Today I want to look at an interesting REIT, Safehold (NYSE:SAFE), which focuses only on investment grade ground leases. The company recently went through a merger with iSTAR so their most recent results are all over the place, however, the company does have a unique advantage thanks to what they do. Because the tenant does not own the land but only the building on top of it they are sort of bound to pay the rent unless they sell the building. Moreover, they have extremely long lease terms so as an investor you are not going to be affected by tenants withdrawing from the contract since SAFE has leases for 99 years resulting in a remaining average lease term of 93 years. Another great thing is that after the 99 years, SAFE will own anything that stands on the land.

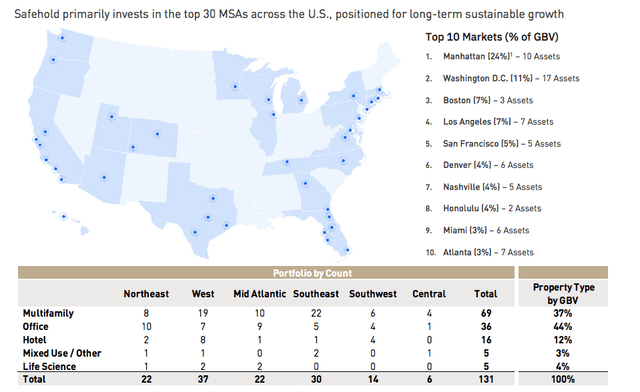

Right now, SAFE owns 131 properties with the largest part in Manhattan (24%), Washington D.C. (11%), Boston and LA (both 6%). The tenants’ buildings are mostly office spaces which account for 44% of the portfolio, than multifamily with 37%, and hotel with 12%. This is not that important though because SAFE is unlikely to be affected by it. Even if the tenant is unable to pay the rent, which is unlikely since it is quite small in relation to the value of the building, SAFE will then own the building so they are sort of insured in case of tenant defaults.

SAFE

Financials

As I mentioned before, their Q1 results are a bit unstable but I would still like to go over them. YoY, the revenue increased by 30%, however, the net income decreased by 81%, earnings per share by 82%, and their expenses basically doubled. These results are heavily affected by the merger because if it were not accounted for it the net income would have increased by 6% and earnings per share would have decreased by only 2%. Which is obviously a huge difference. But again since SAFE is a unique REIT the results are likely to stabilize and return to normal which I will go into in the valuation.

On the flip side, their balance sheet is healthy and BBB+ rated. SAFE has $4.2 billion of outstanding debt. They have $900 million available on a credit line and in cash combined and no maturities until the end of 2025. This is great, because it means essentially no interest rate risk with regards to their interest expense. In 2026, they have to repay $970k which is debt from their revolver, but since that’s quite far in the future, they will have plenty of time to refinance. Moreover, they have a weighted average debt maturity of 23 years which is a bit plus. The downside of this is high interest rate sensitivity which is the primary reason the stock has sold off so much as interest rates went up.

The quarterly dividend is $0.177 per share which translates into a 2.8% yield. That’s definitely on the lower side for any REIT, but as you’ll see SAFE is not really a dividend play, but rather a turnaround play on price upside.

Valuation

Now for the valuation, the company trades at a P/FFO of 18.73x. Frankly, we cannot compare this with any direct peers since SAFE is a unique company and does not have any in my opinion.

To get an idea if the multiple is roughly fair, I looked at Agree Realty Corporation (ADC) which generates about 12% of their revenue from ground leases and the rest from net lease properties. We can argue that the net lease part of their portfolio is worth about 15x FFO since that the multiple that Realty Income (O) trades at. Since ADC trades at 17x, the difference must be primarily because of their exposure to ground leases. Since these account for 12% I get an implied fair multiple for round leases of 30x. That suggest that SAFE is about 40% undervalued right now.

The analysts on FastGraphs expect the P/FFO to grow by 40% next year. On Seeking Alpha the estimated FFO for next year is 30% higher. Beyond that, the growth is expected to slow down to 10%.

Not too long ago, the price of the stock was at an all-time high at around $70 but has dropped significantly mostly because of rising interest rates. I would not expect it to return any time soon but a 30% increase in the FFO seems reasonable, and still conservative, as a follow-up to the recent merger. Beyond that, and when the rates decrease, the price can return to higher levels. In the next three years, it could reach $40 which is about 60% upside.

To conclude, the REIT has a unique business plan that has a bright future. Even though the merger has affected the recent results they should balance out over time and the stock could likely offer a stable growth. Therefore, I rate SAFE as a BUY and set a target price of $40.

FastGraphs

Risks

A risk is if the merger with iSTAR does not work out well. If the results do not stabilize, SAFE will inevitably struggle and so will the stock. The risk here in particular is that the expected synergies will not be realized. I do not think this is really probable though since SAFE’s business plan seems strong and the management team is quite experienced, but still any time there’s a merger, it’s important to keep an eye on what management prioritizes.

If interest rates continue to increase, they will likely drag the price lower. This is mainly because SAFE’s very long term leases generate rent at very low cap rates (about 3%) which makes the stock price very sensitive to interest rate increases. Of course, volatility works both ways which means that a reversal in rates could act as a strong catalyst for a price increase.

Read the full article here