As an analyst and investor, I have a solid track record. But every so often, I make a call that just does not play out the way that I expected it to. One really good example of this can be seen by looking at Silgan Holdings (NYSE:SLGN). Over the past several months, shares of the company have significantly underperformed both my own expectations and the broader market. Even though the company posted solid but mixed results for the 2022 fiscal year, recent performance has shown signs of weakening. On an absolute basis, shares of the company are still fundamentally attractive. But relative to similar firms, the stock is a bit pricey. Given these facts, combined with my own decision to become a bit more cautious because of broader economic conditions, I’ve decided to downgrade the company from a ‘buy’ to a ‘hold’.

A revision is appropriate

In November of last year, I decided to revisit my prior bullish thesis on Silgan Holdings. In that article, I talked about how well the company had done over the prior few months, with robust sales and profits leading the way. The forecast for the company from a growth perspective was promising and, while shares of the company were pricey compared to similar firms, they were attractively priced on an absolute basis. This led me to keep the ‘buy’ rating I had assigned the stock previously. Unfortunately, things have not played out as I would have hoped. Since the publication of that article, shares are down 8.8% at a time when the S&P 500 has generated upside of 9.9%. This is not to say that my overall history with the company has been negative. Since I first rated the company a ‘strong buy’ back in August of 2021, shares have seen upside of 12.8% compared to the 2.1% decline the S&P 500 experienced.

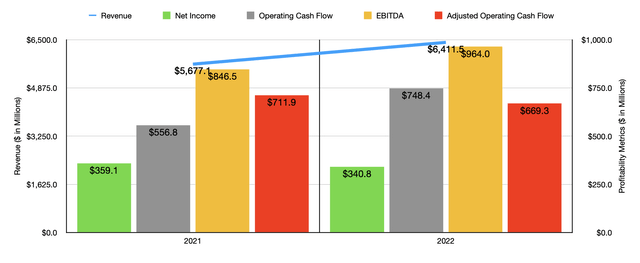

Author – SEC EDGAR Data

Recent pain may look peculiar if you look at only the annual data provided by management. Consider, for instance, how the company performed during 2022. Revenue for that time came in at $6.41 billion. That’s up significantly over the $5.68 billion that the company reported for 2021. It is true that net profits declined during this time, dropping from $359.1 million to $340.8 million. But other profitability metrics showed improvement year over year. As an example, operating cash flow jumped from $556.8 million to $748.4 million. Though it is worth noting that, if we adjust for changes in working capital, we would have seen it decline from $711.9 million to $669.3 million. Meanwhile, EBITDA for the company grew from $846.5 million to $964 million over the same window of time.

All around, I would say that those results were pretty solid. But when you look at data that’s more recent, such as data covering the first quarter of the 2023 fiscal year, you start to see some cracks form. Revenue of $1.42 billion represented a decline of 1.6% over the $1.44 billion generated the same time last year. There were two areas of weakness that pushed sales down. Revenue associated with its Dispensing and Specialty Closures operations, for instance, saw revenue drop from $597.9 million to $579.9 million, while its Custom Containers business saw revenue fall from $193.3 million to $168.3 million. These decreases, management said, were largely associated with lower volumes, foreign currency fluctuations, and non-recurring revenue that the company generated from its operations in Russia last year. Even in this inflationary environment, management was forced to cut pricing as well. But that seems to have been largely associated with a lower pass through of resin costs in its Custom Containers business.

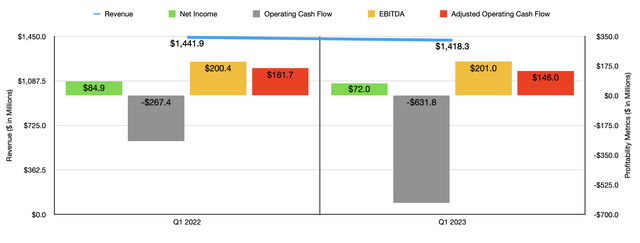

Author – SEC EDGAR Data

As can be expected, the decline in revenue brought with it a worsening of the company’s profits. Net income fell from $84.9 million to $72 million. Far more painful was the plunge in operating cash flow. It went from negative $267.4 million to negative $631.8 million. The good news is that, if we adjust for changes in working capital, this number would have gone from $161.7 million to $146 million. The only profitability metric to show any improvement year over year was EBITDA. According to the data provided, this has inched up marginally from $200.4 million to $201 million.

Management has provided some interesting guidance when it comes to the 2023 fiscal year. They currently anticipate adjusted earnings per share of between $3.95 and $4.15. This is higher than what they previously anticipated. At the midpoint, this would translate to net income of $448.9 million. Management has also guided operating cash flow of about $675 million. If we assume that EBITDA should climb year over year at the same rate as operating cash flow, then we would expect a reading for the year of $972.2 million.

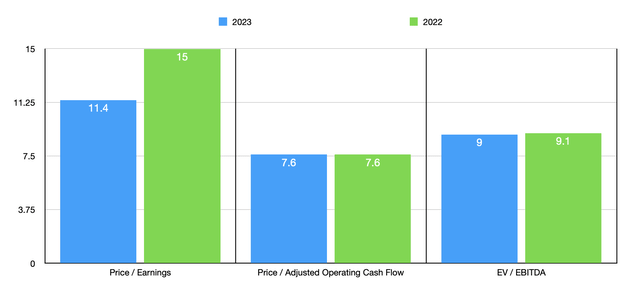

Author – SEC EDGAR Data

If these numbers do come to fruition, shares of the company look priced similarly to what they would look using data from 2022. The one exception, as you can see in the chart above, involves the price to earnings multiple. In this case, the multiple should drop from 15 to only 11.4. But the price to adjusted operating cash flow multiple should remain unchanged at 7.6, while the EV to EBITDA multiple should inch down from 9.1 to 9. As part of my analysis, I also decided to compare the company to five similar enterprises. This analysis can be seen in the table below. Using both the price to earnings approach and the EV to EBITDA approach, four of the five companies ended up being cheaper than our target. And when it comes to the price to operating cash flow approach, only two of the five were cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Silgan Holdings | 15.0 | 7.6 | 9.1 |

| Ardagh Metal Packaging S.A. (AMBP) | 5.2 | 14.1 | 9.0 |

| AptarGroup (ATR) | 32.5 | 15.5 | 14.3 |

| Berry Global Group (BERY) | 10.9 | 4.5 | 8.2 |

| Greif (GEF) | 8.9 | 5.3 | 6.8 |

| O-I Glass (OI) | 4.6 | 94.8 | 4.9 |

Takeaway

In the grand scheme of things, Silgan Holdings still looks fundamentally attractive and the stock looks affordable. Having said that, we are seeing some weakness on both its top and bottom lines. Shares are pricey relative to similar firms and current economic conditions place us in an elevated risk position. Given all of these factors, I don’t believe that the company is a bad prospect. But I do think that there are better opportunities that could be had at this time. Because of this, I’ve decided to downgrade the company from a ‘buy’ to a ‘hold’.

Read the full article here