Investment Thesis

Shift4 Payments, Inc. (NYSE:FOUR) isn’t a very followed business. But what it lacks in following, it more than makes up with its enticing prospects.

It’s not only that Shift4 is rapidly growing, but it’s growing at a rapid rate while oozing free cash flow.

In fact, according to my estimates, the stock is priced at less than 19x forward free cash flows.

This stock is one that’s worth following closing.

Why Shift4 Payments? Why Now?

Shift4 provides software and payment processing solutions. They offer a range of payment processing solutions, including, end-to-end payment processing, contactless, and QR code-based payments, as well as software integrations.

Beyond payment processing, Shift4 provides business intelligence and Point of Sales software, although this side of its business is a rather small contributor.

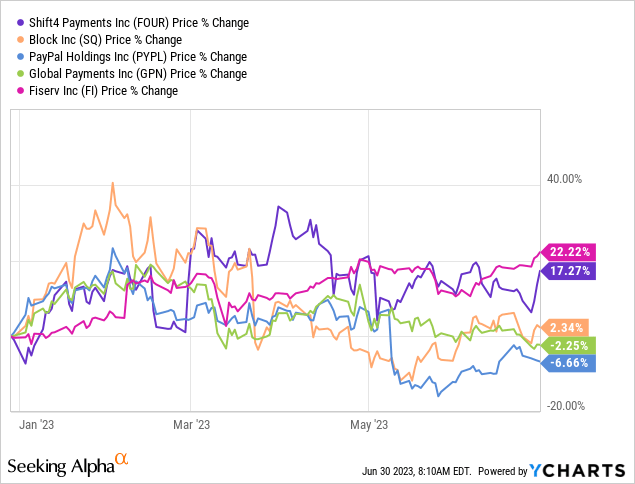

Compared with its larger and better-known competitors, in the past 6 months, Shift4 has significantly outperformed most of its peers. Although it came slightly behind Fiserv (FI).

As you would expect given this strong performance, management is very upbeat, confident, and eager to describe some of its recent successes such as how Shift4 is now rapidly expanding beyond such a high level of exposure to restaurants.

Here’s a recent quote echoing this statement,

It is important to emphasize that today restaurants represent approximately 40% of our total end-to-end volume compared to around 55% of our volume back in early 2019. This percentage shift occurred despite growing restaurant volumes and is due to our rapid growth in hotels, new verticals and larger enterprise merchants to our mix.

Next, let’s discuss Shift4’s financials.

Revenue Growth Rates Are Stabilizing

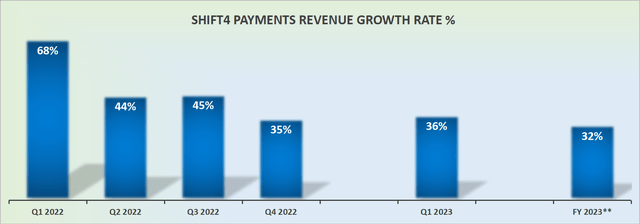

FOUR revenue growth rates

Throughout 2021-2022, Shift4 was growing at very rapid growth rates. However, its growth rates have now slightly moderated.

That being said, as you can see above, the business is still clearly growing at more than 30% CAGR.

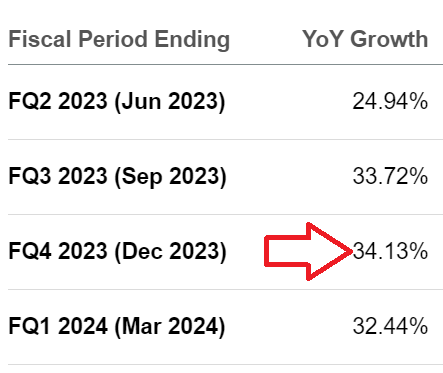

I fully suspect that Shift4 could end up positively surprising investors as it approaches Q4 2023.

SA Premium

Particularly when we consider that Q1 2023 saw Shift4’s revenue growth rates increase by 38% and that was its most challenging comparable period with the prior year. Given the relatively easier comparables for the remainder of 2023, it appears possible that Shift4 could end up growing in the high 30s%.

Altogether, this means that there’s a high likelihood that Shift4 could deliver mid-30 % growth rates in 2024. And if that were the case, together with a strong free cash flow profile, this would make paying about $5 billion for the company a compelling investment.

What Makes Shift4 Payments Unique?

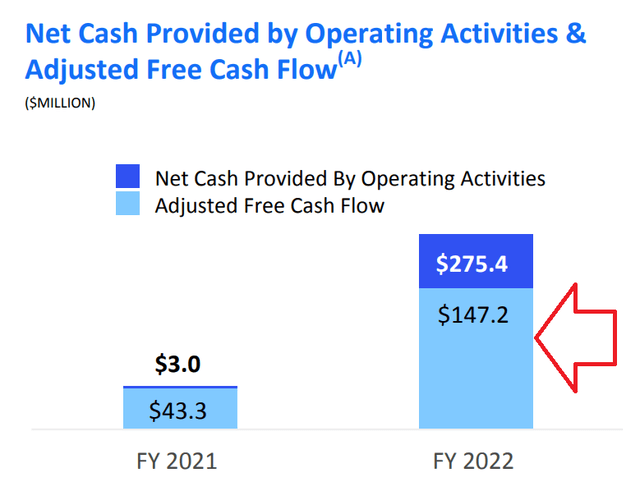

Unlike countless other processing payment solutions, Shift4 is highly free cash flow generative.

FOUR Q1 2023

As you can see above, Shift4 is expecting to end 2023 with more than $225 million of free cash flow.

For a business that just last finished with less than $150 million of free cash flow, this clearly speaks of its ability to rapidly grow its free cash flows.

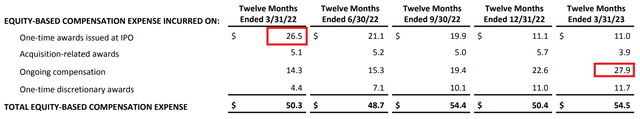

What’s more, unlike many other businesses, its free cash flow isn’t solely made up of stock-based compensation expenses.

FOUR Q1 2023

However, if I were to note one pesky blemish in its free cash flow profile it would be that it appears that with time, its on-time IPO stock-based compensation figures are trending lower, while its ongoing compensation is trending higher, with the result that the total SBC is largely unchanged on a y/y basis (or even slightly higher).

Regardless, I don’t believe that investors will be too disgruntled, after all, Shift4 is not only reporting strong free cash flows, but its free cash flows are climbing, rapidly.

FOUR Q1 2023

Consequently, this means that as we look ahead to 2024, it’s likely that Shift4 payments could end up reporting more than $300 million of free cash flow. This would be supportive of its valuation, leaving the stock priced at less than 19x next year’s free cash flow.

The Bottom Line

Shift4 Payments is a lesser-known business but has promising prospects. It is experiencing rapid growth and generating substantial free cash flow.

With a forward free cash flow multiple of less than 19x, the stock is undervalued.

Despite a slight moderation in growth rates, Shift4 is still growing at a CAGR of over 30%. The company’s strong performance in Q1 2023, with a 38% increase in revenue growth rates, suggests the possibility of high growth rates in the mid-30s% for 2024.

Shift4’s unique feature is its ability to generate significant free cash flow, which is projected to surpass $225 million by the end of 2023 and potentially reach over $300 million in 2024.

This, combined with its valuation and growth potential, makes Shift4 Payments an appealing investment opportunity.

Read the full article here