Note:

I have covered SEACOR Marine Holdings Inc. (NYSE:SMHI) previously, so investors should view this as an update to my earlier articles on the company.

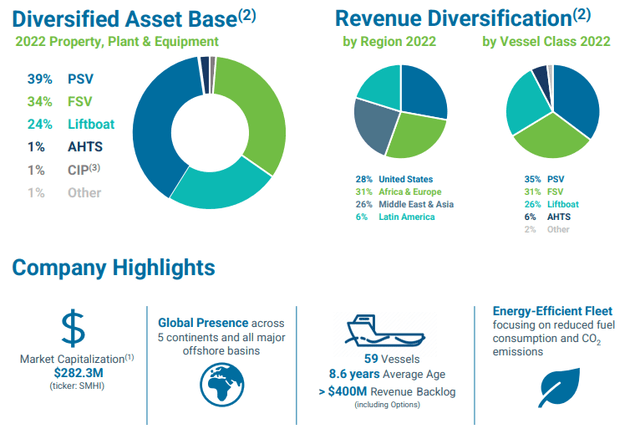

SEACOR Marine Holdings or “SEACOR” is a leading provider of marine and support transportation services to the offshore energy industry.

As of June 30, 2023, the company operated a diverse fleet of 59 support vessels, of which 57 were owned or leased in and two were managed on behalf of unaffiliated third parties:

Company Presentation

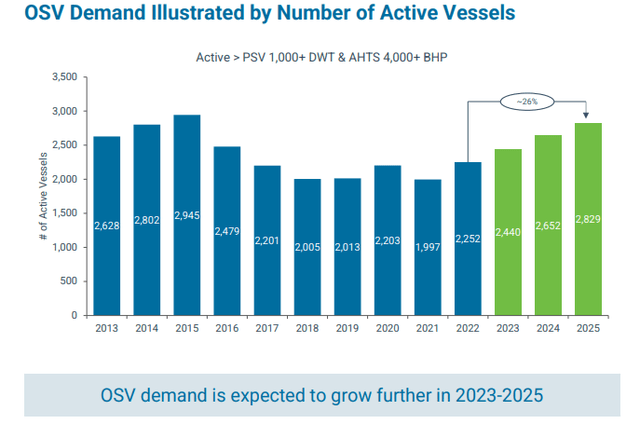

SEACOR’s closest publicly-traded peer is Tidewater (TDW), a company I have been very positive on for quite some time now, based on the ongoing recovery in offshore drilling markets and persistent tailwinds from recent geopolitical events.

While Tidewater cleaned up its balance sheet in bankruptcy six years ago, SEACOR has managed to avoid Chapter 11 at the expense of ongoing debt and liquidity issues very similar to offshore drilling industry leader Transocean (RIG).

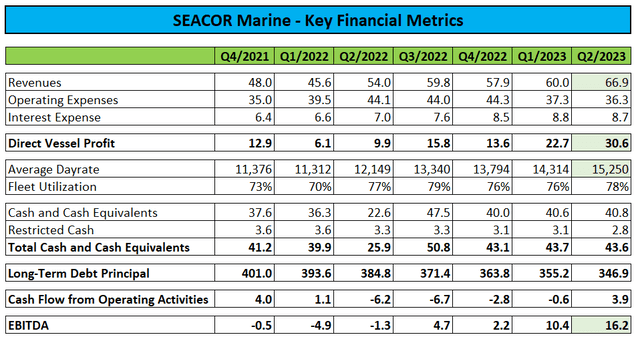

On Wednesday, the company reported strong second quarter results with revenues, average day rates, direct vessel profit, and EBITDA all reaching new multi-year highs:

Company Press Releases and Regulatory Filings

Management attributed the ongoing improvement to the company’s international operations in Africa, Europe and the Middle East while domestic activity in the Gulf of Mexico was impacted by the recent bankruptcy of leading shallow water player Cox Operating LLC as well as delays in contract startups for several offshore wind projects in the Northeast.

In addition, one of the company’s premium liftboats remained offhire for previously reported repairs. Management expects the vessel to return to service during the second half of the year.

As a result, direct vessel profit for the company’s domestic operations turned negative in Q2.

During the second quarter, SEACOR replaced the shipyard financing for three Chinese-built platform supply vessels (“PSVs”), albeit the terms were nothing to write home about.

The facility provides for a new 5-year term loan that bears interest at a fixed rate of 10.25% and is secured by first priority mortgages on each of the three PSVs and guaranteed by SEACOR Marine. The PSVs are currently chartered in the Middle East and Angola.

The new interest rate is more than double the rate charged by the shipyard, but admittedly, the interest environment has changed quite meaningfully as of late.

Please note that competitor Tidewater recently managed to place a $250 million unsecured bond at a similar interest rate while SEACOR’s recent efforts to attract investors for a note offering at competitive rates have been unsuccessful as stated by management in the Q1 earnings release:

On April 21, 2023, the Company announced it was exploring a potential offering of new USD denominated 5-year senior secured bonds. The Company has determined not to pursue the bond offering at this time as the indicative terms and conditions were not sufficiently attractive for the Company.

Given the strong business environment, CEO John Gellert’s optimism in the Q2 press release regarding further improvements going forward is hardly a surprise:

I am optimistic about our ability to continue to improve our profitability in the current cycle given the margin available to improve utilization and the fact that average day rates have yet to reflect full cycle dynamics.

With average day rates expected to increase further and fleet utilization likely to exceed 80% sooner rather than later, SEACOR should start to generate meaningful earnings and free cash flow in the near future.

Company Presentation

At this point, I am still looking for SEACOR to generate between $60 million and $70 million in EBITDA this year and cash flow from operations to turn substantially positive in the second half.

With higher utilization and more vessels rolling over from legacy contracts to prevailing market rates, the company should achieve annual EBITDA well in excess of $100 million in 2024.

Please note that in contrast to many competitors, SEACOR expenses all maintenance and drydocking costs rather than capitalizing them on the balance sheet, which understates margins and profitability relative to peers.

Bottom Line

Despite some weakness in the company’s domestic operations, SEACOR Marine Holdings reported strong Q2 results with revenues, average day rates, direct vessel profit, and EBITDA all reaching new multi-year highs.

With a substantial increase in profitability and cash flow generation anticipated over the coming quarters, investors should consider initiating or adding to existing positions in SEACOR Marine Holdings as the ongoing recovery in offshore drilling activity continues to be supported by persistent tailwinds from recent geopolitical events.

In addition, a comprehensive debt refinancing at favorable terms could provide an additional, near-term catalyst for the stock.

Given ongoing, strong market conditions, I am increasing my 2024 EBITDA expectation for SEACOR Marine Holdings Inc. to $120 million and reiterate my “Buy” rating on the shares while raising my price target to $15 based on a 2024 EBITDA/EV multiple of 6x.

Read the full article here