Introduction

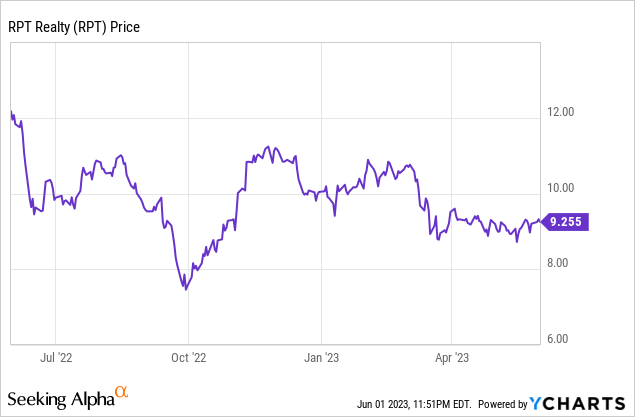

I initially started looking at the preferred shares of RPT Realty (NYSE:RPT) in the summer of 2021 when they were trading above par. As these preferred shares (trading with (NYSE:RPT.PD) as their ticker symbol) cannot be called, the yield was pretty good back in the day at around 6.4% (as the preferred shares didn’t have a call feature, you simply could not calculate a ‘yield to call’). As interest rates on the financial markets started to increase, the price of the preferred shares started to move down to reflect the impact of a higher interest rate environment. In September last year, the preferred shares were trading just below the principal value of $50 resulting in a yield of 7.5%. Right now, at the current share price of $46.75, the yield has increased to 7.75%. As three quarters have now passed since my previous write-up, I thought this was a good moment to catch up to see if I should add to my relatively small position.

The Q1 results indicate the preferred dividends enjoy excellent coverage

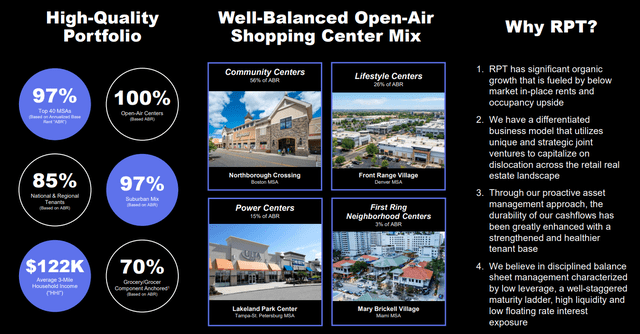

This article is meant as an update to my thesis. For a better understanding of the REIT’s focus and business model, I’d like to refer you to the two older articles, which you can find here. Additionally, fellow author Weighing Machine recently published a good overview of RPT’s performance, so if you are interested in looking at the common units, you should definitely read his article.

As you may know from previous articles, when I look at a preferred share issue, I judge them based on two criteria: the dividend coverage level and the asset coverage level.

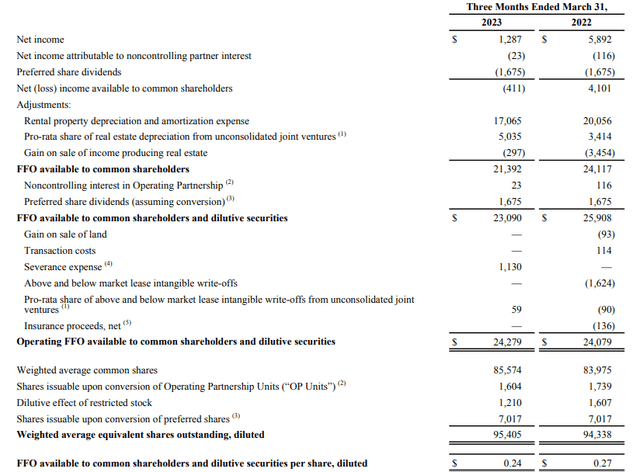

The FFO and AFFO results in the REIT space are the most important ‘earnings metrics’. The reported net income is irrelevant because it includes the depreciation of the real estate assets. The image below shows the FFO calculation and the Operating FFO calculation, which comes in at $23.1M and $24.3M respectively. According to the REIT, the total FFO available to common shareholders, including the impact of dilutive securities, is $0.24 per share.

RPT Realty Investor Relations

This includes the impact of the possible conversion of the preferred shares into common units, which would add about 7.02M units to the total. I’d like to argue that there are two elements that warrant a closer look. First of all, an investor in the preferred shares usually invests for the safer dividend payments as preferred distributions obviously rank senior to the distributions on the common units. Therefore, while theoretically possible, it is very unlikely all preferred shares would be converted to common units.

Secondly, should that happen, there technically also won’t be a preferred dividend payable anymore. So rather than using the $0.24 which is based on the $23.1M FFO and the 95.4M units outstanding, one should actually add the preferred dividends to the equation again. After all, I the dilutive effect of an additional 7.02M shares takes place, there are no more preferred dividends to be paid out as there will be no preferred shares outstanding. That would increase the FFO available to common shareholders to $0.26 and the operating FFO available to common shareholders to $0.27.

However, that is not what this article is about. By comparing the preferred dividends of $1.675M to the $24.3M in underlying (operating) FFO, the FFO before making these preferred dividend payments is approximately $25.9M. Which means RPT only needs about 6.5% of its underlying FFO to cover the preferred dividends. In other words, the preferred dividend coverage ratio exceeds 1,500% and that’s a good position to be in, as a preferred shareholder. RPT Realty clearly passes the preferred dividend coverage ratio test.

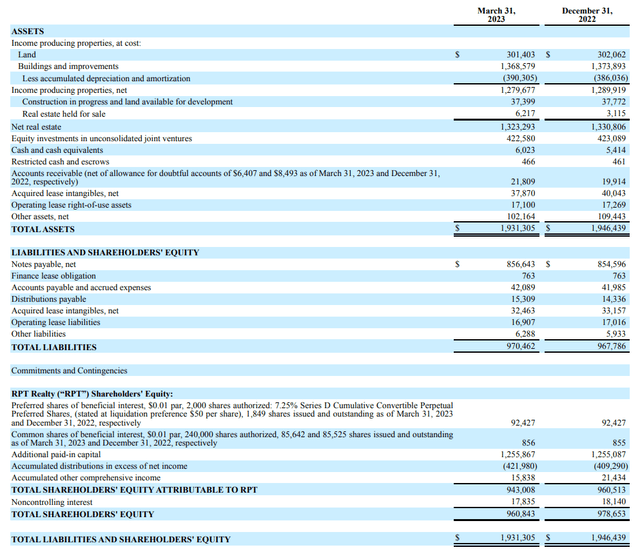

Moving over to the asset coverage level ratio, we see the balance sheet of RPT Realty contains about $943M in equity, with about $92.5M of the total equity consisting of preferred equity. This means there’s about $850M in equity ranking junior to the preferred equity. Or in other words, the total amount of equity attributable to the RPT shareholders represents about 10 times the total preferred equity. That again is an excellent multiple.

RPT Realty Investor Relations

On the image above, you also see the total book value of the real estate assets of about $1.28B already includes almost $400M in depreciation expenses. Despite the increasing interest rates on the financial markets, the market value of the real estate assets is likely higher than the book value which means there’s an additional (hidden) layer of value providing an additional cushion to the preferred shares.

RPT Realty Investor Relations

As a reminder: The preferred shares have a 7.25% preferred dividend yield, resulting in a quarterly preferred dividend of $0.90625 (for a total preferred dividend of $3.625/year). An interesting feature is that there’s no call provision included in these preferred shares: RPT Realty cannot call these securities, but owners of preferred shares are able and allowed to convert them into common units at a conversion price of $13.17 per share as each preferred share entitles the owner to convert it into 3.7962 common units.

Investment thesis

I was hoping the preferred shares of RPT Realty would drop below $45 but it doesn’t look like that will happen anytime soon as the market seems to realize the preferred dividend coverage ratio and the asset coverage ratios are strong. The preferred shares are currently yielding approximately 7.75% and I think the risk/reward ratio of the preferred shares is excellent. That being said, I’m also warming up towards going long on the common units as RPT’s common units are currently trading at just 9 times the anticipated FFO. And as Weighing Machine mentioned in his article, this implies the capitalization rate of the assets is just 9.2%, and that’s too low for a REIT focusing on grocery stores as anchor tenants.

Read the full article here