Shares of SL Green Realty Corp. (NYSE:SLG) popped over 6% on Monday in response to the company’s Investor Day, where it announced a slew of actions, including a dividend cut and asset sale, to strengthen its business amidst the ongoing downturn in office real estate. Shares are now actually higher than a year ago, though they are still down over 50% from pre-COVID levels when remote working was far less prevalent.

Seeking Alpha

At the company’s Investor Day, management confirmed its 2023 guidance for $5.05-$5.35 in funds from operations (FFO). It also initiated 2024 guidance of $4.90-$5.20, essentially forecast a 3% annual decline, alongside net income of $1.35-$1.65. This was largely better than feared, even as it still is down from last year. Given the ongoing pressures in office real estate, I expect several years of declining FFO as occupancy gradually declines, but a 3% fall is relatively manageable next year.

The company also set an annual dividend for 2024 at $3.00, to be paid on a monthly basis at $0.25 starting on January 16. That is down about 7.7% from the dividend it had been paying. That still provides about a 7.1% yield for investors. Based on guidance, SLG will have about 1.65-1.7x FFO/dividend coverage, which should provide some flexibility for debt reduction. Based on this, I am hopeful further dividend cuts will not be needed for a few years, though I see medium-term downside pressure on it.

The other major news from the investor day is that SL Green and its partners have also sold their ownership interest in 625 Madison Avenue for $632.5 million. SLG had a $302 million investment in this property via a mezzanine loan. This loan went into foreclosure in September, resulting in SLG and partners taking an ownership interest. As part of the transaction, they will make a $235 million preferred investment back into the property, and the net proceeds of the transaction will go toward debt reduction. SLG owned 90.4% of this building, and there was $232 million of debt on it. That will provide $360 million of gross proceeds, about half of which will be going back in via the preferred investment.

In terms of gross proceeds, SLG is receiving nearly $60 million more than the value of its investment, which seems like a clear win. However, it is putting a substantial portion of the proceeds back into the property via a preferred investment, which it may or may not recoup. That cash infusion was likely a prerequisite to complete the transaction; otherwise, the previous owner would have sold the building at a profit rather than have it foreclosed upon.

Essentially, for SLG to “break even,” it needs to recoup about 75% of its preferred investment over time. This is not that high of a hurdle. So, while SLG may not really earn a $60 million profit when the final math on the transaction is completed, it should recoup its original debt investment, which is a positive outcome in my view for a loan that was a default.

Compared to many other REITs, SL Green is somewhat complex because of how many of its buildings are in JVs, or where it just has debt or minority equity investments in them, similar to the original debt investment in 625 Madison. SLG is quite active in this part of its business; so far this year, it has disposed of $548 million of JV interests and real estate, while it has invested $194 million into buildings and $120 million into JVs.

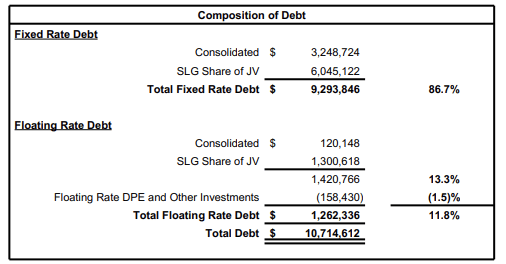

As you can see below, SLG has just $3.3 billion of consolidated debt, but when looking across its share of debt across all of its properties, there is about $10.7 billion of debt. In SL Green’s third quarter, same-store net operating income rose by 10.4%, even as its own property NOI declined from $75 million to $63 million. Increased operating income from unconsolidated properties drove the gains.

SL Green

SLG has $5 billion of net real estate, alongside $3.15 billion of investments in joint ventures. With $7 billion in unconsolidated debt, those JV interests are more highly leveraged than its own properties, which is why debt reduction has been a priority and will be the use of proceeds on its newly announced asset sale. In the first nine months of 2023, consolidated debt fell to $3.3 billion from $5.4 billion, aided by the movement of consolidated properties into JVs. It has paid down $550 million in its share of debt this year. Total debt reduction is about $1 billion including minority interests.

Despite this decline in debt, interest expense was $6 million higher at $27 million in the last quarter. That is because SLG has had to refinance debt at higher rates (there have been over $3 billion of refinancing transactions this year), and it also has about 12% of debt floating rate. Now, the company and its partners have swapped out much of this floating rate debt to fixed rates via derivatives, but these agreements do not last forever. Next year, $1.2 billion of debt (with SLG’s share are $500 million) have the associated swaps roll off with an average cap below 2.75%. Given the Fed funds rate is over 5%, we will likely see these reset at a higher rate. As such, even with some debt reduction, we will likely see interest expense flat or somewhat higher again next year.

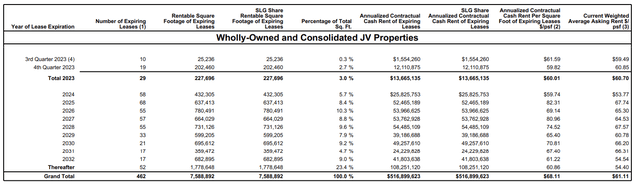

SLG is focused on debt reduction because its core business faces headwinds. As of September 30, same-store occupancy was 89.9%. This is down from 92.8% last year and 92% at the start of the year. On new leases it is earning $83/sq ft whereas the previous rent had escalated to $86, a 3.6% reduction. There was just a 4.9-year lease term from 6.0 years in Q3 2022. SLG is not replacing all expiring leases, and when it does, it receives less for a shorter period of time. It may be that given long-term uncertainties about remote working, employers are unwilling to commit to as long of a lease term as previously.

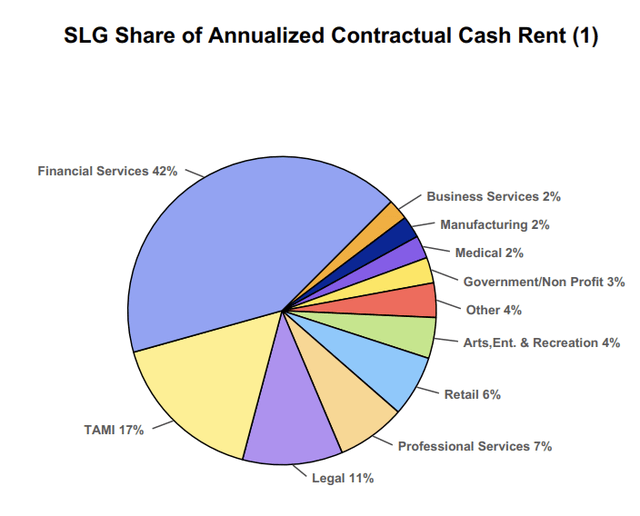

Given its Manhattan focus, SLG primarily rents to financial firms, rather than technology firms. As banks have been more aggressive about bringing workers back, this is positive, though lower aggregate demand for office space would likely reduce rent rates, no matter the tenant.

SL Green

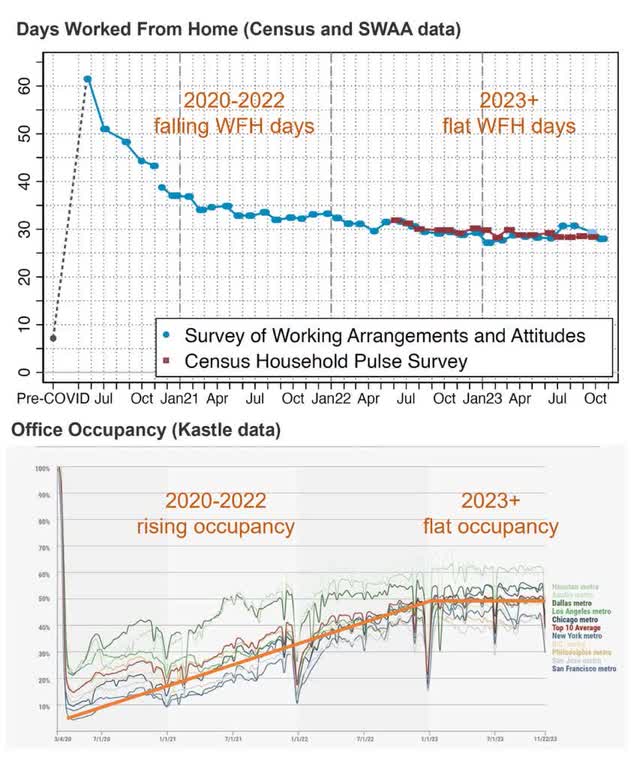

The fundamental problem is that the effort to bring workers back into the office has stalled out. In 2021-2022, more workers were returning to the office, but this has stopped at around 50%, as many employers have adopted a 3/2 hybrid system. In the long run, those employers will likely seek to reduce space. They may not be able to cut space by 40%, as a disproportionate share of workers go in Tuesday-Thursday, but they may be able to cut space by 10-25%, which would create a significant drop in occupancy.

WFH Research

The reason this has yet to occur is that office contracts are quite long-term, so even if an office is sparsely attended, tenants continue to pay rent. As such, I view office FFO as more of a melting ice cube, steadily declining, rather than a cash flow stream that can suddenly crash. Even with this, SLG has seen occupancy fall nearly 3%, pointing to significant difficulty in signing new leases. In 2024, it only has 5.7% of leases coming due, but this picks up materially in 2025-2026, which is where I see greater risk to cash flow falling more meaningfully. Given the weaker rental market, SLG has already taken $305 million in impairments this year.

SL Green

One challenge for cash flow will be that there is a significant fixed cost in operating a building, which means cash flow can fall more materially than revenue. Even with occupancy down, operating expenses rose by 10% last quarter to $49.6 million while G&A was up 7% to $23 million. I expect cost reduction to be an increased focus to mitigate declining occupancy.

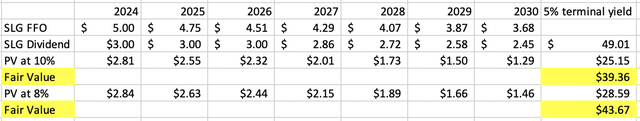

Given these pressures and larger lease maturities in 2025-2026, I see the risk to FFO declining somewhat more quickly. If we assume about a 5% annual decline after 2024 and a minimum FFO/dividend coverage ratio of 1.5x, SLG can sustain its dividend until 2027. By 2030, most leases will have been reset in this new remote world, which should provide some stability. I would discount these future cash flows at 10%, resulting in a fair value of $39. It appears the market may be discounting them closer to 8%, given shares are around $43. Considering the fact I see a risk of faster FFO decline if re-leasing proves more difficult in 2025-206, this feels like a full valuation

My own calculation

Today’s investor day was a positive as investors can breathe a sigh of relief that results are not declining more quickly and that 625 Madison was resolved in a reasonably positive fashion. Still, there is substantial debt, consolidated and unconsolidated, which will be the focus of capital allocation policy for some time, and occupancy is still declining. While the dividend should be safe at this lower rate, I see long-term negative risks to it. With shares having recovered so much lost ground, I see limited upside and risks skewed to the downside. I would take advantage of the rally to exit SL Green Realty Corp. shares.

Read the full article here