We previously covered RTX Corporation (NYSE:RTX) in September 2023, discussing its mixed prospects, thanks to the additional $3B pre-tax impact from the Pratt & Whitney powder metal issue prior to the FQ3’23 earnings call.

With the stock plunging then, we had recommended an entry point of $70s for an improved margin of safety and expanded forward dividend yield, with it still being a viable dividend play as the Seeking Alpha Quant rated the stock’s dividend safety at B+.

In this article, we shall discuss why the RTX stock’s discounted valuations remain a gift for value-oriented investors, due to its growing backlog over the next 15 years, thanks to the robust commercial and defense spending trends over the next few quarters.

This allows the management to sustain its (prospective) dual-pronged returns through capital appreciation and dividend income, triggering our Buy rating here.

The Defensive RTX Investment Thesis Remains Robust Here

For now, RTX has reported a double beat FQ3’23 earnings call, with adj revenues of $18.95B (+3.4% QoQ/+11.7% YoY) and adj EPS of $1.25 (-3.1% QoQ/+3.3% YoY) in October 2023, with the former adjusted upward for a $5.4B charge related to the previously disclosed Pratt powder metal defect.

No matter the noise surrounding the defect, the management continues to report a growing backlog of $190B (+2.7% QoQ/+13% YoY), with $115B comprising commercial aerospace contracts (+2.6% QoQ/+13.8% YoY) and $75B comprising defense contracts (+2.7% QoQ/+11.9% YoY).

These numbers imply that RTX’s top line is pretty much set for the next decade since up to 45% of its backlog spans over the next 15 years.

As a result, we believe that the powder metal defect is likely temporal despite the noise surrounding the additional regulatory inspections, with most of the accelerated maintenance inspection headwinds likely baked in already.

If anything, readers may also want to note the multiple military conflicts occurring globally, which will likely drive demand for RTX’s defense offerings, building upon its long-term backlog.

Part of the boost is attributed to the US government restock of supplies shipped to Ukraine and the precautionary armament in Europe, with things likely to further lift with the ongoing Israel-Gaza conflict.

This is why RTX’s military sales have been growing YTD to $27.01B (+3.5% YoY), with a near-term tailwind ahead, attributed to the recent announcement of a $250M military package to Ukraine on December 27, 2023.

While it remains to be seen if the $106B worth of funding may be eventually approved, we believe that defense spending will be elevated until a permanent cease-fire is achieved.

Furthermore, readers must note that RTX operates in the commercial sector, with YTD adj revenues of $27.38B (+19.6% YoY), with the impressive growth attributed to the normalizing commercial travel trend post-pandemic.

Market analysts from AITA already expect the commercial airline industry to outperform in 2024, based on the projected revenues of $964B (+7.6% YoY) and net profits of $25.7B (+10.3% YoY), with up to 4.7B passengers expected, well exceeding 2019 levels of 4.5B.

As a result of these promising developments, it is unsurprising that RTX already reported excellent growth in its YTD overall adj sales to $19.19B (+14% YoY), with a moderately expanding operating margin of 10.7% (+1 point YoY).

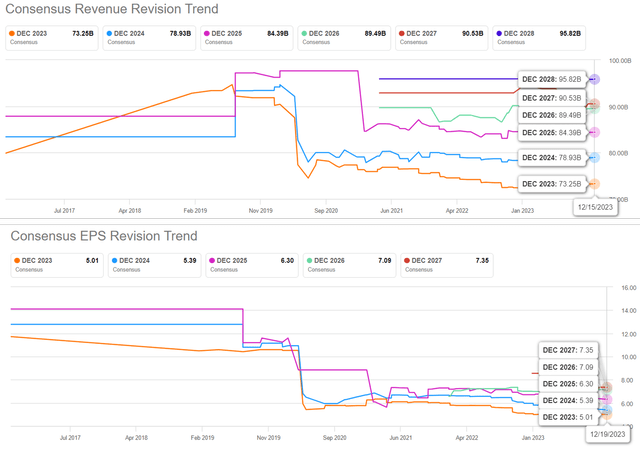

The Consensus Forward Estimates

Seeking Alpha

The same optimism has been estimated by the consensus, with RTX expected to generate a top and bottom line CAGR of +8% and +9.6% through FY2025.

This is somewhat similar to the previous estimates of +8%/+11.97% while building upon the sustained growth at a historical CAGR of +2.8%/+16.9% between FY2020 and FY2022, respectively.

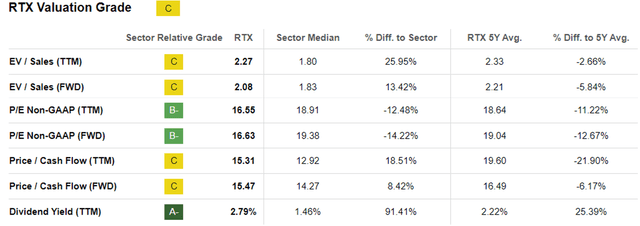

RTX Valuations

Seeking Alpha

RTX’s prospects have been notably discounted indeed, despite the somewhat consistent forward consensus estimates as discussed above, attributed to the impacted FWD P/E valuation of 16.63x and FWD Price/Cash Flow valuation of 15.47x.

This is compared to its 1Y mean of 17.70x/20x, 3Y pre-pandemic mean of 17.73x/20x, and the sector median of 19.38x/14.27x, respectively.

So, Is RTX Stock A Buy, Sell, Or Hold?

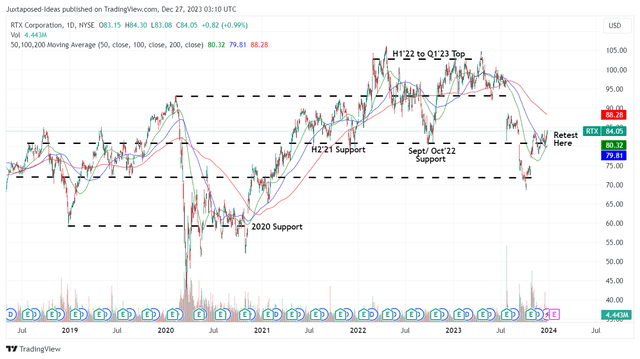

RTX 5Y Stock Price

TradingView

As a result of the impacted valuations and pessimistic market sentiments surrounding the powder metal defect, we can understand why the RTX stock has yet to climb out of its current rut, with its upward momentum from the October 2023 bottom stalling at the $80s.

There is, of course, a risk that the defect may spread to other models, triggering further headwinds to its profitability while potentially impacting consumer confidence.

For now, we prefer to look at the stock’s development as a good one instead, with RTX likely to be well-supported at current levels, offering interested investors with an improved upside potential of +27.4% to our long-term price target of $107.10.

This is based on the consensus FY2025 adj EPS estimates of $6.30 and the eventual re-rating of its FWD P/E valuations to its normalized levels of 17x once the defect has been fully resolved.

RTX’s dividend investment thesis remains robust as well, thanks to its excellent operating cash flow from continuing operations of $7.8B (+38% sequentially) and free cash flow generation of $5.33B over the LTM (+62.9% sequentially), against the $3.26B of dividend obligations (+5.8% sequentially).

Combined with the expanded forward dividend yields of 2.84%, compared to its 4Y average of 2.48% and sector median of 1.46%, we believe that RTX offers a relatively decent investment thesis across capital appreciation and income for value-oriented investors.

Readers must also note that the stock market is forward-looking, with the growing long-term backlog further ensuring the safety of its top and bottom line performance over the next few years, as with its dividend payouts.

Therefore, we continue rating the RTX stock as a buy.

Read the full article here