Investment Outline

Despite the promising future of Shockwave Medial Inc (NASDAQ:SWAV) one has to ask the question about how much you should be paying for growth. With SWAV I think we are far above where you should be. Eventually, the share price will have to contract to more reasonable levels as growth slows down. I don’t think SWAV can continue growing EPS at a CAGR of 15% for perpetuity. But even with higher growth than that, it will take many years for the p/e to reach somewhere in the range of where the sector is at. That leaves many years of poor performance I think.

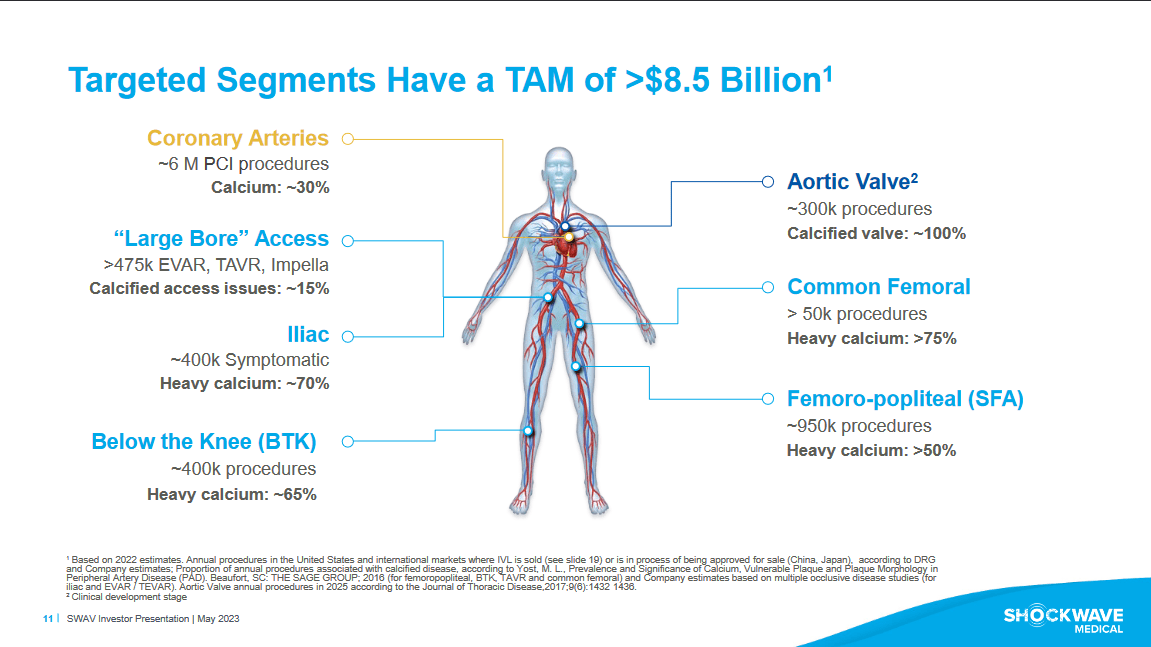

The market opportunity the company has however seems great and I don’t doubt their ability to grow within it. The company is a medical device developer which is focusing on calcified cardiovascular disease treatments. The company is a leader in the space and has been able to gain impressively from it, boasting a ROC of 18%. I think it’s unfair to rate them a sell, and will instead pivot to a hold rating for the company.

Recent Developments

Back in April earlier this year we got the news that SWAV had completed the acquisition of Neovasc Inc. The company is the first outfit’s kind technology which is addressing refractory angina. This is a chronic condition in which patients suffer chest pain that cannot be controlled by conventional therapies. There is a massive market opportunity here for the company to take part in as the combination of the United States and Europe accounts for 300 000 new patients diagnosed with obstructive coronary disease. For SWAV the acquisitions speak volumes about the market share they seek to take on.

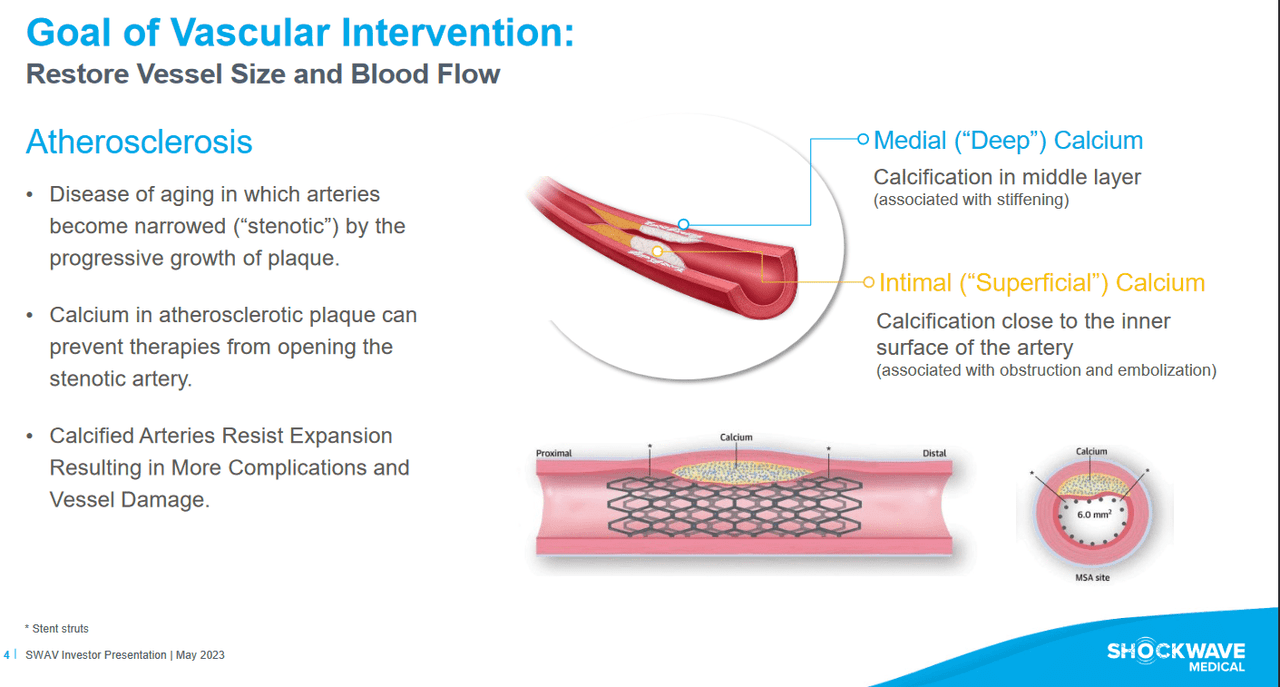

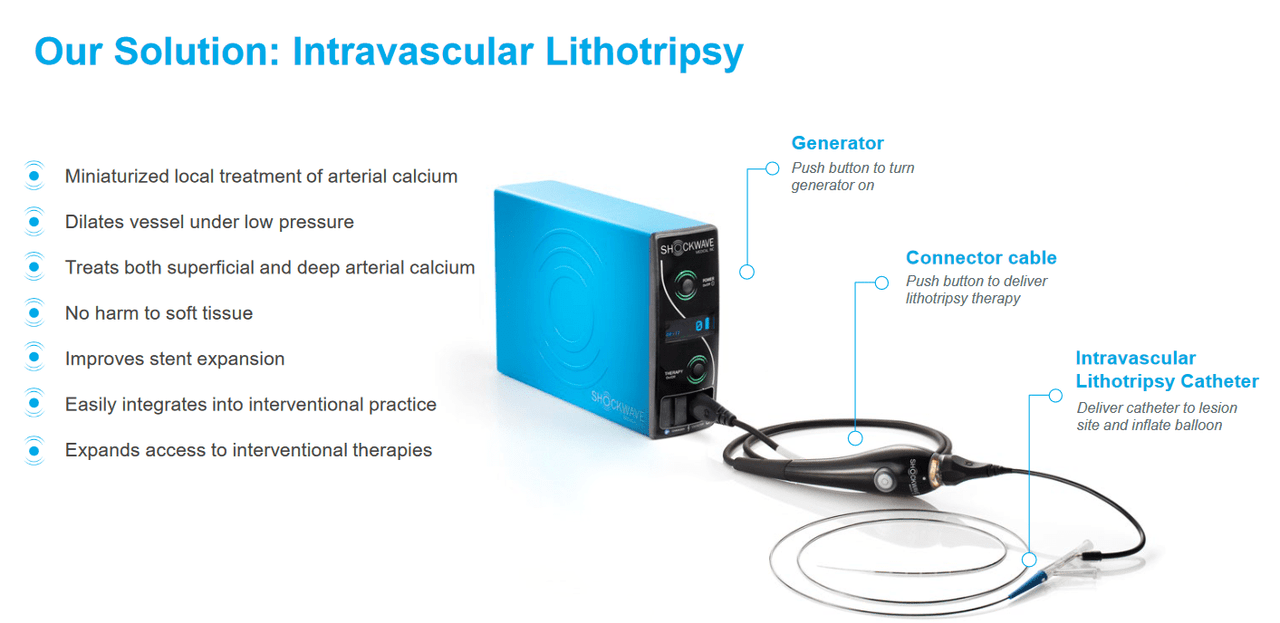

Company Product (Investor Presentation)

Diving deeper into the company SWAV is a medical device company that specializes in the advancement of intravascular lithotripsy (IVL) technology. This innovative approach is dedicated to addressing the challenges posed by calcified plaque within the arteries of patients grappling with a range of cardiovascular conditions, spanning from peripheral and coronary vascular diseases to heart valve disorders. The company’s influence extends both domestically within the United States and on an international scale.

Company Product (Investor Presentation)

IVL technology serves as a groundbreaking solution for medical professionals striving to manage calcified plaque effectively. This hardened plaque, known for its obstructive properties within blood vessels, presents a formidable obstacle to optimal blood flow. Shockwave Medical’s mission centers on developing cutting-edge solutions to enhance patient outcomes, alleviate symptoms, and potentially avert more invasive interventions.

Besides this, we also recently got the latest earnings results from the company, showcasing a beat on the revenues but a miss on the EPS indicating that rising costs are taking a toll on the earnings. The revenues came in at $180 million, beating out estimates by $6.4 million. Because of the results, the company raised the full-year projected revenues to $725 – $730 million. The effect of the results seems minimal as the share price decreased in after hours.

Margins

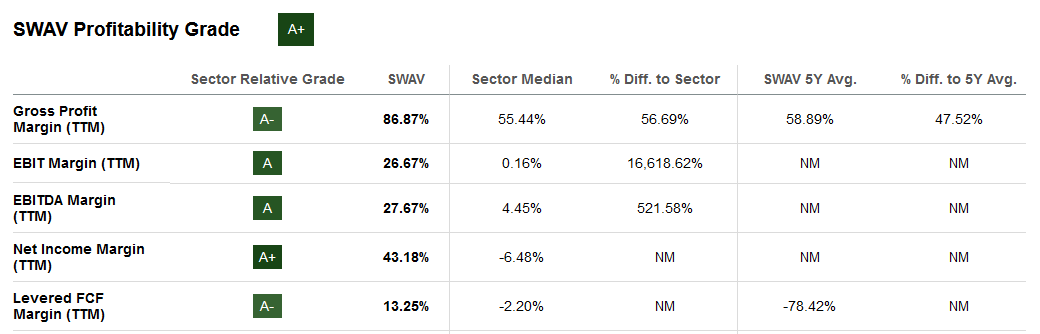

Margin Profile (Seeking Alpha)

The margins of SWAV are a real highlight in my opinion. The company has come a very long way and now boasts net margins of 43% and FCF margins of 13%. This sort of strong delivery has resulted in the valuation being where it is today, very high. SWAV is yet to establish a dividend for its shareholders but I don’t think we are very far off, especially when the margins are this good. However, the R&D expense does remain high but I think going forward the biggest expenses will be more acquisitions, like the one we saw in April. This much means we aren’t getting a dividend any time soon, and I don’t think buybacks are on the table either. It seems a lot of the FCF is going towards building up the cash position instead, which isn’t a bad thing by any means. But to make SWAV a buy for me would mean they need to have some more shareholder-friendly practices like the ones mentioned.

Valuation

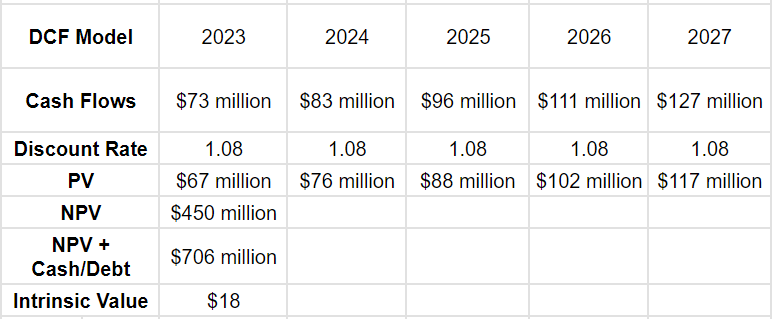

DCF Model (My Own Model)

If there is anything that could provide proof that SWAV is vastly overvalued right now I think this DCF model does a very good job of it. For the model, I have estimated a terminal FCF growth of 15%, which is in line which what the company is supposed to grow in the coming years. SWAV holds a strong cash position and barely any debt which helps support the fact they have a solid financial position to operate from. But the intrinsic value comes out to $18 and we know this is far below where it’s trading right now. It’s difficult finding growth companies well below intrinsic value, but it also helps showcase some of the absurd valuations there are out there still. I am a hold with SWAV and won’t be a buyer until the price compresses.

Risks

It’s important to realize that SWAV operates within an environment characterized by both innovation and intense competition. While the company’s IVL technology is very unique and pioneering, it is situated within a quickly evolving landscape of medical device advancements. This dynamic underscores the potential for technological breakthroughs from competitors that could potentially challenge SWAV’s market position and even its profitability.

Company Segment (Investor Presentation)

In addition to competitive pressures, a crucial factor driving SWAV’s growth trajectory is in its ability to navigate the regulatory landscape successfully. Regulatory approvals, often contingent upon rigorous clinical trials, are pivotal milestones for medical device companies. These approvals not only validate the safety and efficacy of the technology but also pave the way for its commercialization. However, it’s important to know that the regulatory process can be complex and subject to delays or unforeseen challenges. Any unexpected hurdles in obtaining regulatory clearances or unfavorable clinical trial outcomes could have profound implications for SWAV’s future growth prospects and consequently impact the stock’s performance. I think that if we see any regulatory disagreements with SWAV it would like to cause the market to value the company lower than where it is right now. A growing company like SWAV needs to have a clear path of growth, if it’s muddled by regular uncertainties the risks will be visible as the valuation gets a lower premium.

Investor Takeaway

SWAV has made a lot of progress in developing a leading technology in their field. They are beginning to make more and more acquisitions which will field growth for many more years. However, for investors seeking an undervalued play, SWAV is far from that. The company trades at very rich multiples and this is concerning as a buy case risk facing large downside risk. The quality of the business though makes me rate them a hold, as a sell seems unfair given the progress they have had so far.

Read the full article here