Roivant Sciences Ltd. (NASDAQ:ROIV) is a pioneering biotech focused on inflammation and immunology that operates with an innovative business model through its subsidiaries. Each company in the Roivant family specializes in specific therapeutic areas such as immuno-dermatology, autoimmune disorders, RNA therapies, blood diseases, clinical trials intelligence, and AI for drug discovery and development. Notable achievements for this company are the lucrative sale of Telavant to Roche, the successful performance of Vtama cream for psoriasis, and the significant advancements of clinical trials for atopic dermatitis and IMVT-1402 antibody development. In my valuation analysis, I conclude that the stock trades at a substantial discount relative to its sector post-Televant. Thus, the promising “vant” model and a seemingly compelling valuation make ROIV a “buy” at these levels despite the lack of future immediate catalysts and ongoing cash burn.

Business Overview

Roivant Sciences Ltd. (ROIV) is a commercial-stage biopharmaceutical company founded in 2014, based in London, UK. ROIV focuses on drug development. It also operates building subsidiary companies to produce medicines and technologies using an agile business model to deliver inflammation and immunology drugs. ROIV is a parent company to subsidiaries that have the “vant” name, such as Dermavant, Immunovant, Priovant, Genevant, Kinevant, Hemavant, Lokavant, Datavant, Covant, Psivant, Vantai, and Telavant.

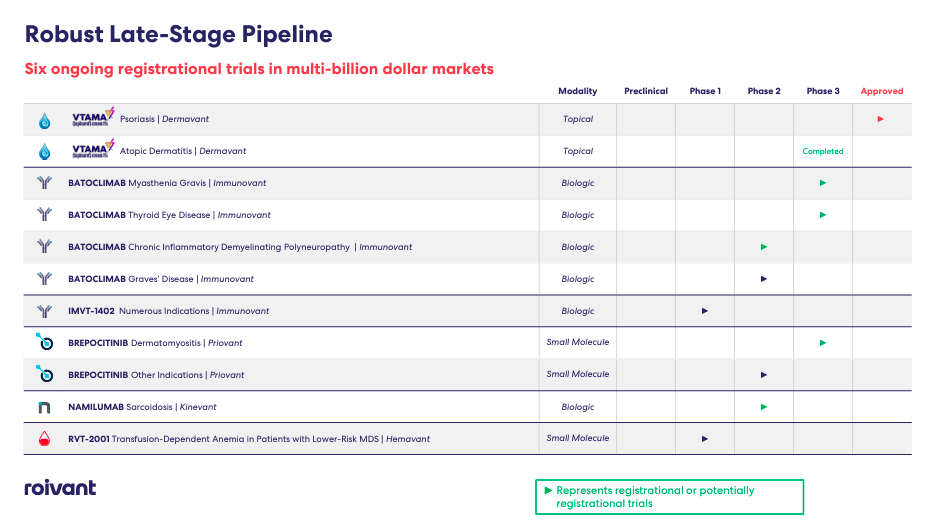

To better understand ROIV, let’s briefly review the focus of each of the subsidiaries in its family of companies. Dermavant provides solutions in the area of immunodermatology. Immunovant develops advanced treatments for autoimmune disease patients. Priovant Therapeutics produces targeted therapies for severe autoimmune disease. Genevant uses proprietary platforms to deliver RNA therapies and gene editing. Kinevant is developing new treatments for rare inflammatory and autoimmune conditions, starting with sarcoidosis. Hemavant is a clinical-stage company focusing on developing blood disorders and hematological malignancies.

Another interesting angle is that ROIV uses data-driven AI insights on Lokavant, providing a clinical trial intelligence platform that enhances drug development. Datavant specializes in technology to improve health data management and sharing while respecting patients’ privacy. Covant works with a license agreement with Boehringer Ingelheim to explore the benefits of covalency for developing new drugs. In this context, covalency refers to forming a covalent bond between a drug molecule and its target to create stable links to enhance drug efficacy.

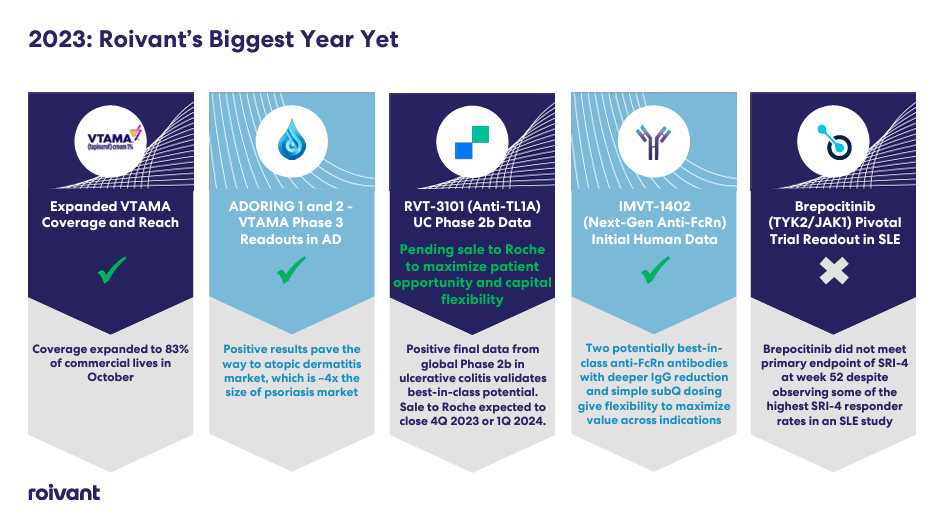

Source: Roivant Corporate Presentation, November 2023.

Furthermore, Psivant delivers its proprietary QUAISAR platform to combine simulation tools for drug discovery based on physics, chemistry, and biology research. Vantai pairs deep learning with biology to build AI models for protein design and optimization for drug discovery and development. Finally, Telavant focuses on inflammatory and fibrotic conditions such as Crohn’s disease. Its RVT-3101 main drug is an antibody used to alleviate ulcerative colitis.

As you can see, ROIV’s IP is broad and ranges across several different verticals. This is one of the most notable features of the company, as these add optionality to the business and, by extension, the stock. The vant model has a proven track record with ten positive results for products in Phase 3 clinical trials and the obtention of six FDA approvals. So, this approach is undoubtedly effective at obtaining FDA approvals and successfully commercializing its pipeline.

Telavant’s Lucrative Roche Deal, Vtama’s Psoriasis Success, and Clinical Advancements

Nevertheless, the company’s most notable development is the recent M&A with Roche. Roche will acquire Telavant for $7.1 billion upfront and $150 million for milestones. Initially, the agreement was expected to close in the first quarter of 2024. It included the development and commercial rights for RVT-3101 in the US and Japan and the option to collaborate with Pfizer on developing next-generation directed bispecific antibodies. However, on December 14, 2023, the acquisition was officially completed, which seems slightly ahead of schedule and a positive for the company.

Looking forward after Televant, ROIV’s next step should be to continue the commercial success of Vtama Cream for psoriasis, currently with over 250 thousand prescriptions written since its launch in May 2022. Vtama reported a $18.4 million net product revenue for the quarter ended in September 2023. These are respectable figures but evidently pale in comparison to Televant’s payday.

Source: Roivant Corporate Presentation, November 2023.

Moreover, in ROIV’s most recent earnings call, the CEO highlighted the successful results of the clinical trials for VTAMA applied to atopic dermatitis. Also, there is progress on the product’s commercial launch for this application. Additionally, management reported the advance of IMVT-1402 antibody for Batoclimab-like IgG suppression. The Immunovant drug batoclimab for the treatment of Graves’ disease produced positive initial Phase 2 results with a response rate that exceeded 50%. The CEO emphasized that the capital infused by the sale of Telavant will be used in the development of the pipeline for further growth. Hence, while the Televant chapter closes as a win for the company, I’d argue that clearly, they’re not slowing down, and there are still future catalysts for further upside.

Still at a Discount: Valuation Analysis

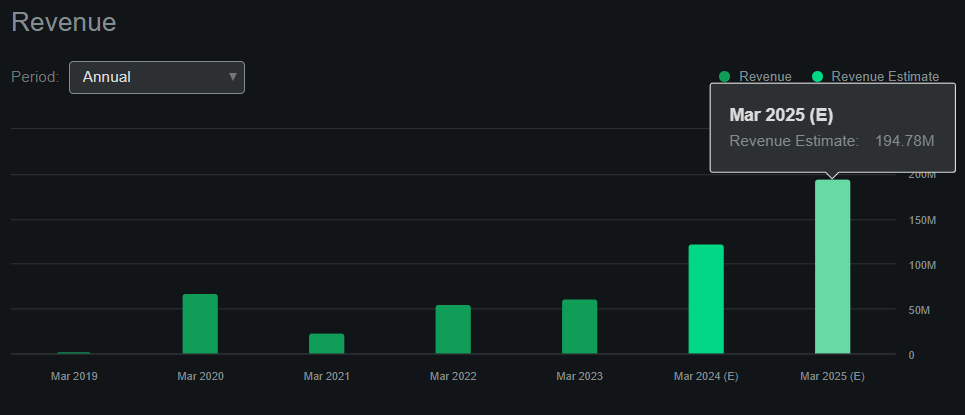

From a valuation perspective, the key factor to consider is ROIV’s current balance sheet. This is because their current revenue-generating capabilities are tiny compared to the company’s market cap. After all, the Televant deal infused ROIV with substantial cash. We don’t yet have the updated balance sheet, but we can infer roughly how much it grew using the latest quarterly figures and the deal’s information. Concretely, by September 30, 2023, ROIV held approximately $2.07 billion in assets, of which $1.41 was held in cash and equivalents. ROIV’s liabilities were about $0.74 billion, resulting in a stockholders’ equity of approximately $1.33 billion. Televant was sold for $7.1 billion, and ROIV owned about 75%. This means that ROIV’s cash should increase by about $5.33 billion in the updated financials. Therefore, the equity should increase by $5.33, resulting in equity of roughly $6.66 billion post-transaction.

Source: Seeking Alpha.

Currently, the company has a market capitalization of $8.70 billion. This means that the implied price-to-book ratio is 1.31, which seems cheaper than the sector’s median P/B ratio of 2.23. Moreover, ROIV is a quality company with a proven business model through its “vant” approach to IP development. I don’t think there’s any reason for the company to trade at a discount relative to its sector, especially when it has demonstrated that it can successfully develop IP and sell it for substantial profits. The disparity is too wide to be ignored, so I rate ROIV a “buy” at these levels.

Investment Caveats and Risks

The only reason why I don’t rate it a “strong buy” is because post-Televant, ROIV still has work to do to develop a similarly successful IP. So, I don’t see a catalyst as significant for the shares in the short term. Moreover, as of the latest quarterly filing, the company continues to burn cash. Using their cash flow statement, I estimated ROIV’s quarterly cash burn rate at about $197.7 million by adding the quarterly CFOs and CAPEX, representing a yearly cash burn rate of $786.8 million.

These are not small figures, but after the Televant deal, I calculate that ROIV’s cash reserves stand at $6.74 billion, implying a cash runway of 8.6 years. I believe this is more than enough for any biotech company, especially one like ROIV, with many potentially successful products under development. In my view, despite these risks and negatives, ROIV still has the ingredients to continue being a successful biotech company, delivering shareholder value over the long run.

Investors appear optimistic on ROIV post-Televant. (Source: TradingView.)

Conclusion

Overall, ROIV is a promising biotech company with a peculiar approach to developing its product pipeline. Yet, its “vant” approach to building its product portfolio has proven successful, as evidenced by the recent Televant deal with Roche. In my view, the valuation analysis is simple, as the multiples-based approach suggests that the stock is undervalued relative to peers. While I concede that the main risks for ROIV are 1) a lack of similarly significant potential deals like Televant and 2) a considerable yearly cash burn of $786.8 million, these negatives don’t seem enough to justify such a valuation disparity relative to peers. Hence, I think there’s still room for the upside in the shares, rating ROIV a “buy” at these levels.

Read the full article here