Buying above-average stocks at below-average prices is a good recipe for long-term success in the stock market. With the S&P 500 (SPY) hitting its all-time highs in recent days, that may seem hard to accomplish.

However, it’s important to keep in mind that the Santa Claus rally that has continued leading up to New Year’s is rather lopsided, with mega-cap growth names like Meta Platforms (META) being responsible for a lion’s share of SPY’s market-cap weighted gains.

Thankfully, value investors can still rejoice with a large number of stocks that remain in value territory that are ripe for the picking. This brings me to RTX Corporation (NYSE:RTX), which I last covered here back in August, highlighting the value opportunity despite the recent powder metal issue. RTX has since seen its price dip as low as $69 in October before recovering back to just 0.45% below where it was since I last visited it.

As shown below, RTX remains materially down by 15% since the start of 2023. In this article, I provide an update and discuss why RTX is a top-shelf value stock for potentially strong returns from here, so let’s get started!

RTX Stock (Seeking Alpha)

Why RTX?

RTX Corporation is a leading aerospace and defense contractor that serves governments and commercial customers around the world. It employs 180K people across its business segments: Collins Aerospace, Pratt & Whitney, and Raytheon. Over the trailing 12 months, it generated $67.1 billion in total revenue.

As one can imagine, the aerospace/defense industry is a hard nut to crack, with the incumbents having significant advantages of scale. The high capital requirements and accumulated industry know-how result in pricing power and barriers to entry. RTX in particular has done well on these fronts, leading to high shareholder returns over its history. As shown below, RTX has produced a 3,124% total return over the past 30 years, outpacing that of the S&P 500, and industry peers Boeing (BA) and Lockheed Martin (LMT), while being bested by Northrop Grumman’s (NOC) 6,127% total return.

Those who follow RTX know that it’s seen some challenges over the past year, not least of which is the impact from the Pratt powder metal matter, which requires that hundreds of aircraft engines will need to be removed for inspections through 2027. This flaw can result in cracks in the engine and resulted in RTX taking a $2.89 billion charge to resolve the matter.

While product flaws are not welcomed news for any investor, the good news is that much of the damage has already been quantified with no additional financial impact expected, as reflected by recent comments by management during the last investor conference call:

Just a few thoughts on the powdered metal issue. Through the early stages of removals and inspections of the PW1100 engine, which powers the A320 Neo aircraft, our outlook both financially and operationally remains consistent with our expectations. We’ve also made significant progress on the safety assessments for the other Pratt & Whitney powered fleets. That includes the PW1500, which powers the A220, the PW1900 which powers the Embraer E2, and the V2500, which powers the legacy A320.

With the analyses substantially complete, we do not expect any significant incremental financial impact as a result of those fleet management plans. The focus of both Pratt & Whitney and the entire RTX organization is on maintaining the trust of our customers, and our partners, and we are relentlessly working to improve upon the plans we have in place today.

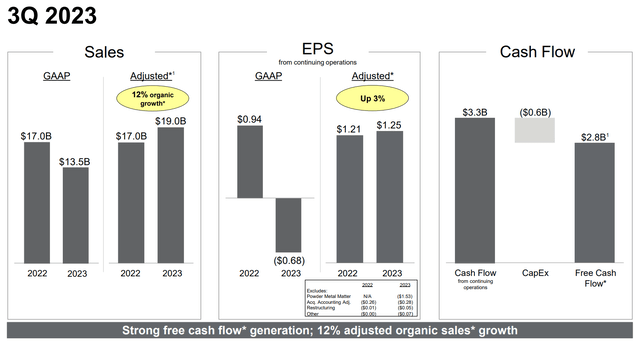

Despite the near-term noise related to its recall, RTX continues to see strong business growth, with adjusted sales growing organically by 12% YoY to $19.0 billion during the third quarter. This was led by mid-teens sales growth in the Collins Aerospace segment due to high demand across commercial aerospace end markets and due to a lesser extent, 3% sales growth in the Raytheon segment. As shown below, RTX has also seen adjusted EPS growth of 3% YoY and generated substantial free cash flow of $2.8 billion during Q3.

Investor Presentation

Looking ahead, RTX has plenty of greenfield opportunities that are supported by its substantial backlog of $190 billion. This backlog has grown in the current fourth quarter, as RTX has won a number of contracts with the U.S. DoD, including a $156 million award from the U.S. Navy to produce 53 Air-To-Ground missiles, and a $408 million contract from the U.S. Air Force to experiment with Hypersonic missiles. The robust backlog and recent wins should add to RTX’s revenue stream in the near to medium term, as it carries an efficient YTD book-to-bill ratio of 1.26x (1.17x in the Raytheon segment).

Risks to RTX include the hard-to-predict nature of defense spending bills every year, as cuts to defense by the U.S. Congress can negatively affect defense contractors. However, with most of RTX’s future revenues locked in through long-term contracts, this doesn’t appear to be a significant factor in the near term.

Plus, defense spending has traditionally garnered bipartisan support in Congress, but nonetheless, is something worth considering for investors. Other risks stem from unexpected product defects and unforeseen issues related to the latest powder metal issue, as that can result in incremental financial obligations.

Notably, with plenty of risks stemming from the powder metal issue seemingly baked into the discounted share price, RTX plans to return plenty of cash to shareholders via buybacks. This is reflected by its $10 billion accelerated share repurchase program.

This could be immediately supported by RTX’s substantial $5.5 billion in cash on the balance sheet and the $3 billion in expected proceeds in 2024 from the combined sales of Raytheon’s cyber services business and Collins actuation business. Based on the current equity market cap of $120.8 billion, a full execution of this $10 billion share buyback could reduce the outstanding float by 8.3%.

Meanwhile, RTX carries a BBB+ investment grade rating from S&P and has a net debt to EBITDA ratio of 3.46x, which remains reasonable for a capital-intensive business. I would expect for the leverage ratio to trend closer to 3.0x as recent EBITDA has been negatively impacted by the powder metal defect.

Importantly for dividend investors, RTX is a dividend aristocrat with 30 years of consecutive raises under its belt. It currently yields 2.8% and the dividend is well-protected by a 45% payout ratio. RTX has also grown its dividend annually in the 7.3% to 7.8% range since 2021.

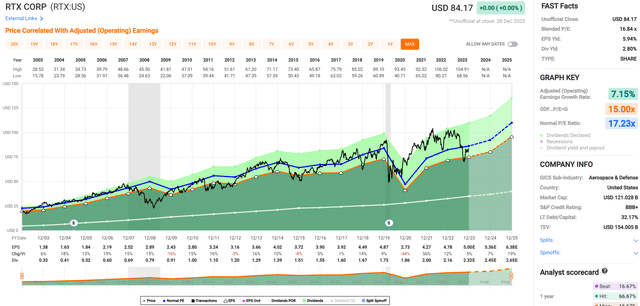

Turning to valuation, I continue to find RTX to be attractive at the current price of $84.17 with a forward PE of 16.8, sitting below its normal PE of 17.2. While analysts expect just 7.6% EPS growth next year, annual earnings growth is expected to accelerate to the 12% to 17% range in the 2025-2026 timeframe.

FAST Graphs

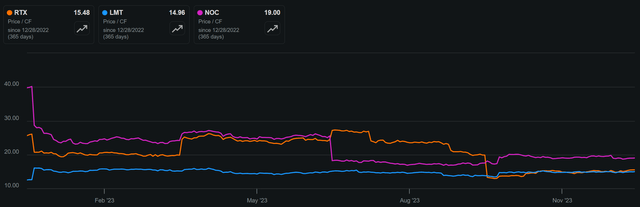

RTX also appears to be reasonably valued compared to peers with a price-to-cash flow of 15.5x, sitting just slightly above the 15.0x of LMT, despite having a more diversified revenue stream and sitting well below the 19x of NOC.

RTX vs. Peers Price-To-Cash Flow (Seeking Alpha)

Investor Takeaway

Overall, RTX appears to be well-positioned for future growth, despite the challenges presented by the powdered metal issue. With a strong backlog, solid financials, and a focus on returning value to shareholders through buybacks and dividends, RTX is a solid option for investors looking for exposure to the aerospace and defense industry. Given that the stock price has had plenty of time to settle from both company-specific and macroeconomic news on interest rates, I believe RTX stock may be range-bound in the near term, and therefore, downgrade from a ‘Strong Buy’ to a ‘Buy’ rating.

Read the full article here