Investment Thesis

Albert Einstein: “In the middle of difficulty lies opportunity.”

In our view, Roku (NASDAQ:ROKU) has the potential to be one of the surprise success AI stories for 2024. We know they aren’t as flashy as the AI darlings or metaverse stocks. But we think Roku’s position in streaming video ads sets it up perfectly for a big year.

Let us walk through why we’re so bullish on this company. First off, the streaming revolution is still in full swing. Traditional cable TV continues to lose subscribers rapidly as people switch to on-demand streaming. Roku is at the epicenter of this seismic shift, with its platform and devices used in a huge percentage of streaming households. So as the streaming pie grows, Roku stands to capture more and more of the market.

Now combine that core strength with Roku’s advanced advertising capabilities. Their AI-powered ad targeting platform allows for more relevant, personalized, and effective video advertising. Marketers are shifting ad dollars to Roku because their tech improves results. This is a sustainable competitive edge that Roku is parlaying into explosive ad revenue growth.

In our article, we illustrate that looking at the macro picture, we think the economy will avoid recession in 2024 barring any black swans. That would provide a solid backdrop for Roku’s secular growth drivers to accelerate.

The one knock is Roku is still losing money as it spends aggressively on growth initiatives and expanding its platform. But we foresee the company improving profitability next year by tightening up operating expenses while still investing smartly.

If we’re right that Roku strikes this improved balance between growth and profits in 2024, the stock could go up significantly. The market will reward earnings progress, especially in a risky environment. Roku has all the ingredients to put it all together next year and show its full potential. This could be the breakout moment investors have been waiting for.

AI’s Impact on Advertising

In a previous piece, we talked about how artificial intelligence is starting to shake up the advertising industry in a major way. AI enables advertisers to target their messages more precisely to the right audiences. It allows for the automated generation of customized ad creative content, tailored to each user. Further, it is streamlining complex backend processes that used to require extensive manual work.

Early adopters like Baidu (BIDU), Meta (META), and Spotify (SPOT) are already seeing tangible benefits from implementing AI in their ad operations. The technology is helping them cut costs, while also improving the performance of their ad campaigns. It effectively smoothes out some of the inherent frictions and inefficiencies that have always existed in advertising. This leads to a better return on investment for ad spend.

We used Baidu as a shining illustration of how AI can optimize the finer points of connecting the appropriate adverts to the appropriate users. And when Google (GOOG) (GOOGL) revealed layoffs in its advertising section in December, that development served as more confirmation of this tendency. Those workforce reductions stemmed directly from AI boosting operational efficiency, as Google openly acknowledged.

So in addition to enabling better ad targeting and response, AI also confers meaningful labor cost savings as it takes over certain manual tasks from human employees. This illustrates how the deployment of AI is already improving the financial results of significant industrial participants. Furthermore, there is still a ton of headroom in the technology to handle future challenges with much more complicated advertising. This space is being completely transformed by AI.

Roku’s Dominance in Streaming TV Advertising

Roku stands out to us as an intriguing company to keep an eye on in 2024 for a couple of key reasons.

First, they are dominating the streaming TV advertising game right now. According to Comscore, Roku accounts for a whopping 38% of all US household streaming hours – that’s just insane! They are by far the leader in this space.

As user viewing patterns shift, advertisers need precise campaign performance across all screens to optimize spend and manage frequency. Shifting dollars to Streaming TV requires data-driven decision-making. Much of this consumption occurs on Roku; 38% of US household streaming TV hours are spent on Roku. Looking year over year, Comscore reported a 16% increase in households viewing Streaming TV on a Roku device (2022-2023).

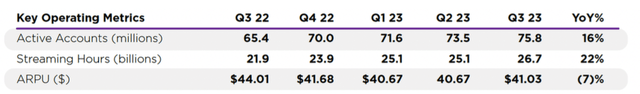

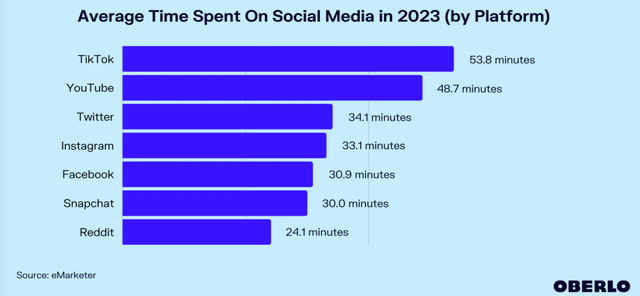

And not only that, but Roku continues to grow at impressive rates. In Q3 2023 alone, they grew active accounts by 16% and streaming hours by 22%. People are clearly spending more and more time streaming shows and movies through Roku. The average Roku user streams nearly 4 hours per day now, which is more time than people spend on many social media apps.

ROKU

Content Partnerships and Ad Product Innovations

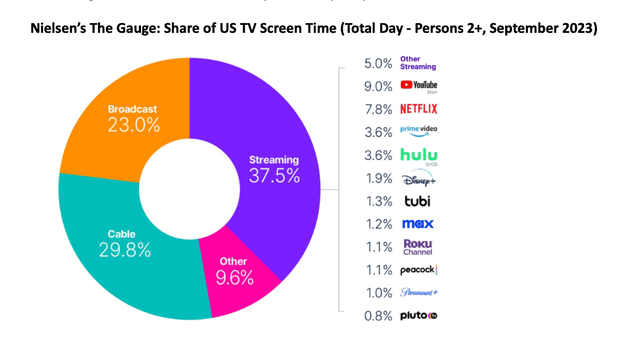

This ongoing shift from traditional TV to streaming plays right into Roku’s strengths. Experts estimate streaming still only makes up about 37% of total US TV viewing time, so there’s a long runway for growth ahead as streaming disrupts traditional cable and broadcast TV.

NFLX

One advantage Roku has is that it leverages content from partners like YouTube, Netflix, and Prime Video, saving substantial costs on producing original programming. Roku also aggregates viewing data across these services to build a rich understanding of audience behaviors from multiple angles.

The other key reason we’re bullish on Roku for 2024 is their advertising products. Roku has invested heavily in making its ad targeting extremely customized and precise, using advanced data like location, viewing habits, and more. As AI and machine learning tech improves, Roku is poised to take advantage and make its already stellar ad targeting even better.

OBERLO

And while Roku’s ad revenue per user is currently less than Facebook’s, for example, we think their massive engagement levels and room for innovation with AI put them in a great position to drive growth in ad ARPU next year.

Risk

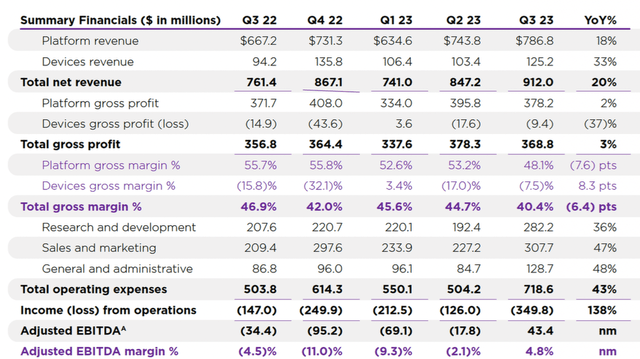

One potential concern some may have about Roku is that they are currently losing money on an operating basis, driven by high growth in operating expenses. Expenses grew around 30-40% last quarter, which is admittedly pretty steep.

ROKU

However, we don’t think this loss is too worrying for a few reasons. First, Roku has already guided for a significant slowdown in expense growth next quarter, forecasting only a negative mid-teens percentage increase versus 70% last year. It shows they are tightening the belt and becoming more efficient even amidst rapid expansion.

Second, even with losses on the operating income line, Roku has been cash flow positive since 2020. So they aren’t burning through cash despite not being profitable yet under GAAP accounting. The free cash flow generation helps reduce concerns about their finances.

SA

And lastly, it’s common for high-growth tech companies like Roku to invest aggressively upfront to capture a leadership position, then focus on profitability later. We think they are still in the early stages of growth in the streaming market and have room to invest to cement their pole position.

Valuation and Investment Potential

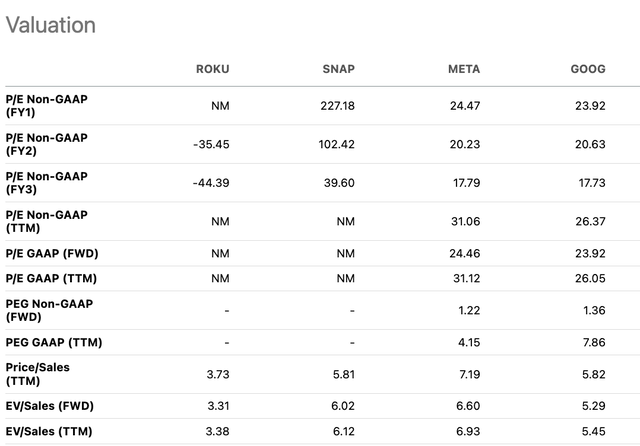

When looking at P/S and EV/S ratios, Roku currently trades at a discount compared to other advertising-focused peers. This discount makes sense given that Roku is unprofitable right now.

SA

However, we are making a bet that Roku can improve profitability in 2024 with the help of AI tailwinds in advertising. If Roku executes smoothly on using AI to optimize operations and boost advertising performance, the company may start closing the valuation gap as profits materialize.

Essentially, we see the potential for multiple expansions if Roku leverages AI to turn the corner on profitability next year. Smoother execution and visible margin improvement could rerate the stock higher as investors gain confidence in Roku’s earnings growth trajectory.

The market is not yet pricing in the benefits of AI adoption. So if Roku succeeds on this front as we expect, its valuation multiples should lift in response, driving upside for the stock.

Conclusion

We view Roku favorably for a few key reasons. First, the company has a dominant position in the US streaming TV market, commanding the top view share. Second, Roku employs an asset-light business model, leveraging content from partners rather than spending heavily on originals. This expands Roku’s ecosystem at minimal incremental cost.

Currently, Roku trades at a discount to advertising peers because of its losses. However, we are confident the US economy can continue growing in 2024, and the advertising industry should benefit from AI adoption tailwinds.

Given Roku’s competitive strengths in streaming TV ad targeting and ability to optimize its model with AI, we believe the company can improve profitability next year. If Roku executes well, its discounted valuation should rerate higher as the market gains confidence.

We like Roku’s market leadership, economical business model, and potential as an AI advertising player. While risks exist around execution, the stock offers an attractive upside if Roku can deliver improving efficiency. We rate Roku a Strong Buy.

Read the full article here