Ross Stores, Inc. (NASDAQ:ROST) has just declared its Q2 earnings report as Seeking Alpha has covered here. The market seems to be liking what the retailer has reported as the stock is up more than 5% as of this writing, although this can change on a dime. Let’s find out how Ross did in Q2 and what its short-to-medium term prospects look like in this edition of The Good, The Bad, and The Ugly.

The Good

- Ross Stores beat on both top and bottom-lines in Q2, by about 4% and 14% respectively. This marks the 5th consecutive quarter that Ross Stores beat on EPS and 4th consecutive quarter that it beat on revenue, as confirmed here by Seeking Alpha.

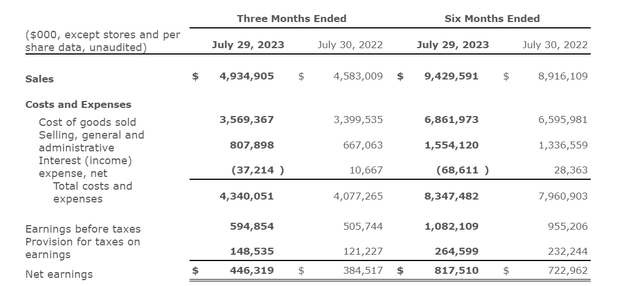

- The fact that EPS beat was much larger than the revenue beat tells us that the company operated with a lot more discipline than expected to improve the bottom-line while sales was more or less on the expected lines. As shown below, Cost of Goods Sold [COGS] went up by just 5% while sales went up nearly 8%. This likely means the company was able to rein in on direct labor costs and also did not face as much of an inflationary pressure on its supplies to completely offset the revenue increase.

- The company guided up on Q3 as well as Q4 with Q3 now projected to be between $1.16 to $1.21 vs. $1.17 consensus, and Q4 EPS projected to be $1.58 to $1.64 vs. $1.56 consensus. That means, for the full-year EPS guidance is up to $5.26 (using the higher guidance range from Q3 and Q4) while the previous EPS forecast for the full-year was $4.96. Based on the new EPS guidance, ROST stock is now trading at a forward multiple of 22.

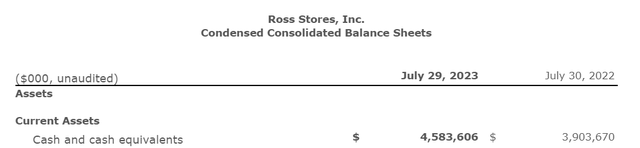

- Ross Stores’ cash and short-term equivalents increased an impressive 18% YoY by increasing nearly $680 million in the one-year time period.

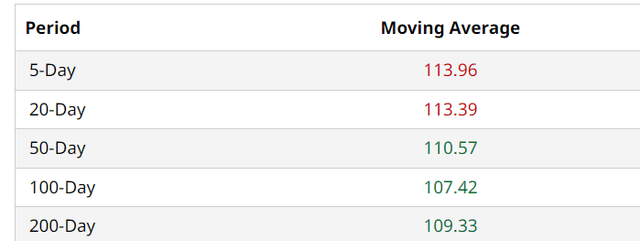

- From a technical perspective, ROST stock had already moved past all the commonly used moving averages. The earnings beat followed by the after-hours price action sets up the stock nicely for a run up from a technical perspective.

ROST 2022 vs 2023 (investors.rossstores.com) Cash and ST (investors.rossstores.com) ROST Moving Avgs (Barchart.com)

The Bad and The Ugly

- Stock-based compensation expenses went up 15% YoY in H1 2023 compared to H1 2022. This is a bit of a reversal from the 8% decline in shares outstanding over the past 5 years and needs to be monitoring carefully.

- While the company raised its guidance for Q3 and Q4, the CEO presented a cautious tone when it came to the consumer and economy. Being a retail company in this environment is not easy as consumers at every level feel some sort of pinch in their budget. Although Ross thrives on “Dress for Less” motto, they sell discretionary products at the end of the day. So, consumer weakness amidst inflation worries remain a legitimate threat in the short to medium term. I believe the company will meet these numbers given their recent streak of beating estimates as well as the fact that they seem to be acutely aware and cautious of the situation.

“CEO outlook: “Despite the recent moderation in inflation, our low-to-moderate income customer continues to face persistently higher costs on necessities. As such, we believe it is prudent to continue to plan the business cautiously. However, given our improved second quarter performance, we are raising our second half sales and earnings outlook.”

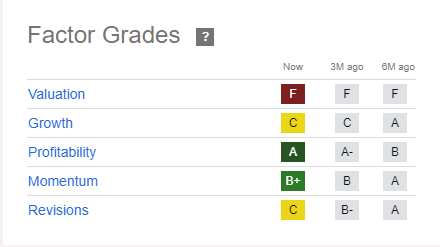

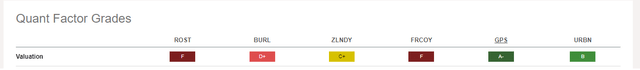

- The stock is trading at a forward multiple of 22 and is expected to grow earnings at about 11%/yr for the next 5 years. While the Price-Earnings/Growth [PEG] of 2 makes the stock reasonably valued, I am very skeptical about paying so much for a retail stock when inflation is raging on and the economy looks set for a soft-landing at the very least. Seeking Alpha’s quant rating has a “F” for ROST stock’s valuation as peers like The Gap, Inc. (GPS) and Urban Outfitters, Inc. (URBN) seem a lot cheaper in comparison.

SA Valuation (Seekingalpha.com) SA Quant (Seekingalpha.com)

Outlook and Conclusion

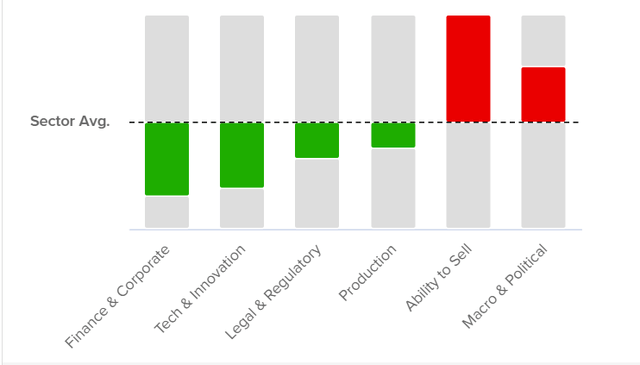

Ross Stores operates in one of the most cut-throat competitive industry, retail apparel. Margin and competitive pressures add to the risks here just by definition of the industry, in addition to the macro environmental factors covered above. No wonder, these two factors, ability to sell and macro/political risks are higher for Ross Stores than the sector (consumer discretionary) in general.

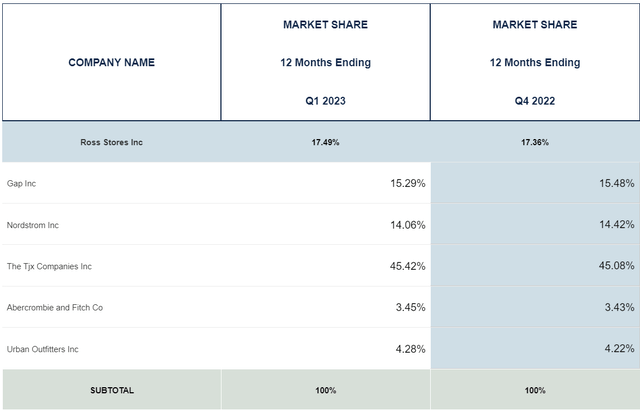

But can the company grow market share? Sure, but I don’t believe it will be easy. As shown below, Ross Stores already enjoys the second highest market share with the others following very closely while the leader, The TJX Companies, Inc. (TJX) holds nearly three times the share, which reflects in the market caps of the two companies. That means, Ross’s position as #2 is at much higher risk than the possibility of it becoming #1. In such circumstances, the buying price (aka, the valuation) of the stock is of paramount importance.

I personally like Ross Stores as a consumer. We recently bought some household items like area rugs and lightings at much cheaper prices and comparable quality. And like the earnings report as well as the guidance. However, the stock appears fully valued here and I don’t like over-paying for any stock and especially a retail stock in the current economic conditions. I’d wait to buy the stock at around $100 as that would give the stock a forward multiple in high-teens and enough margin of safety considering the current median price target of $133, which is based on estimates from 23 analysts.

ROSS Risks (tipranks.com) ROST Market Share (csimarket.com)

Read the full article here