Thesis

The third-quarter fiscal report for 2023 highlights Schnitzer Steel’s robust financial growth, powered by an uptick in sales volumes and sturdy margins. As the world veers towards decarbonization and lower-carbon technologies, there’s a burgeoning global demand for recycled metals, positioning Schnitzer Steel advantageously. The company’s strategic investments in metal recovery systems, a diversified product mix, and alignment with increasing infrastructure development mark it for sustained expansion, despite the market volatility and supply chain challenges. My article provides a comprehensive analysis of the company’s fiscal performance, strategic priorities, valuation, risks, and future prospects, while contemplating the implications for (potential) investors.

Company Overview

Schnitzer Steel Industries, Inc. is a global player in the realm of metal recycling and steel manufacturing. Known for recycling both ferrous and nonferrous metals, Schnitzer’s core operations center around the acquisition, processing, and repurposing of salvage—from cars to home appliances, industrial machinery, and even construction scrap.

The company has also mastered the art of generating value at every stage of the lifecycle of salvaged assets, demonstrated in their recovery of mixed metal joint products like zorba, zurik, and a medley of valuable metals including aluminum, copper, and high temperature alloys, during the shredding process.

Additionally, they boast 51 retail self-service auto parts stores, 54 metals recycling facilities, and an electric arc furnace steel mill. This vertically integrated model not only allows Schnitzer to salvage vehicles but also retail serviceable auto parts, further enhancing their revenue stream.

Finally, Schnitzer expands their portfolio by producing a variety of finished steel products using recycled metal and other raw materials. Their product line spans from semi-finished goods such as billets to finished goods like rebar, coiled rebar, wire rods, and other specialty products.

Founded over a century ago in 1906, Schnitzer Steel Industries operates out of its headquarters in Portland, Oregon.

Schnitzer’s Bullish Q3 2023 Earnings Takeaways

The company’s third-quarter fiscal report for 2023 flaunts an adjusted EPS of $0.67 and a highly encouraging adjusted EBITDA of $56 million, showing an impressive uptick from the prior quarter. You can see the financial muscles flexing here, with a marked augmentation in earnings, which is chiefly propelled by an uptick in sales volumes and buoyant margins.

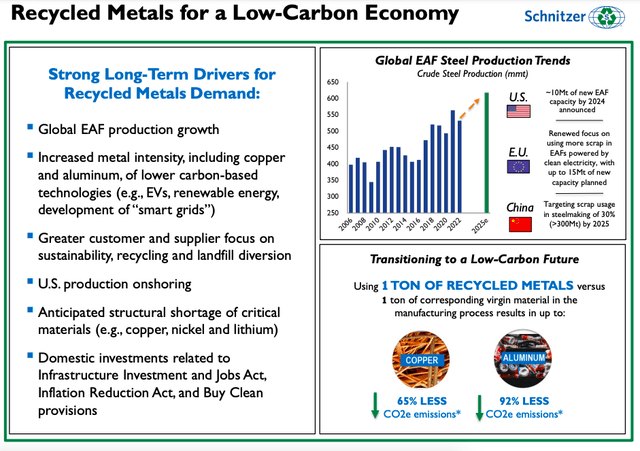

Now, stepping into the world of recycled metals, Schnitzer Steel is riding the wave of surging demand.

Schnitzer Steel Earnings Presentation

However, no financial landscape is without its peaks and valleys (more on this in “Risks & Headwinds” below). There have been some discernible ripples in the market, including a dip in ferrous export prices and dwindling demand in certain pockets. Yet, it’s not all gloomy.

The company’s strategic positioning is revealed in its diversified product mix and market reach. By selling ferrous and nonferrous products across various countries, the company is effectively reducing its dependence on any single market, thereby diffusing potential risks associated with regional market fluctuations.

For instance, the company has noted a gentle upward trend in ferrous export demand off the East Coast. Also, the Asian markets, particularly China, offer a ray of hope with an anticipated stabilization of prices, credited to an increase in fiscal stimulus, curtailed steel exports, and robust demand in South Asia. Delving into the third-quarter details further, there’s a reassuring leap in the company’s adjusted EBITDA per ferrous ton, landing at $48.

Strategic investments in advanced metal recovery systems are also bearing fruit, leading to beefed-up nonferrous sales volumes and healthier margins. There’s a promise of these investments yielding even higher value products, further fortifying the company’s position in the competitive arena. Along these lines, CEO Tamara Lundgren noted:

These systems enable us to extract more nonferrous metals from our shredding activities, increase throughput and improve our margins, expand our product offerings and customer base and reduce materials going to landfills

Looking ahead, Schnitzer Steel is poised to gain from the projected boom in U.S. infrastructure development. With the company’s steel mill perfectly aligned to feed into this increased demand for finished steel products, there’s a promising potential for volume growth that could offer substantial support to the company’s financial performance over the medium to long term.

Expectations

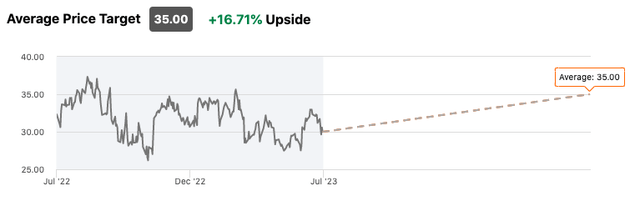

Schnitzer Steel is covered by two Wall Street analysts with an average “buy” rating on the stock that translates to a 16.71% upside price appreciation.

Seeking Alpha

Performance

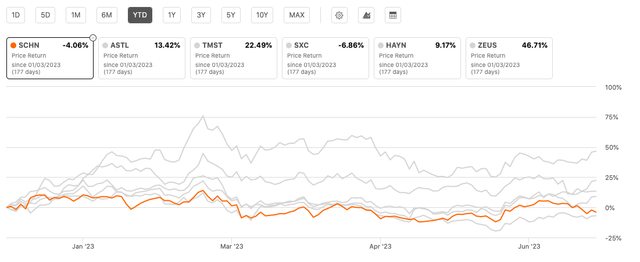

Relative to its peers in the steel industry, SCHN is a notable laggard with a mild -4.06% YTD price return.

Seeking Alpha

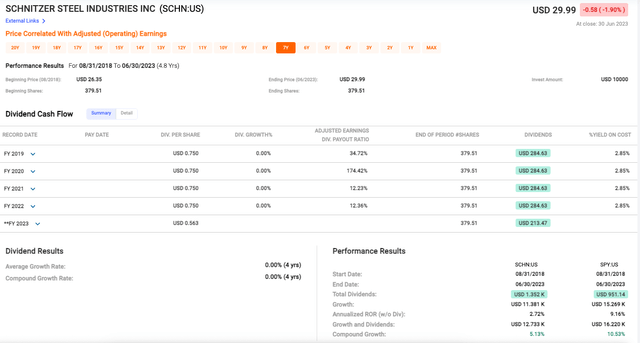

SCHN’s annualized rate of return (ROR) sans dividends stands at a rather lackluster 2.72% (see data below), underperforming the robust 9.16% seen by the broader SPY index. When dividends are taken into account, SCHN’s compound growth rate marginally improves to 5.13%, yet it still doesn’t quite measure up to SPY’s 10.53%. While this could be expected given we’re comparing a sector-specific entity with a wide-ranging market index, the discrepancy does raise an eyebrow.

Fast Graphs/Schnitzer Steel Performance

When we delve into the dividend scenario the silver lining is the consistency: a steady dividend per share of $0.75 has been maintained for the past five years straight (4.8 years, to be exact). The raincloud, however, is the unexpected reduction to $0.563 per share in FY 2023, which isn’t the most encouraging sign. Coupled with a stagnated dividend growth rate over the past five years, it’s a blow for those seeking to reap income from their investments.

Valuation

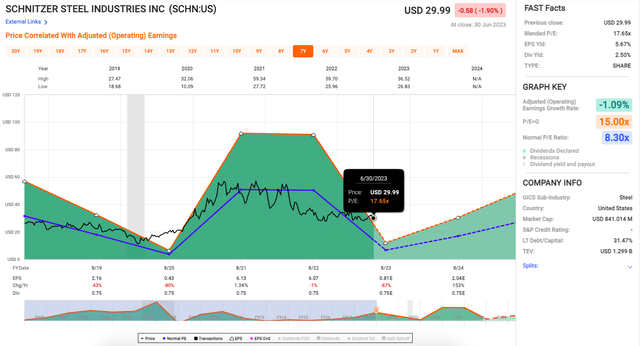

To begin, the firm’s blended price-to-earnings (P/E) ratio is a considerable 17.65x, much higher than its normal P/E ratio of 8.3x which implies an expectation of high growth (see data below). However, the reality here is at odds with that expectation; Schnitzer Steel’s adjusted operating earnings growth rate stands at a troubling -1.09%.

Fast Graphs

Moreover, the company’s earnings yield (EPS yield) is currently at 5.67%, which in theory sounds attractive; however, when we consider the relatively high P/E ratio and the negative earnings growth rate, the picture begins to blur. The blend of these metrics suggests that the company is overvalued, potentially creating a risky proposition for investors; yet, one of the brighter aspects here is the dividend yield, currently at a decent 2.50%.

Sector Valuation

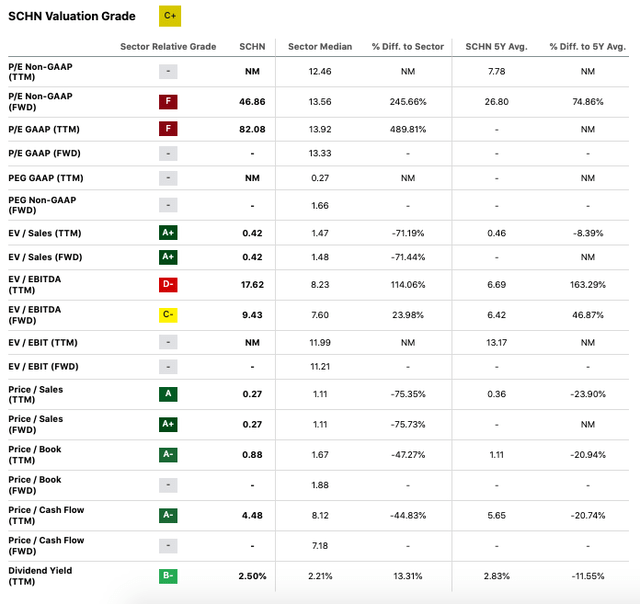

SCHN’s overall valuation grade is C+ (see table below), reflecting average performance relative to the Materials (steel industry) sector. However, the disparities in its individual metrics suggest an investment in SCHN may be better for value investors rather than those looking for growth potential.

Seeking Alpha

SCHN’s forward non-GAAP P/E ratio is F-rated at 46.86, a whopping 245.66% above the sector median and 74.86% above its 5-year average. This signals a gross overvaluation based on expected earnings, which is not an encouraging sign for potential investors. The GAAP P/E ratio is also discouraging at an F-rated 82.08, a shocking 489.81% above the sector median, suggesting investors are paying a hefty premium for the stock.

On the other side of the coin, SCHN seems undervalued in terms of its price relative to sales and assets. EV/Sales, Price/Sales, and Price/Book ratios are all A-graded or better, implying that SCHN’s stock price is quite low compared to its sales and asset values. A key standout is its EV/Sales ratio of 0.42, well below the sector median of 1.47. Similarly, the Price/Sales ratio of 0.27 is far below the sector median of 1.11. These ratios suggest that SCHN is underappreciated by the market in terms of its sales figures and assets.

However, SCHN’s EV/EBITDA ratio, a critical measure of enterprise value to earnings, paints a less rosy picture with a D- rating for its TTM measure at 17.62, significantly above the sector median. This suggests the company is significantly overvalued when considering its earnings before interest, taxes, depreciation, and amortization, which may raise questions about its operational efficiency.

Seeking Alpha

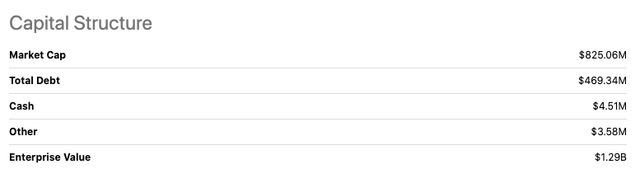

Finally, SCHN’s capital structure shows a market cap of $825.06M, which is moderate but dwarfed by its high total debt of $469.34M. The company’s cash reserves are low at $4.51M, indicating potential liquidity risks, especially when coupled with the high total debt. However, its enterprise value stands at a respectable $1.29B.

Risks & Headwinds

As CEO Lundgren noted on the conference call, Schnitzer Steel is actively grappling with an economic landscape characterized by significant market volatility and oscillating metal prices. This unpredictable pattern, particularly noticeable in the reduction of ferrous and nonferrous prices towards the tail-end of Q3, has potential to unfavorably impact Schnitzer Steel’s financial health. The anticipated outcome is a shrinkage in metal spreads, which could, in turn, apply pressure on profit margins.

Addressing Supply Flow Bottlenecks:

It’s worth noting that Schnitzer Steel encountered substantial hurdles regarding supply flow during Q3. These supply chain difficulties, manifesting as a continued squeeze in supply, could hinder the company’s ability to enhance metal spreads. Potential disruptions in the supply chain or a further tightening of supplies might significantly curb the company’s capacity to meet demands, thereby posing threats to its operational effectiveness.

Market Dependencies and Competitive Pressure:

And finally, like many companies in the industry, Schnitzer Steel’s fortunes are bound to the ever-changing dynamics of the global recycled metals market. A cocktail of factors, such as declining global steel demand, potential alterations in trade policies, and heightened competition from other industry players, could detrimentally affect the company’s sales volumes, pricing, and overall profitability.

Final Takeaway

After analyzing Schnitzer Steel’s Q3 2023 performance, it’s clear that the company is leveraging key trends like decarbonization and a burgeoning demand for recycled metals. Despite some market volatility and supply chain issues, Schnitzer’s strategic investments in technology, diversified product mix, and alignment with anticipated U.S. infrastructure boom give it a sturdy foothold for future growth. While the valuation is mixed and the stock may appear overvalued in certain metrics, the strength of underlying business fundamentals coupled with its strategic positioning in an industry witnessing increased demand lead me to “hold” the stock.

Read the full article here