Since early 2022, when we entered into a new environment of higher interest rates, the overall BDC sector has benefited a lot.

There are really two major drivers, which have injected significant loads of fresh demand in the BDC segment:

- Higher interest rates or SOFR channel through the floating loan exposures of most BDCs, which, in turn, contribute directly to improved NII levels.

- A more constrained access to conventional financing markets (e.g., public bonds and bank financing), comes in extremely handy for private lenders such as BDCs.

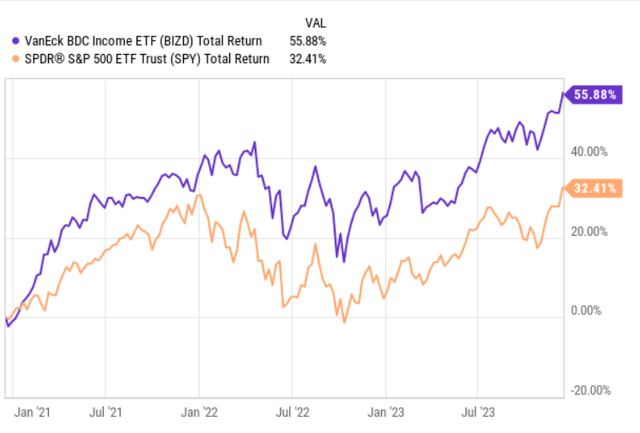

As a result of this, the overall BDC market has recently outperformed the S&P 500 by a notable margin.

Ycharts

Despite the recent run-up in market capitalization levels within the BDC segment, the average yields that are offered still provide an attractive entry point for investors, who chase double-digit current income streams with a somewhat balanced risk profile.

Lately, I have been covering several BDC names and by looking at the U.S. domiciled BDC space, SLR Investment (NASDAQ:SLRC) caught my attention.

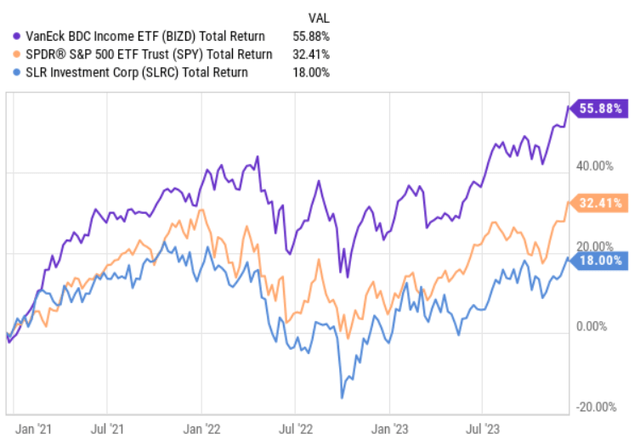

While SLRC is a rather conventional BDC (e.g., exposure to first lien, floating loans, external leverage, etc.), it has massively underperformed the broader BDC universe.

Ycharts

A divergence of such a magnitude could imply two things: (1) currently, there exists a significant opportunity for investors to take a position in the equity to benefit from multiple increases closer to the peer segment; (2) or that SLRC embodies some systematic issues, which introduce structural headwinds in the Company so that the odds for experiencing solid returns going forward are quite limited.

Thesis

Let’s explore the underlying structure of SLRC.

SLRC operates across four main business streams:

- Sponsor finance, where the recipients of the funding are primarily owned and supported by private equity sponsors. There are no officially stipulated covenants that SLRC has to follow. The only risk-mitigating aspect is the policy’s bias towards companies placed in defensive/non-cyclical sectors.

- Life science finance provides 1st lien senior secured loans to mostly venture capital-backed healthcare companies. Here to de-risk the lending profile, SLRC puts a focus on late-stage opportunities and companies that are backed by reputable strategic investors.

- Lenders finance, where SLRC channels secured financing against the loan portfolios of mid-sized finance businesses. According to SLRC’s strategy, there is a strong focus on high-quality collateral and companies carrying asset base from $50-300 million.

- Commercial finance under which SLRC issues credit to a vast set of business activity and client profiles such as equipment finance, corporate leasing, healthcare ABL etc.

Looking at these four business directions, only sponsor finance and specific segments of commercial finance could be deemed as traditional and inherently more risk-balanced.

For example, life science and funding of small or mid-sized non-bank lending companies entail relatively elevated unpredictability. In the former case, there is always a huge uncertainty involved surrounding the outcome of a particular drug, whereas, in the case of failure, the company more or less falls into the Chapter 11 stage. This risk is per definition very hard to manage. In the latter case, exposure to non-bank lenders, which are thinly capitalized adds an additional layer of systematic risk to SLRC’s exposure, which itself is very sensitive to the changes in the economy.

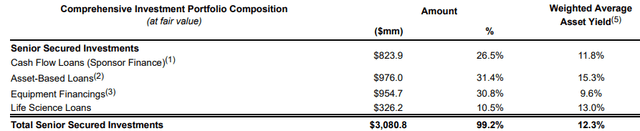

SLR Investment Corp

As of Q3, 2023, SLRC had only 26.5% of its AUM in sponsor finance (i.e., the safest vertical of SLRC). Theoretically, one could argue that equipment finance should also be deemed as relatively defensive position, but in the context of dividend predictability, the underlying collateral does not matter that much as the level of seniority and company’s ability to service both principal and interest payments.

So, from the table above we can see that at least ~42% of the total portfolio (life sciences and asset-based loans or non-banking sector) is exposed to more risky elements of the economy than, say, standard sponsor finance. The fact that the corresponding yields are higher confirms this (i.e., SLRC requiring additional yield to compensate for the assumed risks).

SLR Investment Corp

Another area of concern in the context of SLRC’s portfolio is the sources of investment income, which is one of the most crucial positions for BDCs.

Based on the most recent quarterly results, SLRC generates ca. 18% of its investment income through equity-type securities, where the distributions are made in a dividend format.

Given that BDCs (including SLRC) rely on external leverage and strive to offer stable dividends to their shareholders, it is crucial to have aligned investment income and cash outflow positions. When you have almost one-fifth of the cash flows coming through dividends, there is an automatic indication of an elevated risk for potential delays or even sudden reductions of these payments. Given this, it is rather uncommon for BDCs to rely so heavily on dividends.

Finally, from all of the issued loans (investments) by SLRC, only 64% are based on variable rates; and this excludes the dividend-paying component from the calculation. Again, it is quite rare that BDCs make fixed-rate loans to such an extent as SLRC. The reason is that by incorporating notable exposures towards fixed-rate loans, BDCs run a risk of a potential mismatch between the cost of financing and the captured portfolio yields. Plus, fixed-rate financing makes it almost impossible to pass through higher interest rate factors, which has benefited the overall industry.

The bottom line

While SLRC is placed in a sector, that enjoys favourable tailwinds and currently embodies positive performance prospects mainly due to a higher interest rate environment and constrained access to conventional financing, the underlying portfolio structure renders the case unattractive.

High exposure to equity-type instruments, half of the portfolio invested in inherently unpredictable sectors such as life science and non-bank lending sectors, and a significant chunk of the investments made on fixed rate loan basis have been some of the key reasons for the notable underperformance of SLRC relative to the overall BDC sector.

On a go-forward basis, it will be difficult for SLRC to realize the full potential of the BDC factor given the reasons above and especially considering the embedded opportunity cost (i.e., not being able to fully pass through the benefits of higher SOFR).

It is not a sell due to the positive sector-wide dynamics, but it is clearly not a solid buy.

Read the full article here