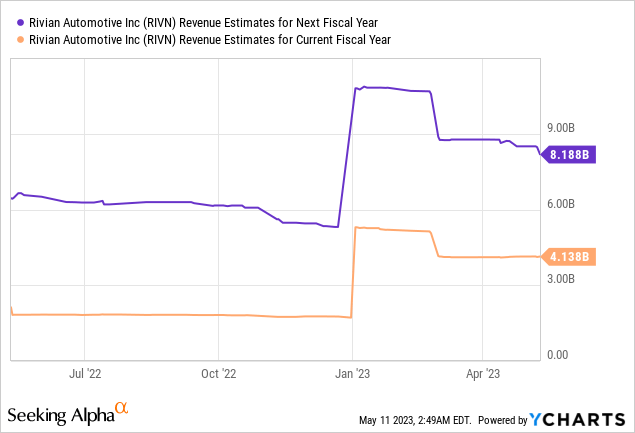

Rivian is expected to generate $4.1B in revenues in FY 2023 and $8.2B in FY 2024, showing year over year top line growth rates of 147% and 96%. However, top line estimates have reset lower in the last couple of months as investors have become more concerned about weakness in EV demand. If demand for electric vehicles slows down, Rivian may see a new round of top line estimate revisions which could hurt the EV company’s valuation.

Risks with Rivian

A number of electric vehicle companies have walked back or lowered their production forecasts for FY 2023 lately, and I am specifically naming Lucid and Fisker. For Rivian, there is definitely a risk that the company is forced to lower its FY 2023 production forecast if demand for electric vehicles slows, perhaps in the context of a recession. What I also see as a risk factor for Rivian is that price cuts in the electric vehicle industry and increasing competition could put pressure on margins or delay revenue recognition going forward. As a result, EV companies may generally see weaker growth in production, deliveries and revenues in FY 2023 than investors currently expect.

Final thoughts

It was definitely a positive that Rivian did not cut its production target for FY 2023 and that the company is sticking to its 50 thousand EV production guidance. Other EV companies are feeling softening demand which has resulted in them down-grading their production targets for the current year. From a balance sheet point of view, I am not concerned that Rivian can finance its production ramp of the R1T and R1S. However, I didn’t see much in Rivian’s Q1’23 earnings release that would indicate to me that the EV company’s share price could break out of its down-trend. Considering that Rivian’s shares are still quite expensive with a P/S ratio of 1.3X, I believe that the risk profile continues to remain unattractive!

Read the full article here