Dear readers/followers,

Siemens Energy (OTCPK:SMEGF) has been a high-risk investment from the get-go. While operationally sound, the company has had a risk profile that’s outside of my typical comfort zone. So when I went into the investment, I did so at a very limited sizing and I have no plan to massively size this up now either.

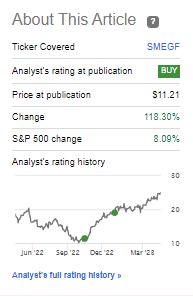

However, the company’s performance since mid-October and my first bullish articles deserve immediate highlighting. Because my position and the investment have generated a triple-digit RoR in a very short time.

Seeking Alpha Siemens Energy (Seeking Alpha)

Recognizing undervaluation is what I try to do. It’s my “job”, not just here on SA, but overall. And something like this, well it’s easy to say that I’ve “done” my job, because an outperformance of more than 13x in less than 8 months is obviously a good track record – at least for this particular investment.

However, I’m not at a place personally where I feel comfortable putting significant amounts of capital in these sort of higher-risk investments. Hence, my actual cash profit is relatively trivial. Still, if one of you had the guts to go in with a fair percentage of cash, then congratulations.

For now, I’m going to re-review and put an expectation on this company.

Siemens Energy – A lot to like, but a lot of risks as well

The company’s volatility is no secret. All you have to look at is what has happened over the past year and more, and look at how you would calculate future returns and profits for a company that is as fresh as this, with an asset portfolio that is currently not easily analyzable. Most services do not provide forecasts for this company – I do, but I have a hard time doing so.

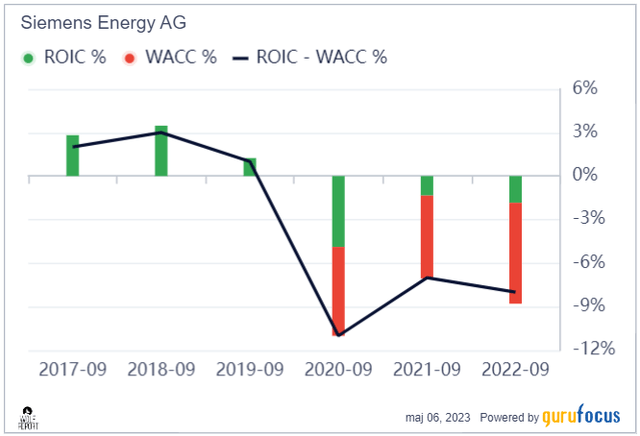

The company’s current margins and fundamentals are still heavily impacted. Almost every single non-gross margin is negative. It has no profitability history. Its ROIC net of WACC is in the red, and it has an equity/asset ratio of less than 0.3x. It’s heavily debt-laden at 5.64x to EBITDA and almost 0.5x to equity, and it cannot showcase an EBITDA growth rate – or any attractive or trustworthy profit growth rate. The company is cash-heavy, but there are reasons for that. And a company can be as cash-heavy as “it wants”, when coupled with these trends, that still amounts to “a bit” of a problem.

Siemens Profitability (GuruFocus)

Net income has been negative for 3 years, and if you look at a high-level overview of the company’s top-line to net flows, you’ll see that COGS consumes most of the results at nearly 88%, leaving less than 15% to gross profits, making it nearly impossible under current circumstances to post any sort of profit.

So, risk. That is why I am “light” Siemens Energy overall.

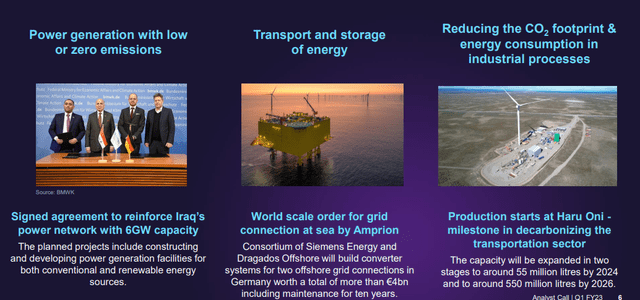

Remember, The company is the legacy division of what remains of Gas & Power in Siemens, as well as, at the time of its spin-off including a majority stake (67%) of Siemens Gamesa (OTCPK:GCTAF). In short, you get exposure to pretty much all “things power” that Siemens did, or does. This is not an unattractive set of assets in the least, but it’s one in a time of change.

The company’s argument for stability is rooted in asset quality and expertise. The people in charge of Energy know what they’re doing – or at least, that is the message management wants to give us. Christian Bruch has extensive expertise from Siemens, and the former Siemens CEO Joe Kaeser (The “Kaiser”) is the chairman of the supervisory board. Kaeser is the one that oversaw most of what Siemens is today.

This is really a turnaround/special situation sort of business. What characterizes these businesses is that they are able to post very impressive top-line growth rates, despite their operational challenges.

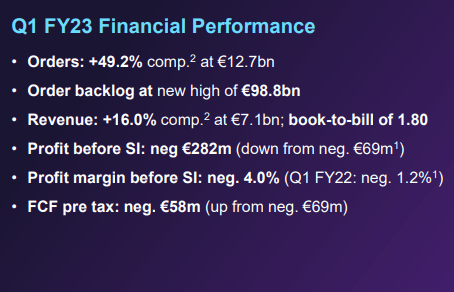

We see this once again in 1Q23. The company posts strong order and revenue growth, and improved cash flow numbers. Underlying profit “improvements” are lauded, but there is no talk of a positive net profit. But that is also not where the company currently is.

That is where the company is going – and in a case like this, it all becomes about “Can the company actually manage the transformation?”

Here are the 1Q23 results.

Siemens Energy IR (Siemens Energy IR)

As you can see, many of the negative trends are still there. But there are light spots and improvements as well – indicators that things are moving in the right direction and that we may see the light at the end of the tunnel.

The company managed to get approval for the delisting of Gamesa – and the market environment is considered attractive across all of the company’s core segments. Siemens Energy has adjusted its guidance to account for the more positive market environment, now expecting higher revenue up to 7% growth, but lower profit margin, down around 1% with a top expectation of 3%.

The company also is very clear that this year will be another year of net loss for the company, and that net loss is at 2022A level – compared to a sharp reduction before.

The positives are easy to summarize – terms and conditions for new order intakes have been improved, onshore stabilization is on track, and Gamesa is doing better, with increased manufacturing volumes and installations, improving its deliveries. The new organization is in place since early 2023, and the company has reached a restructuring agreement in Spain.

Siemens Energy IR (Siemens Energy IR)

What will be important to keep an eye on is the delisting process, Gamesa’s continued performance, and how the company comes out of this transaction, since it involves financing of a convertible bond, a bridge facility of €1.3B, and another €1.15B worth of cash. The company further intends to raise €1.5B to fund the transaction value with “equity or equity-like instruments”, which at this point could be a mix or something singular, but likely unappealing to current shareholders in terms of dilution. Not necessarily to the company, given the share price journey since October. If I was in Siemens Energy, I would say that now would be the time to dilute given the current valuation.

But it also tells me that current shareholders should be considering what to do about their hypothetical, or very real (as with me) profit from that investment.

The company’s reported strong revenue growth is moot to me – because it is accompanied by worsening margins. It’s good to see, but until I see improvements in actual profit, that near-€100B order backlog is icing on a non-existent cake, since at current profit levels, that’s a loss-making set of €100B in orders.

The company speaks mostly in terms of top-line and revenues – very little in terms of profitability, and its net cash position continues to decrease as a result of financing. The company does have plenty of cash available, over €10B at the company level including undrawn facilities, but what we want is to look at underlying trends.

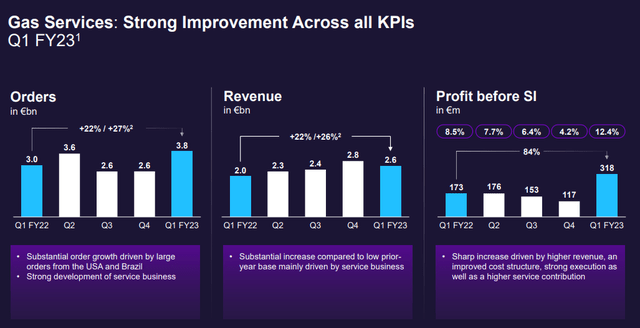

Some light spots exist. Gas service profits are improving, and this is a segment that has been profitable since the get-go.

Siemens Energy IR (Siemens Energy IR)

The same profit improvements can be seen in grid tech, and the Transformation segment, which on a YoY basis has finally gone into profitability. However, all of these profit numbers, as you can see above, are “before special items”, which is where the real hammer comes down. Until these special items are removed or we can see the company giving us GAAP/IFRS profit, then this becomes a risky play.

I’m not opposed to risky plays, but I want them at a good price.

Siemens Energy – the price does not currently reflect the risk you’re taking

Combining the fact that the company is seeing to raise cash through equity, with a triple-digit RoR in a short time begs the question if the company’s current journey has come to an end and if it’s time to consider rotating profit.

I would say yes, it’s time.

I’m also changing my rating on Siemens Energy as of this article. In my last article, I gave the company a rating of €20/share. This once again showcases that my ratings or price targets are not pulled from the ether – they have reasons. While analysts from S&P Global come in at ranges from €15-€34 with PTs of around €23-€24, I consider these somewhat too positive, and failing to take into account the potential of dilution that seems likely here. Out of 17 analysts, 8 are at “BUY” here. That is actually significantly higher than when the company traded at €11/share, which is not surprising to me.

I was positive at €11. I’m not positive at €22/share.

The company is currently expected to see GAAP profitability in 2024E as SIs start winding down, with growing profitability going into 2025-2026. I wouldn’t argue too much with this assumption, but I would once again say that these assumptions fail to account broadly for potential impacts from macro, dilution, and the integration of Gamesa, a segment that has been proven to be difficult to handle.

I have faith in this company’s management – but I wouldn’t be doing my job as an analyst if I didn’t question and demand more from the company before going in and making a non-IG-rated business a core holding in my portfolio.

For that reason, I am taking a more conservative stance here, and calling this company now a “HOLD”.

I’m also rotating my position at a ~118% profit and investing it in a mix of businesses I view as far more conservative with a more realistic upside and not the same risk profile.

If the company goes down again, I’ll revisit here – as I will, if the company significantly improves its profitability.

But for now, I believe we’ve reached a point where taking profits is not a bad idea.

This brings me to my current thesis.

Thesis

My thesis for Siemens Energy is as follows:

- The company is one of the more interesting plays in all of Europe on a mix of legacy Gas/power as well as a massive Renewable operation it seeks to pull from the public markets. The company is a transformation play, with a “due date” of 2023-2025 at the earliest, but now is the time to invest.

- I’m leaving my “BUY”, changing to “HOLD”, and am rotating my position. My PT remains at €20/share, but I want to see what the company does in terms of dilution and other things going forward.

- For those reasons, I’m going more conservative here, and I believe investors should consider doing the same.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

It’s neither cheap nor with an attractive upside – I say “HOLD”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here