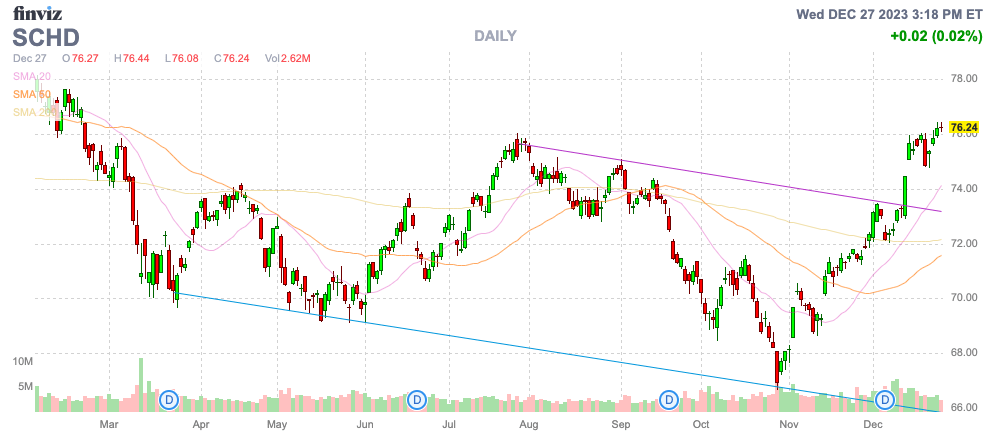

As with any investment vehicle, once the product becomes overly loved the returns slow down. The Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD) is a prime example of an over-loved investment idea that has now dramatically underperformed the S&P 500 Index (SP500) for an extended period. My investment thesis is more Neutral on the SCHD ETF following a very weak 2023.

Source: Finviz

Great Dividend Concept

SCHD is designed to closely mirror the performance of the Dow Jones U.S. Dividend 100 Index. The theory is to buy an investment fund that focuses on dividend-growing stocks for long-term cash flow compounding.

The fund list highlights including a low-cost fund with potential tax-efficiency along with investing in stocks based on fundamental strength relative to peers, based on financial ratios. SCHD invests in stocks with a market capitalization of $142 billion with a PE ratio of 15x.

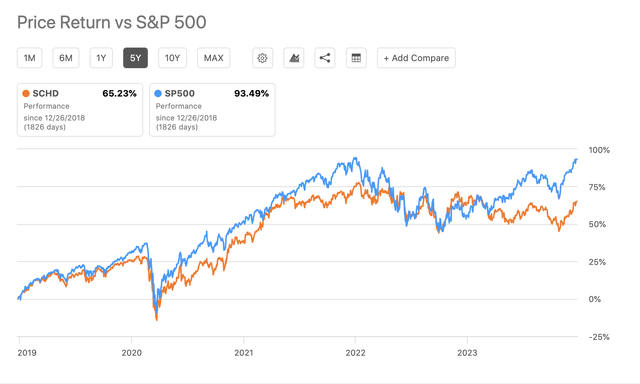

The problem is that the investment concept became overly loved in the last decade and investors started overpaying for the core dividend stocks in the ETF. SCHD has dramatically underperformed the S&P 500 in the last year and actually trails the benchmark over the 5-year period by a dramatic amount, 93.5% versus only 65.2% for SCHD. The fund has only produced a 4.7% return YTD when the S&P 500 has surged this year up 26.4%.

Source: Seeking Alpha

Investors only have to go on Twitter/X to see dividend influencers pushing people to just blindly buy shares of SCHD. Here, a Twitter account called Cade Invests got 211 likes and 45K impressions for perhaps unintentionally implying it was wise to blindly buy SCHD, along with other ETFs.

Source: Twitter/X

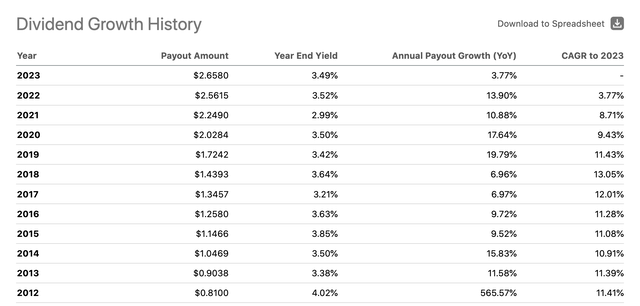

The dividend ETF now offers a nearly 3.5% dividend yield after the yield slumped below 3.0% at the end of 2021. The ETF offers consistently strong dividend growth, with double-digit growth over the prior 4 years.

Source: Seeking Alpha

The basic concept of the SCHD ETF is very solid. The issue remains the price investors are willing to pay for the stocks in the ETF due to a pure focus on buying dividend-growing stocks with little regard to price paid.

Investors need to learn the difference between a company and a stock. All of these companies are some of the best in the world with strong cash flows, but the stocks don’t always offer the best investments due to the price.

Top 10 Holdings Problem

One only has to look at the top 10 stocks in the SCHD portfolio to see the problems. The top 10 stocks are as follows with corresponding forward P/E ratios:

- Broadcom (AVGO) – 4.48%, 24.1x FY24

- Home Depot (HD) – 4.21%, 22.3x FY24

- AbbVie (ABBV) – 4.20%, 13.8x CY24

- Texas Instruments (TXN) – 4.12%, 25.7x CY24

- Amgen (AMGN) – 4.00%, 14.0x CY24

- Merck & Co. (MRK) – 4.00%, 12.7x CY24

- Chevron Corporation (CVX) – 3.94%, 10.7x CY24

- Cisco Systems (CSCO) – 3.92%, 13.0x FY24

- PepsiCo (PEP) – 3.77%, 20.7x CY24

- Coca-Cola (KO) – 3.76%, 20.9x CY24.

In general, the model has costly consumer stocks with limited growth compared to valuations and biopharma stocks with no growth, but companies that still hike the dividend. Most investors wouldn’t be surprised that this selection of stocks would underperform the market.

Most notably, SCHD has underperforming tech stocks, such as Texas Instruments and Cisco Systems. In the tech sector, higher dividend yields are usually a sign of weak growth and solid cash flows.

Another quick noticeable issue is the inclusion of both PepsiCo and Coca-Cola. The ETF has a combined position of 7.5% in these soda companies that tend to trade at inflated valuations, leading to subdued performance.

As a prime example, Coca-Cola trades at a premium valuation with limited growth. The company is forecast to grow annually in the 6% range, yet the stock trades at nearly 21x 2024 EPS targets.

These stocks are constantly listed as market favorites, in part due to Warren Buffett and Berkshire Hathaway (BRK.B) owning Coca-Cola, yet both stocks have underperformed the market in the last decade. Coca-Cola might have a solid 3.1% dividend yield with strong dividend growth, but investors have long overpaid for this yield, leading to weak total returns despite the odd popularity.

In essence, an investor is getting a group of overly loved dividend stocks from the prior decade. The major benefit of an ETF with a diversified portfolio of over 100 stocks is the ability to spread out risk amongst a group of stocks, but SCHD only manages to reduce returns via concentrating on stocks too loved for a history of consistent dividend growth that now actually lack the growth necessary to reward investors.

Takeaway

The key investor takeaway is that investors should always be careful chasing the latest investing fad. Schwab U.S. Dividend Equity ETF™ is a prime example of where the more investors jumped on the concept, the worse investment returns got in the last decade, culminating in the weak performance in 2023.

SCHD is still too loved for investors to aggressively buy the ETF here, though the weak returns and the climbing dividend yield should improve the returns compared to the benchmark in 2024.

Read the full article here