Introduction

What makes Runway Growth Finance Corp. (NASDAQ:RWAY) appealing right now seems to come from the large dividend yield it has, over 11% nearing 12%. With such a high dividend yield the company seems to have gotten a lower multiple. Estimates suggest that the dividend yield may be decreasing in the coming years as other capital priorities will need to be adopted for the company to continue growing. The TTM payout ratio is over 70% at least and that to me doesn’t seem that sustainable if we don’t want to harm potential expansions.

I don’t, however, think that the dividend will be decreased that quickly and likely stay this high for a few more years. Investors wanting to be in a high-income dividend company still and don’t mind the slight YoY decrease then RWAY might be decent. The investment portfolio for the company has grown immensely and I find it appealing enough to hold an investment in RWAY still.

Company Structure

RWAY has not a very long and rich history, it was founded only back in 2015 and has grown the investment portfolio to over $1 billion as we saw in the Q1 report. This represented a significant improvement from a year prior. What has made RWAY able to do this though comes from the fact that they have established a very solid customer base. Offering senior secured loans to late-stage and growth companies.

The focus markets that RWAY engages in are the tech sector but also life science and health care. These are quite risky sectors when looking at the growth companies that are present in them, especially the tech sector. Here companies are far from profitability often and that places a risk on RWAY as missing paying back debt is a real risk factor.

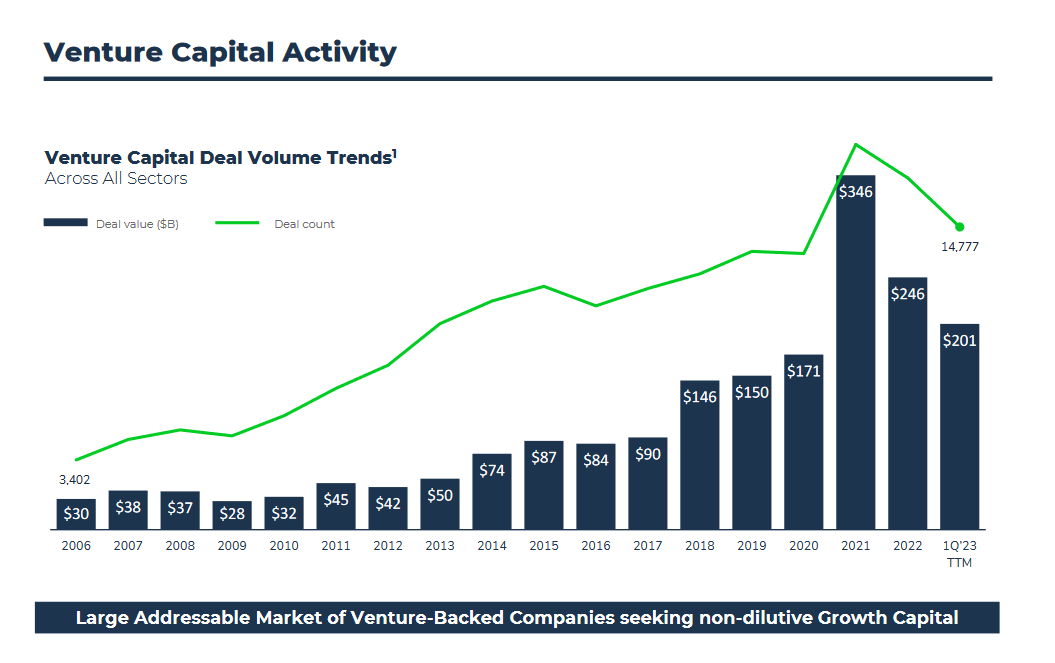

Capital Activity (Earnings Presentation)

The results from RWAY are likely to be quite volatile as they will directly reflect the broader sentiment in the market. In times like now when interest rates are higher, the returns that RWAY is generating are larger than previously, but the revenues and volumes might be decreasing. Seeing the chart above in 2021 clearly shows that many companies tried to enter into loans when the interest rates were so low.

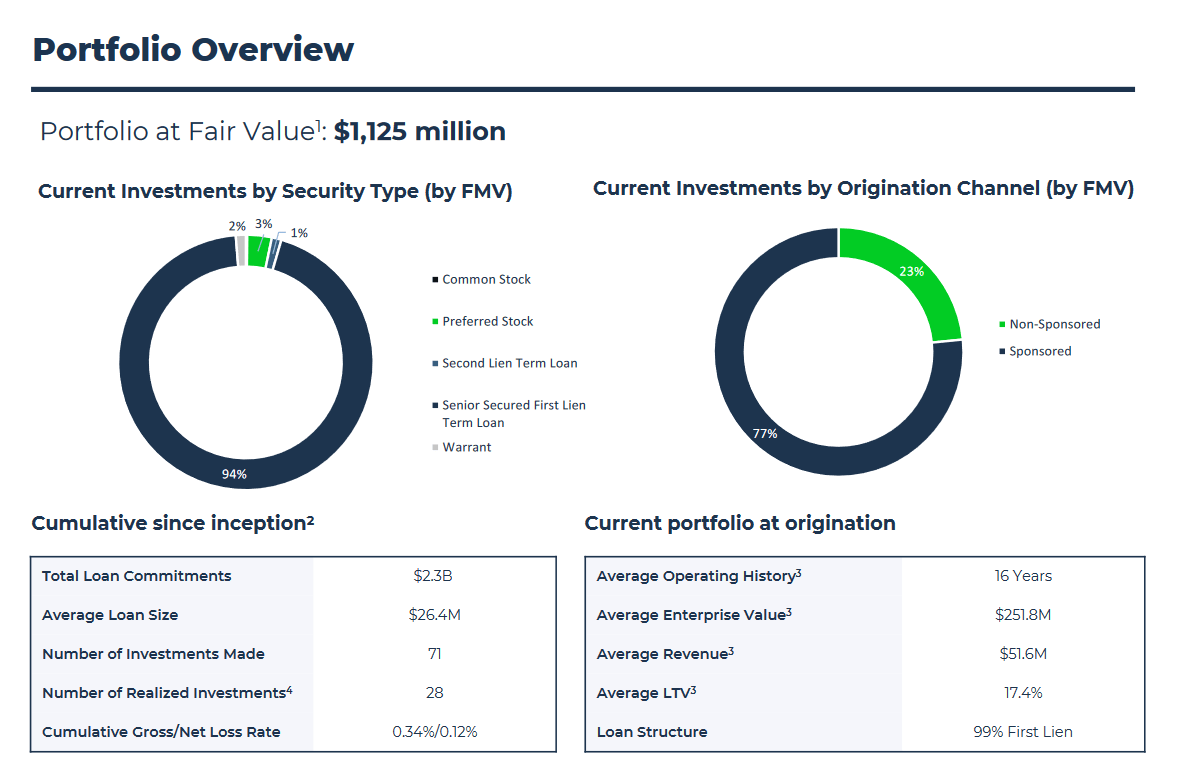

Portfolio Overview (Earnings Presentation)

This momentum has made RWAY able to significantly increase its investment portfolio and it’s now valued at $1.125 billion. That is a near 80% increase YoY. 99% of the term loans that RWAY is holding are in senior secured loans. Investments into companies only make up $49 million but is a factor that could help yield significant returns in the coming years depending on how well the sector does.

Earnings Transcript

Results from the first quarter to 2023 were a success in my opinion. Estimates were high for the company and I think they delivered. Revenues came in at $39 million, a 101% YoY increase and that momentum I think will be carried through into Q2 of 2023. On August 8 we get the results from that quarter.

But I want to highlight comments from the last earnings call that give an idea of how the company viewed its performance. CEO David Spreng said the following.

“We want to take a moment to address the volatility we’ve seen in the banking sector since our last call, which began with the closure of Silicon Valley Bank. As stated previously, Runway had no deposits or loans with SVB, nor did we participate in any credit facilities agented by or that included SVB as a lender. SVB’s lending portfolio was particularly concentrated in early-stage companies. Given our focus on the latest-stage companies in the venture ecosystem, the recent banking disruptions did not financially impair Runway’s portfolio”.

This comment shows very well that RWAY has positioned itself very well and where early on in recognizing the dangers of investing in smaller up-and-coming companies. This speaks volumes about the management team that already before the founding of RWAY had a lot of experience.

“Turning to the market outlook. According to recent Pitchbook data, US late-stage venture equity deal value slowed to $11.6 billion in Q1. While this data provides a snapshot for BC equity market trends, Runway is not dependent on venture equity dynamics. We believe that our focus on late-stage companies including non-sponsored borrowers with defined paths to profitability insulates us further from downstream financing risk.”

Here the CEO mentions that the outlook still looks very good and that despite short-term headwinds for the sector they remain resilient to guarantee as much earnings as possible to shareholders. This sentiment is proven by the high payout ratio the company has currently. Looking for more news on the dividend in coming quarters will be important. In Q1 they announced a $0.4 dividend being distributed.

Valuation & Comparison

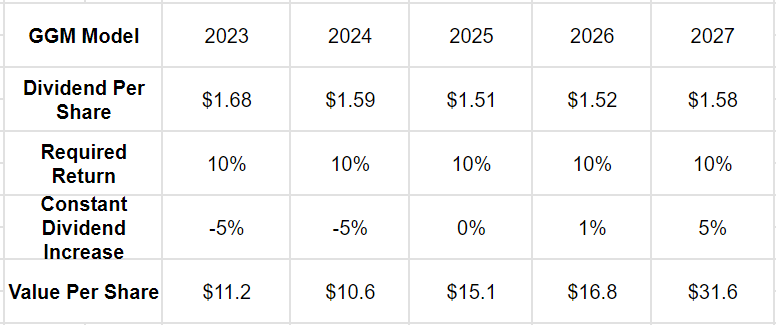

GGM Model (My Model)

Long-term RWAY looks like a very good dividend investment for a high-income portfolio. The share price is far below where you would be wanting to buy if you want a solid 10% return at least. In the near term though it seems to be a little pricey still. But this comes down to the fact that I am predicting they will slightly lower the dividend in the coming few years. Which isn’t enough to suppress a buy case though. The company just has a very high yield right now and prioritizing capital to build out the investment portfolio more is also beneficial to shareholders. I think of RWAY as a dividend addition that lends exposure to high-growth industries through the safety net of solid investment strategy and low-risk capital allocations.

Investor Takeaway

Runway hasn’t been in operation for that long, only since 2015. But during this period they have done a fantastic job in growing the business and the investment portfolio is valued at over $1 billion right now. The priority in the business seems to be to return as much earnings as possible to shareholders. The payout ratio is over 70% but looks sustainable. Making RWAY into a decently sized position in a high dividend-oriented portfolio seems like a solid move. Rating them a buy now.

Read the full article here