Whether you’re a retail investor or a financial industry professional, it’s likely that you’re familiar with Robinhood (NASDAQ:HOOD), the leading low-cost retail brokerage platform that went public a few years ago.

The company was infamous in the financial community before the pandemic due to its zero-commission business model, which we believe forced bigger incumbents like TD Ameritrade and ETRADE to follow its lead in cutting commission fees to zero.

However, despite the company’s industry-shaping impact, Robinhood eventually became most famous for its role in the GameStop (GME) meme stock craze in early 2021, during which the brokerage firm briefly prevented customers from purchasing GME stock (and other stocks) as they rose.

While the action was prudent and essentially mandated by the NSCC due to HOOD’s small balance sheet, the move generated a tremendous amount of controversy and prompted several conspiracy theories from HOOD’s main customer base of retail traders.

In additional to the reputational damage (that the firm is still shrugging off), the company’s stock has also struggled since IPO, down more than 85% from its all-time high of $85 per share.

Behind the decline are issues around revenue predictability, market cyclicality, and high interest rates, which have hurt fintech multiples across the market.

However, we believe that the company has officially turned a corner, and now stands to generate improving financial results as a consequence of its continued business execution and product shipping velocity.

Well positioned in its industry, and with numerous catalysts set to launch in the coming months, we expect that if interest in the stock gets re-ignited, then investors could see some serious upside in future quarters.

Today, we’re taking a look at where things stand with the company, and how upcoming catalysts could send the stock soaring with a new core narrative focused on the company’s consolidated product offering.

Sound good? Let’s jump in.

Where Things Stand

While Robinhood has a lot of baggage in the minds of the general public due to the aforementioned controversy around GameStop (which has been recently re-enforced by the release of “Dumb Money”, a movie about the events of January 2021), management has largely prevented the company’s degraded reputation and poor stock price performance from impacting business execution.

Since the company’s IPO, there has been progress on several fronts.

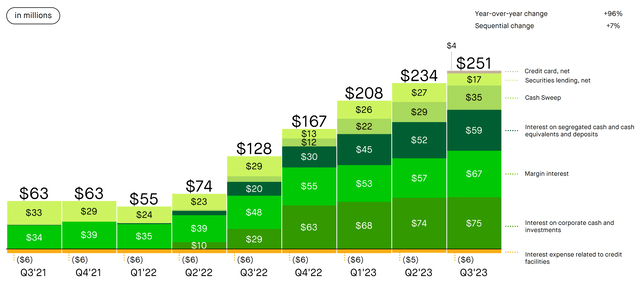

First off, HOOD is less reliant on transaction revenues than ever before.

In the period right before Robinhood’s IPO, nearly 6% of all revenues were from Dogecoin (DOGE-USD) trading:

For the three months ended March 31, 2021, 17% of our total revenue was derived from transaction-based revenues earned from cryptocurrency transactions, compared to 4% for the three months year ended December 31, 2020. While we currently support a portfolio of seven cryptocurrencies for trading, for the three months ended March 31, 2021, 34% of our cryptocurrency transaction-based revenue was attributable to transactions in Dogecoin.

In addition, a lion’s share of total revenue was derived from PFOF, or “Payment for Order Flow”, a controversial practice where Robinhood sells orders to market markets and pockets a rebate:

S-1

As a side note; theoretically this doesn’t cause a worse price impact for customers, but that has been disputed.

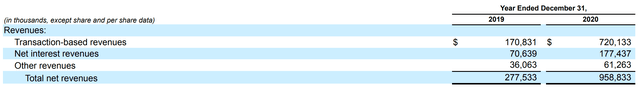

Overall though, transaction revenue made up fully 75% of revenue in 2020 for Robinhood. This is a highly cyclical business, and when the trading boom collapsed in 2022, so did HOOD’s stock price.

However, that has changed in recent quarters, and in Q3, HOOD reported that less than 40% of revenues were transaction-based:

Earnings Presentation

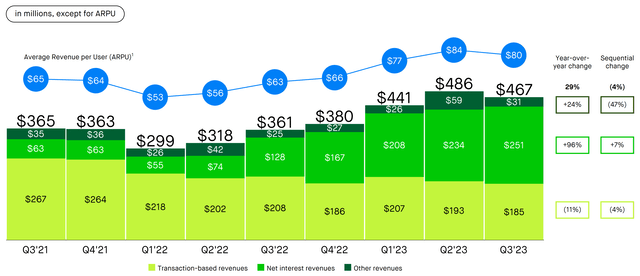

This is a result of improving interest revenues, which have been driven by higher rates, impacting corporate cash interest, sweep revenues, and segregated cash that HOOD earns a spread on:

Earnings Presentation

While rates aren’t expected to stay high forever, as we’ve discussed here and here, Vlad Tenev, Robinhood’s CEO, has expressed that to some degree the business is self-hedging:

One of the nice things about our business is that it’s naturally hedged for changes in interest rates. Trading revenues and interest income tend to move in opposite directions. So we think we’re pretty well positioned to perform financially regardless of the rate environment.

We’ve seen this play out over the last few years. In the lower rate environment, trading revenues were strong. But with rates moving higher, trading revenue abated some, but interest income has picked up.

This remains to be seen across longer cycles, but the dynamic here is similar to the one we’ve discussed in Coinbase (COIN).

As Coinbase has diversified its revenue streams, it has improved its business by leaps and bounds while also positioning itself for huge gains in the next potential crypto bull market.

Similarly, as brokerage transaction revenue has dried up, HOOD has continued executing, diversifying its revenue sources and growing market share by launching and improving its product suite.

No longer is Robinhood simply an app you can use to trade stocks; it’s an all-in-one platform with a spending, saving, and retirement offering, all tied together with a synergistic subscription membership program called “Robinhood Gold”.

When combined with strong recent adjusted profitability and a GAAP net income in Q2, things appear to be trending in the right direction.

Future Catalysts

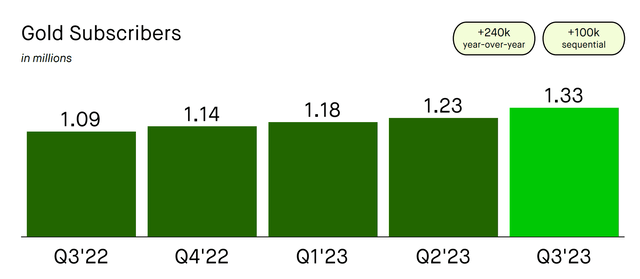

As Robinhood launches new products and improvements, Gold’s value proposition only looks stronger, which should serve to further increase revenue diversity, which is what should drive long term operating leverage – as 90% of HOOD’s cost base remains fixed.

Thus, new product launches should further bolster the ecosystem and the Gold offering specifically.

But what is Robinhood about to launch?

First up, Robinhood is set to launch its equity offering in the UK. This would mark the first international expansion by the company, which is exciting.

This is important for a few key reasons. First, international retail brokerage has not seen the pressure that U.S. brokerage has. Competition should be light, especially for equity trading, as a large portion of foreign trading is done via CFD, not physical settlement.

Second, getting Robinhood’s feet wet is key to launching in more and more jurisdictions in the future. This is doubly true as the CEO has maintained that launching is not a technical issue, but simply a regulatory one:

So I did mention that equities trading, in particular, 24-hour market will be available at launch. In terms of the other value props, again, would rather not run ahead of the announcement, like we’ll find out very soon. The benefits of doing our international expansion organically is we can leverage the same platform. That’s why Robinhood 24 Hour Market is available at launch. It’s all on the same platform. So there’s really no technical limitation to making our services available anywhere that we operate. It’s all just a matter of licensure and making sure that we have the appropriate licenses for all the different products we offer. And I think you’re really going to start to see the organic strategy paying dividends as we continue to expand across multiple jurisdictions, and we add things here in the US and we add — we connect to different market centers overseas. You’ll see that the value accrue both to our US customers and the customers in new jurisdictions.

This is important, as it means that the international business could become a large portion of HOOD’s total revenue in the future. Building with this modularity should lead to faster-than-expected launches going forward.

In addition to the UK launch, HOOD is also launching its Crypto offering in the EU. This is another opportunity to refine the international strategy with a relatively low amount of risk to the core U.S. business.

Second, Robinhood will be launching a Credit Card offering in the coming months.

The offering is said to be built into Robinhood Gold, which strengthens the moat around membership.

This should build gold momentum, which has been very strong as of late, up 22% YoY:

Earnings Presentation

Here’s some more info about the credit card offering, direct from the CEO:

We actually just reviewed and approved the final designs for what’s going to become the Robinhood credit card last week, so we’ve been making good progress. The team is super motivated to launch it. And we do anticipate there will be a period of learning. Of course, X1 has had some data from their customer base. But we anticipate once we release this new product, the scale of Robinhood’s customer base is much bigger.

…

After acquiring X1 in July, our team has been hard at work, creating an awesome credit card and we’ve got something special planned for Gold customers.

As HOOD continues to flesh out its product offering, it begins to look more and more like a one stop shop. As the platform builds in size and scope, there are more and more opportunities for HOOD to monetize its userbase, which should lead to long term top line growth.

Finally, Robinhood is looking to launch futures in 2024. The CEO recently mentioned that he thinks this has the potential to be a 9-figure revenue business, which would be a serious boon to HOOD’s current financial situation:

Let me now talk about futures. We’re getting closer to unveiling our offering there. And we have been hard at work, building what we believe is the best-designed futures product, particularly on mobile. Competitors generate hundreds of millions of annual revenue from futures trading. So as we continue to execute, we believe we have a real opportunity to expand the market, take market share, and build a nine-figure revenue business over time.

In addition to the impact of a new revenue stream, this should also help HOOD capture share.

Right now, we believe Robinhood is still viewed by professional traders as a somewhat unsophisticated platform that can’t compete with more fully featured software, like NinjaTrader, TradingView, or Sterling. However, if HOOD is able to build out a solid, vertically integrated, commission-free futures offering, then it will seriously help HOOD’s goal of building up their more advanced trading offerings, which should drive loads more revenue:

Talking about our active trader offerings, as I mentioned earlier, our goal is to be the number one platform for active traders and we have been gaining share. And for the last three quarters sequentially, we’ve seen our market share of options and equity transactions continue to increase.

A well thought out futures offering should boost financial results significantly.

All in all, these product launches could lead to new interest in the company from both customers and investors, which could lead to stronger financial results, as well as an improved multiple.

The Valuation

Given that all of these product launches are expected to come in the first few months of 2024, it appears that the stock may be undervalued:

TradingView

Trading at only 4.8x revenue, the stock is trading at the low end of its historical multiple, and below other high-growth stocks that are also turning the corner on profitability, like Nubank (NU).

As we expect the international expansion, the credit card, and the futures product launches will generate significant new business for HOOD (on the company’s relatively fixed cost base), it seems as though real, sustained positive GAAP net income is on the table given that the company is already mostly breakeven.

Combined with the transaction business and subsequent diversification story that has been playing out, the setup in HOOD right now reminds us of COIN, which has had quite the run since we called it out last year.

In our view, HOOD could see its multiple double to ~10x, out of the valuation trough it currently finds itself in, and closer to other high growth, brokerage/like peers like COIN.

If the stock ends up re-rating higher, when combined with some top line growth as a result of continued product execution, then it’s possible that shares could double to ~$23 by 2025.

Risks

There are some risks when it comes to buying HOOD.

The number one risk to be aware of is around HOOD’s transaction business. if PFOF is ruled illegal or regulated out of existence by the SEC (or any other market regulatory agencies), then HOOD could lose a big chunk of business. There was some chatter about this a while back, but it’s died down for the time being.

That said, there is still serious headline risk there.

Other risks to be aware of include the fact that our thesis here is somewhat speculative in nature. HOOD may fail to launch these products, or they may fail to generate significant top line growth that would ultimately facilitate an improved top line multiple.

However, if you look at HOOD’s execution track record, we have every belief that the company will be able to meet its product goals in 2024, given how well it has executed historically:

Investor Presentation

Other than that, the story has been significantly de-risked since the GME fiasco. Robinhood has more than $5 billion in corporate cash on the balance sheet, which should buttress the company from most other risks.

Summary

Ultimately, while there are some risks in play, especially around PFOF as a business practice, HOOD has done a great job building its app into a one stop shop for spending, investing, saving, and retiring.

With every new product release, HOOD’s ‘gold’ subscription offering gets stronger, and as the company looks to deepen, expand, and monetize each user relationship, we think the future looks bright.

Given the currently depressed valuation, now is the time to buy some stock before the market fully realizes the impact of the company’s future product launches and top line revenue potential.

If all goes according to plan, we think that shares could double by 2025.

Cheers!

Read the full article here