Introduction

Let’s start this article a bit differently.

Below, you’re looking at six charts from the Harvard Mathematics Department. All of them are different varieties of exponential functions.

Harvard Mathematics Department

In finance, it’s all about exponential growth. After all, that’s how we all want to accumulate wealth: exponentially.

5% compounding interest on a $1,000 investment results in a total return of $1,628 after ten years. It turns into $2,653 after twenty years.

It turns into $11,467 after fifty years.

Compounding at a 10% rate turns $1,000 into $117,390 after fifty years!

Being on the receiving end of this phenomenon is great! Being on the paying side, not so much.

I’m bringing this up because I just saw one of the scariest exponential charts in a while.

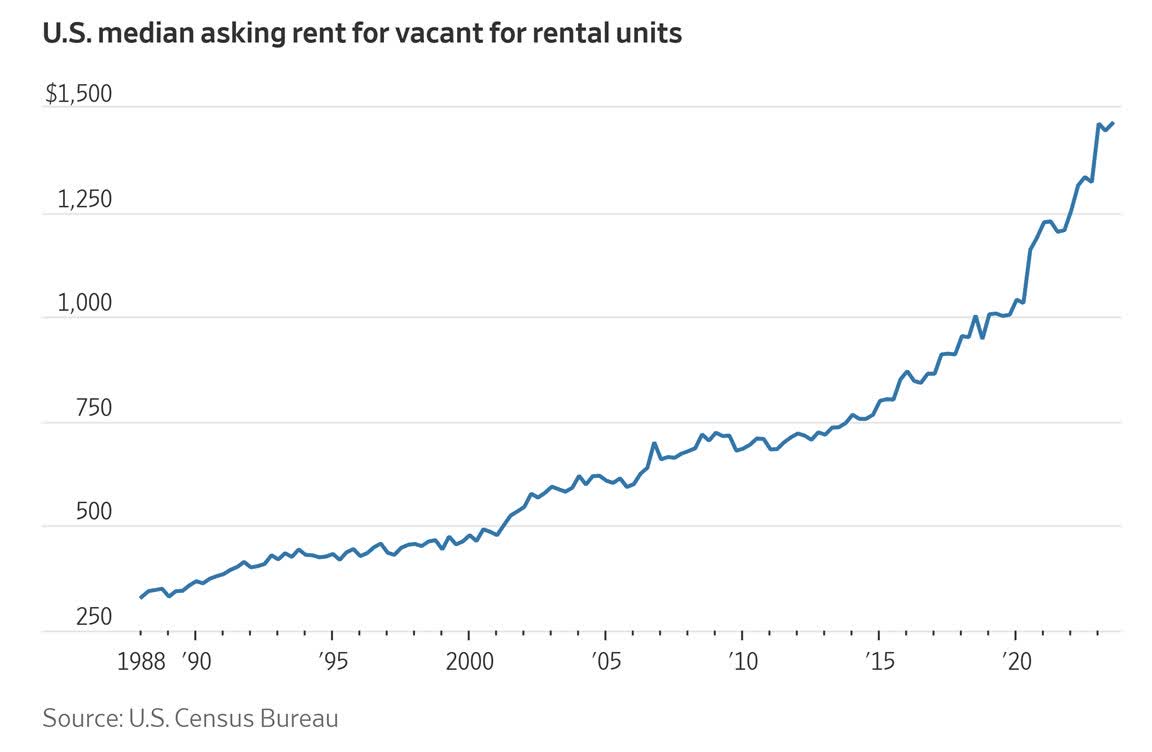

Below, you’re looking at the median asking rent for vacant rental units in the United States.

Wall Street Journal

In 2014, the median asking rent was $750. Now, it’s $1,500. That’s a 100% increase in less than ten years…

This is one of the reasons why so many consumers are struggling to pay even for basic needs. As someone who spends a lot of time on Twitter/X, I can tell you that I have seen countless videos and messages from people who are struggling to find an affordable place to live.

But wait, it gets worse, as buying isn’t a good alternative, either.

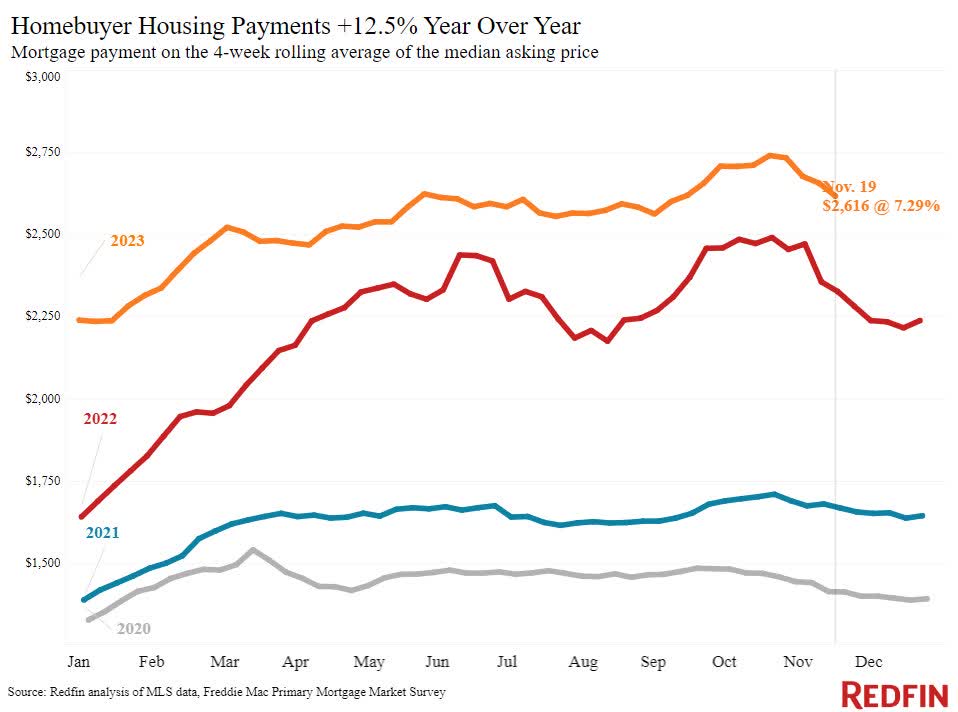

According to Redfin, it costs roughly $2,600 per month to service the mortgage on a median house. Before the surge in rates, that number was below $1,750. That number is the current median rent, with the exception that buying allows people to build home equity.

Redfin

While I cannot say that I predicted that affordability issues would get this bad, I have been an advocate for manufactured housing investments for many years.

This brings me to the star of this article.

Sun Communities (NYSE:SUI) may be one of the best REITs money can buy. I’m not just saying that to get a fancy article title.

As we’ll discuss in this article, the company has a fantastic business model that thrives on affordability issues.

It has a top-tier balance sheet, which protects it against elevated rates and recessions.

It also has the ability to outperform the market and its REIT peers and consistently grow its dividend.

So, with all of this in mind, let’s dive into the details!

Manufactured Housing Is Where It’s At

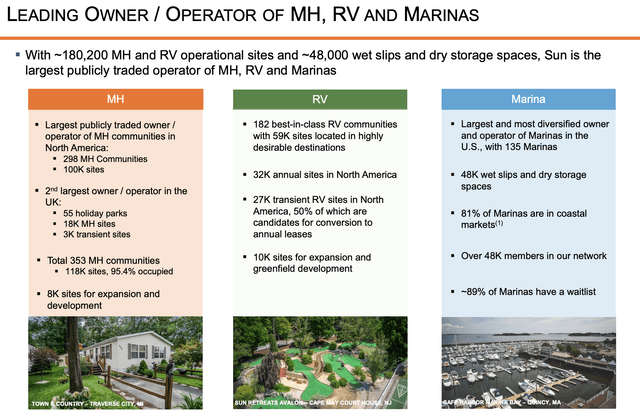

Sun Communities is the largest manufactured housing (“MH”) operator in the United States, owning roughly 300 communities in the United States, which cover 100 thousand sites. It’s also the second-largest operator of MH and holiday parks in the United Kingdom.

On top of that, it generates half of its revenues from RV communities and marinas. Both have significant benefits:

- Its RV communities have massive internal expansion potential, which is an efficient way of boosting income, while a big part of these sites can be turned into annual leases.

- Marinas have major shortages, as new residential supply reduces the supply of marinas. It’s one of the few assets in real estate that is prone to falling supply. Close to 90% of its marinas have a waitlist.

Sun Communities

In other words, the majority of the company’s revenues are anti-cyclical.

Speaking of anti-cyclical, the major benefit of MH is the fact that it’s a cheaper alternative to traditional single-family housing, especially because the quality of these homes has rapidly increased in the past decade.

We aren’t dealing with “trailer parks” that often have a bad reputation.

According to a recent article on ManufacturedHomes.com, and in light of what I wrote in the introduction, policymakers in the United States are grappling with the challenge of making homeownership more accessible, especially for first-time buyers and middle- to lower-income families.

The limited supply of affordable housing options has hindered the dreams of many aspiring homeowners. To address this, there is a growing interest in exploring the potential of manufactured homes as a viable solution.

Manufactured homes and affordable factory-built residences offer a promising alternative. These homes, built to a federal specification known as the HUD Code, undergo automated and standardized construction, reducing costs compared to traditional site-built or modular housing.

Notably, manufactured homes are the only single-family homes subject to a federal building code.

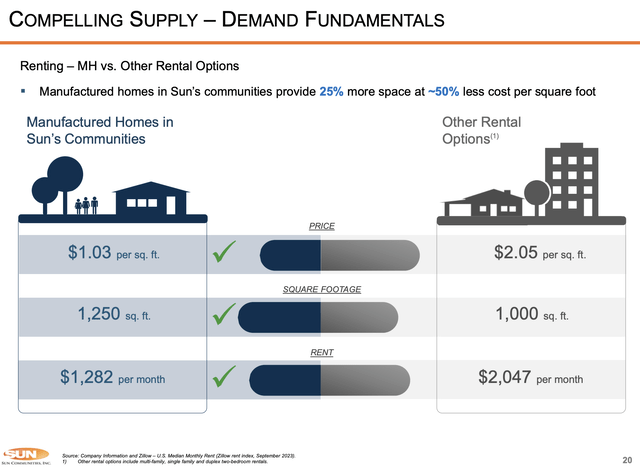

According to SUI data, MHs provide 25% more space at 50% less cost per square foot, bringing costs down to roughly $1,300 per month.

Sun Communities

On top of that, Sun Communities has other benefits as well.

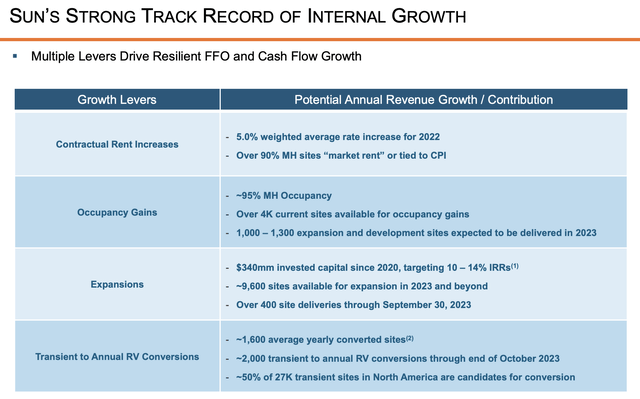

- It has 95% occupancy and a focus on retirees who often have a stable and predictable income (less risk!).

- 90% of its rents are tied to CPI, lowering inflation risks.

- It has strong internal growth capabilities, which means it is not forced to acquire new communities in an unfavorable environment.

- It can effectively manage costs, as costs mainly cover park maintenance, labor, and related. It does not have to manage each unit individually.

Sun Communities

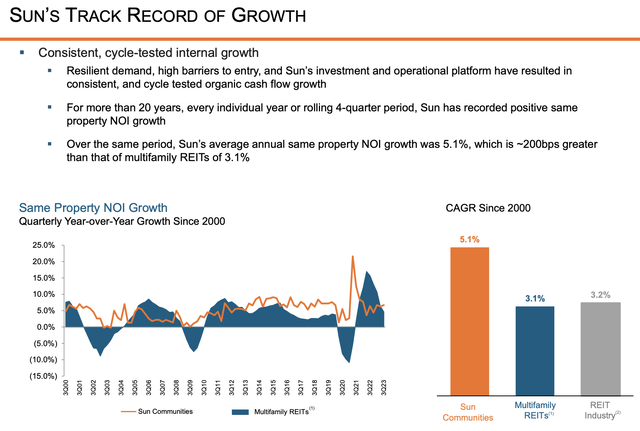

As a result of these benefits, the company has outperformed its peers by a mile.

Going back to the year 2000, the company has grown its net operating income (“NOI”) by 5.1% per year. That’s 200 basis points above the multifamily average.

Even better is that the company has avoided NOI declines during all major recessions!

Sun Communities

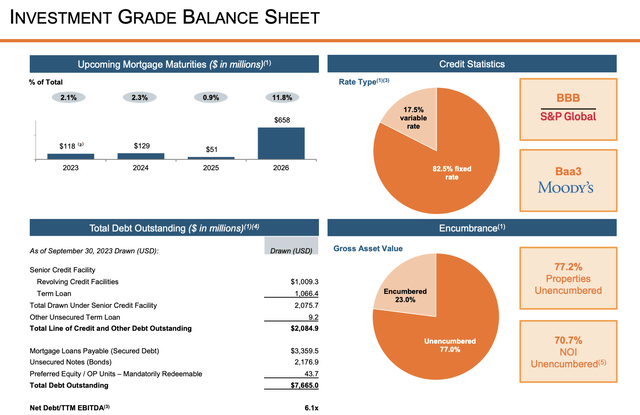

It also helps that the company has one of the best balance sheets in the industry.

SUI has a BBB credit rating. This is an investment-grade credit rating. While there are certainly REITs with better ratings, we are dealing with subdued financial risk.

It has a 6.1x net leverage ratio. That’s not extremely low, but it does benefit from the fact that less than 6% of its debt is due before 2026. This protects the company against the current elevated rate environment.

Sun Communities

Furthermore, the majority of its debt has a fixed rate. 77% of its assets are unencumbered, which further lowers risk for equity investors.

[…] we had $7.6 billion in debt outstanding at a weighted average rate of 4.15% and had a weighted average maturity of approximately seven years. Our trailing 12-month leverage ratio was 6 times and approximately 14% of our debt is floating. – SUI 3Q23 Earnings Call

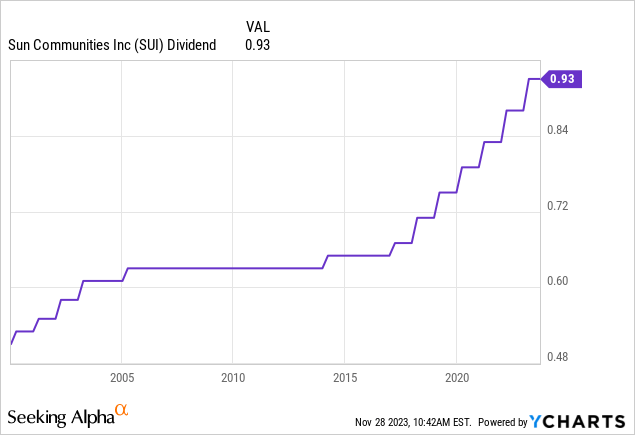

This also helped its dividend.

SUI, which did not cut its dividend during the Great Financial Crisis, has a current yield of 3.0%. This dividend has a five-year CAGR of 5.6%.

On March 6, the dividend was hiked by 5.7%.

The dividend is protected by a 60% AFFO payout ratio.

Additionally, in light of current economic headwinds, SUI continues to perform well.

Strong Growth & Guidance Despite Economic Headwinds

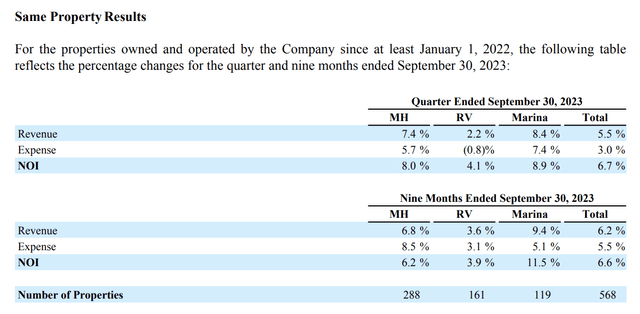

Sun’s total same-property NIO in the third quarter exceeded guidance by 220 basis points, with a 6.7% increase. This growth was driven by a 5.5% increase in same-property revenue and a 3.0% growth in property operating expenses.

That’s a terrific result, given that a lot of REITs struggle with elevated costs.

Sun Communities

- Manufactured Housing Segment: Q3 same-property NOI grew by 8.0%, supported by a 6.1% increase in monthly base rent per site and occupancy gains. According to the company, its transient to annual conversion strategy is successful, surpassing 1,800 sites.

- RV Communities: Achieved 4.1% same-property NOI growth, showcasing continued high demand and successful execution of the transient to annual lease strategy, surpassing 1,800 sites.

- Marinas: Delivered strong performance with 8.9% same-property NOI growth, demonstrating robust demand and an 89% rate lift.

Looking forward, Sun Communities provided a positive outlook for 2024, anticipating rental rate growth in its same-property portfolio to exceed inflation.

- The company expects average annual rental rate increases of 5.4% for manufactured housing in North America and 7.1% in the U.K.

- Additionally, Sun foresees a 6.5% increase in annual ROI rates for its annual RV portfolio and 5.6% growth in annual rates across Marinas.

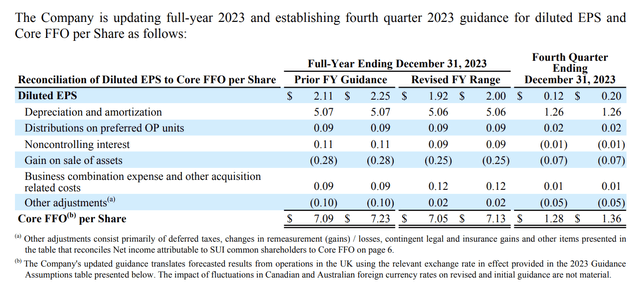

Unfortunately, it did not keep the company from somewhat lowering guidance.

The full-year core FFO per share guidance was revised downward by 1% to $7.05 to $7.13. Q4 core FFO per share is expected in the range of $1.28 to $1.36.

Sun Communities

Factors influencing the revision include higher expected interest expenses, U.K. home sales NOI, and lower expectations for transient revenue in the U.S.

The good news is that the total same-property NOI guidance increased by 50 basis points to 6.2%, driven by expectations of strong demand and effective expense management.

Despite acknowledging headwinds from the challenging macro environment, Sun remains confident in its ability to navigate these challenges and deliver strong organic cash flow growth in the coming year, as it sees durable income and its ability to streamline operations.

The company also remains attractively valued.

Valuation & Outperformance

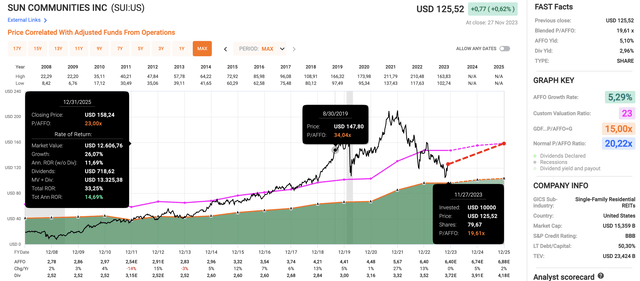

SUI shares are currently trading 40% below their 2021 highs. This has significantly benefitted the valuation. After all, analysts expect that SUI can avoid contraction this year, with 0% expected AFFO growth.

Next year, AFFO is expected to grow by 5%, followed by 2% in 2024. I believe that the company can beat both of these numbers.

With that said, SUI is currently trading at a blended P/AFFO ratio of 19.6x.

Its 15-year normalized valuation is 20.2x. However, in my model, I’m using 23.0x AFFO, which, I believe, is more appropriate.

I also need to mention that SUI’s valuation has been all over the place. After the Great Financial Crisis, SUI was way too cheap for more than five years. Between 2018 and 2021, it was overvalued.

FAST Graphs

Based on this context, a return to 23x AFFO by incorporation of expected AFFO growth could result in a >14% annual total return.

Since the 2009 bottom, SUI has returned 23% per year.

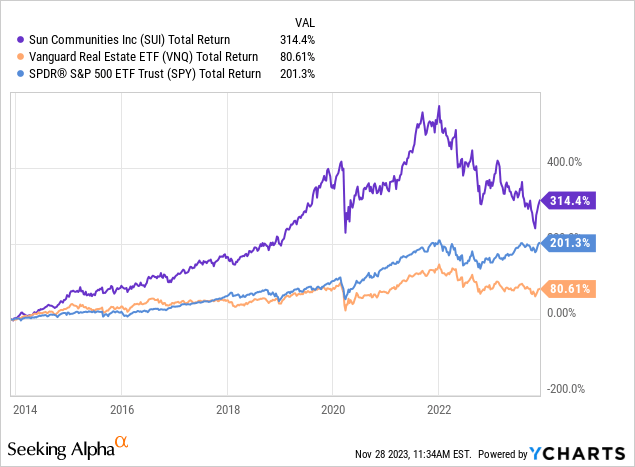

Furthermore, despite falling 40% since its peak, SUI has returned 314% over the past ten years, beating the S&P 500 by more than 100 points and the Vanguard Real Estate ETF (VNQ) by an even bigger margin.

Although I cannot promise that the theoretical 14% annual return will turn into reality, SUI offers good value, and its business characteristics make it very likely that it will continue to outperform both its peers and the market.

Takeaway

Sun Communities stands out as a top-tier REIT with a business model tailored to thrive amidst affordability challenges. Specializing in manufactured housing, RV communities, and marinas, SUI boasts anti-cyclical revenues.

With benefits like cost-effective housing solutions and robust financials, the company consistently outperforms its peers, delivering a 5.1% yearly growth in net operating income since 2000.

Meanwhile, SUI’s prudent management, high occupancy rates, and a 60% AFFO payout ratio contribute to its reliable 3.0% dividend yield.

Despite economic headwinds, SUI’s strong Q3 performance and positive 2024 outlook position it as an attractive, undervalued investment opportunity.

The only reason why I do not own SUI is because I went overweight self-storage, which I have added to aggressively this year. This somewhat limited me in my ability to diversify.

Needless to say, SUI stock is on my watchlist.

Read the full article here