Investment thesis

Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is a traditional television industry company, and it is apparent that this industry is in a secular decline due to the rapid development of new ways to deliver content to customers. The management strives to innovate and implement transformation, but I think they are significantly lagging behind the rapidly evolving environment. The stock might look undervalued, but at the same time, the net debt position is massive and profitability metrics are shrinking. All in all, I do not recommend investing and assigning the stock a “Hold” rating.

Company information

Sinclair is a diversified media company with a national reach. The company is the second-largest television station operator in the U.S. According to the latest 10-K report, as of the fiscal 2022 year end, SBGI operated 185 stations in 86 markets. These stations broadcast 636 channels, including 236 channels affiliated with primary networks or program service providers comprised of FOX, ABC, CBS, NBC, CW, and MyNetworkTV.

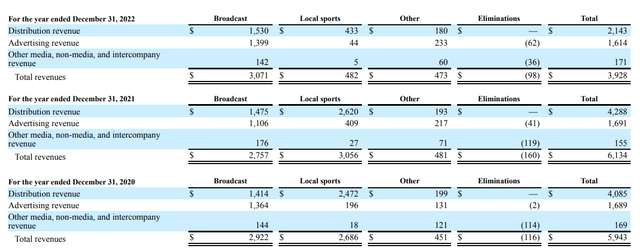

The company’s fiscal year ends on December 31 with a sole “Broadcast” operating segment. Two major revenue streams are distribution and advertising revenues. It is important to emphasize that the company deconsolidated its “Local sports” segment during Q1 of FY 2022.

Sinclair’s latest 10-K report

Financials

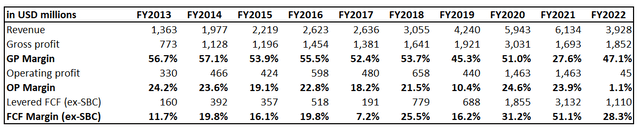

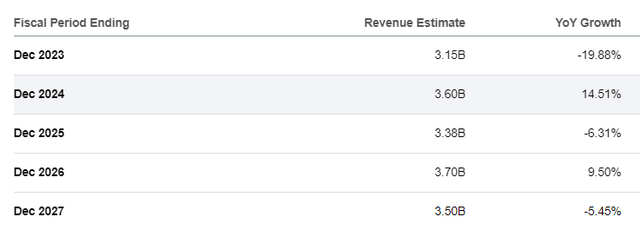

SBGI’s financial performance was impressive over the past decade, but the revenue and profitability metrics highs seem to be in a rearview window. Looking just at the revenue CAGR over the decade, it looks solid at 12.5%. But FY 2022 revenue was substantially lower than in the previous two years, and profitability metrics deteriorated substantially. The decline in revenue is explained by the deconsolidation of Diamond Sports Group’s financials, but still, revenue is expected to stagnate in the foreseeable years. Overall, the gross and operating margins stagnated over the past decade, and the business scaling up did not help to expand profitability metrics.

Author’s calculations

Though, the free cash flow margin [FCF] ex-stock-based compensation [ex-SBC] is still wide and that enables the company to offer potential shareholders above 7% forward dividend yield. Actually, the capital allocation approach is friendly to shareholders with consistent dividend payouts and stock buybacks. But I think that the shareholder-friendly capital allocation policy is not always good. The company underinvested in growth and innovation, and that is the major reason why the company is expected by consensus estimates to face revenue stagnation over the next five years.

Seeking Alpha

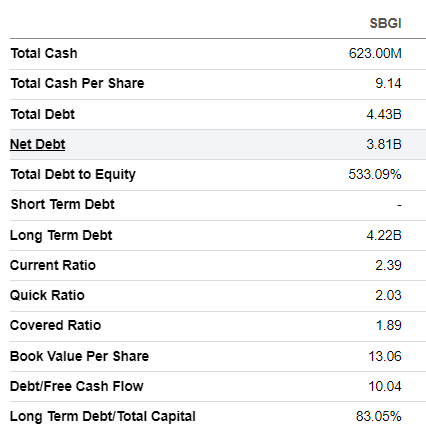

I also do not like the company’s capital allocation approach because the company holds a substantial net debt position, which looks like a problem for me in the situation of stagnating revenue and shrinking profitability metrics. The major part of the debt is long-term, but still, I am not comfortable with the below two coverage ratio.

Seeking Alpha

The latest quarterly earnings were released on May 3, the company failed to meet consensus revenue estimates but topped the EPS expectations. Revenue declined 39% YoY. Despite the revenue decline, the gross margin demonstrated resilience and even expanded by almost six percentage points. On the other hand, the operating margin slipped substantially from 8.2% to 2.7%. Excluding the Local sports segment deconsolidation effect, the revenue decreased by 7%. During the latest earnings call, the management reiterated the strategic importance of realigning and transform the business to fit better in the evolving environment. Still, I think these initiatives might be late. The management has also admitted that the current headwinds adversely affect the business and provided cautious guidance for the year.

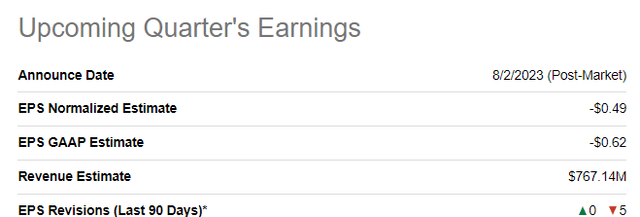

The upcoming quarter’s earnings are scheduled on August 2. The overall revenue decline is expected to decelerate and drop by 9.2%. The reason is that the Diamond Sports Group’s deconsolidation will not affect the comps starting from the Q2 earnings. Still, a 9.2% revenue decrease is not a good sign for potential investors, and the adjusted EPS is expected to decline from -$0.17 to -$-0.49.

Seeking Alpha

Overall, I think that Sinclair should have started its turnaround initiatives much earlier, as traditional television started losing competition to the new content delivery channels at the beginning of the past decade. The management’s initiative looks outdated to me. I think the company’s business model is in a secular decline, and the vast net debt position is a big burden that can significantly limit the ability to unlock new growth drivers. On the other hand, the FCF margin is still wide, and I think the dividend is safe.

Valuation

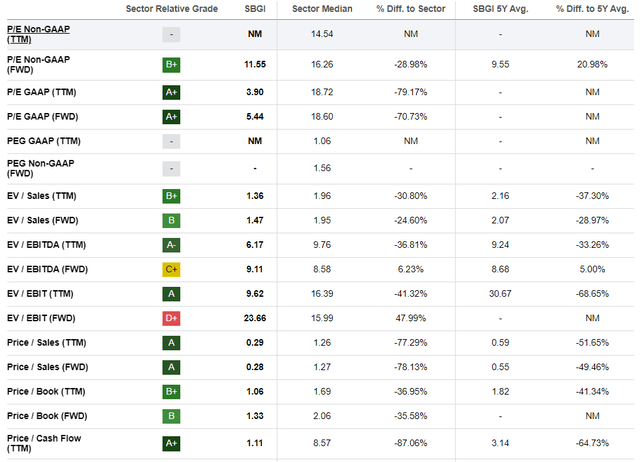

The stock demonstrated an 11% price decline, significantly underperforming the broad market. The stock is very cheap from the perspective of the multiples, which is why Seeking Alpha Quant assigned the stock a high “A” valuation grade.

Seeking Alpha

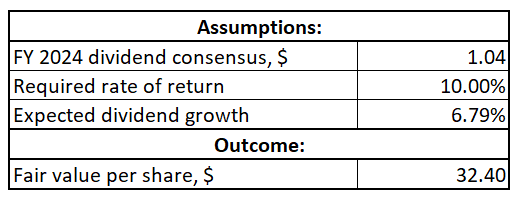

The company has been paying dividends consistently over the past decade, so the discounted dividend model [DDM] approach looks fair to proceed with valuation analysis. I use a 10% WACC for SBGI stock valuation. The dividend consensus estimates forecast a $1.04 dividend payout in FY 2024. According to the dividend growth scorecard, the growth dynamic was unstable. But I think the past five-year CAGR of 6.8% would be fair.

Author’s calculations

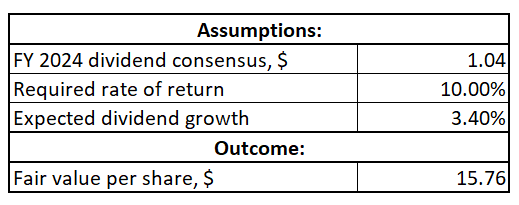

From the DDM’s point of view, the stock is massively undervalued, with an upside potential for the stock price to more than double. To calculate a more conservative scenario, let me half the dividend growth rate to 3.4%. Even under a much more conservative dividend growth assumption, the stock is still about 15% undervalued.

Author’s calculations

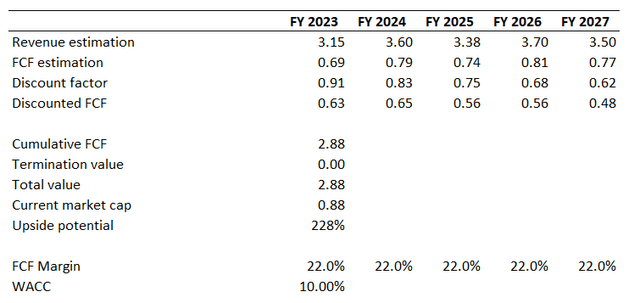

To get more evidence regarding undervaluation, I need to proceed with a discounted cash flow [DCF] approach. I use the same 10% discount rate. I have earnings consensus estimates available up to FY 2027, forecasting that the revenue will stagnate. That is the reason why I use only five years horizon and ignore the exit terminal value here. I use a 22% FCF margin, which is the past decade’s average. The assumptions I use for DCF valuation are extremely conservative.

Author’s calculations

The stock might look massively undervalued from the DCF point of view with a 228% upside potential. However, let me remind you that the company is in a massive net debt position of $3.8 billion, which is higher than the expected revenue for FY 2023. Considering the substantial net debt level, the stock does not look undervalued.

To conclude, the stock looks cheap for dividend investors seeking for high yield, but it does not look good for investors seeking massive long-term growth. Now let me discuss the risks to assess whether the benefits outweigh the attractive dividend yield.

Risks to consider

The major risk for the company is that the traditional television industry is declining, and the management’s initiatives to adapt to the changing environment should have been implemented about five years ago. Now the company is experiencing a decline in revenue, and the profitability metrics are stagnating. The amount of debt accumulated looks substantial, though it significantly improved in recent years. The business also suffers from near-term headwinds due to the uncertain macro environment. The current situation looks complicated to implement significant turnaround initiatives. That said, there is a massive risk that the company will have significant difficulties in gaining benefits that will outweigh the costs of transformation.

Another risk that I see is dividend growth. While I am highly convinced that the dividend is safe, given the current headwinds and the massive net debt level, and the transformation plan, SBGI might implement a more modest dividend increase in the near term. That said, decelerated dividend growth might lead to investors’ disappointment, resulting in a stock sell-off.

Bottom line

To conclude, SBGI is a “Hold”. The dividend yield looks very attractive at above 7%, but I think there is a high risk that the dividend increases might be postponed in the current challenging environment multiplied by the management’s transformation plans. The industry is in a secular decline, and I think that management’s turnaround initiatives might be too late to get the expected benefits from it. I also think that the massive net debt position limits options for the company to unlock new growth drivers.

Read the full article here