Summary

This spring, bank stocks felt the cold shoulder of the markets and many investors, however with summer here it is time to thaw out from the ice and look for buying opportunities if one has not already.

With that said, in today’s analysis, I am giving Royal Bank of Canada (NYSE:RY) a Buy Rating.

Its positives are being in a bargain price range, having a balanced income diversity across multiple segments, a very competitive dividend yield among its sector, strong capital, and benefiting from a favorable rate environment.

This is offset by it being slightly overvalued in terms of P/B ratios.

Company Brief

With roots going back to 1864, the Toronto-based financial firm also commonly known as (RBC) and traded on the NYSE.. deals in banking, investing, wealth management, capital markets, and insurance, according to its website. It announced in 2022 that it is acquiring HSBC (HSBC) Canada for $13.5B.

Rating Methodology

The methodology I use to rate bank stocks is based on rating the following criteria individually and assigning a score for each:

- Valuation – P/E Ratio and P/B Ratio (20 points)

- Current Price Trend (20 points)

- Income Diversification (20 points)

- Dividends (20 points)

- Capital Ratios (10 points)

- Interest Rate Impact (10 Points)

The total score for the stock will determine the rating as follows:

- 100 points: Strong Buy

- 80 to 90: Buy

- 30 to 70: Hold

- 10 to 20: Sell

- 0: Strong Sell

It Remains Slightly Overvalued

Based on valuation data from Seeking Alpha, this stock’s forward P/E Ratio (GAAP method) stands at 11.73, 24.51% above its sector median.

At the same time, its forward P/B ratio stands at 1.57, 57% higher than the sector median.

How does that compare to two of its listed peers?

For HSBC, its P/E is 6.04 (36% below the sector median) and its trailing twelve month P/B is 0.80 (24% below the sector median).

Toronto-Dominion Bank (TD) has a P/E of 11.12 (18% above the sector median), and a P/B of 1.32, (32% above the sector median).

The valuation references I use are the S&P 500’s median P/E ratio of 14.93 as of May 2023, according to Investopedia, and the Corporate Finance Institute interpretation of P/B Ratio in that a low ratio (less than 1) could indicate that the stock is undervalued (i.e. a bad investment), and a higher ratio (greater than 1) could mean the stock is overvalued.

In this scenario, therefore, I think currently this stock is not competitive enough on valuation particularly the P/B ratio which appears overvalued, so in this category it earns a score of 0.

A Current Trend Showing Bargain Price.

From the current price trend chart below on June 9th, I see that the 50-day SMA (dark blue line) crossed the 200-day SMA (dark red line) in May, forming a death cross and acting as a lagging indicator of a bearish price trend:

Royal Bank of Canada – Price Chart June 9 (StreetSmart Edge trading platform)

I like this stock in the $90 – $94 range, and I think there is still time to snatch it up at that price, before the trend reversal and the next golden cross formation.

So with the current price range, I think there is still opportunity for that, and therefore in this category the stock scores 20 points.

A Balanced Income Diversification

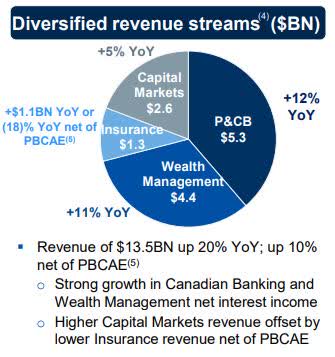

Next, I want to highlight some key income data taken from the company’s most recent quarterly results, released May 25th.

Their income stream is diversified across its key business segments: personal and commercial banking, wealth management, insurance, and capital markets.

From a top line view, I see a balanced distribution across the 4 segments, from their quarterly presentation:

Royal Bank of Canada – Quarterly results – Revenue Diversity (Royal Bank of Canada)

From a bottom line view, here are some notable points from the release:

In personal and commercial banking, “net income of $1,915MM decreased $319MM or 14% from a year ago, primarily attributable to higher provisions for credit losses mainly reflecting provisions taken on performing loans in the current quarter.”

In wealth management, “net income of $742MM decreased $67MM or 8% from a year ago, mainly due to lower average fee-based client assets driven by unfavorable market conditions.”

In insurance, “net income of $139MM decreased $67MM or 33% from a year ago, primarily due to higher capital funding costs.”

In capital markets, “net income of $939MM increased $82MM or 10% from a year ago, primarily driven by a lower effective tax rate reflecting changes in earnings mix, higher revenue in Corporate & Investment Banking and the impact of foreign exchange translation.”

So, although they are posting lower income results YoY across 3 of their 4 business segments, this rating category asks whether their income is well-diversified, and it is, as they have a portfolio that does not include just traditional consumer banking, for example, but is balanced across multiple segments, like many large banks are today.

I think this is important to a serious company so it can spread its risk better, and not rely completely on one segment, but also to be competitive among its peer group of large banks which have mixed business portfolios.

For instance, HSBC-Canada, the bank it is acquiring, also is a firm that goes beyond traditional banking by also having a wealth management, online retail brokerage, and retirement solutions segment too.

In this case, it scores 20 points in this category for being a well-diversified company.

A Highly Competitive Dividend Yield Among Peers

According to Seeking Alpha, this stock has a dividend yield of 4.22%, with an upcoming quarterly payment of $0.99 per share based on an ex date of July 25th.

Further, it has been able to grow its dividend from $0.87 in October 2021 to $0.98 for this coming July, an over 11% dividend growth!

Is that a competitive yield in relation to its peers? Let’s take a look…

Toronto-Dominion Bank’s yield is in a similar range, at 4.65%, while HSBC Holdings does not pay a dividend it seems. Another listed peer, Wells Fargo (WFC), currently offers a dividend yield of 2.83%

In this example, Royal Bank of Canada at over 4% is highly competitive in its yield, in my opinion, so the dividends category scores a rating of 20 points.

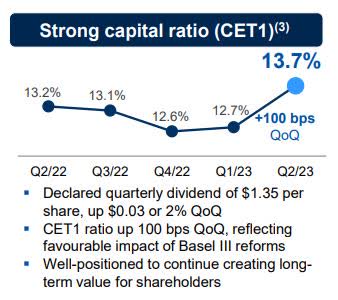

Capital Ratios are Strong

Also from its recent quarterly release in May, we have insight into their capital ratios and liquidity:

- CET1 ratio was 13.7%, up 100 bps from last quarter.

- Average Liquidity Coverage Ratio was 135%, which translates into a surplus of approximately $102 billion, compared to 130% and a surplus of approximately $88 billion last quarter.

Here is their graphic presentation on this:

Royal Bank of Canada – Quarterly results – CET1 (Royal Bank of Canada)

Along with their competitive dividend, this tells me the bank is well capitalized and in a position to return capital back to shareholders, which is important to me as a dividend-oriented analyst and investor.

More importantly, many investors are looking for confidence after the isolated bank failures this spring at a few regionals in the US, and the takeover of Credit Suisse by UBS.

Another Seeking Alpha analyst, The Affluent Tortoise, had this to say in a May 4th article on this stock, which echoes my view that this bank is in a favorable market position:

While the extent of bank insolvencies in this most recent banking crisis is unknown, it is clear that quality names with reasonable risk profiles are better positioned to preserve investors’ capital. Should the banking crisis spread further, the highest caliber franchises will benefit from a flight to quality.

So, in terms of capital strength, I think it scores its 10 points in this category.

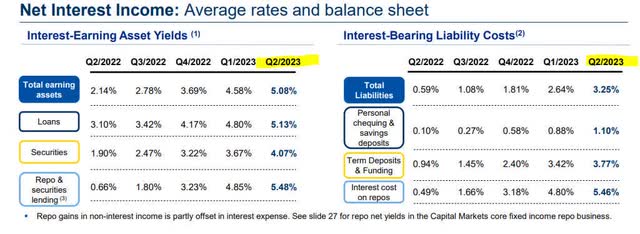

Interest Rate Impact is Favorable

One cannot analyze banks without talking about the impact of interest rates on this sector.

Here is a graphic from their quarterly results, showing the impact of rising interest rates since Q2 2022, on both sides of the balance sheet, and the type of rate spread they are seeing:

Royal Bank of Canada – Quarterly results – NII (Royal Bank of Canada)

I think they can continue to benefit from healthy rate spreads between interest-earning assets and interest-bearing liabilities, as shown above, especially after the Bank of Canada, that nation’s central bank, decided to hike rates again in early June and raise its benchmark rate to 4.75%.

From a forward-looking perspective, although it makes borrowing more expensive for consumers and businesses, it also can benefit banks.

Consider that, according to a June 7th article by Canadian news network CBC:

Within hours of the central bank’s decision, Canada’s big banks all moved to match the bank’s hike, raising their prime lending rates to 6.95 per cent.

There is uncertainty, and perhaps doubt, that the rates will be brought down significantly this year, or perhaps at all, and again I think that could be in this company’s favor as well, in terms of its interest-bearing assets.

This is what the company CEO Dave McKay had to say on this during management remarks on the quarterly results in late May:

Given signs of softening consumer demand for discretionary goods and rising debt service costs, we continue to forecast a mild recession, partly due to the lagging impact of higher interest rates on economic activity. However, with labour markets remaining firm despite declining levels of attrition and job postings combined with higher jobless claims, we do not expect central banks to cut interest rates through 2023.

This stock scores 10 points in this category, as the current rate environment and the forward-looking environment for the rest of 2023 favors it.

Risks to my Outlook

As this is a buy-side rating, the key risk I see is that this stock becomes what is known as a value trap, which can make many experienced investors wary of overly cheap stock prices, and see this rating as overly bullish at this time.

For this reason, the price chart itself and the P/E valuation showing it to be undervalued vs the S&P500 median are not the only metrics in my evaluation, but part of a holistic approach.

I like to refer to what Finance Monthly magazine had to say about value traps:

Investors should avoid making investment decisions based on short-term market fluctuations or speculative rumors, and instead concentrate on the long-term fundamentals of the firms in which they are interested.

In that regard, I have shown that the long term fundamentals of this company are attractive, and more so after they are acquiring HSBC-Canada, which I believe will add to its growth and market position.

Conclusion

In conclusion, I reiterate my Buy Rating on this stock.

Its positives are a favorable interest rate environment, strong capital, a competitive dividend, a price bargain, and a diversified revenue portfolio.

Its negatives are being slightly overvalued, in terms of valuation metrics, which is why it is not rating a Strong Buy at this time but only a Buy.

As Canada’s largest bank with C$1.05T in AUM and one of the Financial Stability Board’s listed global systematically critical banks, I will continue to track this stock due to the sheer scale and impact this company has in the global markets, and look forward to seeing some improvements on the net income side in the next quarterly results.

Read the full article here